IPO - Kucingko Bhd (Part 2)

MQTrader Jesse

Publish date: Tue, 02 Jul 2024, 04:09 PM

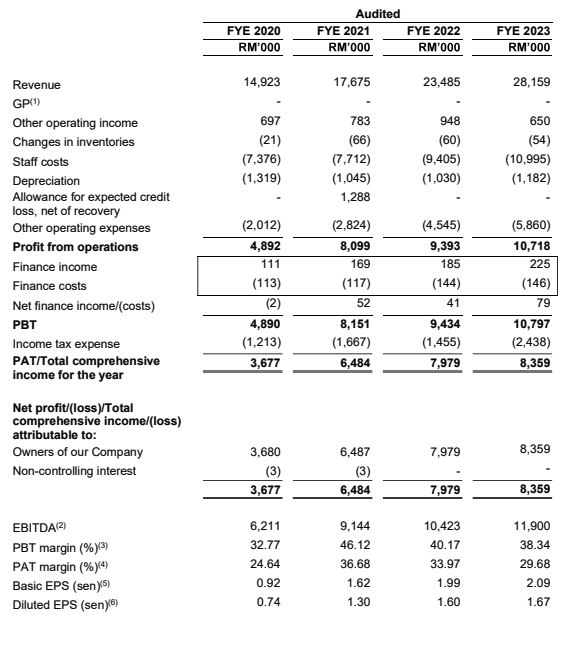

Financial Highlights

The table below sets out financial highlights based on the audited combined financial statements for the Period Under Review:

The revenue grew from RM 14 million in FYE 2020 to RM 28 million in FYE 2023. The company is expanding its market share in this industry.

The PBT margin increased from 32.77% in FYE 2020 to 46.12% in FYE 2021, but it declined to 38.34% in FYE 2023. The decline in the PBT margin was mainly due to the decrease in cash flows into the company.

The PAT margin grew from 24.64% in FYE 2020 to 36.68% in FYE 2021, but it declined to 29.68% in FYE 2023.

The gearing ratio is 0.05, which is below the benchmark. This indicates that the company still has room to further increase its debt, indirectly suggesting that in the event of any crisis, the company will not easily face risks due to excessive debt. (A good gearing ratio should be between 0.25 – 0.5).

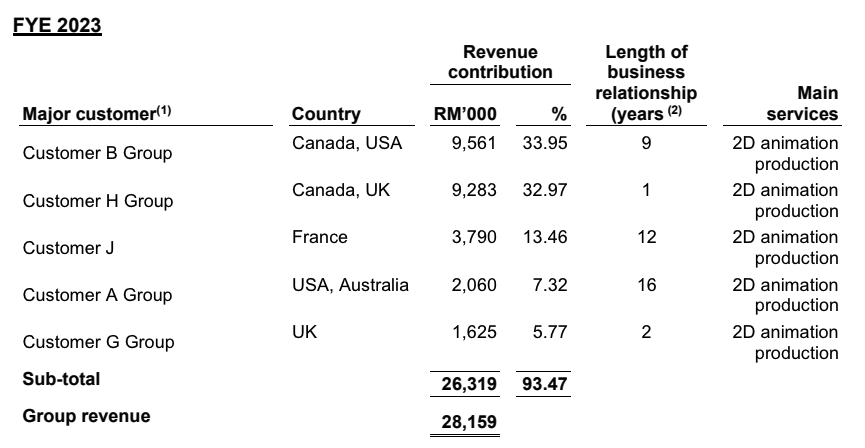

Major customers and suppliers

The Group’s top 5 major customers and their contribution to the revenue for the FYE 2023 are as follows:

The top 5 customers contribute 93.47% of the company's revenue. The company faces high concentration customer risk as it is dependent on these major customers. However, the management mentioned that their established track record of 22 years in the 2D animation production will serve as testament of their capabilities and provide them with the advantage to secure new projects from their existing and prospective customers.

