IPO - BWYS Group Bhd (Part 1)

MQTrader Jesse

Publish date: Wed, 26 Jun 2024, 11:26 AM

Company Background

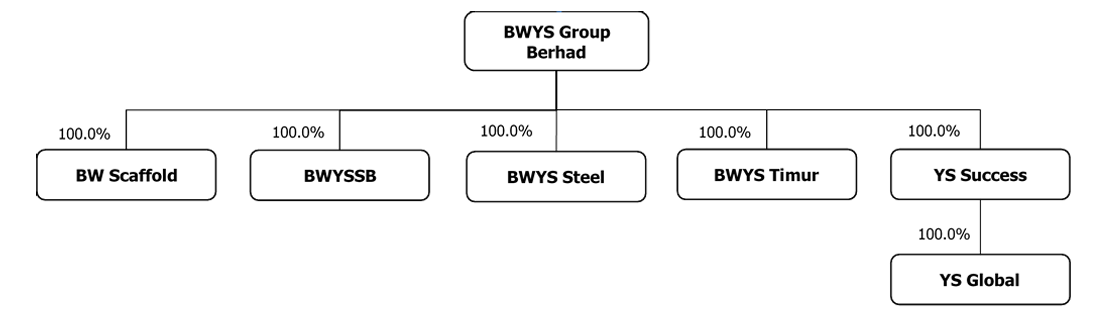

The Company was incorporated in Malaysia under the Act on 4 January 2023 as a public limited company under the name of BWYS Group Berhad. The company is principally an investment holding company. Through its subsidiaries, the company is principally involved in the manufacturing of sheet metal products and the supply of scaffoldings.

The Group’s structure after the IPO is as follows:

Use of proceeds

- Capital expenditure - 73.3% (within 36 months)

- Construction of New Penang Factory - 40.4% (within 36 months)

- Purchase of new machinery and equipment - 13.7% (within 36 months)

- Implementation of new ERP system, production and inventory management systems - 19.2% (within 36 months)

- Repayment of bank borrowings - 7.1% (within 12 months)

- Working capital - 9.8% (within 12 months)

- Estimated listing expenses - 9.8% (within 3 month)

Capital expenditure

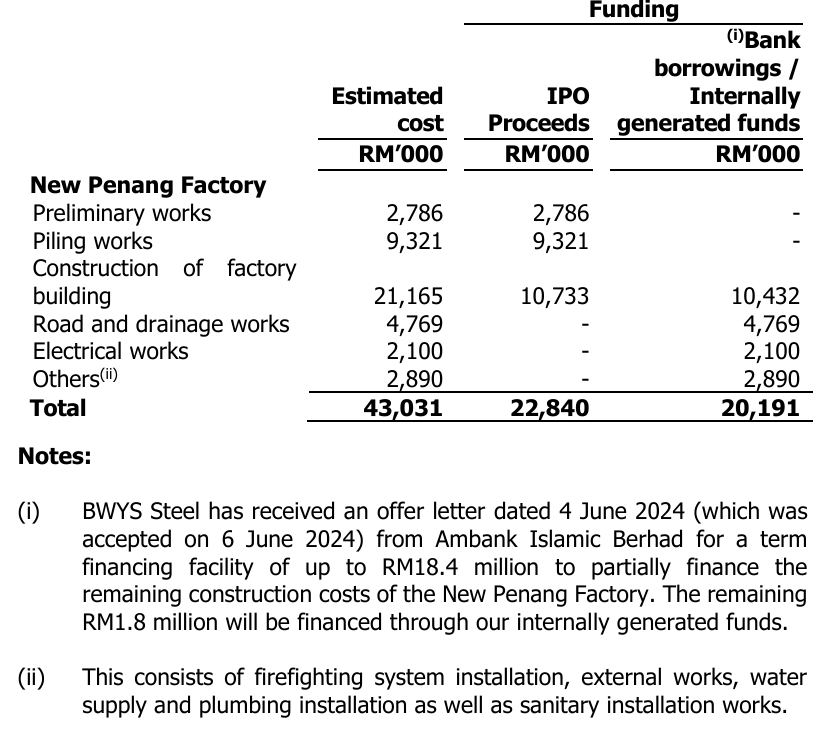

(a) Construction of New Penang Factory - 40.4% (within 36 months)

The Group plans to allocate RM22.8 million or 40.4% from the IPO proceeds to partially finance the construction of the New Penang Factory.

