IPO - MKH Oil Palm (East Kalimantan) Holdings Berhad (Part 3) - Why is MKH Oil Palm (East Kalimantan) Holdings Berhad a highly potential plantation company?

MQTrader Jesse

Publish date: Mon, 08 Apr 2024, 03:32 PM

MKH Oil Palm (East Kalimantan) Holdings Berhad (MKHOP) represents an intriguing addition to the Malaysian stock market as a new IPO company. The firm has strategically selected land that is exceptionally suitable for palm oil cultivation, leveraging the tropical rainforest climate of Southeast Asia. This region, known for its year-round high temperatures and abundant rainfall, provides the perfect conditions for oil palm growth. Notably, Malaysia and Indonesia, as the world's leading palm oil producers, contribute over 80% to the global market, highlighting the sector's robustness and the region's pivotal role in meeting global demand.

In this in-depth analysis, we draw upon expert insights to delve into the nuances of the palm oil industry and MKHOP's positioning within this dynamic sector. For investors familiar with the Malaysian stock market, the plantation industry is not new. However, understanding the intricacies of each player, especially a newly listed entity like MKHOP, requires a deeper examination.

MKHOP stands out for its strategic foresight in selecting East Kalimantan as its operational base. This choice is not incidental; East Kalimantan's climatic conditions are ideal for palm oil plantations, ensuring that MKHOP can maintain a consistent and high-quality production output. This strategic location also allows MKHOP to tap into the logistical advantages of proximity to major shipping routes, enhancing its export capabilities and market reach. Now, let's take a closer look at MKH Oil Palm (East Kalimantan) Holdings Berhad's advantages in the plantation sector.

The company is well-positioned to benefit from the optimal conditions for oil palm plantation in East Kalimantan, Indonesia.

The company's plantations are located in East Kalimantan Province, situated near the equator and within the tropical rainforests of Southeast Asia. This region experiences consistently high temperatures and abundant rainfall, making it highly suitable for oil palm cultivation. The reduction in rainfall will directly affect the growth of oil palms and consequently impact the yield of FFB. Therefore, adequate rainfall is a crucial factor for the plantation industry. Furthermore, the area is located outside the Alpine-Himalayan seismic zone, thus avoiding risks such as earthquakes.

Moreover, all oil palm-planted areas are generally flat to gently undulating, with the land typically below 50 meters AMSL. Most elevations range between 15 and 30 meters AMSL, reaching up to 40 meters AMSL near the eastern boundary. This facilitates operations, including planting, upkeep, maintenance, harvesting, and evacuation of FFB, thereby contributing to FFB yields.

The company has oil palm plantations with maturity

Each oil palm tree has an economic lifespan of 20-25 years, and the yield varies within the range of tree age structure. Before transplanting, oil palm trees generally require 16-18 months of nursery time. After being transplanted to the plantation, oil palm trees begin to bear FFB after 3-4 years of growth (Young Mature). Initially, the weight of the FFB is only 10-15 kg, gradually increasing year by year, and stabilizing eventually at 20-30 kg. Between 10-20 years (Prime mature), oil palm trees reach their peak yield. From the 21st year onwards (Old), the yield gradually declines, leading to aging and eventual replanting.

Here is the age profile of the oil palm for MKH Oil Palm (East Kalimantan) Holdings Berhad

| Age Profile | Percentage |

| Young Mature (4 to 9 years) | 3.5% (4 to 6 years) 1.6% (7 to 9 years) |

| Prime Mature (10 to 20 years) | 4.8% (10 to 12 years) 90.1% (13 to 16 years) |

The ideal age profile of the company’s oil palms whereby the majority of them are in the early or mid-years of the prime mature stage, the company achieved an average FFB yield of 29.3 MT per Ha, 23.2 MT per Ha, and 24.1 MT per Ha for FYE 2020 to 2023 respectively. In comparison, according to the latest available information published by the Plantation Office of East Kalimantan, the average FFB yield in East Kalimantan was 17.4MT per Ha in 2020. The Group’s FFB yield is relatively high in comparison to the average FFB yield in East Kalimantan.

