IPO - MKH Oil Palm (East Kalimantan) Holdings Berhad (Part 2)

MQTrader Jesse

Publish date: Fri, 15 Mar 2024, 04:38 PM

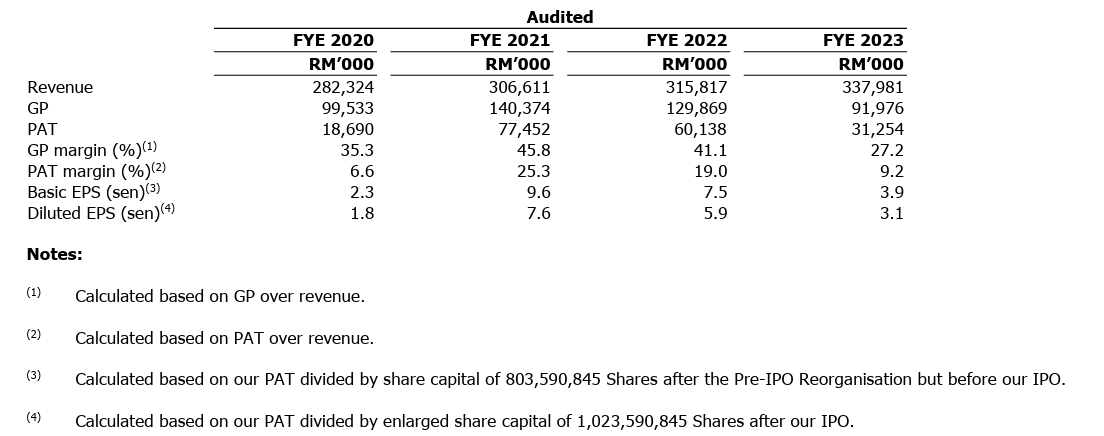

Financial Highlights

The following table sets out the financial highlights based on the combined statements of comprehensive income for FYE 2020 to 2023:

- The revenue increased from RM 282 million in FYE 2020 to RM 337 million in FYE 2023, showing that the company is expanding its market share.

- The gross profit margin increased from 35.3% (FYE 2020) to 45.8% (FYE 2021), declined to 41.1% (FYE 2022), and further decreased to 27.2% (FYE 2023). The decrease in the GP margin in FYE 2023 is mainly due to the decrease in the average selling prices for CPO and PK (CPO: RM 3,847 at FYE 2022; RM 3,348 at FYE 2023; PK: RM 2,627 at FYE 2022; RM 1,589 at FYE 2023). The current market price of CPO is around RM 4,472. (Generally, a GP margin of 20% is considered high/ good).

- The PAT margin increased from 6.6% in FYE 2020 to 25.3% in FYE 2021, declined to 19.0% in FYE 2022, and further decreased to 9.2% in FYE 2023.

- The gearing ratio was 0.2 in FYE 2023, indicating that there is still room to increase debt and bring it within a reasonable gearing ratio range. This provides more flexibility to the company's cash flow. (A good gearing ratio should be between 0.25 – 0.5).

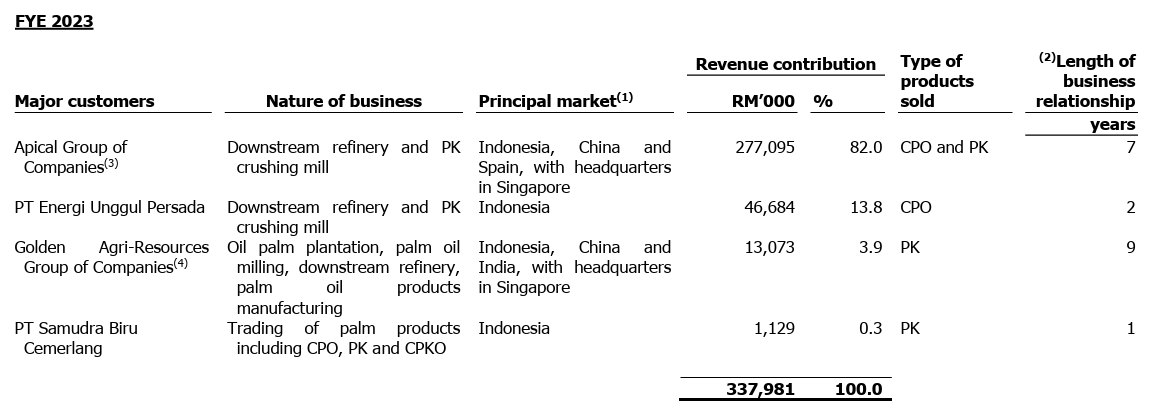

Major customers and supplier

Major Customers

The top 5 major customers for FYE 2023 are listed in the following table:

The top 5 customers contribute 100% of the company's revenue. The management has mentioned that, due to the nature of its business, it is more efficient to engage with a concentrated number of established customers with large order quantities, rather than having a wide range of customers with smaller order quantities at the expense of efficiency.