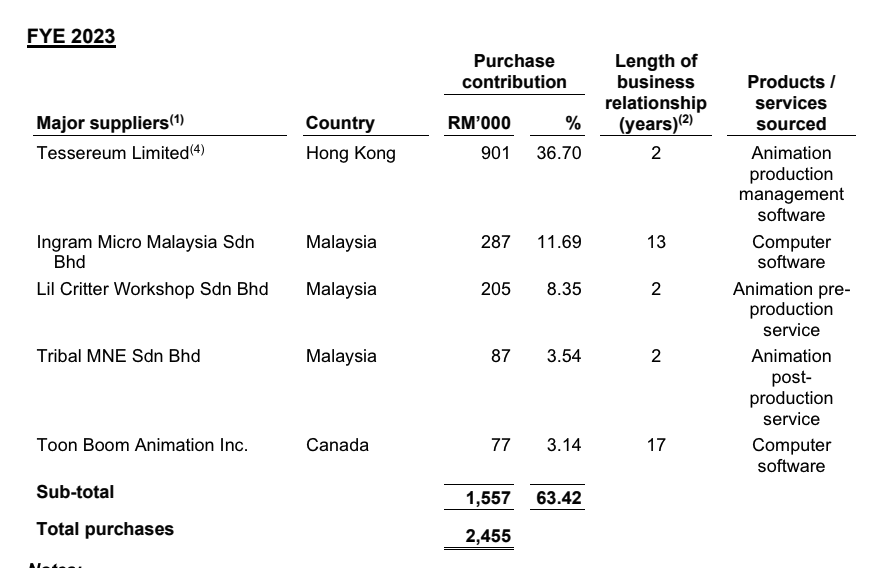

Major Suppliers

The top 5 major suppliers for FYE 2023 as follows:

The company is not dependent on any single supplier, as they can use alternative software such as ShotGrid for animation production management or CelAction for animation production or we may purchase Adobe software from other suppliers.

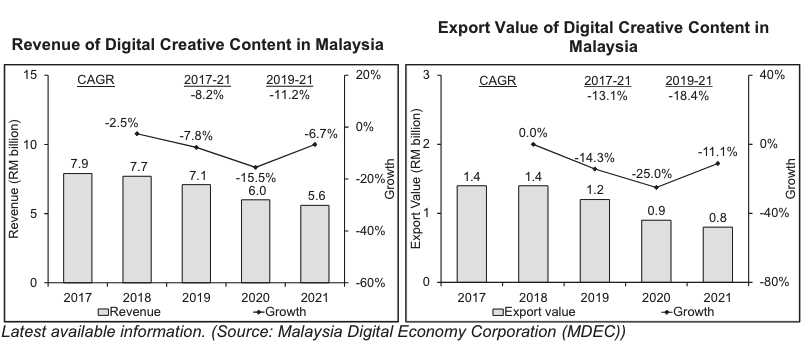

Industry Overview

In Malaysia, 2D animation production is part of the broader digital creative content industry, which includes companies that utilise technologies for the development, production and distribution of digital content, and complementary tools, products, services and platforms. Between 2019 and 2021, being the latest available information, the revenue and export value of digital creative content in Malaysia have been declining at an average annual rate of 11.2% and 18.4% respectively. In the first half of 2022, the revenue of the digital creative content industry in Malaysia reached RM2.8 billion, while the export value reached RM0.4 billion (Source: Malaysia Digital Economy Corporation (MDEC)).