The company manages the plantation more scientifically with the help of technology and tools.

1. Focusing on efficient plantation management and quality crop

Usage of powered wheelbarrows as well as farm allterrain vehicles (“ATV”) and utility terrain vehicles (“UTV”) to improve the efficiency of FFB collection and minimise the delivery time to the CPO mill.

2. Optimising Water Management

During the wet season, the system discharges rainwater through canals and drains. During the dry season, the company uses canals and drains to store rainwater to maintain the moisture level of the soil. The company employs an amphibious long-arm excavator to desilt the canal outside the plantation.

3. Using app and drones for efficient monitoring of the plantation

The use of Ronda App allows real-time monitoring of the plantation and optimising operational efficiency through automation. The technology used allows for real-time monitoring and timely decision-making.

4. Bridging the distance between Malaysia and East Kalimantan

Real-time CCTV monitoring at the office in Malaysia allows monitoring of the plantation in East Kalimantan, Indonesia.

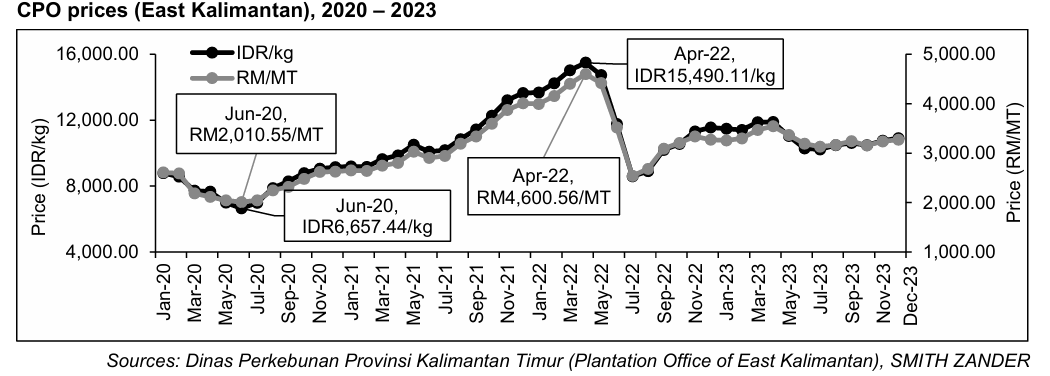

The price of palm oil in the first quarter of 2024 has risen above RM4,000 per ton again.

MKH Oil Palm (East Kalimantan) Holdings Berhad's revenue for the financial year ending (FYE) 2023 all comes from CPO, so fluctuations in CPO prices have a crucial impact on the company's financial income.

