IPO - MKH Oil Palm (East Kalimantan) Holdings Berhad (Part 1)

MQTrader Jesse

Publish date: Fri, 15 Mar 2024, 04:38 PM

Company Background

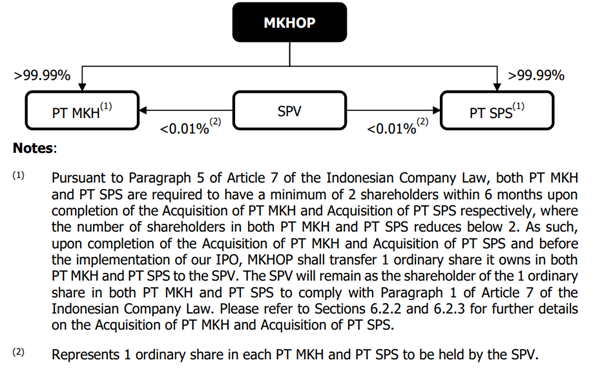

The Company was incorporated in Malaysia under the Companies Act 1965 on 10 August 2004 as a private company limited by shares under the name of Detik Merdu Sdn Bhd and is deemed registered under the Act. On 7 January 2021, the company changed its name to MKH Global Plantation Sdn Bhd. Subsequently, on 1 October 2021, they further changed the name to MKH Oil Palm (East Kalimantan) Sdn Bhd. On 11 August 2022, the company was converted into a public company limited by shares and assumed its present name.

Through the subsidiaries, the company is principally involved in the cultivation of oil palm, production and sales of CPO and PK.

Use of proceeds

- Expansion of land banks for oil palm plantation - 30.8% (Within 24 months)

- Capital expenditures for existing plantation lands - 7.3% (Within 18 months)

- Setup of PK crushing facility - 6.6% (Within 12 months)

- Refurbishment and/or upkeep of existing palm oil mill - 8.9% (Within 24 months)

- Capital expenditures for refurbishment and construction of workers/staff housing quarters - 7.3% (Within 24 months)

- Capital expenditures to expand coverage of electricity supply - 7.3% (Within 24 months)

- Repayment of loan due to a related party - 22.0% (Within 6 months)

- Working capital -3.2% (Within 12 months)

- Estimated listing expenses - 6.6% (Immediate)

Expansion of land banks for oil palm plantation - 30.8% (within 24 months)

