IPO - TMK Chemical Bhd (Part 2)

MQTrader Jesse

Publish date: Wed, 27 Nov 2024, 02:52 PM

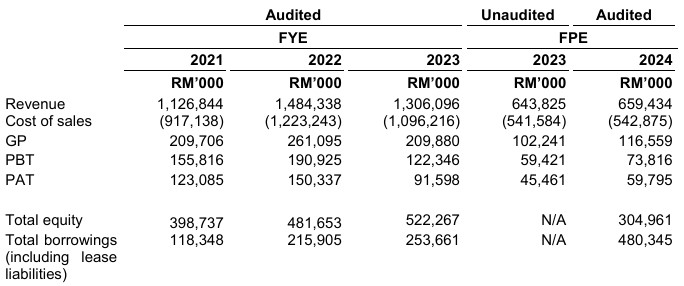

Financial Highlights

The following table sets out the company selected historical consolidated financial data for the Periods Under Review:

- The revenue increased from RM 1.126 million in FYE 2021 to RM 1.484 million in FYE 2022, but declined to RM 1.306 million in FYE 2023, primarly due to a decrease in ASP for alkalis, acids and salts products, driven by slower demand for inorganic chemical products.

- The gross profit margin dropped from 18.6% in FYE 2021 to 16.1% in FYE 2023 due to rising average material prices and the inability to pass the increased cost to customers promptly due to pre-agreed selling price.

- The PAT margin fell from 10.9% in FYE 2021 to 7.0% in FYE 2023.

- The gearing ratio is 0.50 in FYE 2023, which is within the healthy range of 0.25 - 0.5, indicating that the company maintains a good balance of debt and equity.

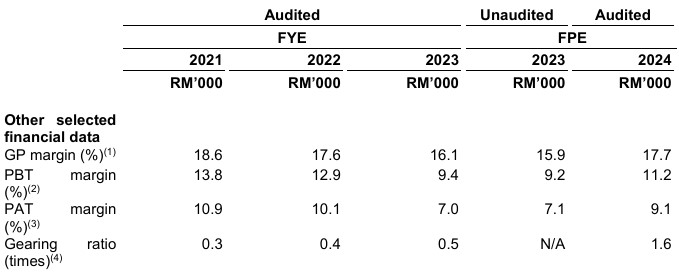

Major customers and suppliers

Major Customers

The company group’s top five major customers by revenue for FPE 30 June 2024 are as follows:

The company is not dependent on any of its major customers as they can easily sell their products to other customers locally and overseas.

