IPO - BWYS Group Bhd (Part 2)

MQTrader Jesse

Publish date: Wed, 26 Jun 2024, 11:27 AM

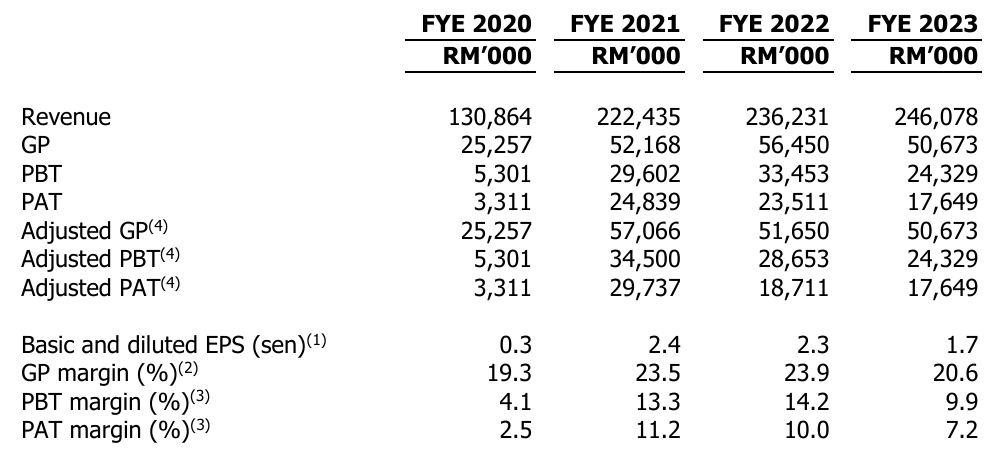

Financial Highlights

The following table sets out the financial highlights based on the combined statements of profit or loss and other comprehensive income for the Period Under Review.

- The revenue grew from RM 130 million in FYE 2020 to RM 246 million in FYE 2023, indicating that the company is expanding its market share within the industry.

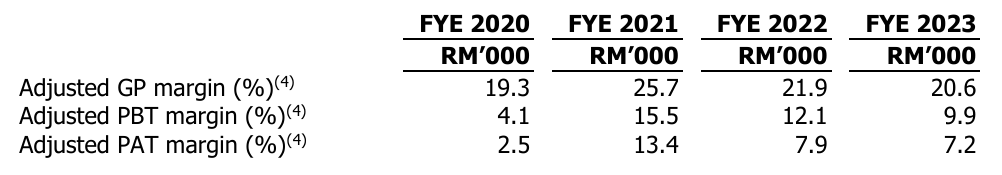

- The gross profit margin grew from 19.3% in FYE 2020 to 25.7% in FYE 2021, then declined continuously to 20.6% in FYE 2023. The decrease in the gross profit margin in FYE 2022 and FYE 2023 was mainly due to the decrease in steel prices and the increase in labor costs and subcontractor wages. (Generally, a GP margin of 20% is considered high/ good).

- The PAT margin grew from 4.1% in FYE 2020 to 15.5% in FYE 2021 and declined to 12.1% in FYE 2022 and 9.9% in FYE 2023.

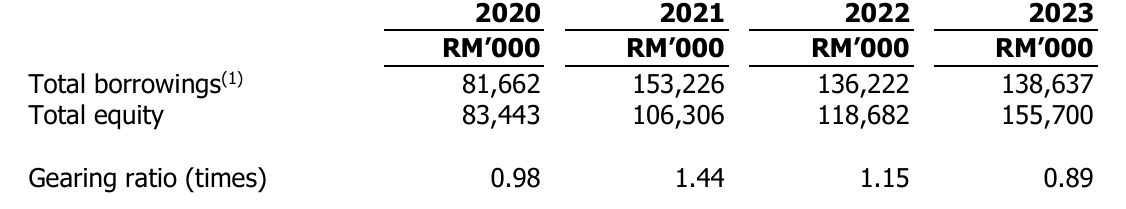

- The gearing ratio is 0.89, which is above the benchmark range. The increase in the FYE 2021 gearing ratio was mainly due to higher outstanding bankers' acceptances as of 31 December 2021. After that, the company repaid the borrowings, increased total equity, and issued additional shares resulting from the capitalization. However, since the latest gearing ratio is still above the benchmark, we remain concerned about its future debt and equity performance. (A good gearing ratio should be between 0.25 – 0.5).