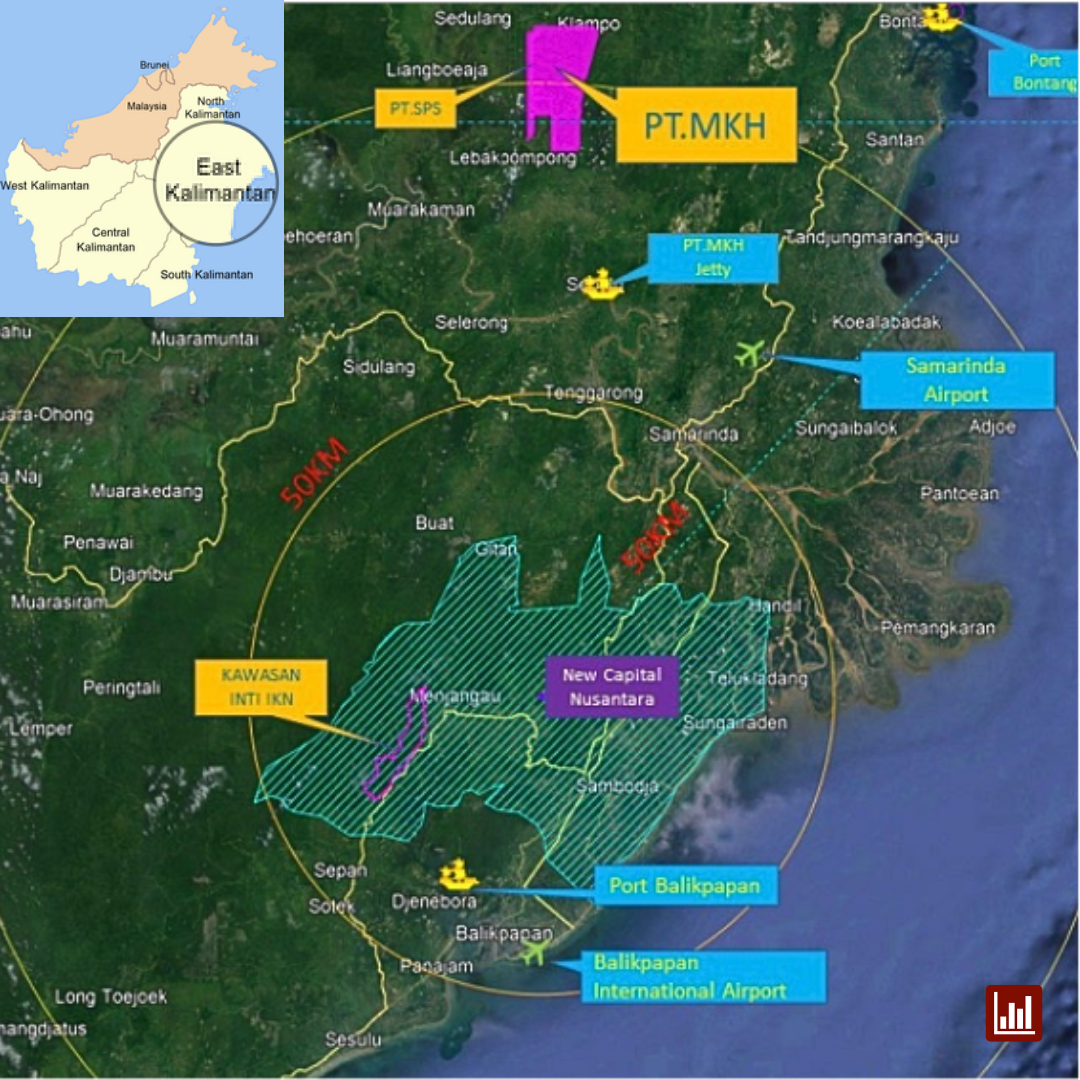

The company owns 2 oil palm plantation estates, 1 palm oil mill and 1 jetty in East Kalimantan, Indonesia. The company intends to grow the oil palm plantation business by expanding the oil palm plantation estates. As such, they plan to acquire additional land located in close proximity to its current oil palm plantation estates in Kutai Kartanegara, East Kalimantan for better coordination of operational and logistics management.

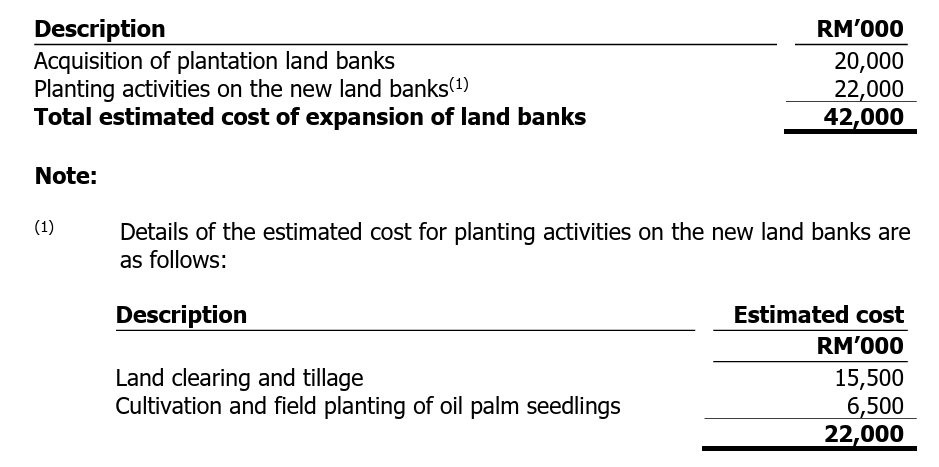

The company allocated RM42 million of the proceeds to fully fund the following expansion of the oil palm plantation estates as well as for oil palm planting activities on the new land banks:

The company has identified company(ies) with potential land banks for oil palm plantation in the sub-district of Muara Kaman, Kutai Kartanegara, East Kalimantan. The estimated land area is approximately 5,000.0 Ha with an estimated area for planting of approximately 4,000.0 to 4,500.0 Ha.

