IPO - Well Chip Group Bhd (Part 2)

MQTrader Jesse

Publish date: Fri, 28 Jun 2024, 09:42 AM

Financial Highlights

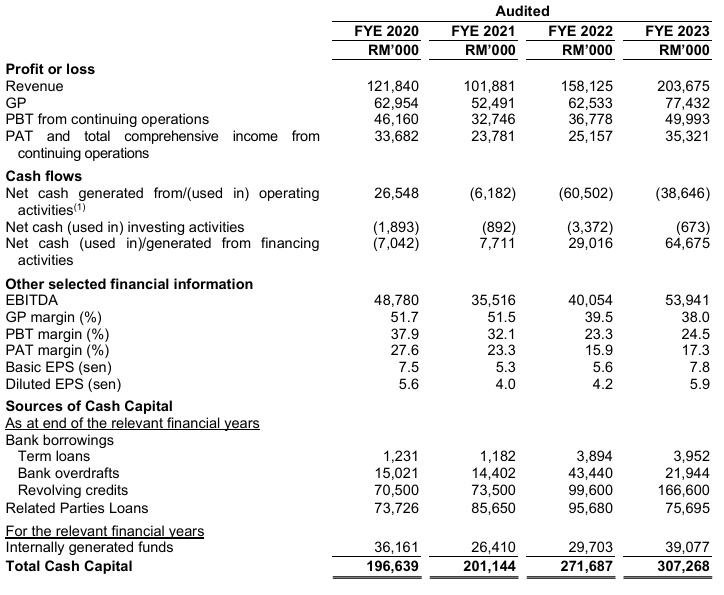

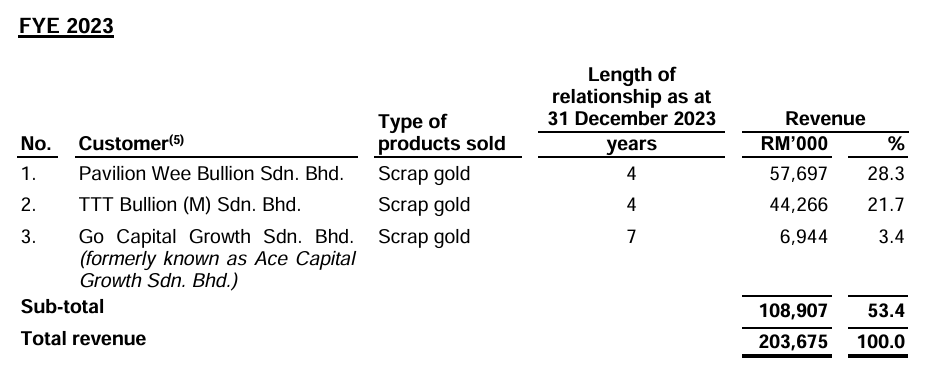

The table below sets out financial highlights based on the audited combined financial statements for the Period Under Review:

- The revenue declined from RM 121 million in FYE 2020 to RM 101 million in FYE 2021 but then grew to RM 203 million in FYE 2023. The decrease in FYE 2021 was mainly due to the marginal increase in the default rate from 7.0% in FYE 2020 to 7.8% in FYE 2021.

- The gross profit margin continuously declined from 51.7% in FYE 2020 to 38.0% in FYE 2023. The decline in the GP margin was mainly due to the increase in interest rates for banking facilities. (Generally, a GP margin of 20% is considered high/ good).

- The PAT margin declined from 27.6% in FYE 2020 to 15.9% in FYE 2022, but it grew to 17.3% in FYE 2023.

- The gearing ratio is 1.32, which exceeds the benchmark range. The main reason for the high gearing ratio is the nature of the business, which increased loans and borrowings mainly for cash capital and working capital for its outlets. (A good gearing ratio should be between 0.25 – 0.5).

Major customers and suppliers

The company has distributed the business into two segments: pawnbroking services and the retail and trading of jewelry and gold.

Major Customers

(a) Pawnbroking services

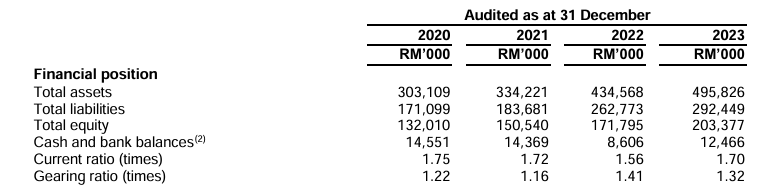

Customers of the pawnbroking segment are walk-in individuals and the contribution from each customer as a percentage of the total revenue is negligible.