The total cost for the above setting up of New Penang Factory including construction and renovation is estimated at RM43.0 million (based on quotations obtained from respective contractors and suppliers for the construction and renovation work) which will be partially funded via RM22.8 million from the IPO proceeds while the remaining via bank borrowings and internally generated funds.

The Group had commenced the construction of the New Penang Factory in the first quarter of 2024 by utilising the internally generated funds. Therefore, when the proceeds from the Public Issue are received, the company will use the proceeds allocated to replenish the internally generated funds.

Details are set out below:

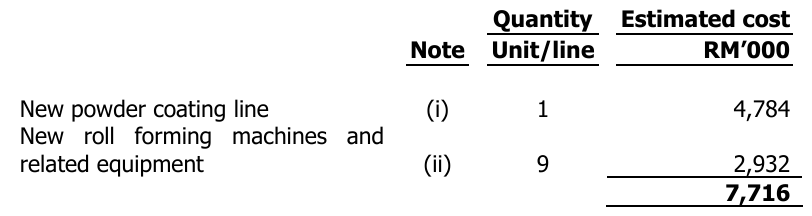

(b) Purchase of new machinery and equipment - 13.7% (within 36 months)

The Group plans to allocate RM7.7 million or 13.7% from the IPO proceeds for the purchase of new machinery and equipment. The total cost for the purchase of new machinery and equipment (based on respective vendor’s quotations) are as follows:

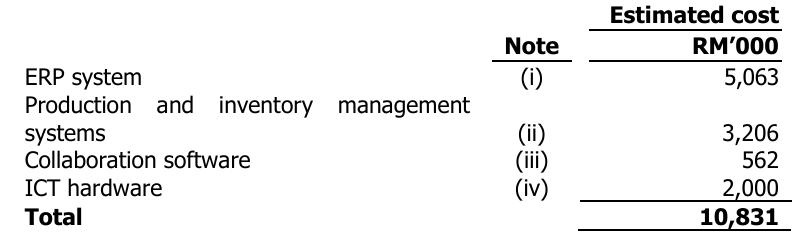

(c) Implementation of new ERP system, production and inventory management systems - 19.2% (within 36 months)

The Group plans to allocate RM10.8 million or 19.2% from the IPO proceeds for the implementation of the new ERP system, production and inventory management systems. This is to integrate the business processes as well as to digitalise the production and inventory management where the existing administrative processes are primarily manual.

With the implementation of the new systems, the company will be able to monitor every stage of the manufacturing process, beginning from the incoming raw materials till the delivery of the finished goods to the customers. The implementation of the systems will create a network to link the manufacturing facility including the manufacturing execution system and inventory management system, which will enable them to monitor and trace the entire manufacturing process in real-time as well as the movement of the inventories.

The total cost for the implementation of the new ERP system, production and inventory management systems is estimated at RM10.8 million (based on vendor’s quotation). The details are set out below:

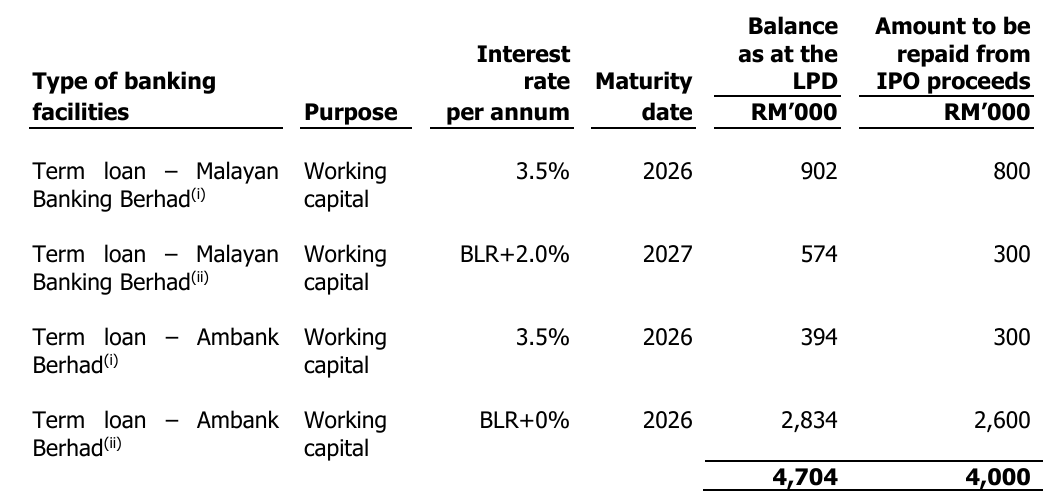

Repayment of bank borrowings - 7.1% (within 12 months)