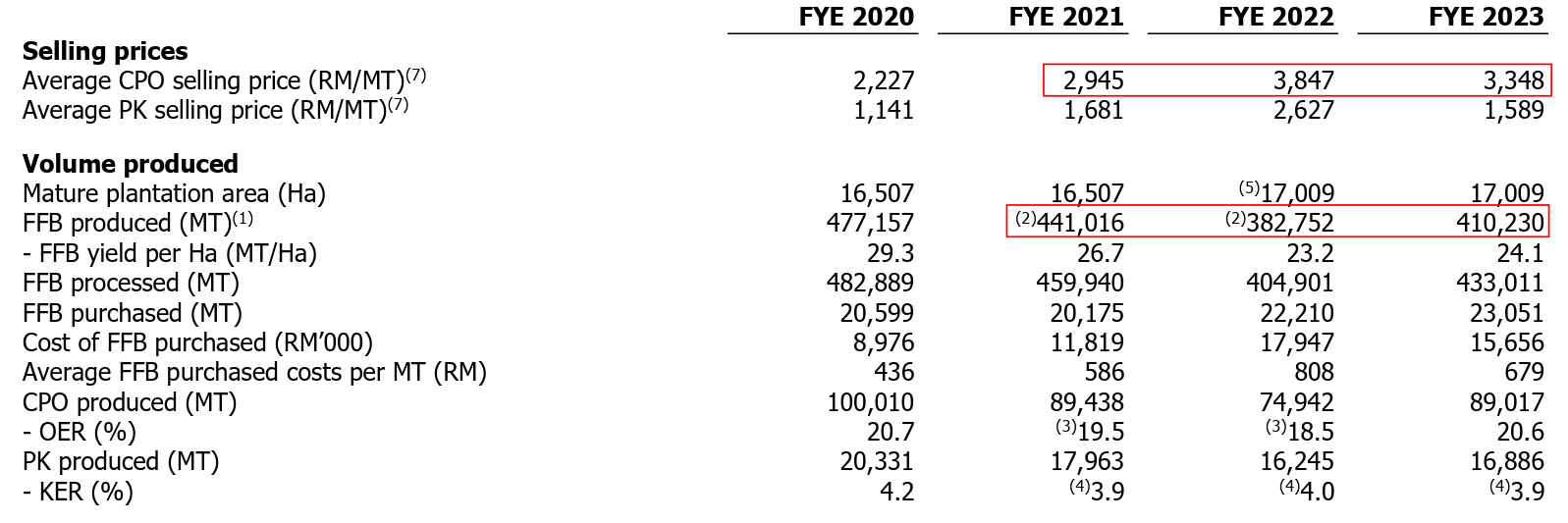

Source: Trading Economics

Now let's take a look at the average selling prices of CPO across different years. From this table, we can see that despite the production decrease in FYE 2021 and 2022 due to the La Nina phenomenon, the company managed to maintain a relatively high gross profit margin due to price increases. Conversely, the production for FYE 2023 increased by 7.18% compared to FYE 2022, but due to a price decrease of 12.97%, this ultimately resulted in a significant drop in the gross profit margin.

Source: Trading Economics

The CPO price experienced a decline in FYE 2022 and remained sideways in FYE 2023, affecting the performance of the plantation industry. However, in the short span of the first quarter of 2024, the price of CPO has already reached RM 4,400 per ton. According to the company's financial results, we know that the company can easily reach profitability when the CPO price exceeds RM 3,500 per ton. If it exceeds RM 4,000 per ton, it will demonstrate outstanding performance. If the CPO price remains above RM 4,000 per ton with consistent production, it will bring huge profits to the company.

The funds raised from this listing will be actively used for business expansion.

The company's mature planting area has reached 100%, so the company's immediate priority is to raise funds to continue expanding. From the company's disclosed 'utilization of proceeds', we can understand that approximately one-third of the funds raised will be used for expansion expenses, including expanding plantations, purchasing new talent, and so on; one-third will be used for maintenance expenses, including capital expenditures for existing plantations, maintenance/renovation of existing palm oil factories, and so on; and one-third will be used for other expenses, including listing expenses and loan repayments. From the distribution of funds, it is evident that the company is more focused on actively expanding its existing business rather than just maintaining it.

The potential risks to take note of:

After reviewing the company's advantages, we must also examine the risks that the company is facing. Only by doing so can we ensure that investors make the most accurate decisions within the possible risk range. The following are the potential risks faced by the company:

The company's financial performance is subject to the fluctuation in the market prices of CPO and PK