The number of customers for its pawnbroking business has grown from 55,835 in the FYE 2020 to 86,528in the FYE 2023. The breakdown of Malaysian and foreign customers are as follows:

(b) Retail and trading of jewellery and gold

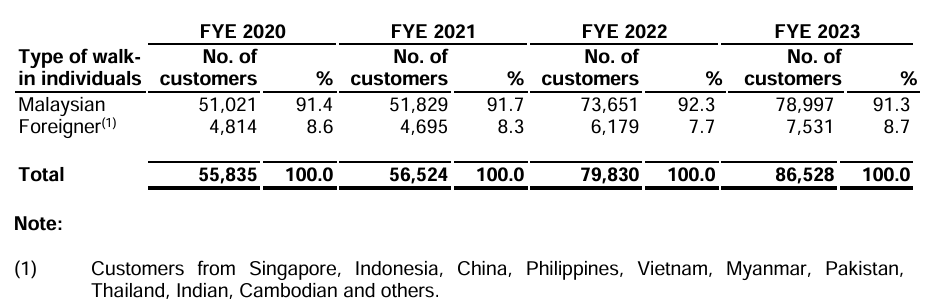

Customers of the retail and trading of jewellery and gold segments are scrap gold traders and individual customers. Contribution from each individual customer as a percentage of the Group’s total revenue is negligible.

The major customers are scrap gold traders who purchase the unredeemed and bid pledges as well as pre-owned jewellery. The Group’s top 5 major customers for FYE 2023 are as follows:

The management mentioned they are not dependent on any major customers for the sales of unredeemed and bid pledges as well as pre-owned jewellery as these scrap gold trades are easily sourced in Malaysia.

Major Suppliers

(a) Pawnbroking service

The company does not have any major suppliers due to the nature of the pawnbroking business as they do not purchase or require any supplies for the operation of its pawnbroking business.

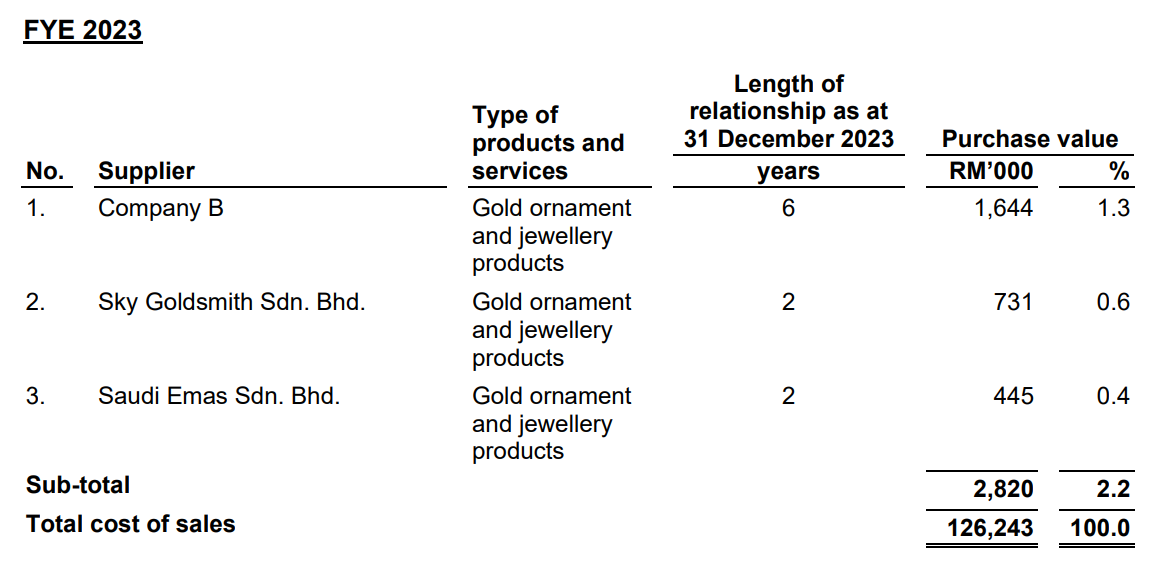

(b) Retails and trading of jwellery and gold

The company procures new gold and gold jewelry from manufacturers and/or wholesalers, as well as pre-owned gold, gold jewelry, diamond jewelry, and watches from unredeemed and bid pledges, and from walk-in individuals at its retail outlets. The major suppliers for FYE 2023 are as follows:

The company is not dependent on any single supplier, as it can source gold products from various gold trading companies.

Industry Overview

According to Protégé Associates' research, the outlook for the pawnbroking industry in Malaysia is expected to be positive during the forecast period. Growth is anticipated to be supported by continued demand for pawnbroking services and a growing number of active licensed pawnbrokers. Pawnbrokers can offer individuals financing without the checks on credit score ratings or income information that are typically required by banks when applying for loans. Pawn loans can also be disbursed immediately upon verification or within the same day, making pawnbrokers a swift financing option. As such, pawnbroking services will likely continue to be in demand as a source of immediate financing.

Additionally, demand is expected to be driven by the unserved population. Without a bank account and proof of income or a credit score, the unserved are unlikely to obtain loans from banks, which may encourage them to approach pawnbrokers for their financing needs. The pawnbroking industry in Malaysia is also likely to benefit from uncertain economic conditions caused by the COVID-19 pandemic, geopolitical conflicts, weaker global economic growth, and an inflationary environment. As weaker economic growth and inflation may lead to lower income and spending power, individuals may choose to utilize pawnbroking services to finance their needs. The local pawnbroking industry is also expected to be supported by a growing number of active licensed pawnbrokers in the country, as a larger number of pawnbrokers will likely improve the availability and accessibility of pawnbroking services.

