IPO - Farm Price Holdings Berhad (Part 1)

MQTrader Jesse

Publish date: Mon, 29 Apr 2024, 11:13 AM

Company Background

The Company was incorporated in Malaysia under the Act on 23 May 2023 as a private limited company under the name of Farm Price Holdings Sdn Bhd and was subsequently converted to a public limited company on 26 June 2023.

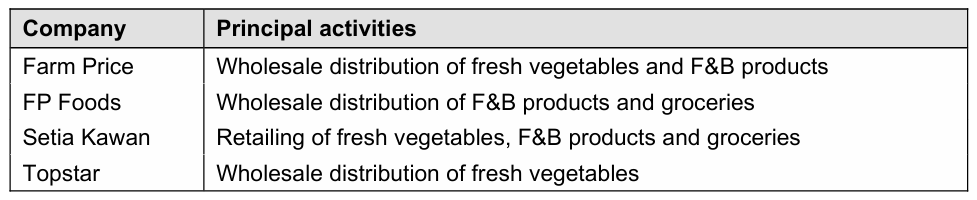

The Company is an investment holding company. The principal activities of the subsidiaries are as follows:

Use of proceeds

- Construction of new facilities on Lot 55359 - 26.14% (within 24 months)

- Purchase of machinery, equipment and logistics fleet - 8.17% (within 24 months)

- Planned regional distribution and procurement centre - 6.54% (within 18 months)

- Working capital - 43.22% (within 6 months)

- Estimated listing expenses - 15.93% (within 3 months)

Construction of new facilities on Lot 55359 - 26.14% (within 24 months)

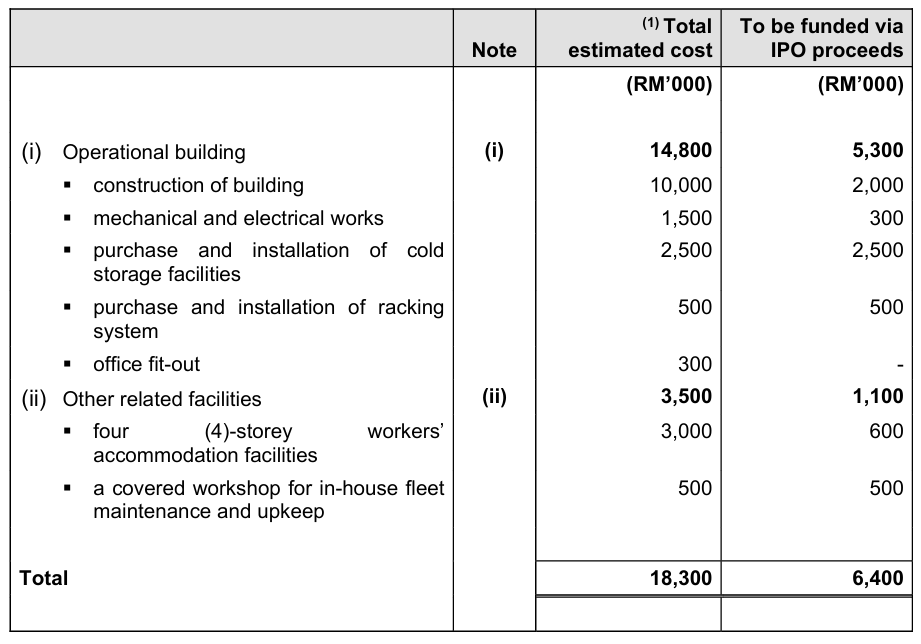

The total estimated cost for the construction of the additional operational and related facilities at Lot 55359 is estimated at RM18.30 million which will be funded using a combination of internally generated funds and/or bank borrowings and IPO proceeds. The company intends to allocate RM6.40 million, representing 26.14% of the proceeds from the Public Issue, to expand its Senai Centralised Distribution Centre by constructing additional facilities on Lot 55359 to cater for future business expansion. The additional facilities include the following:

- two (2)-storey operational building with office, cold room and related facilities; and

- other related facilities including a four (4)-storey workers’ accommodation facilities and one (1) covered workshop for in-house fleet maintenance and upkeep.

The total estimated costs for the expansion of the Senai Centralised Distribution Centre and the utilisation of proceeds are as follows:

Purchase of machinery, equipment and logistics fleet - 8.17% (within 24 months)

