IPO - TMK Chemical Bhd (Part 1)

MQTrader Jesse

Publish date: Wed, 27 Nov 2024, 02:51 PM

Tentative Date(s):

- Opening of application - 25 November 2024

- Closing of application - 29 November 2024

- Balloting of applications - 03 December 2024

- Allotment of IPO shares to successful applicants - 11 December 2024

- Tentative listing date - 12 December 2024

Company Background

The company was incorporated in Malaysia under the Companies Act, 1965 on 20 February 1989 as a private limited company under the name Taiko Marketing Sdn Bhd and is deemed registered under the Act. On 4 September 2023, the company changed its name to TMK Chemical Sdn Bhd and was subsequently converted into a public limited company on 15 November 2023. Through its Subsidiary, they are principally involved in the provision of total chemical management comprising sourcing, processing and distribution of inorganic chemicals and value-added services, as well as the provision of chemical terminal services which encompasses bulk storage services.

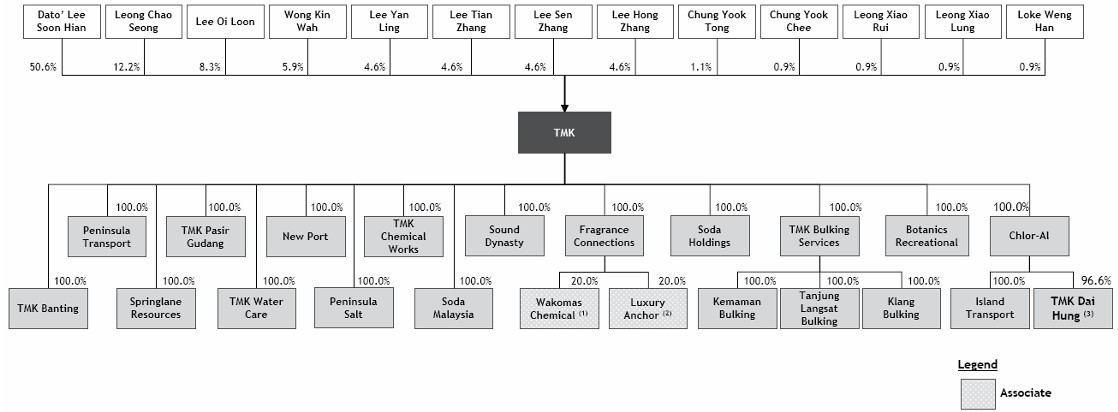

The company group structure at the LPD is as follows:

Use of proceeds

- Expansion of Banting Plant 1 - 23.40% (within 24 months)

- Construction costs of a new facility - 12.90% (within 24 months)

- Acquisitions to be identified - 25.70% (within 36 months)

- Loan repayment - 13.00% (within 6 months)

- Working capital - 20.60% (within 12 months)

- Defray fees and expenses relating to the IPO and Listing - 4.40% (within 6 months)

Expansion of Banting Plant 1 - 23.40% (within 24 months)

The company intends to allocate approximately RM90.2 million or 23.4% of the gross proceeds from its Public Issue for the expansion of Banting Plant 1 by constructing Banting Plant 2 which will occupy a land area of approximately 45,700 m2 to 55,900 m2 to increase the company Group’s manufacturing capacity of chlor-alkali derivatives, namely sodium hydroxide, chlorine, hydrochloric acid, sodium hypochlorite and hydrogen. In anticipation of the company's continued business growth and expansion, this will enable them to take on opportunities arising from increased demand as they secure more customers in the future, which will contribute to their financial performance. Additionally, the construction of Banting Plant 2 will result in better overall cost efficiency.

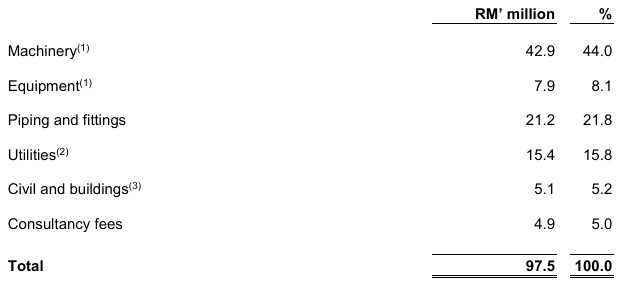

The breakdown of the estimated construction cost of Banting Plant 2 is as follows:

Construction costs of a new facility - 12.90% (within 24 months)

The company intends to allocate approximately RM49.5 million or 12.9% of the gross proceeds from the Public Issue to fund the construction costs of a new processing facility (“Singapore Facility 4”) for the expansion of our Singapore operations.

The estimated construction cost of Singapore Facility 4 comprises approximately RM45.0 million for the land purchase and approximately RM11.0 million for the construction of a processing facility. They have estimated the land purchase cost based on a previous bid for a property with an area of approximately 6,000 m2 and estimated the construction cost based on the historical cost of establishing their existing facilities in Tuas Avenue, which primarily comprises liquid bulk facilities, processing facilities, handling and storage facilities.

Acquisitions to be identified - 25.70% (within 36 months)

The company intends to allocate approximately RM99.1 million or 25.7% of the gross proceeds from its Public Issue for investment and acquisition of target companies to be identified in the next 36 months.