Although customer concentration is high, clients can still be easily found due to the open market. Besides, CPO is a common commodity, it can be easily sold to any customer.

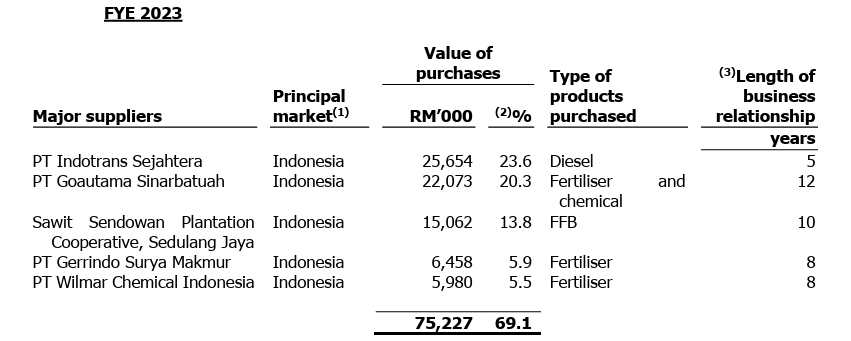

Major Suppliers

The top 5 major suppliers for FYE 2023 are listed in the following table:

The total purchases from the top 5 suppliers account for 69.1%. The management mentioned that the company is not dependent on any suppliers because the products provided by the suppliers can be easily sourced from the Indonesia market.

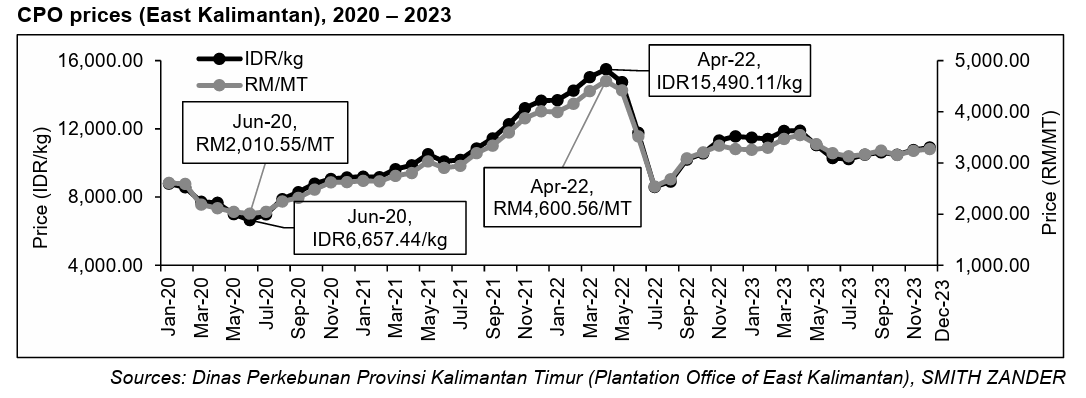

Industry Overview

According to the research from SMITH ZANDER, between 2020 and 2023, prices of CPO in East Kalimantan fluctuated, with the lowest price at IDR6,657.44/kilograms (“kg”) (RM2,010.55/MT) in June 2020 and the highest price at IDR15,490.11/kg (RM4,600.56/MT) in April 2022.

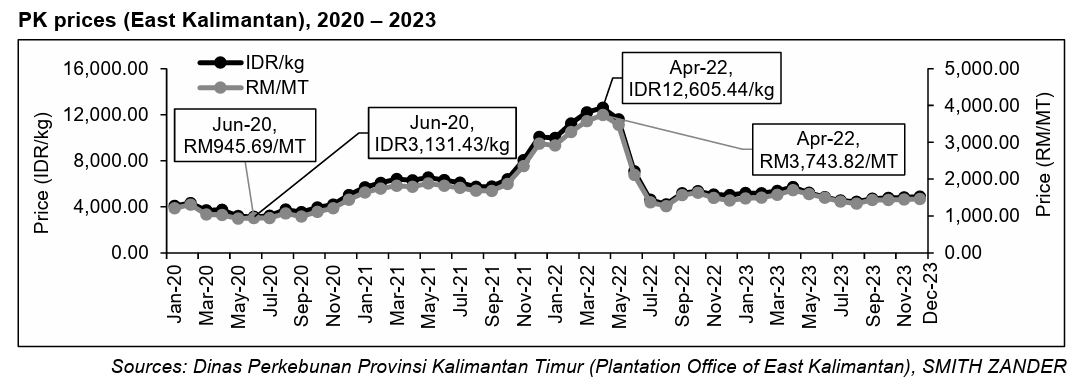

Between 2020 and 2023, prices of PK in East Kalimantan fluctuated, with the lowest price at IDR3,131.43/kg (RM945.69/MT) in June 2020 and the highest price at IDR12,605.44/kg (RM3,743.82/MT) in April 2022.