(a) Purchase of machinery and equipment

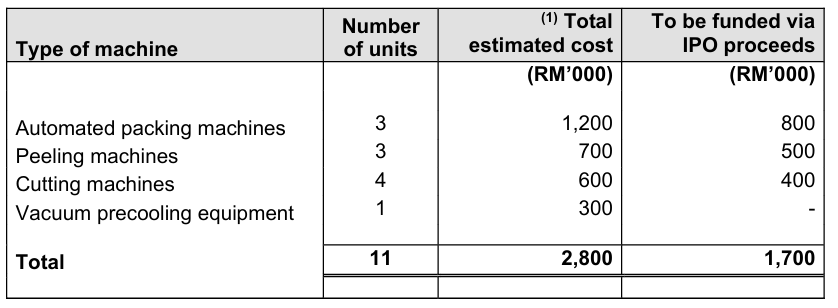

The processing of fresh vegetables such as peeling, cutting and packing activities are done manually as well as by using machines including cutting machines, peeling machines, packing machine and vacuum pre-cooling equipment. As part of the Group’s plans to improve workflow efficiency, the Group intends to purchase additional machinery and equipment such as automated packing machines, peeling machines, cutting machines and vacuum pre-cooling equipment for the processing operations and these will be placed at the existing and new operational buildings. The planned purchases of the new machines are additions to its existing machinery which will enable them to cater for the anticipated increase in customers’ orders and also to reduce the use of labour for the processing operations.

The total estimated cost of the new machinery and equipment is RM2.80 million of which RM1.70 million will be funded via its IPO proceeds. The details of the breakdown are as follows:

(b) Expansion of the transportation fleet

The company intends to purchase 16 additional trucks including eight (8) refrigerated trucks and eight (8) ambient temperature trucks between 2024 and 2026.

The total estimated cost for the purchase of the additional transportation fleet is RM3.00 million whereby RM0.30 million will be funded using the IPO proceeds and the remaining will be fully funded using a combination of internally generated funds and/or bank borrowings. As at the LPD, the company has accepted the letter of offer from the financial institution for the financing for the purchase of the additional trucks. The details of the breakdown are as follows:

Planned regional distribution and procurement centre - 6.54% (within 18 months)

(a) Regional distribution centres

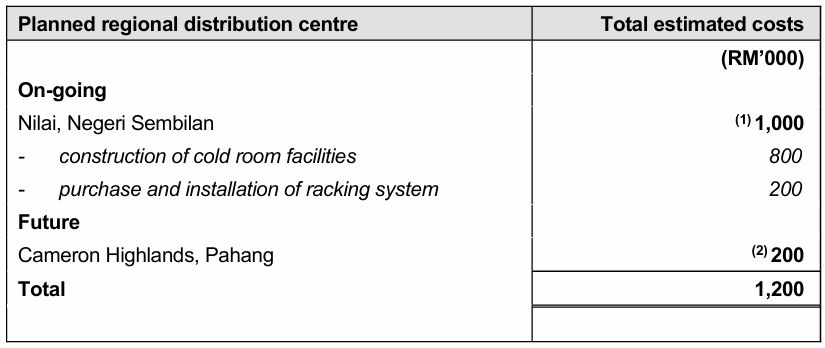

The Group has six (6) regional distribution centres in operation for the wholesale distribution of F&B products and other groceries in various states in Peninsular Malaysia. Part of the Group’s plans is to expand the fresh vegetables wholesale distribution business into the central region of Peninsular Malaysia and the Group intends to set up two (2) additional regional distribution centres as follows:

- Nilai, Negeri Sembilan: One (1) regional distribution centre with cold room facilities to expand its geographical coverage for the wholesale distribution of fresh vegetables, F&B products and other groceries in the central region of Peninsular Malaysia and East Malaysia.

- Cameron Highlands, Pahang: One (1) regional distribution centre with cold room facilities, which will also serve as the procurement centre to source fresh vegetables from Cameron Highlands.

The total cost of setting up the two (2) new regional distribution centres is estimated at RM1.20 million which will be funded using the IPO proceeds as detailed below:

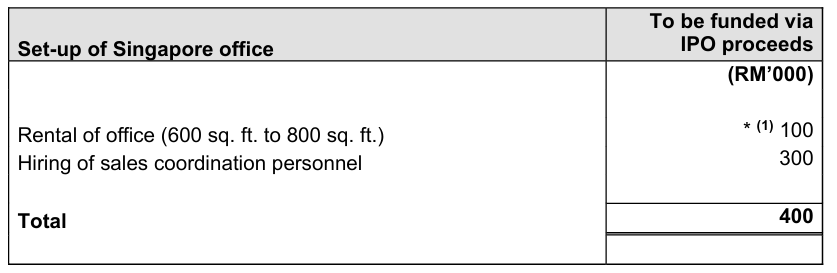

(b) Sales and marketing office in Singapore

The Company has a subsidiary, namely Topstar, which was incorporated in Singapore. Part of the Group’s strategy is to set up a sales and marketing office in Singapore to facilitate the market reach of the products to a wider geographical market of potential customers and to better serve its existing customers. The Company intends to utilise RM0.40 million for the setting up of a sales and marketing office. The estimated cost is mainly for the initial working capital including securing a rented office for 12 months and hiring of two (2) sales coordination personnel based in Singapore for 12 months.

