IPO - Farm Price Holdings Berhad (Part 2)

MQTrader Jesse

Publish date: Mon, 29 Apr 2024, 11:13 AM

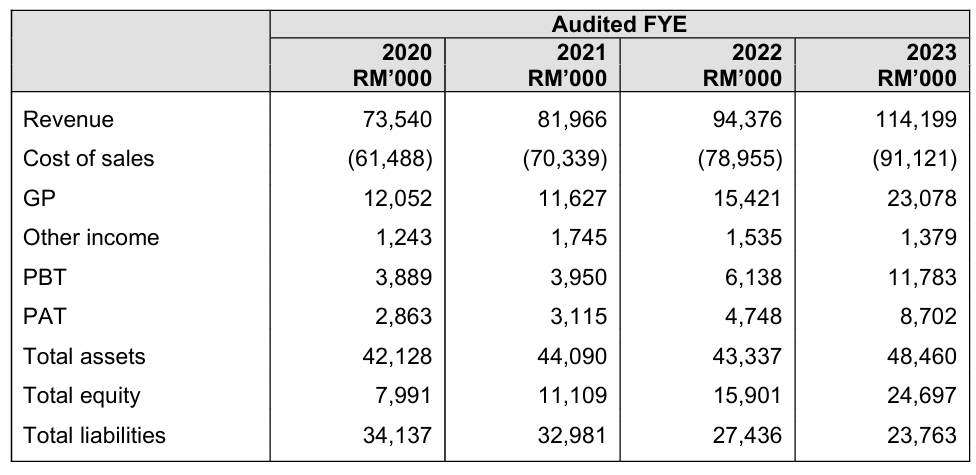

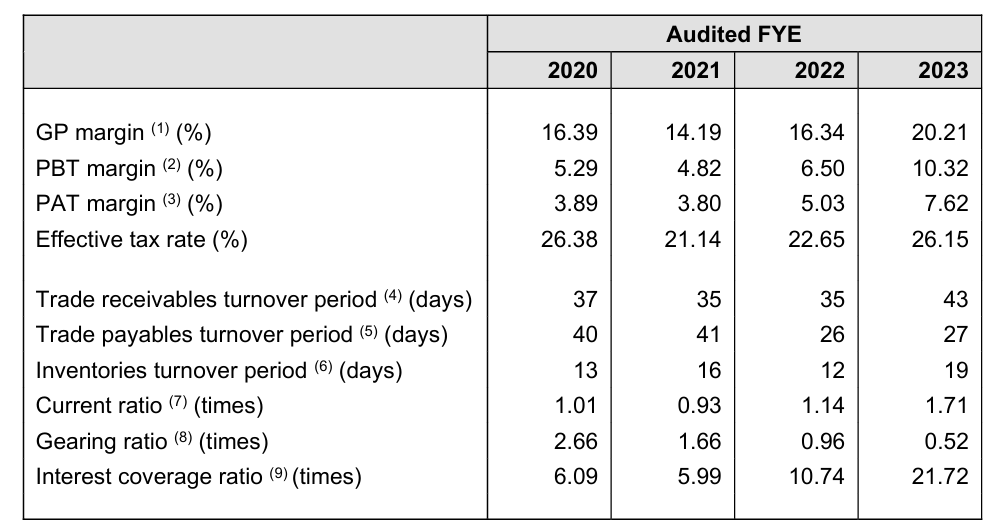

Financial Highlights

The following table sets out a summary of the Group’s audited combined financial statements for the Financial Years Under Review:

- The revenue grew from RM 73 million in FYE 2020 to RM 114 million in FYE 2023. The continuous revenue growth can be attributed to higher average selling prices and an increase in overall demand in the early stage (FYE 2020 to FYE 2022). Subsequently, the increase in revenue was mainly attributed to continuous marketing efforts.