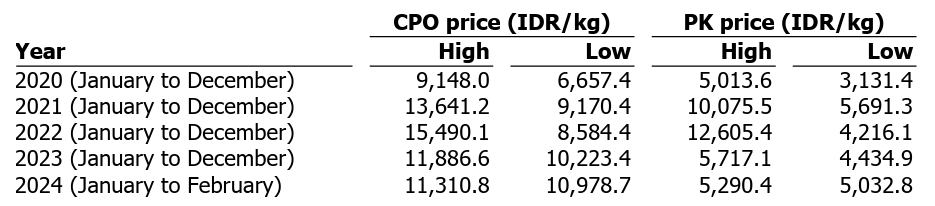

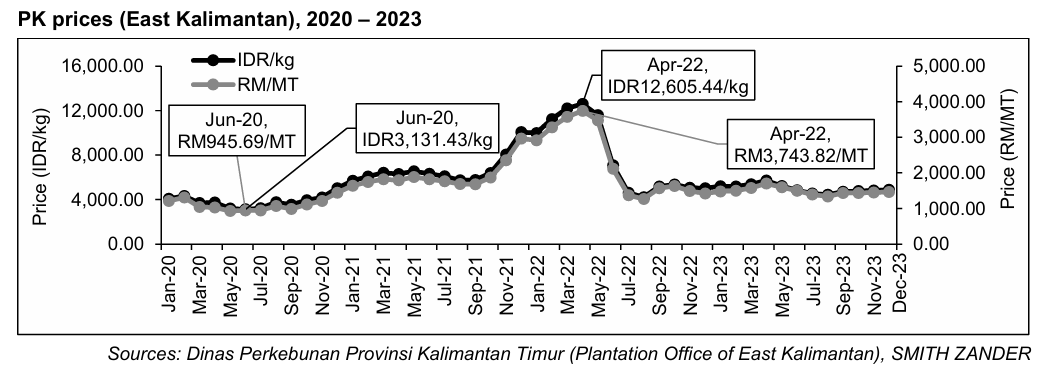

The market prices of CPO and PK fluctuate along with international demand and supply conditions. The highest and lowest market prices for CPO and PK were published by the Plantation Office of East Kalimantan for 2020, 2021, 2022, 2023.

Upon careful examination of the financial reports for FYE 2022 and FYE 2023, we can observe that fluctuations in CPO (Crude Palm Oil) prices directly impact the company's gross profit margin. To mitigate such situations, the company may consider implementing hedging strategies to lock in prices, thus aiming to maintain long-term stable growth, which is the desired outcome for investors.

The specific climate can affect the harvest of CPO.

The above figure shows that the company's harvest between FYE 2021 and FYE 2022 was not ideal, mainly due to encountering the La Nina phenomenon. La Nina is a weather phenomenon in which warm water in the Pacific Ocean is blown by strong winds from South America to Indonesia, leading to increased rainfall in Indonesia. The monthly average rainfall brought by La Nina increased from 140mm in FYE 2020 to 198mm in FYE 2021 and further increased to 240mm by FYE 2022.

Notwithstanding that the plantation estates are equipped with an integrated drainage system to divert excess rainwater to a lake nearby to minimise the risk of flooding, the La Nina phenomenon in FYE 2021 and FYE 2022 resulted in higher-than-expected rainfall which caused flooding to some area in the plantation estates and also affected pollination, which eventually led to lower FFB yield. In FYE 2023, the La Nina phenomenon continued in the first half of FYE 2023 until March 2023 which continued to result in heavy rainfall, before the rainfall began to reduce in April 2023.

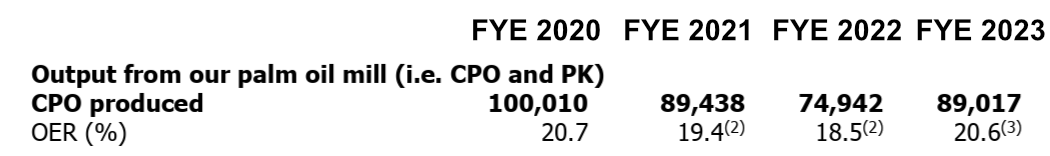

The Oil Extraction Rate (OER) is stable despite La Niña weather phenomenon.

