IPO - Topmix Berhad (Part 1)

MQTrader Jesse

Publish date: Wed, 03 Apr 2024, 12:40 PM

Company Background

The Company was incorporated in Malaysia on 31 March 2022 under the Act as a private limited company under the name of Topmix Sdn Bhd. On 29 May 2023, the company converted into a public limited company and assumed its present name. The company was incorporated as a special-purpose vehicle to facilitate the Listing on the ACE Market.

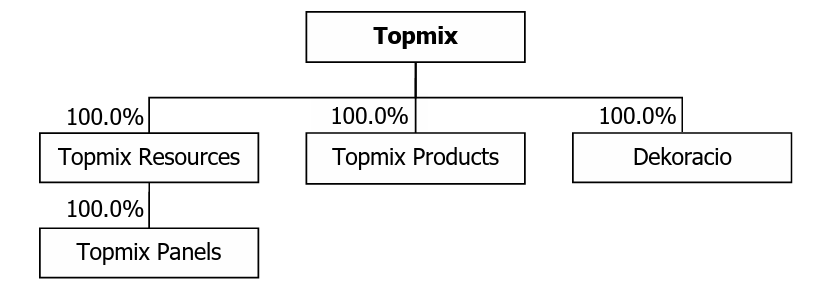

The group structure at the LPD is as follows:

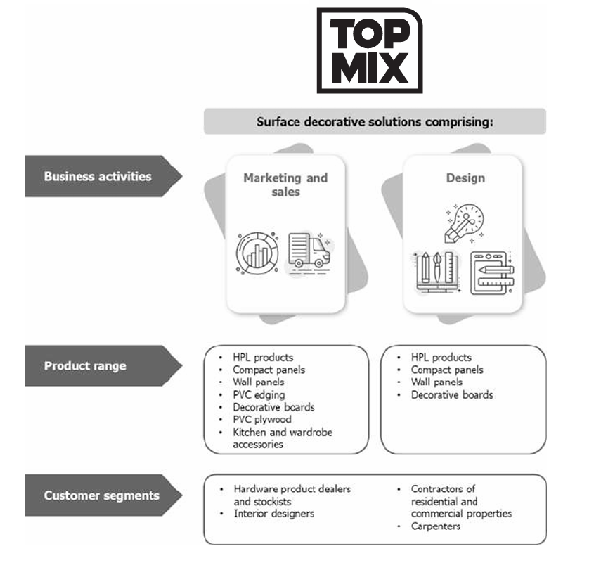

The company is principally involved in the marketing and sales of its brands of surface decorative products. It also undertakes the design of surface decorative products internally as well as in collaboration with third-party décor paper suppliers.

Use of proceeds

- Expansion into assembly of melamine faced chipboard (MFC) products - 20.74% (within 60 months)

- Business expansion, marketing and sales - 23.32% (within 24 months)

- General working capital - 44.24% (within 24 months)

- Estimated listing expenses - 11.70% (within 1 month)

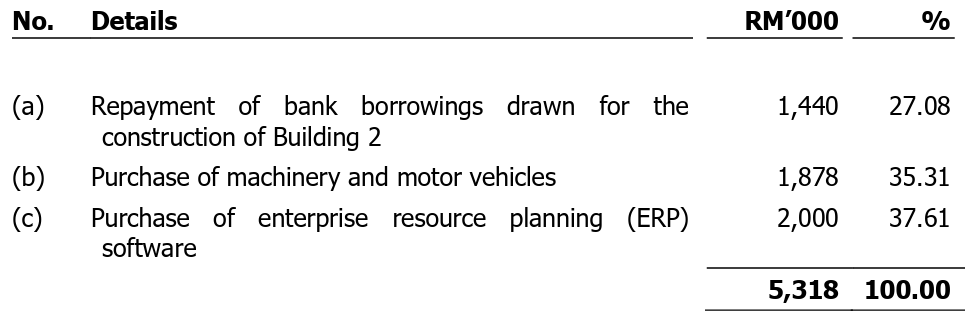

Expansion into assembly of melamine faced chipboard (MFC) products - 20.74% (within 60 months)

Part of its strategy and business plan is to expand into the assembly of MFC products. Additional details of the expansion plan are set out in Section 6.19.1.

