IPO - UUE Holdings Bhd (Part 2)

MQTrader Jesse

Publish date: Thu, 06 Jun 2024, 09:51 AM

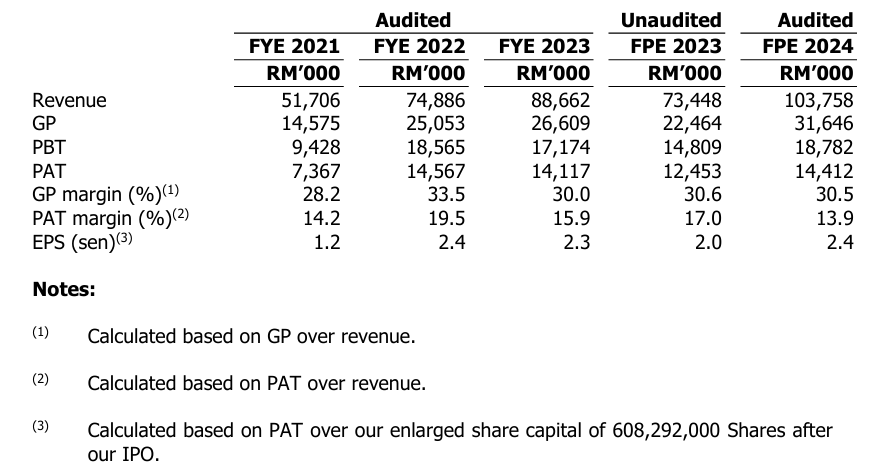

Financial Highlights

The following table sets out the financial highlights based on the combined statements of profit or loss and other comprehensive income for FYE 2021 to 2023 and FPE 2023 to 2024:

- The revenue grew from RM 51 million in FYE 2021 to RM 88 million in FYE 2023. This shows that the company's business still has room to grow.

- The gross profit margin grew from 28.2% in FYE 2021 to 33.5% in FYE 2022 but declined to 30% in FYE 2023. The decline in the margin in FYE 2023 is mainly due to the management's decision to hire an additional 39 site workers in Singapore in preparation for providing full-scale services as a subcontractor, which resulted in higher labor costs. (Generally, a GP margin of 20% is considered high/ good).

- The PAT margin grew from 14.2% in FYE 2021 to 19.5% in FYE 2022, and then declined to 15.9% in FYE 2023.

- The gearing ratio was 0.5 times in FYE 2023, which is within the benchmark. This is a good sign as the company maximizes its leverage to carry out its business. However, investors will need to monitor the gearing ratio in the future to ensure the company does not overextend its debt, which could lead to financial risk. (A good gearing ratio should be between 0.25 – 0.5).

Major customers and suppliers

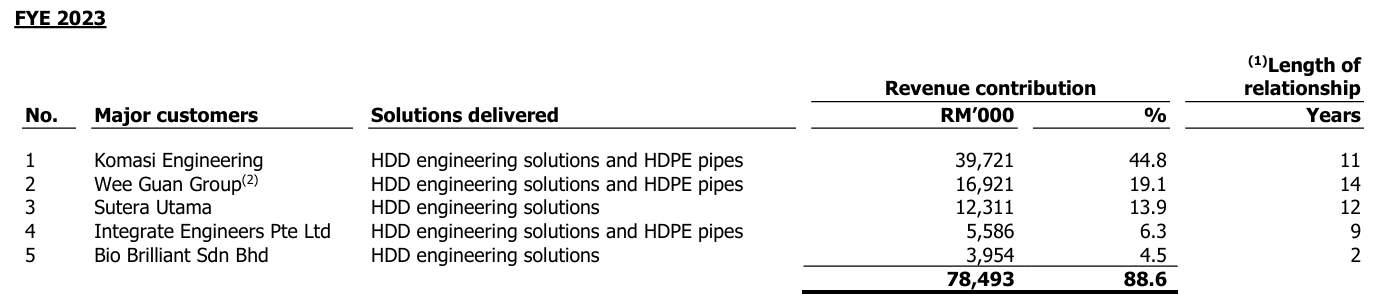

Major Customers

The major customer for FYE 2023 is as follows:

The top 5 customers contributed 88.6% of the revenue, and the top 1 customer contributed 44.8% of the revenue, which is almost half of the company’s revenue. This high concentration of revenue from a single client exposes the company to significant client concentration risk. Although the company's business is conducted on a contract basis and is based on projects secured from time to time and work-in-progress claims, management has disclosed that their business depends on Komasi Engineering, Sutera Utama, and Wee Guan Group.