The Oil Extraction Rate (OER) is a crucial metric for the palm oil industry, indicating the efficiency of the company's processes from planting to delivering FFB to the factory. Even a 1% difference in OER can significantly impact the company's profitability. As the company's plantations are located in Indonesia, typically achieving an OER higher than 19%, and in better scenarios, even reaching 24%, whereas plantations in Malaysia usually yield below 19%. This is mainly due to geographical differences affecting factors such as temperature, sunlight, rainfall, and soil conditions, thereby impacting FFB quality and consequently OER.

From this data, it's evident that the company's OER performance isn't above average, as its OER has been above 19% for the past four years. However, the company explains: it states that during FYE 2021 and FYE 2022, the company was affected by the La Niña weather phenomenon, leading to increased moisture content in the fruit bunches. It wasn't until FYE 2023, after the La Niña phenomenon had ended, that the OER officially returned to above 20%.

Weather is something that the company can’t control. MKHOP has good management team wheares has included plans in place to enhance their OER by migitaing the risk that occurred towards their plantation. They intend to purchase machinery and equipment, which will enhance the efficiency of palm oil milling activities. They predict that this initiative will increase the OER from 20.6% in FYE 2023 to 22.0%. If the OER can be raised to 22.0%, it will directly reflect on the company's profitability.

