IPO - Topmix Berhad (Part 2)

MQTrader Jesse

Publish date: Wed, 03 Apr 2024, 12:40 PM

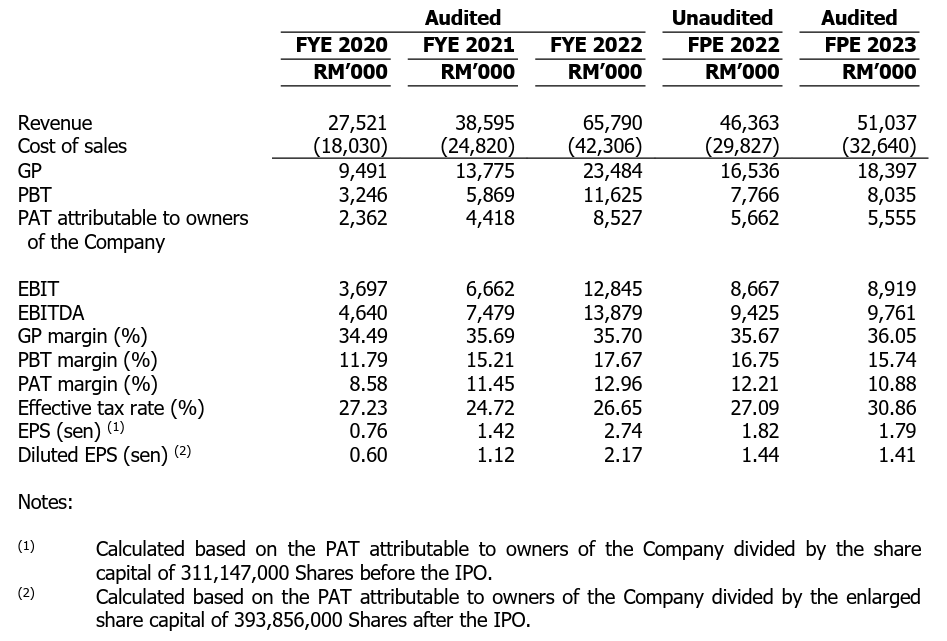

Financial Highlights

The following table sets out the financial highlights of its historical audited combined and consolidated statements of profit or loss and other comprehensive income for the FYEs 2020 to 2022 and FPE 2022 to 2023:

- The revenue grew from RM 27 million in FYE 2020 to RM 65 million in FYE 2022. This indicates that the company is rapidly expanding its market share in this industry.

- The gross profit margin was maintained within the range of 34% to 36%. This maintenance of a high GP margin is attributed to the higher average selling price of the HPL products in the company. (Generally, a GP margin of 20% is considered high/ good).

- The PAT margin increased from 8.58% in FYE 2020 to 12.96% in FYE 2022.

- The gearing ratio was 0.83 times in FYE 2022. This ratio exceeds the benchmark, indicating that the company's debt is slightly higher. However, the gearing ratio for FPE 2023 decreased to 0.74 times, which is also a positive sign as it shows a year-on-year decrease. Therefore, we will need to continue monitoring the gearing ratio closely in the future. (A good gearing ratio should be between 0.25 – 0.5).