The company plans to allocate RM4.0 million or 7.1% of the IPO proceeds to pare down and reduce the bank borrowings as follows:

Working capital - 9.8% (within 12 months)

The company plans to allocate RM5.5 million or 9.8% of the IPO proceeds to fund its working capital requirements for the purchase of raw materials such as steel materials and steel-related products.

For the Period Under Review, raw materials are the main component of the cost of sales,

representing approximately 77.4% to 84.2% of the total cost of sales and the company is expected to increase in tandem with the expected growth in scale of its operations.

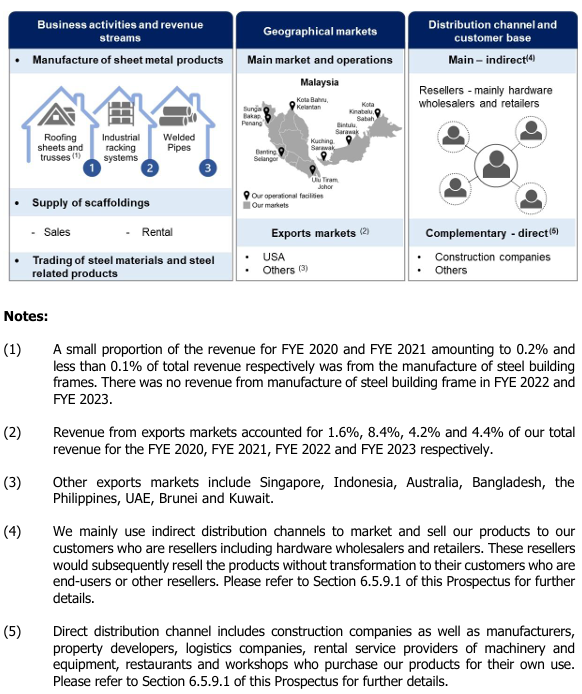

Business model

The business model is as follows:

The company is principally an investment holding company. Through its subsidiaries, the company is principally involved in the manufacturing of sheet metal products and the supply of scaffoldings. To complement its manufacturing of sheet metal products and supply of scaffoldings, the company also engages in the trading of steel materials and steel-related products.

Click here to continue the IPO - BWYS Group Bhd (Part 2)

Looking for 3x cash & 2x shares trading limit? Get started now!

Community Feedback

We encourage traders to try out and evaluate the MQ Trader system and provide us feedback on the features you like to see in the system. We have received many positive feedbacks so far, and we are currently compiling and reviewing them for possible inclusion into the next release of the system.

We would like to develop this system based on community feedback to cater for community needs. Thanks to all those who have provided valuable feedback to us. Keep those feedback coming in!

Disclaimer

This article does not represent a BUY or SELL recommendation on the stock covered. Traders and Investors are encouraged to do their own analysis on stocks instead of blindly following any Trading calls raised by various parties in the Internet. We may or may not hold position in the stock covered, or initiate new position in the stock within the next 7 days.

Join us now!

MQ Trader stock analysis system uses Artificial Intelligence (AI), various technical indicators and quantitative data to generate accurate trading signals without the interference of human's emotions and bias against any particular stock. It comprises trading strategies which are very popular among fund managers for analysing stocks.

MQ Trader stock analysis system is SPONSORED for MQ Trader members. To use this amazing tool, you can sign up via MQ Trader Sign Up!

Contact us

Please do not hesitate to contact us if you have any enquiry:

Facebook: https://www.facebook.com/mqtrader

Instagram:https://www.instagram.com/mqtrader

MQ Chat: https://messenger.i3investor.com/m/chatmq

YouTube: https://www.youtube.com/channel/UCq-26SGjlQTVQfO7DoEihlg

Email: admin@mqtrader.com

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on Initial Public Offering (IPO)