- The gross profit margin was maintained within the range of 14% to 16%. However, the gross profit margin reached 20.21% in FYE 2023, mainly due to a decrease in the average purchase price of fresh vegetables and a revision of the selling prices for fresh-cut vegetables to customers in Singapore. (Generally, a GP margin of 20% is considered high/ good).

- The PAT margin was 3.89% in FYE 2020 and 3.80% in FYE 2021. It grew to 5.03% in FYE 2022 and further increased to 7.62% in FYE 2023.

- The gearing ratio was 0.52 times in FYE 2023, slightly exceeding the benchmark. Although the gearing ratio is acceptable, investors will still need to take note of future debt status. (A good gearing ratio should be between 0.25 – 0.5).

Major customers and suppliers

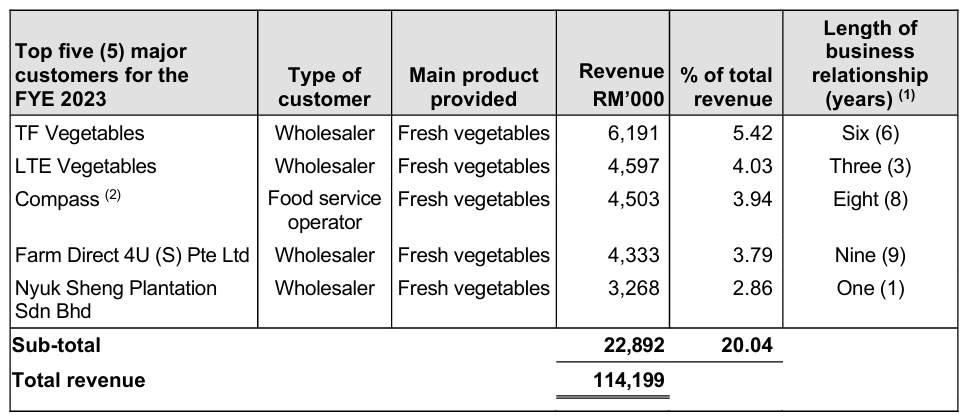

Major Customers

The top 5 major customers for FYE 2023 are as follows:

The top 5 customers contribute 20.04% of the company's revenue. Management disclosed that the company is not dependent on any of its major customers because none of the top 5 customers contribute 10% or more of the total revenue. Additionally, management mentioned that the active customer count declined in FYE 2021 and FYE 2022, possibly due to the closure of some retailers and food service operators as a result of the COVID-19 pandemic, as well as the loss of customers due to competition from other operators. The active customer count rebounded to 980 in FYE 2023.

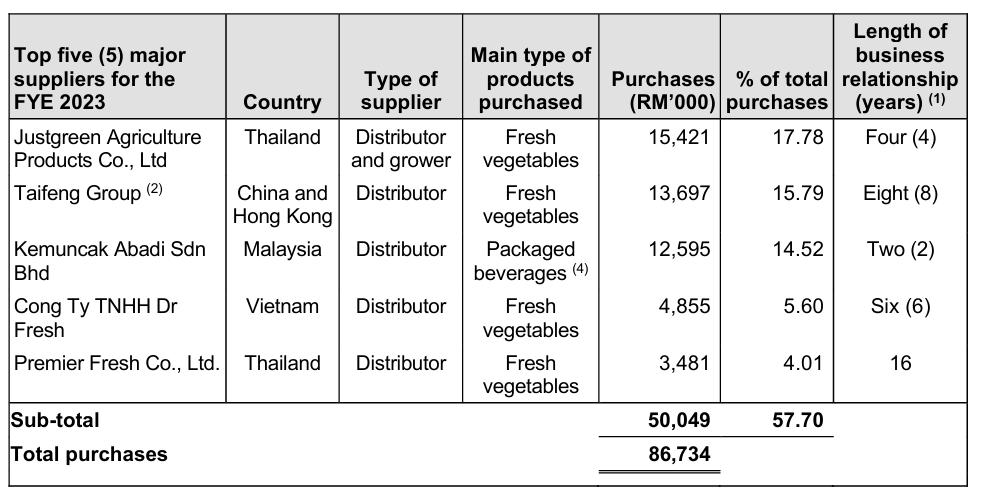

Major Suppliers

The top 5 major suppliers for FYE 2023 as follows:

The top 5 suppliers account for 57.7% of the purchases. Management mentioned that they are not dependent on any of the suppliers, as they can source similar types of fresh vegetables from other suppliers domestically in Malaysia or import from foreign countries such as Vietnam, China, Thailand, and others.

Industry Overview

According to Vital Factor Consulting research, in 2022, global production of fresh vegetables reached 2.2 billion tonnes, with a compound annual growth rate (CAGR) of 1.3% from 2018 to 2022. Thailand and China significantly contributed to this production, making up 1.7% and 35.4% of the global volume, respectively. However, their export percentages were lower, with Thailand and China exporting 0.3% and 12.7% of the global export volume of fresh vegetables. Malaysia was the primary export market for Thailand's fresh vegetables, receiving 45.7% of Thailand's total fresh vegetable exports. Additionally, Malaysia accounted for 11.3% of China's fresh vegetable exports, highlighting its dependence on these two countries for its fresh vegetable supply.

In 2023, agriculture accounted for 7.7% of Malaysia's GDP, with significant contributions from rubber, palm oil, and livestock industries (64.1%), while the remainder came from sectors like forestry, fishing, aquaculture, and other agricultural activities including vegetable farming. Of Malaysia’s agricultural land (7.8 million hectares), only 13% was dedicated to food crops, including vegetables, which represented 8.5% of the planted areas for food crops.

Malaysia remains a net importer of fresh vegetables, with imports valued at RM4.1 billion and exports at RM0.9 billion in 2023. China, India, and Thailand were the primary sources of vegetable imports. In contrast, Singapore was the main export market, receiving 83% of Malaysia's vegetable exports.

The Consumer Price Index (CPI) for vegetables, an indicator of price trends and inflation, showed that vegetable prices were highly volatile between 2020 and 2022, influenced by the COVID-19 pandemic, labor shortages, weather conditions, and rising global fertilizer prices. However, by February 2024, the inflation rate for vegetables decreased to -0.8% due to stabilized supply and reduced demand during the school holiday season. This highlights the sensitivity of vegetable prices to both external shocks and seasonal fluctuations.

In 2023, local consumption of fresh vegetables in Malaysia increased by 10.3%, reaching a total value of RM7.6 billion. As of 2022, the average monthly expenditure for Malaysian households was RM5,150, with RM 841 (16.3%) dedicated to food and non-alcoholic beverages. Of this food budget, 10.6% was spent specifically on vegetables, translating to an average monthly vegetable expenditure of RM89. This represents an average annual increase of 1.2% in vegetable expenditure from 2016 to 2022.

Between 2021 and 2023, retail sales in non-specialized stores, which include hypermarkets, supermarkets, mini markets, and other retail outlets, grew at a compound annual growth rate (CAGR) of 19.2%. This growth was particularly strong in 2022, with a 26.8% increase in sales value, buoyed by the lifting of COVID-19 containment measures and a rebound in tourism following the reopening of international borders on April 1, 2022. The growth continued into 2023, with a 12.0% increase in sales value, driven by increased household spending and rising inbound tourism.