Major customers and supplier

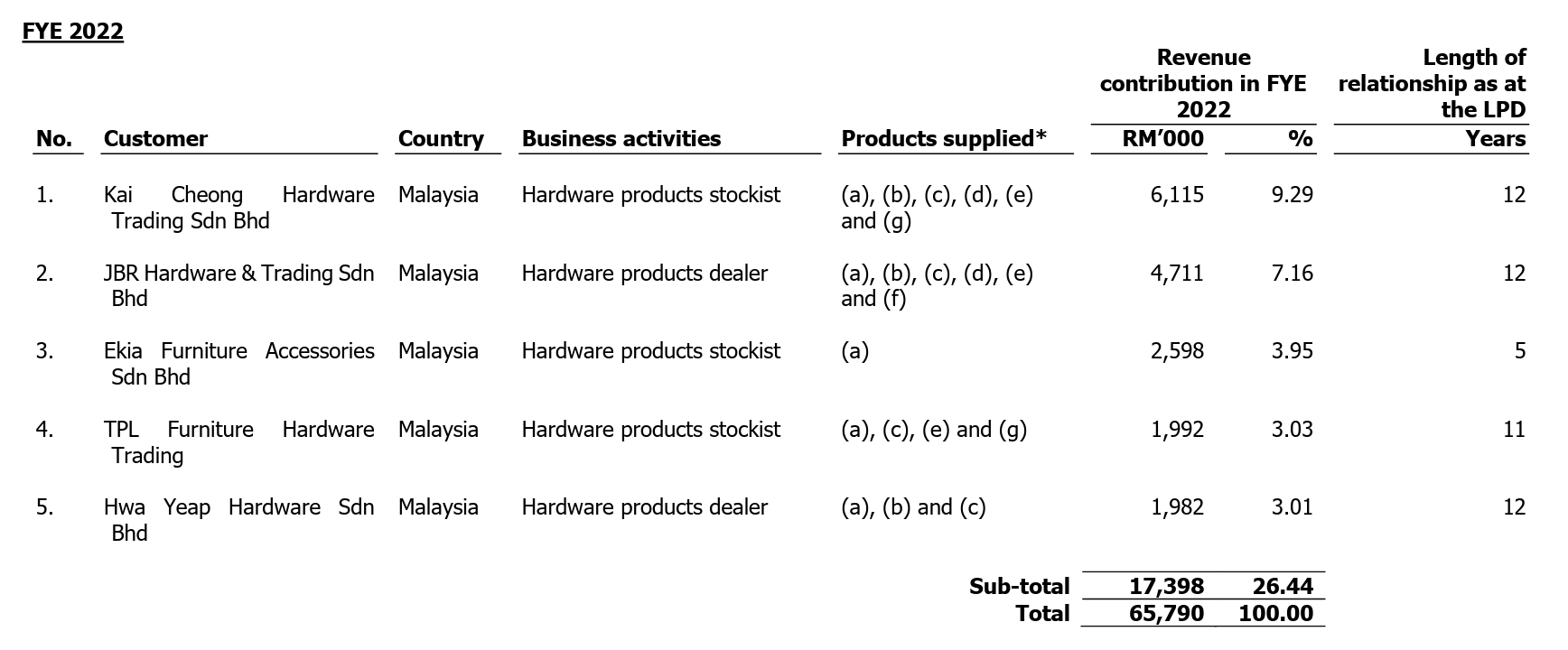

Major Customers

The top 5 major customers for FYE 2022 are as follows:

The top 5 customers contribute 26.44% of the company's revenue. The management disclosed that they have a diverse customer base comprising hardware products dealers and stockists, interior designers, contractors of commercial and residential properties and carpenters. Therefore, they have a large customer base of 1,309 customers as at FYE 2022. Furthermore, none of the top 5 customers contributed to 10% or more of its sales for FYE 2022, thereby indicating that they are not dependent on any of its customers.