Generally, PK prices have similar trends with CPO prices as the production of PK is closely tied to the production of CPO given that PK is a by-product of CPO. As such, the factors which affect the production of CPO also apply to the production of PK. Local prices of PK in East Kalimantan mirror the global prices of PK, which are influenced by supply and demand conditions of PK in the global market.

The key drivers in this industry:

- Growing demand for food drives the demand for edible oils and fats which subsequently drives the growth of the oil palm industry.

- Wide range of applications of palm oil and its derivatives drives the demand for palm oil.

- Demand from India, EU-27 and China as three of the largest CPO import/consumer markets.

- Strong government support to strengthen the oil palm industry.

The key risk and challenges in this industry:

- Dependent on weather conditions and other factors affecting crop productivity and yield

- Fluctuations in edible oils prices which may affect demand for palm oil

- Product substitution with other edible oils and fats

- Environmental concerns surrounding the oil palm industry

Market Share

The market share of MKHOP Group in the oil palm industry in Indonesia and East Kalimantan is represented by its share of total planted area and CPO production in Indonesia and East Kalimantan respectively. MKHOP Group captured a market share based on total planted area of 0.11% in Indonesia and 1.21% in East Kalimantan; and a market share based on CPO production of 0.16% in Indonesia and 1.88% in East Kalimantan.

Source: SMITH ZANDER

Future plans and strategies for MKH OIL PALM (EAST KALIMANTAN) BERHAD.

- The company plans to expand the oil palm plantation business through the expansion of plantation estates.

- The company intends to enhance the operational efficiency by acquiring new machinery and equipment to be used in FFB harvesting and palm oil milling.

- The company plans to expand the processing capabilities and product offerings by producing and selling CPKO.

- The company plans to construct new staff quarters and refurbish the existing staff quarters to house additional workers and improve the living conditions of the workers and their family members.

- The company plans to expand the coverage of electricity supply generated through the turbines at the palm oil mill to other regions of the plantation estates.

MQ Trader View

Opportunities

- The company possesses a highly mature industry chain, sufficient to enable sustained growth. Firstly, the company has an experienced key senior management team with strong industry expertise, capable of managing it efficiently. Besides that, the company holds valuable assets (tangible and non-tangible). For example:

- The oil palm plantations have a maturity and topographical profile that results in high FFB yields.

- The company is well-positioned to benefit from optimal conditions for oil palm plantation and infrastructural development in East Kalimantan, Indonesia.

- Experienced key senior management team with strong industry expertise, capable of managing it efficiently.

- The company is well-positioned to benefit from optimal conditions for oil palm plantation and infrastructural development in East Kalimantan, Indonesia.

- High dividend pay-out, min 50% of net profit.

Risk

- The financial performance of the company is dependent on the fluctuation in the market prices of CPO and PK.

To apply for an IPO, do you need a trading account? Click the link to start your investment journey:

Click here to refer the IPO - MKH Oil Palm (East Kalimantan) Holdings Berhad (Part 1)

Click here to refer the IPO - MKH Oil Palm (East Kalimantan) Holdings Berhad (Part 3)

Community Feedback

We encourage traders to try out and evaluate the MQ Trader system and provide us feedback on the features you like to see in the system. We have received many positive feedbacks so far, and we are currently compiling and reviewing them for possible inclusion into the next release of the system.

We would like to develop this system based on community feedback to cater for community needs. Thanks to all those who have provided valuable feedback to us. Keep those feedback coming in!

Disclaimer

This article does not represent a BUY or SELL recommendation on the stock covered. Traders and Investors are encouraged to do their own analysis on stocks instead of blindly following any Trading calls raised by various parties in the Internet. We may or may not hold position in the stock covered, or initiate new position in the stock within the next 7 days.

Join us now!

MQ Trader stock analysis system uses Artificial Intelligence (AI), various technical indicators and quantitative data to generate accurate trading signals without the interference of human's emotions and bias against any particular stock. It comprises trading strategies which are very popular among fund managers for analysing stocks.

MQ Trader stock analysis system is SPONSORED for MQ Trader members. To use this amazing tool, you can sign up via MQ Trader Sign Up!

Contact us

Please do not hesitate to contact us if you have any enquiry:

Facebook: https://www.facebook.com/mqtrader

Instagram:https://www.instagram.com/mqtrader

MQ Chat: https://messenger.i3investor.com/m/chatmq

YouTube: https://www.youtube.com/channel/UCq-26SGjlQTVQfO7DoEihlg

Email: admin@mqtrader.com

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Initial Public Offering (IPO)

.png)