Major customers and suppliers

Major Customers

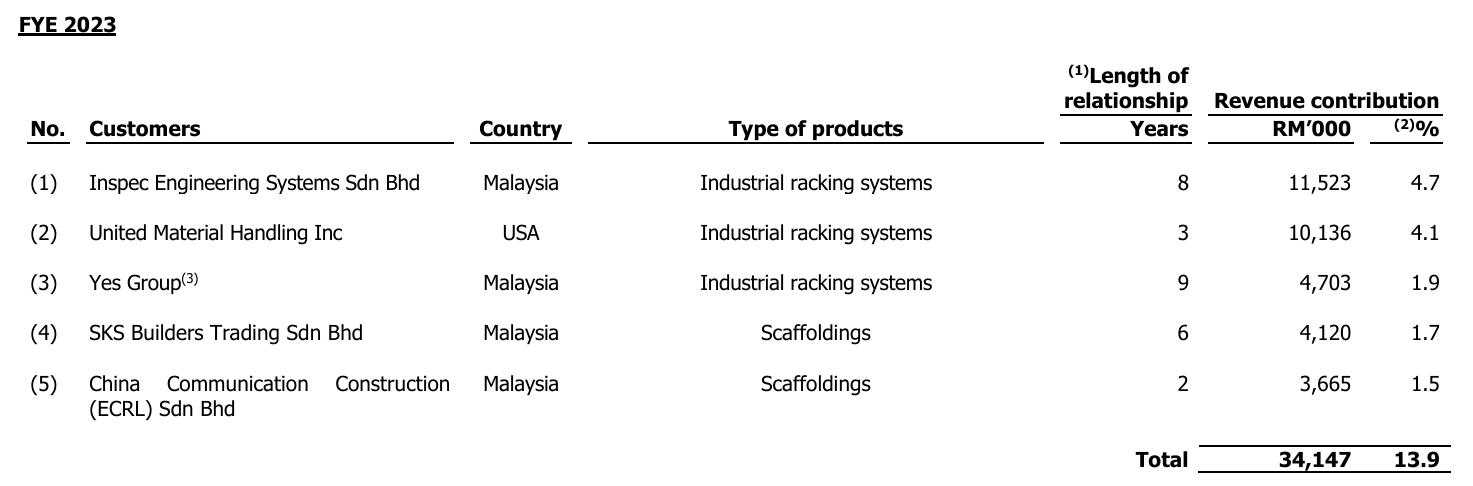

The top 5 major customers for the FYE 2023 is as follows:

The top five major customers contributed 13.9% of the revenue. The company is not dependent on any of its major customers, as none of the top five customers contributed more than 10% of its total revenue for each period under review. In addition, the group has a diverse customer base and served between 1,000 and 1,700 customers from FYE 2020 to FYE 2023. As of the LPD, the group has 1,180 active customers.