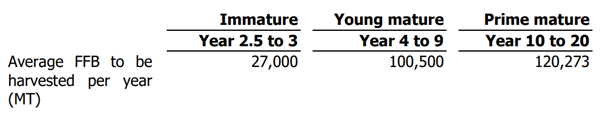

Based on the estimated area for planting of 4,500.0 Ha, the company expects to harvest additional FFB in the plantation land after 2.5 years from the date of field planting, details of which are as follows:

Capital expenditures for existing plantation lands - 7.3% (Within 18 months)

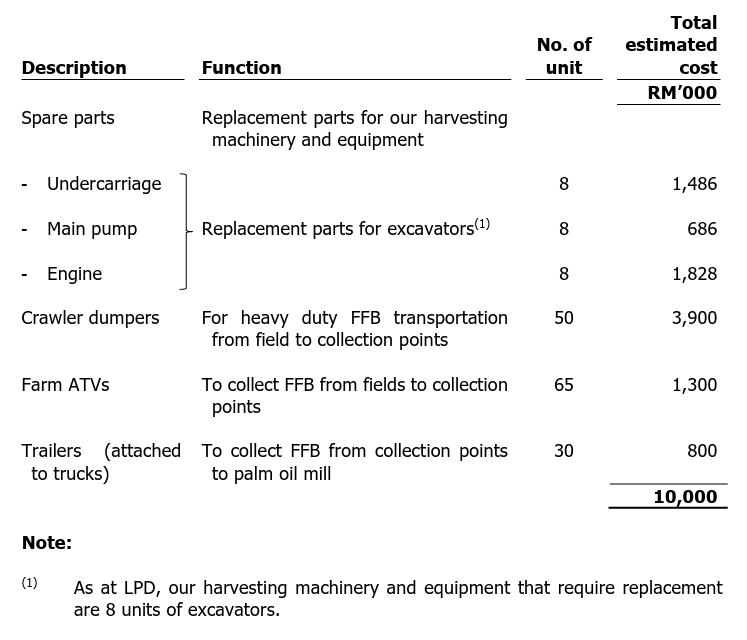

The company has allocated RM10 million to purchase additional machinery and equipment for the FFB harvesting as well as spare parts for its machinery and equipment for example spare parts (undercarriage, main pump, engine), crawler dumpers, farm ATVs, and trailers:

The machinery and equipment that they intend to purchase for FFB harvesting will be used to enhance the efficiency and mechanisation of its FFB harvesting activities, as the company will be able to reduce manual transportation of FFB from the field to collection points, and increase the frequency of FFB transportation from collection points to the existing palm oil mill, while using less human resources.

Setup of PK crushing facility - 6.6% (Within 12 months)