The company has allocated RM5.32 million, which will be used in the following manner:

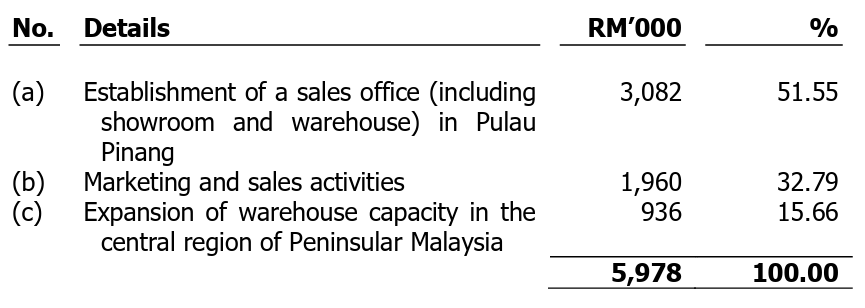

Business expansion, marketing and sales - 23.32% (within 24 months)

Approximately RM5.98 million will be used for business expansion, marketing and sales in the following manner:

General working capital - 44.24% (within 24 months)

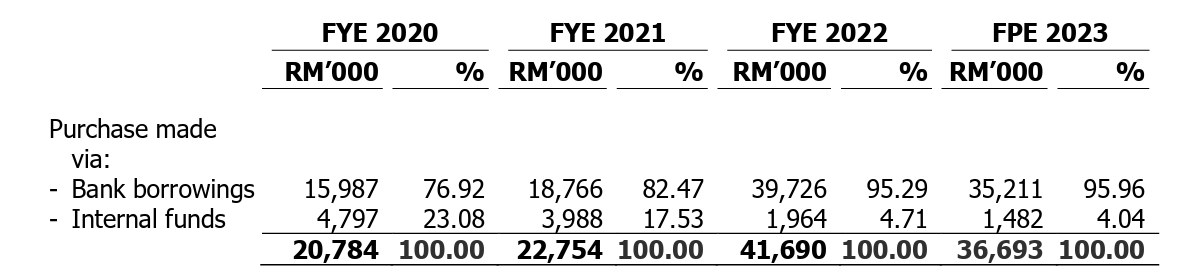

HPL is the largest component of its cost of sales, representing between 82.67% and 86.59% for 3 FYEs 2020 to 2022 and FPE 2023. The purchase of supplies for the past 3 FYEs 2020 to 2022 and FPE 2023 was made using bank borrowings and internally generated funds as follows:

Approximately RM11.34 million of the proceeds from the Public Issue has been earmarked to supplement the working capital requirements of the Group within 24 months upon Listing. The proceeds shall be used for the purchase of HPL products and other surface decorative products such as compact panels, PVC plywood, decorative boards, PVC edging and wall panels.

With the additional working capital of RM11.34 million, the company aims to reduce the usage of banking facilities which will in turn reduce the interest expenses and improve the profitability.

Business model

The company is principally involved in the marketing and sales of its brands of surface decorative products. The company also undertakes the design of surface decorative products internally as well as in collaboration with third-party décor paper suppliers.