The details of breakdown are as follows:

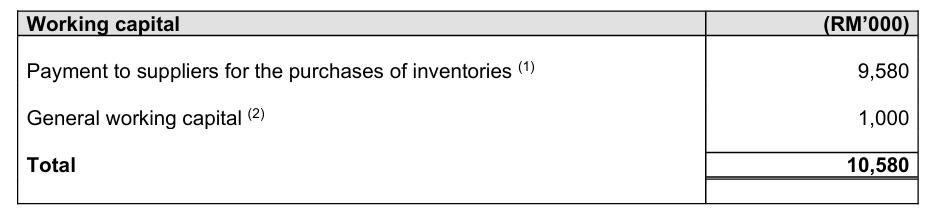

Working capital - 4.0% (within 12 months)

The Group’s working capital is expected to increase in conjunction with the expansion of its business. After taking into consideration the liquidity and capital resources as set out in Section 11.3.4 of this Prospectus, the company intends to allocate RM10.58 million, representing 43.22% of the proceeds from the Public Issue as working capital to finance the Group’s future operations, mainly in respect of the purchase of inventories which comprises vegetables, F&B products and other groceries products, as well as payment for administrative and operating expenses. The breakdown of the allocation is set out below:

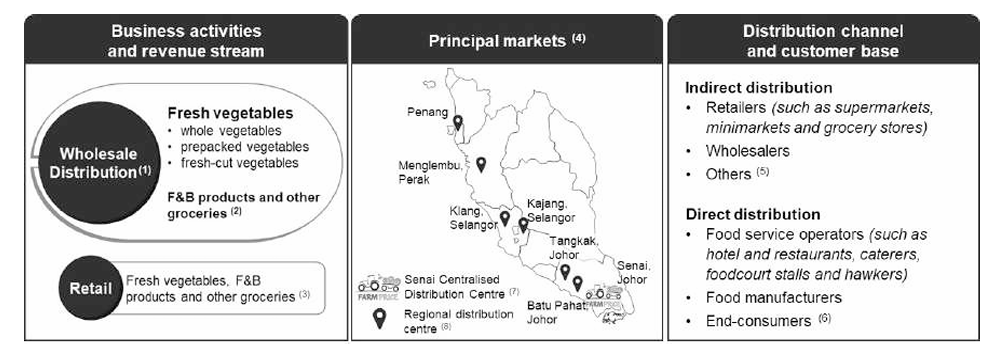

Business model

The business model is as follows:

Wholesale distribution segment

The company is primarily a wholesale distributor of fresh vegetables comprising whole vegetables, pre packed vegetables and fresh-cut vegetables to wholesalers, retailers, food service operators and manufacturers. Fresh vegetables are typically perishable and will be required to be brought to market and sold within a short lead time after harvest. As a wholesale distributor, the company plays a key role in the fresh vegetable supply chain where they source fresh vegetables from domestic and foreign growers, distributors and importers to provide them with a range of vegetables to meet the fresh vegetable requirements of its customers mainly in Johor and Singapore.

The company also supplies F&B products and other groceries to retailers including minimarkets and grocery stores and this comprises mainly packaged beverages, spices and seasonings, other food products as well as personal care products such as hair care and body care products.

The wholesale distribution operations are supported by the Senai Centralised Distribution Centre in Johor which comprises cold room facilities for storage, processing and packing, as well as ambient temperature storage, processing and packing space. The Senai Centralised Distribution Centre serves both Malaysia and Singapore markets for fresh vegetables, F&B products and other groceries.

Retail segment

The company is also involved in the operation of one (1) retail store namely, Mamaku, which sells fresh vegetables, F&B products and other groceries in Puteri Mart in Ulu Tiram, Johor.

Click here to continue the IPO - Farm Price Holdings Berhad (Part 2)

Looking for flat 0.05% brokerage? Get started: https://bit.ly/mqamcash

Community Feedback

We encourage traders to try out and evaluate the MQ Trader system and provide us feedback on the features you like to see in the system. We have received many positive feedbacks so far, and we are currently compiling and reviewing them for possible inclusion into the next release of the system.

We would like to develop this system based on community feedback to cater for community needs. Thanks to all those who have provided valuable feedback to us. Keep those feedback coming in!

Disclaimer

This article does not represent a BUY or SELL recommendation on the stock covered. Traders and Investors are encouraged to do their own analysis on stocks instead of blindly following any Trading calls raised by various parties in the Internet. We may or may not hold position in the stock covered, or initiate new position in the stock within the next 7 days.

Join us now!

MQ Trader stock analysis system uses Artificial Intelligence (AI), various technical indicators and quantitative data to generate accurate trading signals without the interference of human's emotions and bias against any particular stock. It comprises trading strategies which are very popular among fund managers for analysing stocks.

MQ Trader stock analysis system is SPONSORED for MQ Trader members. To use this amazing tool, you can sign up via MQ Trader Sign Up!

Contact us

Please do not hesitate to contact us if you have any enquiry:

Facebook: https://www.facebook.com/mqtrader

Instagram:https://www.instagram.com/mqtrader

MQ Chat: https://messenger.i3investor.com/m/chatmq

YouTube: https://www.youtube.com/channel/UCq-26SGjlQTVQfO7DoEihlg

Email: admin@mqtrader.com

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Initial Public Offering (IPO)