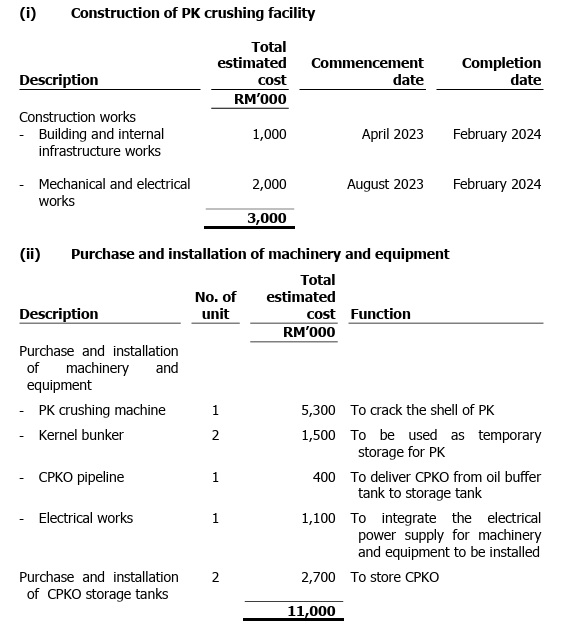

The company has allocated RM 9 million to set up a PK crushing facility adjacent to its existing palm oil mill, with a processing capacity of 90MT PK per day, to crush and press PK for extraction and processing into CPKO and PKE, a by-product of CPKO from the crushing of PK. The setup of the PK crushing facility includes construction of the PK crushing facility within the existing palm oil mill, purchase and installation of machinery and equipment as well as 2 CPKO storage tanks with a total capacity of 2,500MT. The expected output of CPKO and PKE from the PK crushing facility are approximately 40MT CPKO per day and 45MT PKE per day, respectively.

The total estimated setup cost of the PK crushing facility is approximately RM14.0 million, of which RM9.0 million will be funded from the proceeds to be raised from the Public Issue, with RM3.0 million allocated for the construction of PK crushing facility and RM6.0 million allocated for the purchase and installation of machinery and equipment and CPKO storage tanks. The remaining RM5.0 million will be funded through bank borrowings and/or internally generated funds. The total estimated cost for setup of PK crushing facility are as follows:

The setup of PK crushing facility forms part of the Group’s business strategy to increase its revenue streams by expanding the processing capabilities and product offerings to produce CPKO and PKE (a by-product of CPKO from the crushing of PK) for sale to external customers, using PK extracted from the Group’s FFB which is currently being sold to the external customers and/or PK purchased from third parties.

Refurbishment and/or upkeep of existing palm oil mill - 8.9%(Within 24 months)

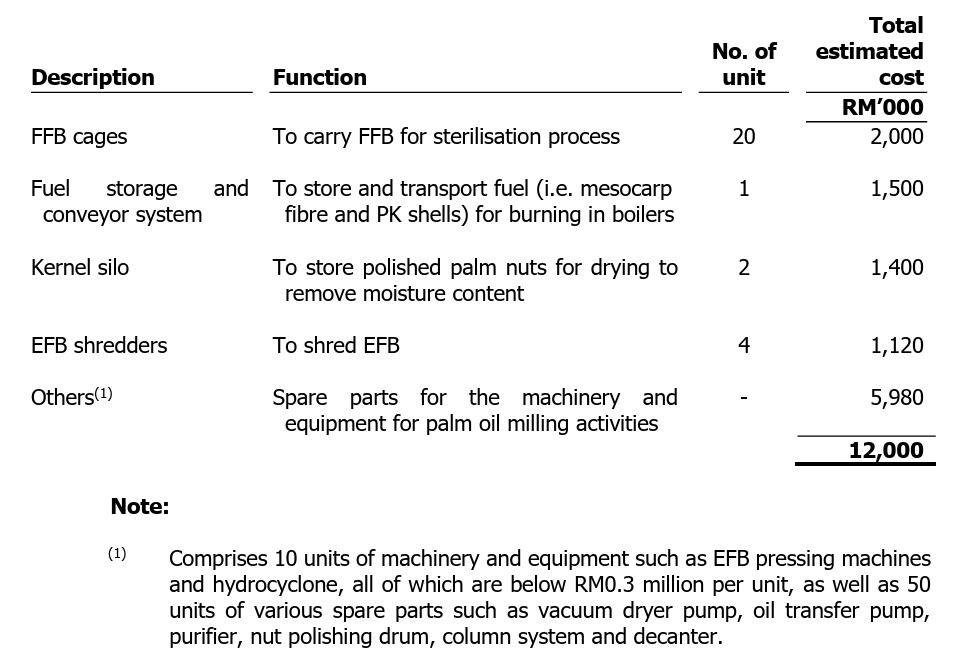

The company allocated RM12 million to purchase new machinery and equipment to replace and upgrade some of the existing machinery and equipment in the existing palm oil mill. This is expected to enhance the efficiency of the palm oil milling activities and further improve the Group’s OER.