Conversely, the local pawnbroking industry may be affected by the availability of other forms of financing, such as financing from banks or through unsecured loans. While such options do not represent a like-for-like alternative to pawnbroking services, they are considered alternative financing options that may reduce the demand for pawnbroking services. Muslim individuals who prefer to use financial services structured in accordance with Shariah principles may opt for Ar-Rahnu services rather than conventional pawnbroking.

The industry may also be constrained by the regulations that govern it. Adverse changes to regulations may cause incumbent industry players to leave or deter new entrants from joining the industry. The high capital requirements may also deter new entrants, thus affecting the industry’s ability to expand. While changes to regulations and high capital requirements may limit the industry's growth, these factors may allow incumbent players with sufficient capital resources and experience to strengthen their position. This could lead to the expansion of their operations and overall growth in the local pawnbroking industry.

Overall, the Malaysian pawnbroking industry is expected to be resilient during the forecast period. The industry is forecasted to expand at a CAGR of 11.4%, from RM3.09 billion in 2023 to RM5.29 billion in 2028.

Source: Protégé Associates

Future plans and strategies for WELL CHIP GROUP BERHAD

The company plans to continue expanding its network of pawnshops in Johor while also penetrating new geographical markets within Peninsular Malaysia. By expanding its network, the company aims to increase its market presence and serve a wider customer base, thereby further improving its financial performance in the future.

- Expansion of 7 new pawnshops in Johor and Melaka.

- Future expansion into Melaka and Negeri Sembilan.

MQ Trader View

Opportunities

- The company can provide quick and convenient pawn loans to populations that are unserved or underserved by conventional financial institutions. The pawnbroking services address the needs of individuals who are financially unserved and underserved by offering them an alternative source of financing in the form of pawn loans.

- The company has a network of outlets strategically located for convenience. It operates 23 pawnshops and 4 retail outlets (adjacent to the pawnshops), all in close proximity to residential and commercial areas with convenient access to amenities such as public transportation, restaurants, and supermarkets.

- The company has several systems such as the ValueMax Pawnbroking System and the Well Chip mobile app, which enhance customer convenience. The ValueMax Pawnbroking System allows the company to efficiently manage pawn pledges, track loan transactions, and streamline operational processes, resulting in faster and more efficient service for customers. The Well Chip mobile app enables customers to check the locations of pawn shops and retail outlets, check their loan balances, renew their pawn loans, pay interest online, receive updates on the pawn shops and retail outlets, access a quick chat function, and more.

Risk

- The company is dependent on skilled, reliable, and trustworthy pawnshop and outlet personnel. The company believes that one of the key factors for the continuous growth and success of the business is the extensive knowledge and experience of the skilled pawnshop and outlet personnel in providing pawnbroking services, as well as in retailing and trading jewelry and gold to customers. Their skills in assessing the value and authenticity of pledges and pre-owned jewelry brought in by walk-in individuals are particularly important.

- The company is subject to gold price volatility. The group’s pawnbroking business involves the sale of unredeemed gold and gold jewelry pledges as part of its cash recovery process. In addition, they also sell new and pre-owned jewelry and gold through their retail outlets.

Click here to refer the IPO - Well Chip Group Bhd (Part 1)

Interested to start trading? Send your inquiry now!

Community Feedback

We encourage traders to try out and evaluate the MQ Trader system and provide us feedback on the features you like to see in the system. We have received many positive feedbacks so far, and we are currently compiling and reviewing them for possible inclusion into the next release of the system.

We would like to develop this system based on community feedback to cater for community needs. Thanks to all those who have provided valuable feedback to us. Keep those feedback coming in!

Disclaimer

This article does not represent a BUY or SELL recommendation on the stock covered. Traders and Investors are encouraged to do their own analysis on stocks instead of blindly following any Trading calls raised by various parties in the Internet. We may or may not hold position in the stock covered, or initiate new position in the stock within the next 7 days.

Join us now!

MQ Trader stock analysis system uses Artificial Intelligence (AI), various technical indicators and quantitative data to generate accurate trading signals without the interference of human's emotions and bias against any particular stock. It comprises trading strategies which are very popular among fund managers for analysing stocks.

MQ Trader stock analysis system is SPONSORED for MQ Trader members. To use this amazing tool, you can sign up via MQ Trader Sign Up!

Contact us

Please do not hesitate to contact us if you have any enquiry:

Facebook: https://www.facebook.com/mqtrader

Instagram:https://www.instagram.com/mqtrader

MQ Chat: https://messenger.i3investor.com/m/chatmq

YouTube: https://www.youtube.com/channel/UCq-26SGjlQTVQfO7DoEihlg

Email: admin@mqtrader.com

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on Initial Public Offering (IPO)