IPO - SBH Marine Holdings Berhad (Part 2)

MQTrader Jesse

Publish date: Thu, 21 Mar 2024, 09:39 AM

Financial Highlights

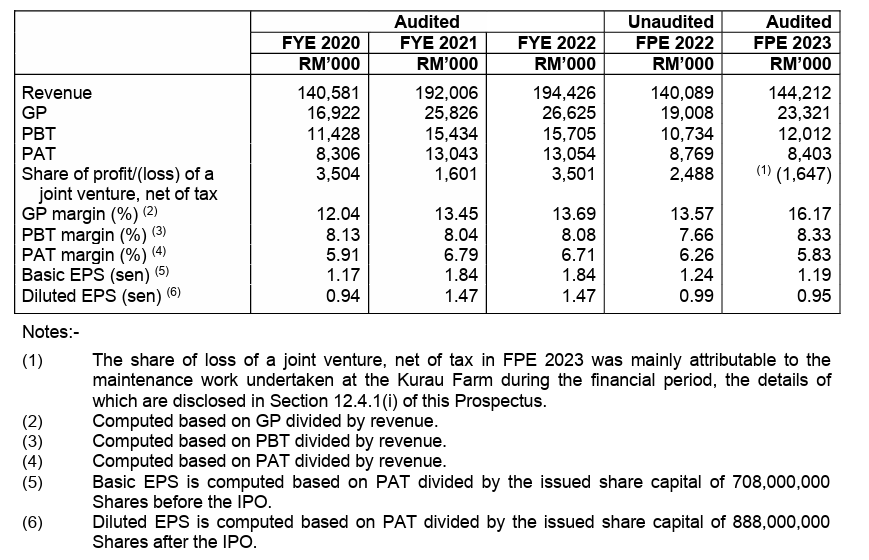

The summary of the audited combined statements of profit or loss and comprehensive income for the Financial Periods Under Review is as follows:-

- The revenue grew from RM 140 million in FYE 2020 to RM 192 million in FYE 2021 and RM 194 million in FYE 2022. The slow increase for FYE 2021 is mainly due to the effects of the shortage of foreign workers at the Kurau Plant, which affected production.

- The gross profit margin increased from 12.04% in FYE 2020 to 13.69% in FYE 2022. The increase in the GP margin is mainly due to the high selling prices of frozen shrimps and the strengthening of the USD against the RM. (Generally, a GP margin of 20% is considered high/ good).

- The PAT margin increased from 5.91% in FYE 2020 to 6.79% in FYE 2021 and declined to 6.71% in FYE 2022.

- The gearing ratio was 0.03 in FYE 2022. The company's gearing ratio is below the benchmark, indicating that the company still has room to increase its debt. (A good gearing ratio should be between 0.25 – 0.5).

Major customers and supplier

Major Customers

The top 5 major customers for FYE 2022 are set out below:

The top 5 customers contribute 50.34% of the company's revenue, with the leading customer accounting for 20.1%, approximately 1/5 of the total revenue. Management mentioned they are dependent on the customer which has contributed more than 10% of its total revenue, namely Customer F from Turkey in FYE 2022. Other than that, the company is not dependent on any other customers as they have a total of 50 active customers spread across the EU, Asian, and Middle Eastern regions. The company also continues to diversify its customer base geographically by exploring new markets/countries for the products, as demonstrated by its success in expanding exports to Turkey.

Major Suppliers

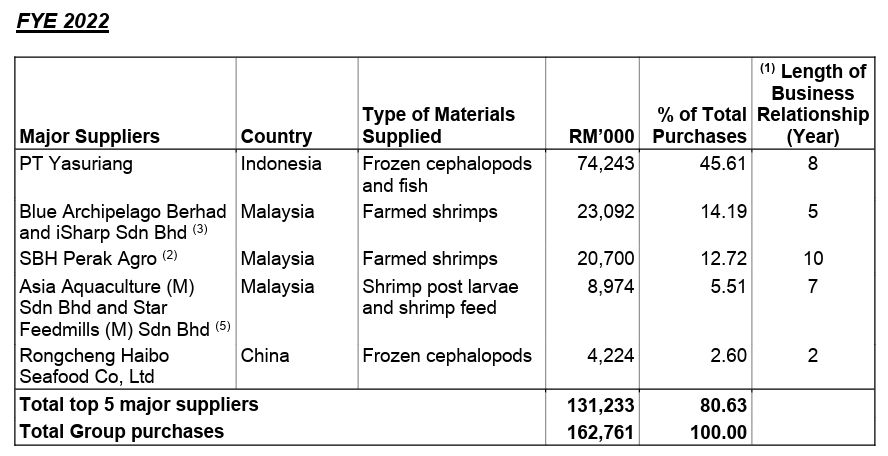

The Group’s top 5 major suppliers for FYE 2022 are as follows:-

The total purchases from the top 5 suppliers account for 80.63%. The company mentioned they are dependent on 3 major suppliers: PT Yasuriang, SBH Perak Agro, and Blue Archipelago Berhad and iSharap Sdn Bhd.

- PT Yasuriang: The company has entered into a Supplies and Marketing Agreement with PT Yasuriang, whereby PT Yasuriang has agreed to supply, on an exclusive basis, all its frozen seafood supplies either to the company for processing at its Kurau Plant or for direct export to its customers in the overseas markets.