The key machinery and equipment for the palm oil milling activities as well as spare parts for the machinery and equipment that the company intends to purchase are as follows:

The machinery and equipment that the company intends to purchase for palm oil milling activities will be used to replace and upgrade some of the existing machinery and equipment in the existing palm oil mill, and the spare parts that they intend to purchase will be used in the maintenance of its existing machinery and equipment for palm oil milling activities to upkeep the efficiency of the palm oil milling activities and further improve the OER from 18.5% (FYE 2022) to approximately 20.5%, which is expected to improve the financial performance of the Group.

Capital expenditures for refurbishment and construction of workers/staff housing quarters - 7.3% (Within 24 months)

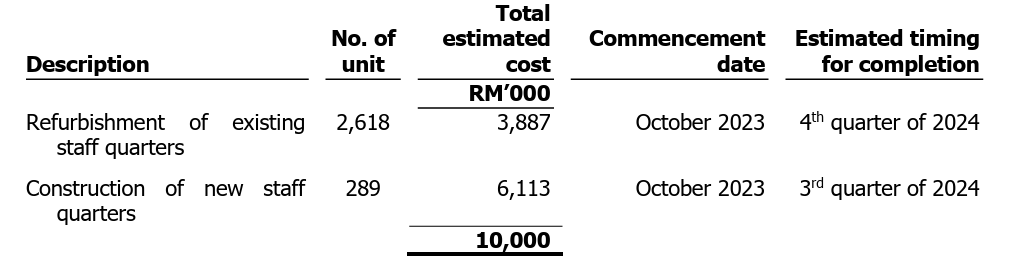

The company allocated RM10 million for the construction of new staff quarters and refurbishment of existing staff quarters.

The company has existing staff quarters constructed in the plantation estates to house its workers (including harvesters, plantation workers and support personnel) and their family members. The existing staff quarters are houses constructed fully by wood. Thus, the company intends to refurbish its existing staff quarters to enhance the living conditions of the workers and their family members as part of the continuous accommodation upgrading initiative.

The total estimated cost for the refurbishment and construction of the existing staff quarters and construction new staff quarters are as follows:

Capital expenditures to expand coverage of electricity supply - 7.3% (Within 24 months)

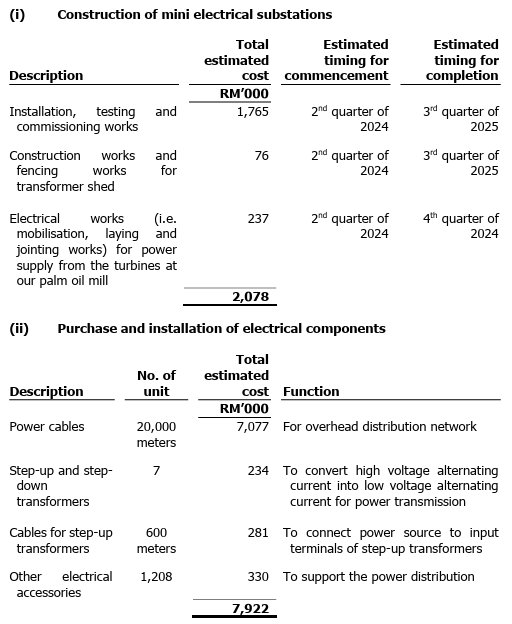

The company uses some of the by-products from palm oil milling, namely PK shells and mesocarp fibre, as fuel for the boilers at the palm oil mill to produce steam for electricity generation by turbines. The electricity generated is used to power the palm oil mill, as well as for some domestic consumption in the central region of its plantation estates, namely for staff quarters, offices, school, clinic and street lightings.