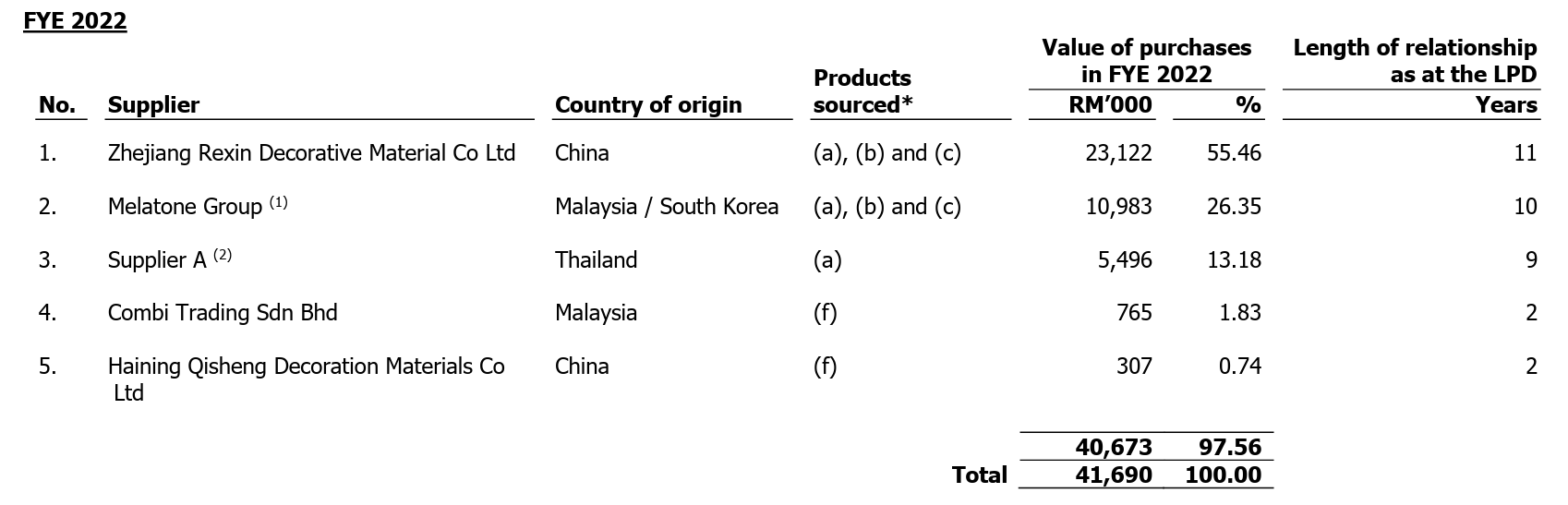

Major Suppliers

The top 5 major suppliers for FYE 2022 as follows:

The top 5 suppliers account for 97.56% of the purchases. Management mentioned that the top 3 suppliers have further agreed that, with the supply of jointly designed HPL products, they are bound to (i) purchase the decor paper from the third-party decor paper suppliers designated by the Group (which the Group has exclusivity of the design), and (ii) to sell the jointly designed HPL products solely to the Group.

The Group owns the exclusive rights to the colorways of jointly designed décor paper used in the production of the HPL products by these top 3 suppliers. Thus, these top 3 suppliers are not able to sell the jointly designed décor paper to any other customer. In the event the company loses any of the top 3 suppliers, the Group still owns the exclusive rights to the colorways of its jointly designed décor paper and will thus be able to source for other suppliers to manufacture HPL based on the quality and volume that they require.

Industry Overview

According to a Providence Strategic research report, the surface decorative products market in Malaysia, based on the revenues of industry players, rose from RM 530.6 million in 2018 to RM 572.8 million in 2019 at a compound annual growth rate (“CAGR”) of 8.0%. In 2020, the surface decorative products market dipped to RM 473.0 million at a year-on-year rate of -17.4% as the COVID-19 pandemic disrupted economic activities, Including construction and property development activities, and hampered consumer spending on discretionary expenses. In 2021, the surface decorative products market began showing signs of recovery in line with the reopening of Malaysia’s economy and resumption of economic activities. While there was resurgence in COVID-19 cases nationwide and lockdowns instituted, the high vaccination rates led to a recovery in economic activities. This led to the demand for surface decorative products rebounding to RM 502.6 million (2020: RM 473.0 million) in 2021 at a year-on year rate of 6.2%. The demand for surface decorative products is driven by their cost-effectiveness and easy customisation, as well as lower maintenance and resistance to scratches and stains. In 2022, the surface decorative products market reached RM640.2 million at a year-on-year rate of 27.4%, driven by the positive growth in residential and commercial property markets during the year. On an overall basis between 2018 and 2022, the surface decorative products market in Malaysia witnessed a CAGR of 4.8%.

PROVIDENCE projects the surface decorative products market to grow from an estimated RM640.2 million in 2022 to RM760.0 million in 2026 at a CAGR of 4.4%. Demand for surface decorative products will be supported by the recovery and growth in commercial and residential property markets, foreign investment and domestic investment growth activities; population growth and urbanisation, growing affluence of population and supportive government initiatives aimed at encouraging homeownership as well as achieving inclusive and sustainable economics in Malaysia.