- SBH Perak Agro: The company completed the acquisition of SBH Perak Agro in January 2024.

- Blue Archipelago Berhad and its wholly-owned subsidiary, iSharp Sdn Bhd: The company has had a 6-year business relationship with these suppliers.

With the continuing development of 79 new shrimp ponds in the Selinsing Farm, which is expected to be fully developed and completed by the middle of 2027, the company expects its external farmed shrimp procurement to be gradually reduced from 82% in FYE 2023 to 48.0%, as they can procure more farmed shrimp directly from both farms.

Industry Overview

The marine shrimp aquaculture market plays a crucial role not only for local food self-sufficiency but also serves as a highly profitable source of trade income. The increasing demand and value realisation of shrimp as a choice food globally continues to create demand for imported shrimp and shrimp products. As a country with a resource-rich coastline and conducive geological and climate conditions, Malaysia is poised to emerge as a supplier to help fill the global demand-supply gap.

Factors influencing demand for local marine shrimp stem from the resilient demand from both global and local markets, declining levels of captured fisheries as well as the growing population which leads to increasing demand for food commodities, including for marine shrimp. At the same time, the growing affluence of customers worldwide is also expected to drive higher consumption of seafood. In addition, the trend of adopting e-commerce and home delivery of seafood products has also opened up new sales opportunities and is expected to continue in the long run. From the supply side, Government initiatives such as the IZAQs, the Q’Fish Programme and AIZ is expected to provide impetus for the development of the local marine shrimp aquaculture market.

The exports of Malaysian frozen seafood were valued at RM2.22 billion in 2022 and registered a marginal drop of 1.0% to RM2.20 billion in 2023. Nevertheless, the market is projected to expand at a CAGR of 5.2% for the period from 2023 to 2027, to reach RM2.86 billion in 2027. The growing health awareness in a growing population where consumers are increasing in affluence is one of the factors propelling the growth of the frozen seafood market. The market is also expected to benefit from various government-led initiatives to boost the local food processing sector. The continuous development of refrigeration technologies and cold chain infrastructure is also expected to boost consumer confidence in the nutritional value and quality of frozen seafood, thus leading to increased demand going forward.

Source: Protégé Associates

Future plans and strategies for SBH MARINE HOLDINGS BERHAD.

The future plans and strategies of the Group are as follows:-

- Expanding the aquaculture shrimp farming operations.

- Construction of a new seafood processing plant.

- Shrimp hatchery and nursery.

MQ Trader View

Opportunities

- The company has adopted a vertical integration strategy. The company intends to venture further upstream by operating its own Hatchery Centre to produce and supply shrimp post larvae directly to the aquaculture shrimp farms by the fourth quarter of 2024. The cultivation of shrimps and processing of frozen shrimp products, in particular, provide the ability to control the quality and traceability of its frozen seafood products.

Risk

- The company is dependent on certain major customers. It does not enter into any long-term supply agreements with these customers. Sales are based on purchase orders received from customers from time to time. This dependence arises because the company relies on customers who contribute more than 10% of the total revenue.

- The company is dependent on foreign workers for its business operations. The operations are labor-intensive, exposing the company to various labor-related issues. A significant shortage in the supply of foreign workers or restrictions imposed on them may disrupt business operations, affecting the FYE 2022 revenue, as mentioned by management.

- The company is exposed to foreign exchange rate fluctuations, primarily denominated in RM, RMB, and USD. Therefore, it is subject to currency exchange rate risks influenced by various factors beyond its control, including but not limited to political and economic conditions in Malaysia and globally.

Click here to refer the IPO - SBH Marine Holdings Berhad (Part 1)

Community Feedback

We encourage traders to try out and evaluate the MQ Trader system and provide us feedback on the features you like to see in the system. We have received many positive feedbacks so far, and we are currently compiling and reviewing them for possible inclusion into the next release of the system.

We would like to develop this system based on community feedback to cater for community needs. Thanks to all those who have provided valuable feedback to us. Keep those feedback coming in!

Disclaimer

This article does not represent a BUY or SELL recommendation on the stock covered. Traders and Investors are encouraged to do their own analysis on stocks instead of blindly following any Trading calls raised by various parties in the Internet. We may or may not hold position in the stock covered, or initiate new position in the stock within the next 7 days.

Join us now!

MQ Trader stock analysis system uses Artificial Intelligence (AI), various technical indicators and quantitative data to generate accurate trading signals without the interference of human's emotions and bias against any particular stock. It comprises trading strategies which are very popular among fund managers for analysing stocks.

MQ Trader stock analysis system is SPONSORED for MQ Trader members. To use this amazing tool, you can sign up via MQ Trader Sign Up!

Contact us

Please do not hesitate to contact us if you have any enquiry:

Facebook: https://www.facebook.com/mqtrader

Instagram:https://www.instagram.com/mqtrader

MQ Chat: https://messenger.i3investor.com/m/chatmq

YouTube: https://www.youtube.com/channel/UCq-26SGjlQTVQfO7DoEihlg

Email: admin@mqtrader.com

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on Initial Public Offering (IPO)