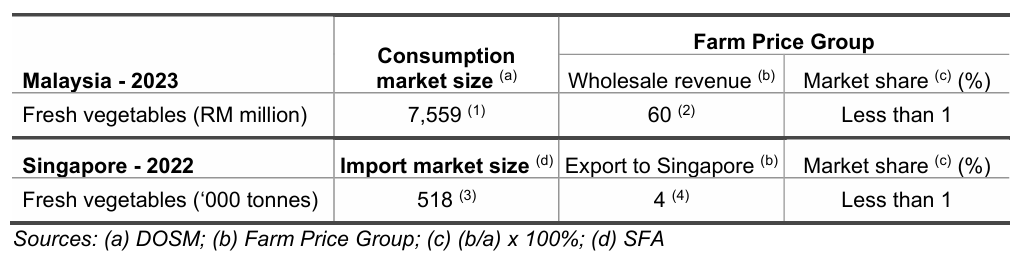

Market Size and Share

The market size in Malaysia and Singapore, and the respective market share of Farm Price Group are estimated below:

Source: Vital Factor Consulting

Future plans and strategies for FARM PRICE HOLDINGS BERHAD.

The strategy is to continue to focus on the wholesale distribution of fresh vegetables, F&B products and other groceries. As part of the strategies, the company plans to expand its operational facilities to expand the market coverage for business growth as well as enhance the supply chain of fresh vegetables.

- Expansion of the Senai distribution centre

- Construction of additional operational and related facilities

- Expansion of value-added processing areas

- Purchase of machinery and equipment

- Expansion of the transportation fleet

- Set-up additional regional distribution centres

- Nilai, Negeri Sembilan

- Cameron Highlands, Pahang

- Set-up sales and marketing office

- Singapore

MQ Trader View

Opportunities

- The company has a complete and sound business model. Firstly, the company offers a wide variety of fresh vegetables, approximately 980 SKUs, which can attract different clients. Moreover, the company has key supporting infrastructure to facilitate the distribution of fresh vegetables, F&B products, and other groceries to its customers. Lastly, the company has built an extensive network of suppliers in Malaysia and foreign countries, which allows them to have consistent and reliable sources of fresh vegetable supply to meet customer needs.

Risk

- The company’s business is subject to the risk of foreign exchange fluctuations. As a wholesale distributor of fresh vegetables, F&B products, and other groceries, the company sources its input materials domestically from suppliers in Malaysia or imports them from foreign countries. The risk of foreign exchange fluctuations arises because 57.71% of the total purchases of input materials for FYE 2023 were transacted in foreign currencies, mainly USD. For FYE 2023, 25.46% of its revenue was transacted in foreign currency, namely SGD.

Click here to refer the IPO - Farm Price Holdings Berhad (Part 1)

Looking for flat 0.05% brokerage? Get started: https://bit.ly/mqamcash

Community Feedback

We encourage traders to try out and evaluate the MQ Trader system and provide us feedback on the features you like to see in the system. We have received many positive feedbacks so far, and we are currently compiling and reviewing them for possible inclusion into the next release of the system.

We would like to develop this system based on community feedback to cater for community needs. Thanks to all those who have provided valuable feedback to us. Keep those feedback coming in!

Disclaimer

This article does not represent a BUY or SELL recommendation on the stock covered. Traders and Investors are encouraged to do their own analysis on stocks instead of blindly following any Trading calls raised by various parties in the Internet. We may or may not hold position in the stock covered, or initiate new position in the stock within the next 7 days.

Join us now!

MQ Trader stock analysis system uses Artificial Intelligence (AI), various technical indicators and quantitative data to generate accurate trading signals without the interference of human's emotions and bias against any particular stock. It comprises trading strategies which are very popular among fund managers for analysing stocks.

MQ Trader stock analysis system is SPONSORED for MQ Trader members. To use this amazing tool, you can sign up via MQ Trader Sign Up!

Contact us

Please do not hesitate to contact us if you have any enquiry:

Facebook: https://www.facebook.com/mqtrader

Instagram:https://www.instagram.com/mqtrader

MQ Chat: https://messenger.i3investor.com/m/chatmq

YouTube: https://www.youtube.com/channel/UCq-26SGjlQTVQfO7DoEihlg

Email: admin@mqtrader.com

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Initial Public Offering (IPO)