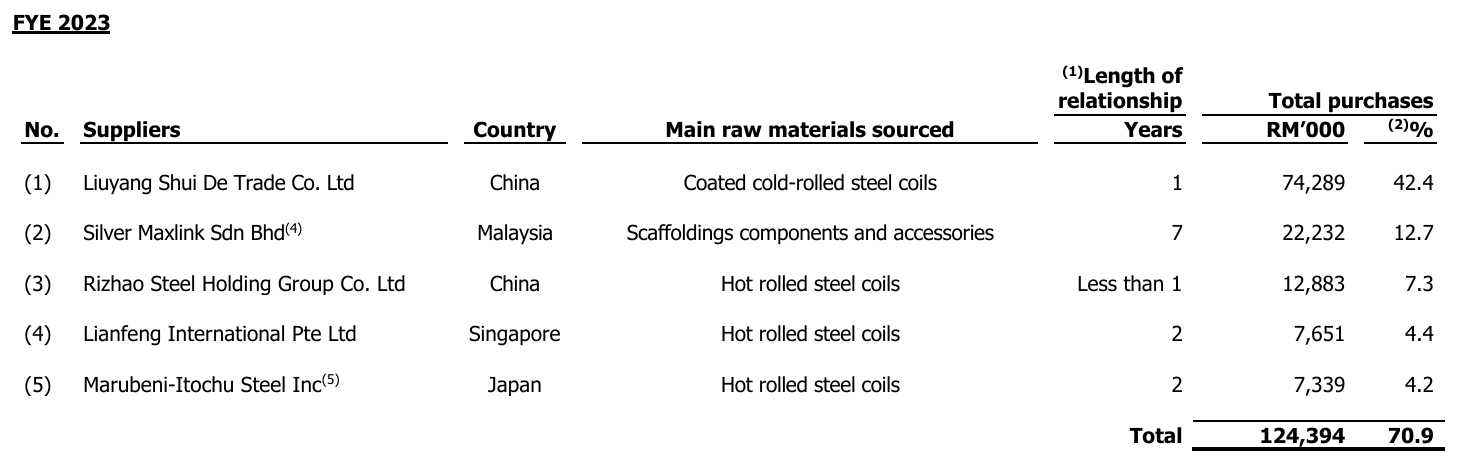

Major Suppliers

The top 5 major suppliers for the FYE 2023 is as follows:

The top five suppliers account for 70.9% of the purchases. The management mentioned that even though purchases from several suppliers exceed 10% of the total purchases, they are not dependent on any one of them. This is because the purchases are commodities, namely steel coils, which are easily available domestically as well as from several foreign countries such as China and Korea.

Industry Overview

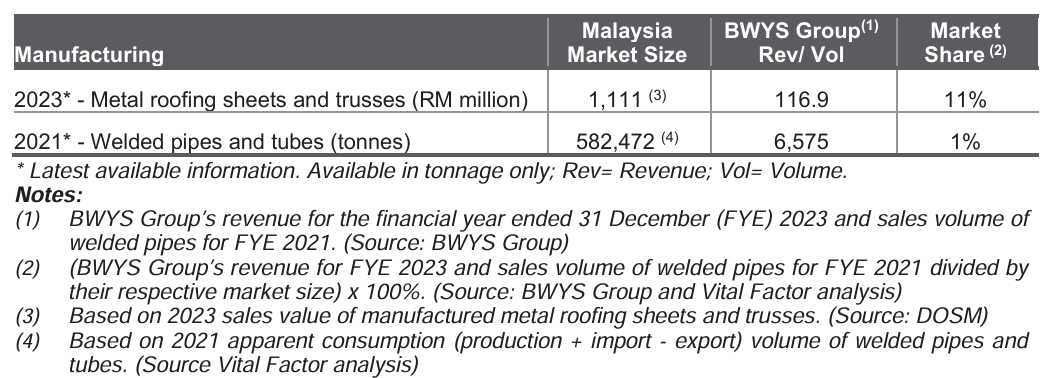

According to Vital Factor Consulting's research, BWYS Group is involved in the manufacture of sheet metal products, including roofing sheets and trusses, industrial racking systems, and scaffoldings, which are part of the overall fabricated metal industry. Between 2021 and 2023, the sales value of the manufacture of fabricated metal products grew at a CAGR of 11.0% to RM 70.2 billion in 2023, which corresponded with the increase in capacity utilization of the sector during this period (Sources: DOSM and Vital Factor analysis). In the first quarter (Q1) of 2024, the sales value of the manufacture of fabricated metal products grew by 12.7% compared to Q1 2023 (Source: DOSM).

Furthermore, BWYS Group is involved in the manufacture of welded pipes that are mainly used for the protection and routing of electrical wiring in buildings or structures in the construction industry, as well as structural welded pipes used for scaffolding and other structural applications. Between 2019 and 2021, according to the latest available statistics, the production and apparent consumption volumes of welded pipes and tubes (structural and non-structural) declined at an average annual rate of 10.2% and 10.7%, respectively, mainly due to the impact of the COVID-19 pandemic. Nevertheless, growth of 11.7% and 26.5% in the production and apparent consumption volumes in 2021 indicated signs of recovery, albeit not reaching pre-COVID-19 levels in 2019.