As such, the company has allocated RM10 million to build the required infrastructure for transmission of electricity from the turbines to other regions of the plantation estates. This will involve the construction of 8 mini electrical substations and the purchase and installation of electrical components such as power cables, step-up and step-down transformers, and other electrical accessories. The company intends to engage a third party solution provider to carry out these works. With the expanded electricity supply system in place, the company expects to reduce the diesel fuel cost used by the generators in other regions of the plantation estates of approximately RM3.8 million, RM4.6 million and RM8.6 million in FYE 2020 to 2022, which represented 2.1%, 2.8% and 4.6% of the total cost of sales, respectively. This will promote self-sustainability and enhance its reputation as the place emphasis on environmental governance and responsibility.

The total estimated cost to build the required infrastructure for transmission of electricity are as follows:

Repayment of loan due to a related party - 22.0% (Within 6 months)

The outstanding loan owed by the company to the related parties namely, Metro Kajang (Oversea) and MKH Plantation amounted to RM119.0 million. The loan was extended to the Group mainly to finance the development of PT MKH’s oil palm plantation together with the palm oil mill as well as PT SPS’ oil palm plantation. The company has allocated RM 30 million from the proceeds from the Public Issue to repay the outstanding loan to MKH Plantation, of which the loan is interest free and repayable on demand.

Upon such repayment, there will be no outstanding loan owed by the company to any related party. Such repayment of outstanding loan to MKH Plantation coupled with the Capitalisation will improve the Group’s current ratio and net current position (net current liabilities position as at FYE 2022) as well as gearing level.

Working capital - 3.2% (Within 12 months)

The company has allocated RM3.4 million towards the working capital for existing staff costs which comprises salaries, bonuses, allowances, statutory social contributions, employees’ provident fund contributions and employment benefit obligations.

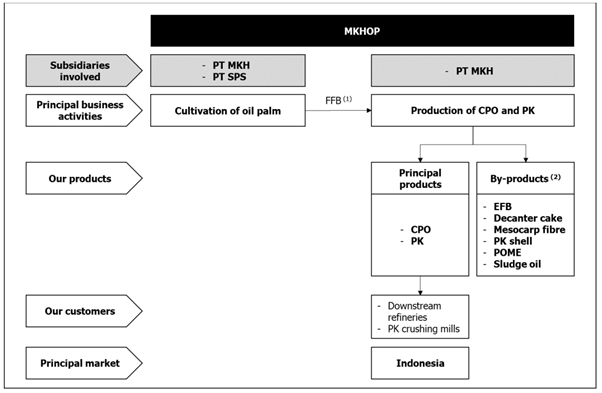

Business model

The company is an upstream oil palm plantation group and the operations are based in East Kalimantan, Indonesia. Through the subsidiaries, the company principally involved in:

- cultivation of oil palm; and

- production and sale of CPO and PK.

The Group owns 2 oil palm plantation estates, 1 palm oil mill and 1 jetty located in

East Kalimantan, Indonesia. The harvested FFB in the plantation estates are sent to its palm oil mill for the production of CPO and extraction of PK for onward sales to the customers.

Cultivation of oil palm

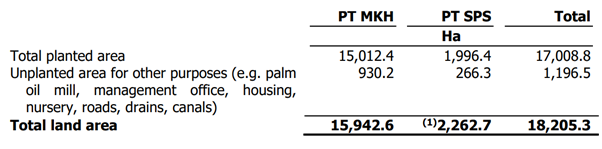

Through the subsidiaries, the company cultivate oil palm and harvests FFB on 2 plantation estates owned by the Group located in East Kalimantan, Indonesia. These 2 plantation estates have a total plantation land area of 18,205.3 Ha, comprising 17,008.8 Ha of planted area and 1,196.5 Ha of unplanted area as at LPD, with details as follows:

Production and sale of CPO and PK

The company has a palm oil mill with a processing capacity of 90MT FFB per hour located within the plantation estate managed by PT MKH. Save for the period where the palm oil mill undergoes maintenance, all FFB harvested in its plantation estates are transported to this palm oil mill for the production of CPO and extraction of PK. As the palm oil mill is located within its plantation estates, it enables the company to deliver their harvested FFB to the palm oil mill to be processed in the shortest time possible. This is essential as FFB from oil palm crops are perishable and need to be processed as soon as possible to achieve maximum oil yield. The company purchase FFB from local cooperatives under the Plasma Programme for processing at its palm oil mill.