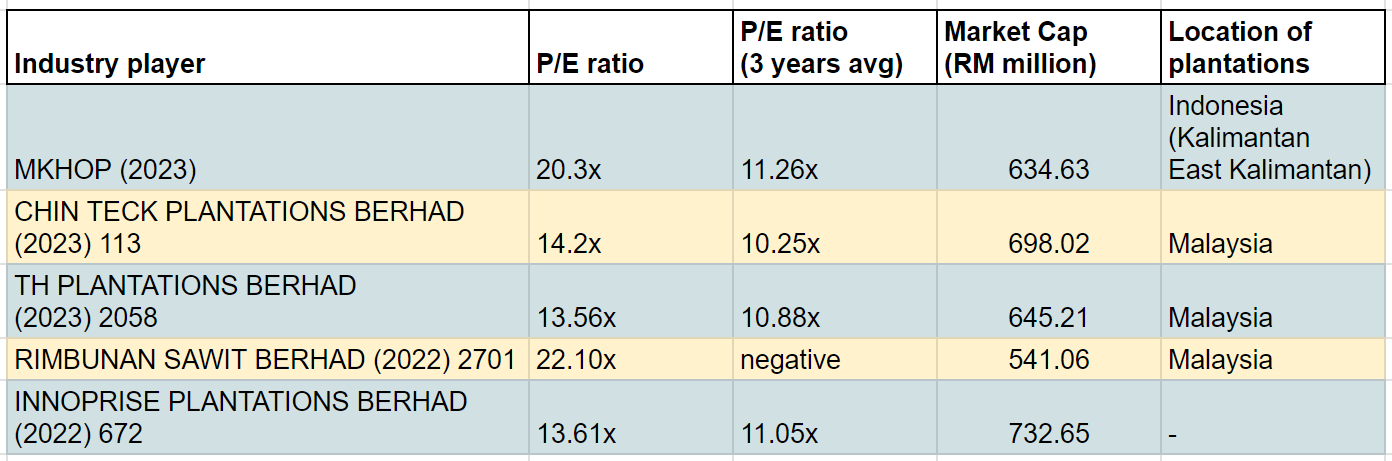

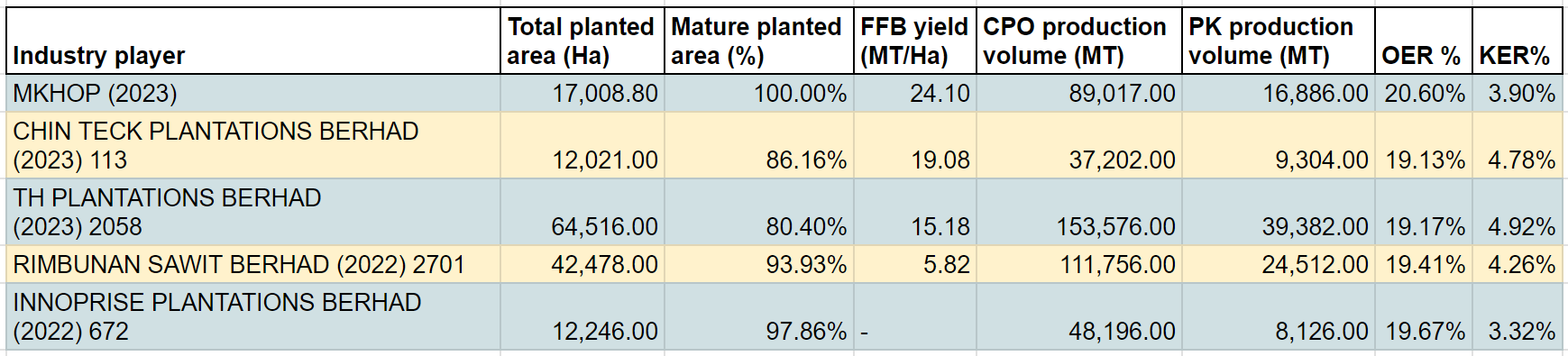

A comparison of planting companies horizontally

**The data was generated on 05/08/2024.

We have chosen to conduct a horizontal comparison with a plantation company that has a similar market capitalization to MKH Oil Palm (East Kalimantan) Holdings Berhad. Through this comparison, we can evaluate the plantation performance of each company from different perspectives, whether it's FFB yield (tons per hectare) or oil extraction rate (OER %). Through the table, we can see that the performance of MKHOP plantation is leading among its peers, mainly due to the more suitable conditions for oil palm cultivation in Indonesia, as well as the efficient management of the entire palm oil production process by the management. Each stage, from land selection, planting, tree maintenance, and harvesting, to transporting the FFB to the processing factory, has an impact on the final yield and oil extraction. Therefore, the management must accurately oversee each standard procedure to ensure high yields of FFB and oil extraction.

If you find this article helpful in understanding the plantation industry, please feel free to share it to benefit more people.

To apply for an IPO, do you need a trading account? Click the link to start your investment journey:

Click here to refer the IPO - MKH Oil Palm (East Kalimantan) Holdings Berhad (Part 1)

Click here to refer the IPO - MKH Oil Palm (East Kalimantan) Holdings Berhad (Part 2)

Community Feedback

We encourage traders to try out and evaluate the MQ Trader system and provide us feedback on the features you like to see in the system. We have received many positive feedbacks so far, and we are currently compiling and reviewing them for possible inclusion into the next release of the system.

We would like to develop this system based on community feedback to cater for community needs. Thanks to all those who have provided valuable feedback to us. Keep those feedback coming in!

Disclaimer

This article does not represent a BUY or SELL recommendation on the stock covered. Traders and Investors are encouraged to do their own analysis on stocks instead of blindly following any Trading calls raised by various parties in the Internet. We may or may not hold position in the stock covered, or initiate new position in the stock within the next 7 days.

Join us now!

MQ Trader stock analysis system uses Artificial Intelligence (AI), various technical indicators and quantitative data to generate accurate trading signals without the interference of human's emotions and bias against any particular stock. It comprises trading strategies which are very popular among fund managers for analysing stocks.

MQ Trader stock analysis system is SPONSORED for MQ Trader members. To use this amazing tool, you can sign up via MQ Trader Sign Up!

Contact us

Please do not hesitate to contact us if you have any enquiry:

Facebook: https://www.facebook.com/mqtrader

Instagram:https://www.instagram.com/mqtrader

MQ Chat: https://messenger.i3investor.com/m/chatmq

YouTube: https://www.youtube.com/channel/UCq-26SGjlQTVQfO7DoEihlg

Email: admin@mqtrader.com

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Initial Public Offering (IPO)