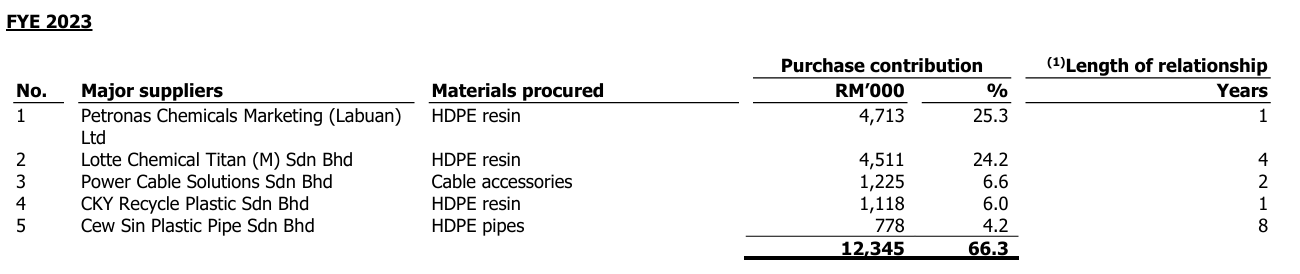

Major Suppliers

The top 5 major suppliers for FYE 2023 as follows:

The top 5 suppliers account for 66.3% of the purchases. The management mentioned that their top supplier is Lotte Chemical Titan (M) Sdn Bhd, as they primarily procure HDPE resin from this supplier. However, they also have other suppliers that can provide HDPE resin based on their production and quality requirements.

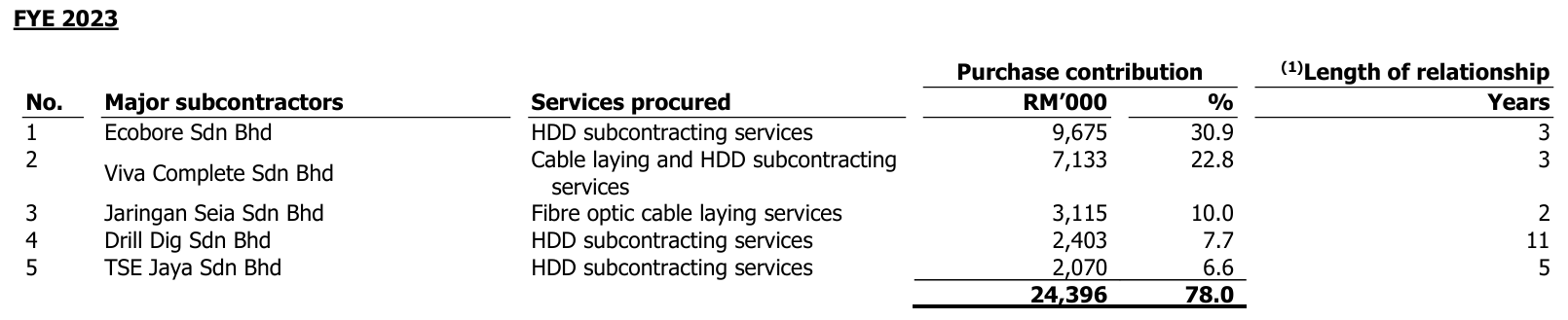

Major subcontractors

The top 5 major subcontractors for FYE 2023 is as follows:

The company engages Ecobore Sdn Bhd, Drill Dig Sdn Bhd, Viva Complete Sdn Bhd, and TSE Jaya Sdn Bhd to carry out the physical HDD works and cable laying portions of HDD projects undertaken by the Group. These tasks are labor-intensive in nature, involving pipeline route boring, and the installation of cables, pipelines, and jointing under the supervision of the Group’s employees.

The Group does not enter into long-term agreements or arrangements with suppliers and subcontractors, as this allows them to have the flexibility to source quality materials and services at competitive prices and favorable credit terms. The Group has established long-standing business relationships with these suppliers and subcontractors to ensure minimal disruptions to the supply chain and business operations.

Industry Overview

According to Providence Strategic Partners' research, the power infrastructure utilities market in Malaysia, based on the capital expenditure incurred for recurring electricity generation, transmission, and distribution, rose from RM5.7 billion in 2016 to RM11.1 billion in 2023 at a compound annual growth rate (CAGR) of 9.8%. In 2020, the capital expenditure incurred for electricity transmission and distribution was affected by the COVID-19 pandemic and the subsequent phases of the movement control order (MCO) that stifled economic activity. In 2024, Tenaga Nasional Berhad announced a capital expenditure allocation of RM13.0 billion, of which RM7.7 billion will be for regulated capital expenditure (including energy transition-related capital expenditure of RM3.3 billion), while the remaining RM5.3 billion will be allocated for other major projects.