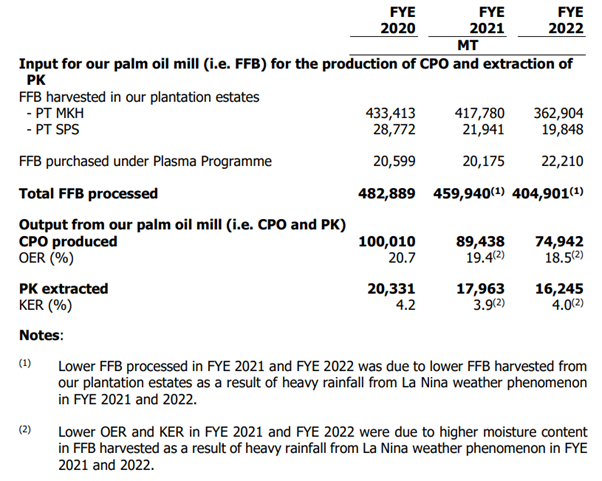

A summary of the FFB produced, purchased and processed; as well as the CPO produced and PK extracted together with the OER and KER is shown as follows:

The company sells the CPO to downstream refineries in Indonesia for further processing into palm-based edible oils and other oleochemical products. Further, PK extracted from FFB in the palm oil mill is sold to PK crushing mills and downstream refineries in Indonesia to produce PK products.

Business model

To apply for an IPO, do you need a trading account? Click the link to start your investment journey:

Click here to refer the IPO - MKH Oil Palm (East Kalimantan) Holdings Berhad (Part 2)

Click here to refer the IPO - MKH Oil Palm (East Kalimantan) Holdings Berhad (Part 3)

Community Feedback

We encourage traders to try out and evaluate the MQ Trader system and provide us feedback on the features you like to see in the system. We have received many positive feedbacks so far, and we are currently compiling and reviewing them for possible inclusion into the next release of the system.

We would like to develop this system based on community feedback to cater for community needs. Thanks to all those who have provided valuable feedback to us. Keep those feedback coming in!

Disclaimer

This article does not represent a BUY or SELL recommendation on the stock covered. Traders and Investors are encouraged to do their own analysis on stocks instead of blindly following any Trading calls raised by various parties in the Internet. We may or may not hold position in the stock covered, or initiate new position in the stock within the next 7 days.

Join us now!

MQ Trader stock analysis system uses Artificial Intelligence (AI), various technical indicators and quantitative data to generate accurate trading signals without the interference of human's emotions and bias against any particular stock. It comprises trading strategies which are very popular among fund managers for analysing stocks.

MQ Trader stock analysis system is SPONSORED for MQ Trader members. To use this amazing tool, you can sign up via MQ Trader Sign Up!

Contact us

Please do not hesitate to contact us if you have any enquiry:

Facebook: https://www.facebook.com/mqtrader

Instagram:https://www.instagram.com/mqtrader

MQ Chat: https://messenger.i3investor.com/m/chatmq

YouTube: https://www.youtube.com/channel/UCq-26SGjlQTVQfO7DoEihlg

Email: admin@mqtrader.com

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Initial Public Offering (IPO)

Created by MQTrader Jesse | Apr 12, 2024

Discover the Growth Potential of MKH Oil Palm!

Created by MQTrader Jesse | Apr 08, 2024

MKH Oil Palm (East Kalimantan) Holdings Berhad (MKHOP) represents an intriguing addition to the Malaysian stock market as a new IPO company. The firm has strategically selected land that is exceptio..