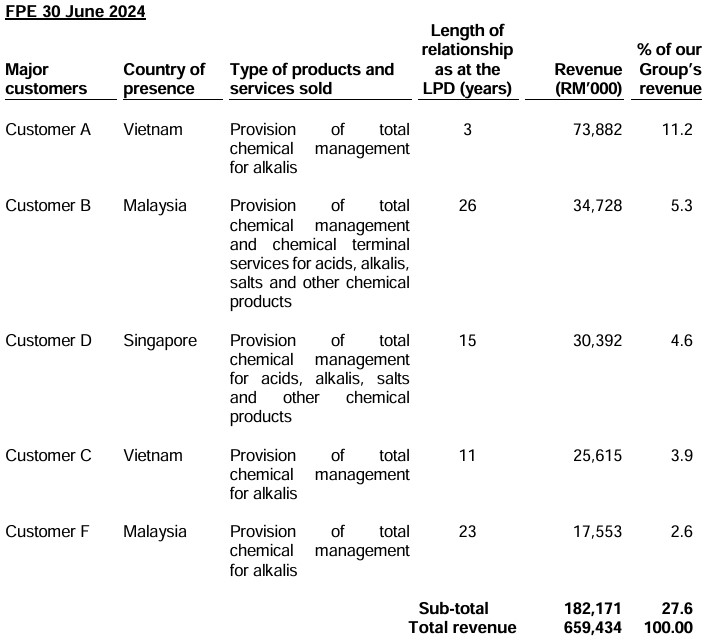

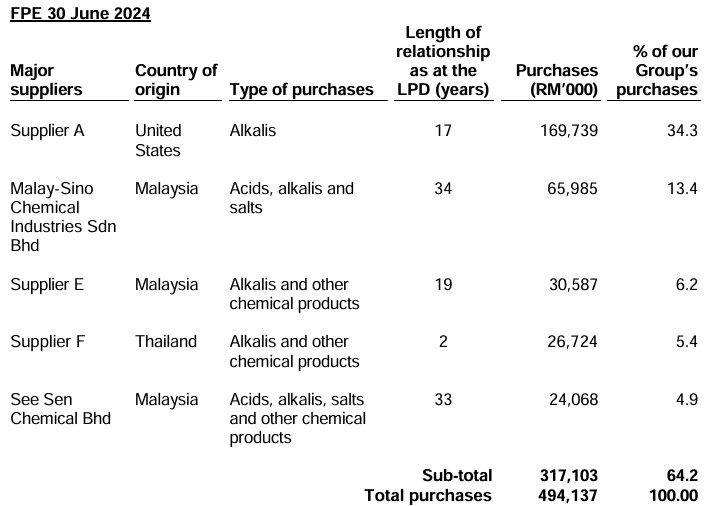

Major Suppliers

The company group’s top five major suppliers by purchases for FPE 30 June 2024 are as follows:

The company is not dependent on any of its major suppliers as they are able to easily source similar products of comparable quality and at similarly competitive prices from other suppliers in the event of any disruption or delay in supply.

Industry Overview

The inorganic chemicals industry involves the production and distribution of chemicals which are derived from inorganic compounds. Inorganic compounds are derived from non-living natural resources such as minerals, rocks and metal ores, and are processed into a wide range of chemical products required primarily in the manufacturing sector for various industries. Inorganic chemicals can be divided into alkalis, acids and salts.

Inorganic chemicals can be used as raw materials for the production of intermediate products and end products, as well as in industrial applications, with some examples as follows:

- Caustic soda – Edible oils and fats, chemicals and/or specialty chemicals and electrical and electronic (“E&E”) products.

- Sulphuric acid – Chemicals and/or specialty chemicals, agrichemical and E&E products.

- Aluminium sulphate – Utilities, pulp and paper, and chemicals and/or specialty chemicals.

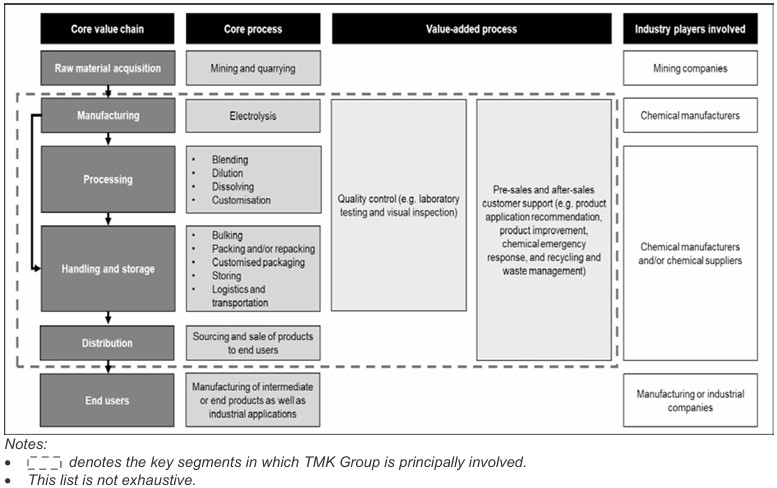

The value chain of the inorganic chemicals industry is as follows:

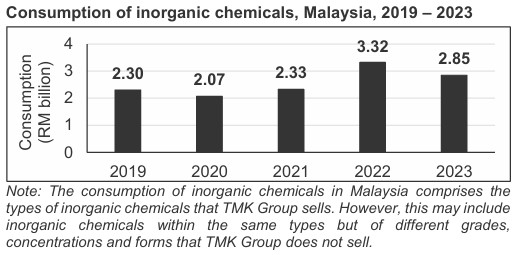

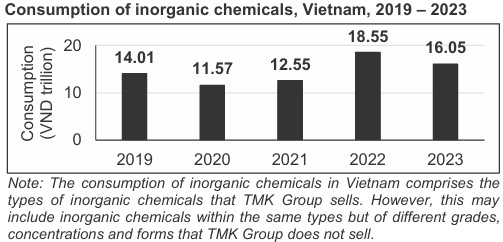

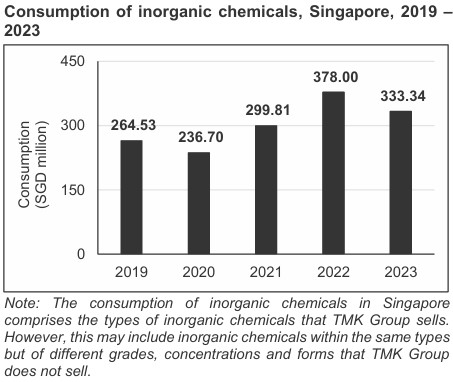

According to the research from SMITH ZANDER, the consumption of inorganic chemicals in Malaysia decreased by 10.00% from RM2.30 billion in 2019 to RM2.07 billion in 2020 due to COVID-19 pandemic outbreak, but recovered at a CAGR of 26.64% from RM2.07 billion to RM3.32 billion in 2022. In Vietnam, the consumption dropped by 17.42% from VND14.01 trillion (RM2.49 billion) in 2019 to VND11.57 trillion (RM2.09 billion) in 2020, then rebounded at a CAGR of 26.62% to VND18.55 trillion (RM3.49 billion) in 2022. Similarly, the consumption of inorganic chemicals in Singapore decline by 10.52% from SGD264.53 million (RM803.43 million) in 2019 to SGD236.70 million (RM721.06 million) in 2020, followed by a 26.37& recovery to SGD378.00 million (RM1.21 billion) in 2022.

The key drivers in this industry:

- Inorganic chemicals are essential raw materials in a wide range of manufacturing and industrial applications

- Economic growth and growth in the manufacturing sector drive the growth of the inorganic chemicals industry

The key risks and challenges in this industry:

- Global economic downturn may negatively impact the demand for inorganic chemicals

- Changes in government regulations which may affect business operations

Future plans and strategies for TMK CHEMICAL BHD

The company's business strategies and future plans are as follows:

- Expansion of the inorganic chemical manufacturing business through the construction of a new chlor-alkali manufacturing plant

- Expansion of the total chemical management business through the construction of a new facility in Singapore and Malaysia respectively

- Pursuit of acquisitions and investments in other companies

- Continued development and growth of the product and service offerings

- Expansion of the regional presence in Vietnam and Indonesia

MQ Trader View

Opportunities

- The company supplies an extensive range of chemicals and has a broad customer base comprising a diverse spectrum of industries

- The company provides end-to-end solutions to customers which encompasses the provision of total chemical management and chemical terminal services

- The company has a regional market footprint and proven capabilities in exporting its products to international customers

Risk

- The company is exposed to foreign exchange fluctuation risks which may impact the profitability of the company

- The company relies on third-party logistics service providers for the delivery of their products, as well as on leased, rented and third-party facilities for carrying out their business operations.

Click here to continue the IPO - TMK Chemical Bhd (Part 1)

Looking for 3x cash & 2x shares trading limit? Get started now!

Community Feedback

We encourage traders to try out and evaluate the MQ Trader system and provide us feedback on the features you like to see in the system. We have received many positive feedbacks so far, and we are currently compiling and reviewing them for possible inclusion into the next release of the system.

We would like to develop this system based on community feedback to cater for community needs. Thanks to all those who have provided valuable feedback to us. Keep those feedback coming in!

Disclaimer

This article does not represent a BUY or SELL recommendation on the stock covered. Traders and Investors are encouraged to do their own analysis on stocks instead of blindly following any Trading calls raised by various parties in the Internet. We may or may not hold position in the stock covered, or initiate new position in the stock within the next 7 days.

Join us now!

MQ Trader stock analysis system uses Artificial Intelligence (AI), various technical indicators and quantitative data to generate accurate trading signals without the interference of human's emotions and bias against any particular stock. It comprises trading strategies which are very popular among fund managers for analysing stocks.

MQ Trader stock analysis system is SPONSORED for MQ Trader members. To use this amazing tool, you can sign up via MQ Trader Sign Up!

Contact us

Please do not hesitate to contact us if you have any enquiry:

Facebook: https://www.facebook.com/mqtrader

Instagram:https://www.instagram.com/mqtrader

MQ Chat: https://messenger.i3investor.com/m/chatmq

YouTube: https://www.youtube.com/channel/UCq-26SGjlQTVQfO7DoEihlg

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on Initial Public Offering (IPO)