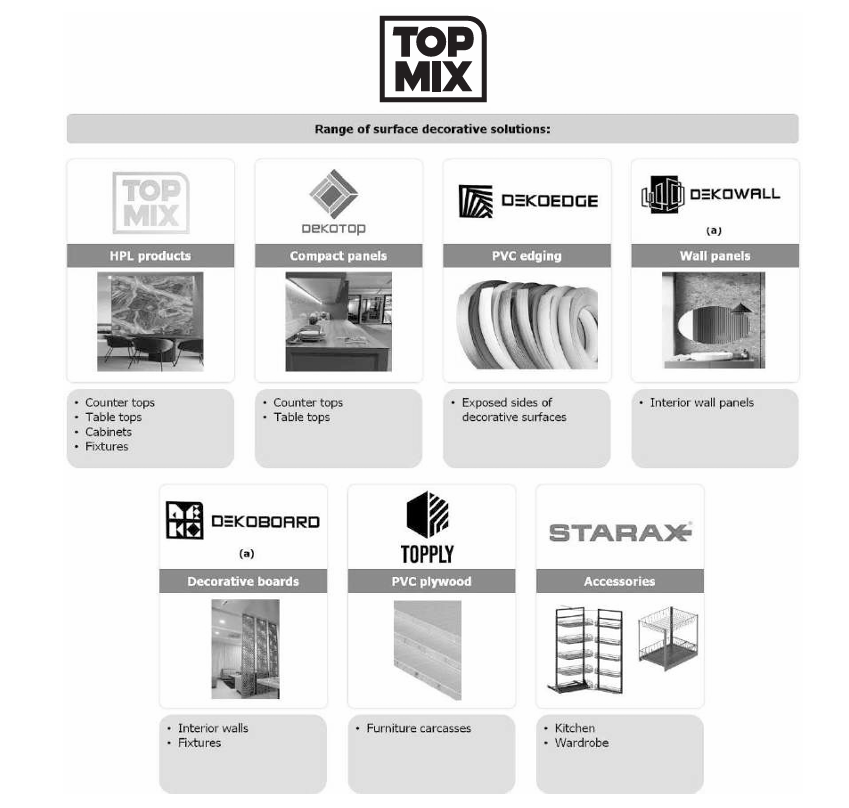

The surface decorative products mainly comprise HPL products. The company also markets and sells compact panels, PVC edging, wall panels, decorative boards and PVC plywood. The surface decorative products are used in a variety of commercial and residential interior surface applications, including wall panels, countertops, table tops, furniture as well as fixtures and displays.

In addition, the company imports and distributes surface decorative accessories (comprising kitchen and wardrobe accessories) in Malaysia, and holds the exclusive dealership to the STARAX range of kitchen and wardrobe accessories, which are complementary to its current range of surface decorative products as it allows them to offer customers a more holistic and seamless design and product range for kitchens, living rooms and bedrooms.

The company also offers consultation and installation works for compact panel products, in selected instances based on the requirements of the customers, primarily interior designers. The company leverages the internal team of installers as well as third-party installers for installation works depending on the complexity level and location of the installation site.

The customers comprise hardware product dealers and stockists, interior designers, contractors of residential and commercial properties and carpenters.

The current business model is as depicted below:

The range of surface decorative brands and products as well as their applications are as illustrated below:

Click here to continue the IPO - Topmix Berhad (Part 2)

Community Feedback

We encourage traders to try out and evaluate the MQ Trader system and provide us feedback on the features you like to see in the system. We have received many positive feedbacks so far, and we are currently compiling and reviewing them for possible inclusion into the next release of the system.

We would like to develop this system based on community feedback to cater for community needs. Thanks to all those who have provided valuable feedback to us. Keep those feedback coming in!

Disclaimer

This article does not represent a BUY or SELL recommendation on the stock covered. Traders and Investors are encouraged to do their own analysis on stocks instead of blindly following any Trading calls raised by various parties in the Internet. We may or may not hold position in the stock covered, or initiate new position in the stock within the next 7 days.

Join us now!

MQ Trader stock analysis system uses Artificial Intelligence (AI), various technical indicators and quantitative data to generate accurate trading signals without the interference of human's emotions and bias against any particular stock. It comprises trading strategies which are very popular among fund managers for analysing stocks.

MQ Trader stock analysis system is SPONSORED for MQ Trader members. To use this amazing tool, you can sign up via MQ Trader Sign Up!

Contact us

Please do not hesitate to contact us if you have any enquiry:

Facebook: https://www.facebook.com/mqtrader

Instagram:https://www.instagram.com/mqtrader

MQ Chat: https://messenger.i3investor.com/m/chatmq

YouTube: https://www.youtube.com/channel/UCq-26SGjlQTVQfO7DoEihlg

Email: admin@mqtrader.com

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on Initial Public Offering (IPO)