The power infrastructure utilities market comprises the capital expenditure of utility companies for utility systems and related services in relation to the construction of generation facilities, transmission and distribution lines, as well as related structures for power utilities by industry players. All structures that are integral parts of utility systems are included in this market. The work performed by these industry players includes new installations, additions, alterations, maintenance, and repairs.

Demand Conditions: Key Growth Drivers

- Long-term economic growth supports investments in utility infrastructure

- Population growth and urbanisation promote investments in utility infrastructure

- Growing demand for electricity stimulates investments in new and replacement utility infrastructure

- Foreign investment and domestic investment growth support investments in utility infrastructure

- Piped gas

- Water and sewerage

- Communication services

- Malaysia’s renewable energy generation targets create opportunities for investments in power infrastructure

- Government initiatives to strengthen utility infrastructure in Malaysia

- Electricity

- Rural infrastructure

- Digital connectivity

Source: Providence Strategic Partners

Future plans and strategies for UUE HOLDINGS BHD.

The business objectives are to maintain sustainable growth and create long-term shareholder value. To achieve the business objectives, the company will implement the following business strategies over 36 months from the date of its Listing:

- The company intends to pursue opportunities to expand regionally in Malaysia.

- The company intends to acquire more machinery to expand the range of underground utilities engineering solutions and scale of projects.

- The company intends to further expand the range of underground utilities engineering solutions in Singapore.

MQ Trader View

Opportunities

- The company's focus on project management and underground utilities survey works has enabled it to grow its underground utilities engineering solution business. The Group focuses on project planning and management, utility detection and mapping, as well as HDD technical expertise. This strategy allows the Group to increase its project delivery capabilities and capacity. Project planning and management is an important facet of construction projects. The focus on project planning provides a competitive advantage as it allows the company to realize benefits in project delivery, including:

- having a clear definition of project requirements, tasks to be done, and the order of task implementation;

- having an accurate assessment of the costs associated with a project, as well as a timeline for completion;

- the ability to effectively manage subcontractors' work performance in line with project requirements, timeline, and cost; and

- ensuring project requirements are met.

- The company has established relationships with its customers, providing it with a stable flow of projects. The company maintains strong business relationships with its customers, which include main contractors, property owners and developers, as well as telecommunications service providers. The company has had business relationships with its top 3 customers for more than 10 years as of FPE 2024.

Risk

- The company is dependent on major customers, which exposes them to high client concentration risk. The company has a high concentration of projects in the electricity supply industry, with 23 ongoing projects (with a contract value of RM 314.2 million) out of a total of 101 ongoing projects (with a total contract value of RM 423.7 million) as of the latest practicable date (LPD). Tenaga Nasional Berhad (TNB) is the project owner for electricity supply-related projects in Peninsular Malaysia.

Click here to refer the IPO - UUE Holdings Bhd (Part 1)

Looking for 3x cash & 2x shares trading limit? Get started now!

Community Feedback

We encourage traders to try out and evaluate the MQ Trader system and provide us feedback on the features you like to see in the system. We have received many positive feedbacks so far, and we are currently compiling and reviewing them for possible inclusion into the next release of the system.

We would like to develop this system based on community feedback to cater for community needs. Thanks to all those who have provided valuable feedback to us. Keep those feedback coming in!

Disclaimer

This article does not represent a BUY or SELL recommendation on the stock covered. Traders and Investors are encouraged to do their own analysis on stocks instead of blindly following any Trading calls raised by various parties in the Internet. We may or may not hold position in the stock covered, or initiate new position in the stock within the next 7 days.

Join us now!

MQ Trader stock analysis system uses Artificial Intelligence (AI), various technical indicators and quantitative data to generate accurate trading signals without the interference of human's emotions and bias against any particular stock. It comprises trading strategies which are very popular among fund managers for analysing stocks.

MQ Trader stock analysis system is SPONSORED for MQ Trader members. To use this amazing tool, you can sign up via MQ Trader Sign Up!

Contact us

Please do not hesitate to contact us if you have any enquiry:

Facebook: https://www.facebook.com/mqtrader

Instagram:https://www.instagram.com/mqtrader

MQ Chat: https://messenger.i3investor.com/m/chatmq

YouTube: https://www.youtube.com/channel/UCq-26SGjlQTVQfO7DoEihlg

Email: admin@mqtrader.com

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Initial Public Offering (IPO)