The declining revenue was mainly due to competition from over-the-top platforms (platforms offering content directly to consumers via the internet) and an increasingly crowded broadcast market. On the export front, the declining export value was mainly due to the impact of the COVID-19 pandemic. In addition, the Children’s Online Privacy Protection Rule also impacted the distribution of content on YouTube, affecting mainly studios that cater to the children segment. (Source: MDEC)

Motion picture, video and TV programme production encompass activities including production, distribution, projection and supporting activities such as film editing, cutting and dubbing. Sound recording and music publishing activities encompass production, release, promotion and distribution of sound recordings, which includes the acquisition and registration of copyrights for musical compositions, as well as the promotion and authorisation of their use. (Source: Department of Statistics Malaysia (DOSM))

Between 2017 and 2021, being the latest available information, the value of gross output of motion picture, video, TV programme production, sound recording and music publishing activities grew marginally at a CAGR of 0.5% to RM3.9 billion in 2021.

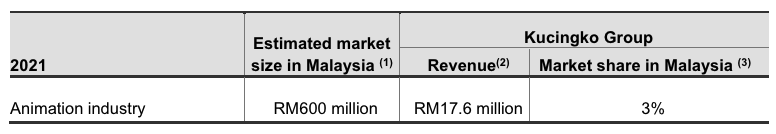

Market Size And Share

Key Industry Drivers

Digitalisation and growth in the distribution of content

Government initiatives and incentives

Threats and challenges

Competition from 3D animation

Recent advances in generative artificial intelligence (AI) tools

Global competition

Future plans and strategies for KUCINGKO BERHAD

The company’s business strategies and plans are to continue with their existing business activities in 2D animation production and leverage from their core competencies to grow the business where for domestic expansion. The total cost is estimated at RM22.14 million which will be funded through the proceeds from the Public Issue is as set out as below:

Set up branch offices in Sabah and Sarawak, undertake technical resources expansion and upgrading their existing operational office in Selangor.

Set up sales office in USA for foreign expansion.

MQ Trader View

Opportunities

The company has an established track record of 22 years in 2D animation production to sustain and grow the business.

The company serve customers in foreign countries where their market coverage includes certain countries from North America, Asia Pacific and Europe regions to sustain and grow their business.

Risk

The company is dependent on certain major customers. The major customers collectively accounted for a significant portion of our total revenue, the loss of any one or a few of these major customers, if they are not replaced promptly either at comparable or higher contract values, it could adversely affect their business operations and financial performance.

The company’s financial performance is dependent on the ability to continually secure new and sizeable projects/contracts to sustain and grow their business. The nature of the business is project-based and they do not have contracts that provides them with recurrent revenue. The financial performance of the Group is dependent on the ability to continually secure new and sizeable projects/contracts to sustain and grow the business.

Click here to refer the IPO - Kucingko Bhd (Part 1)

Interested to start trading? Send your inquiry now!

Community Feedback

We encourage traders to try out and evaluate the MQ Trader system and provide us feedback on the features you like to see in the system. We have received many positive feedbacks so far, and we are currently compiling and reviewing them for possible inclusion into the next release of the system.

We would like to develop this system based on community feedback to cater for community needs. Thanks to all those who have provided valuable feedback to us. Keep those feedback coming in!

Disclaimer

This article does not represent a BUY or SELL recommendation on the stock covered. Traders and Investors are encouraged to do their own analysis on stocks instead of blindly following any Trading calls raised by various parties in the Internet. We may or may not hold position in the stock covered, or initiate new position in the stock within the next 7 days.

Join us now!

MQ Trader stock analysis system uses Artificial Intelligence (AI), various technical indicators and quantitative data to generate accurate trading signals without the interference of human's emotions and bias against any particular stock. It comprises trading strategies which are very popular among fund managers for analysing stocks.

MQ Trader stock analysis system is SPONSORED for MQ Trader members. To use this amazing tool, you can sign up via MQ Trader Sign Up!

Contact us

Please do not hesitate to contact us if you have any enquiry:

Facebook: https://www.facebook.com/mqtrader

Instagram:https://www.instagram.com/mqtrader

MQ Chat: https://messenger.i3investor.com/m/chatmq

YouTube: https://www.youtube.com/channel/UCq-26SGjlQTVQfO7DoEihlg

Email: admin@mqtrader.com

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Initial Public Offering (IPO)