Demand Conditions: Key Growth Drivers

- Recovery and growth in the residential and commercial property markets support demand for surface decorative products

- Foreign investment and domestic investment growth stimulate demand for commercial properties

- Population growth and urbanisation support the demand for surface decorative products

- The growing affluence of the population and preference for personalised spaces support the demand for surface decorative products

- Government initiatives to spur economic activities as well as support residential and commercial property development

- Growth in Malaysia’s furniture industry supports demand for surface decorative products

Industry Risk and Challenges

- Economic uncertainties affect spending on discretionary products and services

- Slowdowns in construction and property development activities affect demand for surface decorative products

Source: Providence Strategic

Future plans and strategies for TOPMIX BERHAD.

The future plans and strategies of the Group are as follows:-

- The company intends to expand into the assembly of MFC products.

- Construction of a new factory for MFC assembly

- Purchase of machinery, equipment and motor vehicles

- Purchase of enterprise resource planning (ERP) software

- The company intends to further expand in Malaysia to capture business opportunities in the northern region of Peninsular Malaysia.

- The company intends to further enhance the Topmix HPL mobile application to increase brand and product awareness

- The company intends to strengthen its marketing and sales activities and expand its warehouse capacity in the central region of Peninsular Malaysia.

- Strengthen its marketing and sales activities

- Trade exhibitions

- Hiring of marketing and sales staff

- Advertising and promotional activities

- Expansion of warehouse capacity in the central region of Peninsular Malaysia.

- Strengthen its marketing and sales activities

- The company intends to further strengthen the sales of its jointly designed as well as internally designed HPL product segments.

MQ Trader View

Opportunities

- The company offers a wide range of surface decorative products for commercial and residential interior applications. These surface decorative products are used in various settings, including wall panels, countertops, tabletops, as well as fixtures and displays.

- The company has a large customer base. Taking the year 2022 as an example, the company's customer base totaled 1309 customers. A large customer base enables the company to avoid the risk of customer concentration. If customers are too concentrated, the departure of any single customer will directly impact the company's financial reports.

Risk

- The company is dependent on its major suppliers, Zhejiang Rexin Decorative Material Co., Ltd. (“Rexin”) and the Melatonin Group, which accounted for 75.52% to 81.81% of the total purchases for the financial years ending 2020, 2021, 2022, and the fiscal period ending in 2023.

- The company is exposed to foreign exchange fluctuation risks. Purchases of supplies from overseas suppliers amounted to between 65.31% and 73.63% of its total purchases. Any significant change in foreign exchange rates may affect the Group’s financial results.

Click here to refer the IPO - Topmix Berhad (Part 1)

Community Feedback

We encourage traders to try out and evaluate the MQ Trader system and provide us feedback on the features you like to see in the system. We have received many positive feedbacks so far, and we are currently compiling and reviewing them for possible inclusion into the next release of the system.

We would like to develop this system based on community feedback to cater for community needs. Thanks to all those who have provided valuable feedback to us. Keep those feedback coming in!

Disclaimer

This article does not represent a BUY or SELL recommendation on the stock covered. Traders and Investors are encouraged to do their own analysis on stocks instead of blindly following any Trading calls raised by various parties in the Internet. We may or may not hold position in the stock covered, or initiate new position in the stock within the next 7 days.

Join us now!

MQ Trader stock analysis system uses Artificial Intelligence (AI), various technical indicators and quantitative data to generate accurate trading signals without the interference of human's emotions and bias against any particular stock. It comprises trading strategies which are very popular among fund managers for analysing stocks.

MQ Trader stock analysis system is SPONSORED for MQ Trader members. To use this amazing tool, you can sign up via MQ Trader Sign Up!

Contact us

Please do not hesitate to contact us if you have any enquiry:

Facebook: https://www.facebook.com/mqtrader

Instagram:https://www.instagram.com/mqtrader

MQ Chat: https://messenger.i3investor.com/m/chatmq

YouTube: https://www.youtube.com/channel/UCq-26SGjlQTVQfO7DoEihlg

Email: admin@mqtrader.com

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on Initial Public Offering (IPO)