Market Size and Share

Drivers of growth and opportunities

- Malaysia's economy is projected to grow between 4.0% and 5.0% in 2024.

- Growth in user industries includes building construction, manufacturing, as well as wholesale and retail trade industries.

- The New Industrial Master Plan (NIMP) 2030 focuses on the manufacturing and manufacturing-related service sectors.

Threats and challenges

- Sustained increases in steel prices

- Shortages and rising labor costs

- Potential downturns in the domestic and global economy

Source: Vital Factor Consulting

Future plans and strategies for BWYS GROUP BERHAD

Moving forward, the company will continue its existing business in the manufacturing of sheet metal products and supply of scaffoldings operations. The company also has put in place strategies and plans to sustain and grow the business as follows:

- Expand operational facilities and increase production capacity

- Set up a new factory

- Purchase new machinery and equipment

- New automated powder coating line

- New roll forming machines and related equipment

- Implementation of ICT systems

- Manufacture of new roofing product

- Expand existing and new foreign markets

MQ Trader View

Opportunities

- The company has operational facilities in various locations across Malaysia to provide market coverage and grow its business. It operates 8 facilities in total: the head office, main warehouse, and manufacturing facility are located in Penang. Additionally, there are operational facilities in Selangor, Johor, Kelantan, Sarawak, and Sabah, enabling wide geographic market access across Peninsular and East Malaysia to support business growth.

- The company offers a range of sheet metal products and scaffolding, providing diverse business opportunities and convenience to its customers. They manufacture various sheet metal products including roofing sheets, trusses, industrial racking systems, and welded pipes. Additionally, they supply scaffolding. Each category of these products generates distinct revenue streams that sustain and foster business growth.

Risk

- The company's business and financial performance are subject to fluctuations in steel prices. The main input materials are steel-based, including hot-rolled steel coils, coated cold-rolled steel coils, as well as other steel products such as steel pipes, bars, and plates. These steel-based materials are prone to market price fluctuations, and an increase in steel prices will lead to higher costs for purchasing these materials.

- The company relies on imports of mainly steel materials, exposing them to risks associated with supply chain disruptions and increases in sea freight rates. Specifically, the company purchases imported steel coils, which accounted for 74.9% of its total purchases of input materials and services for FYE 2023. Of these purchases, 98.7% of the steel coils were sourced from foreign suppliers, including China, Korea, Singapore, Taiwan, and Japan.

Click here to refer the IPO - BWYS Group Bhd (Part 1)

Looking for 3x cash & 2x shares trading limit? Get started now!

Community Feedback

We encourage traders to try out and evaluate the MQ Trader system and provide us feedback on the features you like to see in the system. We have received many positive feedbacks so far, and we are currently compiling and reviewing them for possible inclusion into the next release of the system.

We would like to develop this system based on community feedback to cater for community needs. Thanks to all those who have provided valuable feedback to us. Keep those feedback coming in!

Disclaimer

This article does not represent a BUY or SELL recommendation on the stock covered. Traders and Investors are encouraged to do their own analysis on stocks instead of blindly following any Trading calls raised by various parties in the Internet. We may or may not hold position in the stock covered, or initiate new position in the stock within the next 7 days.

Join us now!

MQ Trader stock analysis system uses Artificial Intelligence (AI), various technical indicators and quantitative data to generate accurate trading signals without the interference of human's emotions and bias against any particular stock. It comprises trading strategies which are very popular among fund managers for analysing stocks.

MQ Trader stock analysis system is SPONSORED for MQ Trader members. To use this amazing tool, you can sign up via MQ Trader Sign Up!

Contact us

Please do not hesitate to contact us if you have any enquiry:

Facebook: https://www.facebook.com/mqtrader

Instagram:https://www.instagram.com/mqtrader

MQ Chat: https://messenger.i3investor.com/m/chatmq

YouTube: https://www.youtube.com/channel/UCq-26SGjlQTVQfO7DoEihlg

Email: admin@mqtrader.com

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Initial Public Offering (IPO)