One of the company's future plans and growth strategies is to selectively pursue acquisitions and investments in other companies that operate in the inorganic chemicals industry or other chemical-related industries such as specialty chemicals, as well as offer products that complement to the company Group. This may potentially result in cost synergies and revenue synergies, enabling them to achieve economies of scale, optimize cost structure, expand customer and supplier networks, penetrate new business segments and increase the diversity of product offerings, and strengthen our regional presence as well as enter into new business segments (i.e. acquire or invest in manufacturing companies in Vietnam to achieve vertical integration of their operations in Vietnam using the existing manufacturing facilities of the target companies, which will help streamline processes along the production chain, since the company Group only provides total chemical management and not manufacturing in Vietnam as at the LPD) and geographical markets. In light of the above strategy, they are exploring investment and acquisition opportunities in companies within the Asia Pacific region which meet the criteria.

Loan repayment - 13.00% (within 6 months)

The company intends to allocate approximately RM50.0 million or 13.0% of the gross proceeds from its Public Issue to partly repay the Islamic term financing of RM250.0 million granted by Maybank Islamic Berhad which was drawn down on 8 February 2024 to finance the cash consideration of the Acquisition.

Working capital - 20.60% (within 12 months)

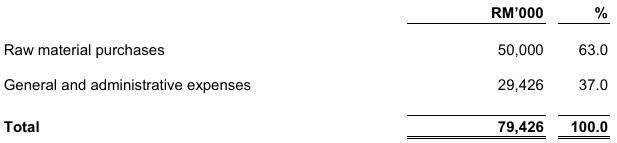

The company intends to allocate approximately RM79.4 million or 20.6% of the gross proceeds from its Public Issue to fund the working capital requirements of the company Group. Working capital will be used to finance raw material purchases, which includes packaging material purchases and logistics, as well as general and administrative expenses, such as staff costs and warehouse-related costs, which are required for Malaysia, Singapore and Vietnam operations.

The breakdown of such utilisation has not been determined at this juncture and will be dependent on the operating and funding requirements at the time of utilisation. Notwithstanding this, and on best estimate basis, the percentage of the allocation of the proceeds to be utilised for each component of the working capital are as follows:

The company working capital requirement is expected to increase in line with their on-going business expansion and their growth strategy. This working capital allocation is expected to enhance the company Group’s liquidity and cash flow position and to reduce their reliance on external financing. They have budgeted the working capital requirements with reference to the historical cost of raw material purchases, packaging material purchases and logistics, subject to the fluctuations in prices.

Business Model

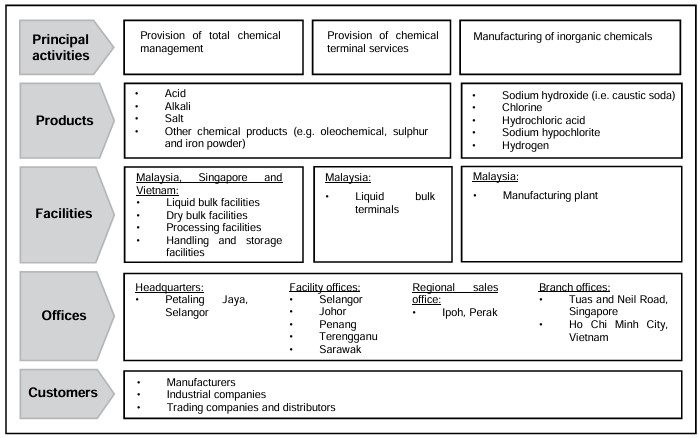

An overview of the company's business activities is illustrated below:

Click here to continue the IPO - TMK Chemical Bhd (Part 2)

Looking for flat 0.05% brokerage?

Get started: https://bit.ly/mqamcash

Community Feedback

We encourage traders to try out and evaluate the MQ Trader system and provide us feedback on the features you like to see in the system. We have received many positive feedbacks so far, and we are currently compiling and reviewing them for possible inclusion into the next release of the system.

We would like to develop this system based on community feedback to cater for community needs. Thanks to all those who have provided valuable feedback to us. Keep those feedback coming in!

Disclaimer

This article does not represent a BUY or SELL recommendation on the stock covered. Traders and Investors are encouraged to do their own analysis on stocks instead of blindly following any Trading calls raised by various parties in the Internet. We may or may not hold position in the stock covered, or initiate new position in the stock within the next 7 days.

Join us now!

MQ Trader stock analysis system uses Artificial Intelligence (AI), various technical indicators and quantitative data to generate accurate trading signals without the interference of human's emotions and bias against any particular stock. It comprises trading strategies which are very popular among fund managers for analysing stocks.

MQ Trader stock analysis system is SPONSORED for MQ Trader members. To use this amazing tool, you can sign up via MQ Trader Sign Up!

Contact us

Please do not hesitate to contact us if you have any enquiry:

Facebook: https://www.facebook.com/mqtrader

Instagram:https://www.instagram.com/mqtrader

MQ Chat: https://messenger.i3investor.com/m/chatmq

YouTube: https://www.youtube.com/channel/UCq-26SGjlQTVQfO7DoEihlg

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on Initial Public Offering (IPO)