MQ Trader - Introduction of Corporate Actions (Part 1)

MQTrader Jesse

Publish date: Mon, 13 Aug 2018, 05:53 PM

What are corporate actions?

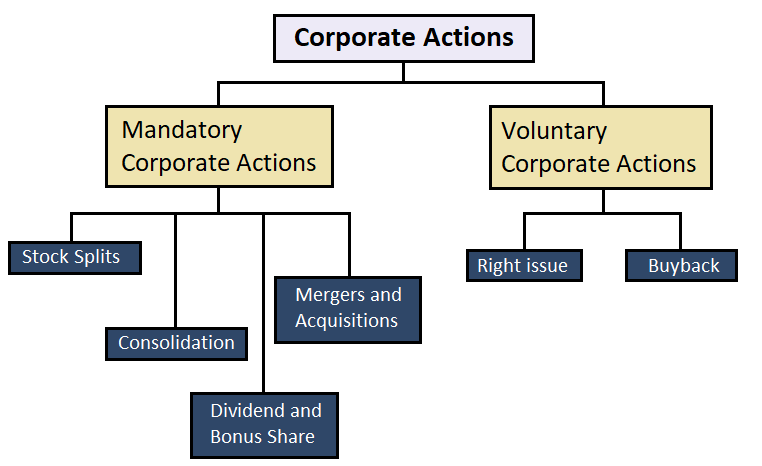

Corporate actions are the actions that initiate a process to bring impacts to the stocks and eventually the shareholders will get affected positively or negatively. It is important to understand the processes and effects of different types of corporate actions, as each corporate action reflects a company’s financial affairs. Besides, corporate actions can influence a company’s share price and performance aiding the investors to make decisions on buying or selling a stock. There are 2 types of corporate actions which are mandatory corporate actions and voluntary corporate actions.

Figure 1: Types of corporate actions

Mandatory Corporate action

Mandatory corporate action is an event approved by the board of directors that can affect all the shareholders who participate for these corporate actions mandatorily. The corporate actions listed below are examples of mandatory corporate action:

Stock Splits

A stock split is a decision by a company’s board of directors to dividing the outstanding shares, so as to issue more shares to the current shareholders. The main purpose of this action is to increase the liquidity of the share in the market.

For example, a shareholder will obtain an extra share for each share held when a 2-for-1 stock split takes place. If an individual has 10,000 shares outstanding before the split, he will hold 20,000 shares outstanding after the 2-for-1 split.

The effects of a stock split are:

- The drop in share price causes the stock to be more attractive to a wider range of investors

- Higher availability of the shares outstanding in the market leading to more interested investors have greater chances to own the shares

In short, the value of the stock will remain unchanged but the higher demand for the share will boost the share price and eventually increasing the company’s value and market capitalization in the long run.

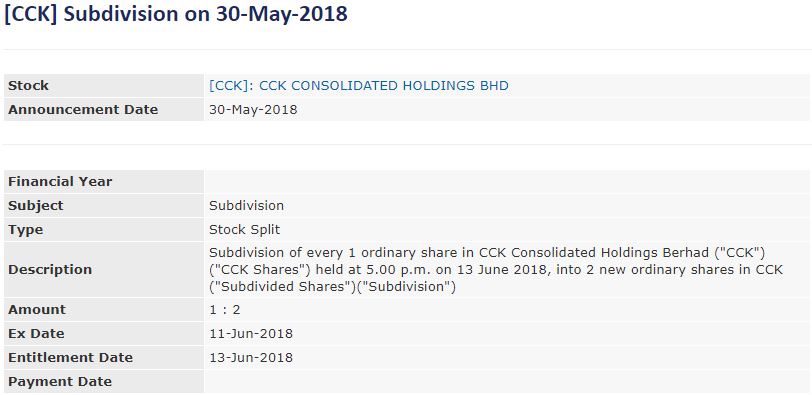

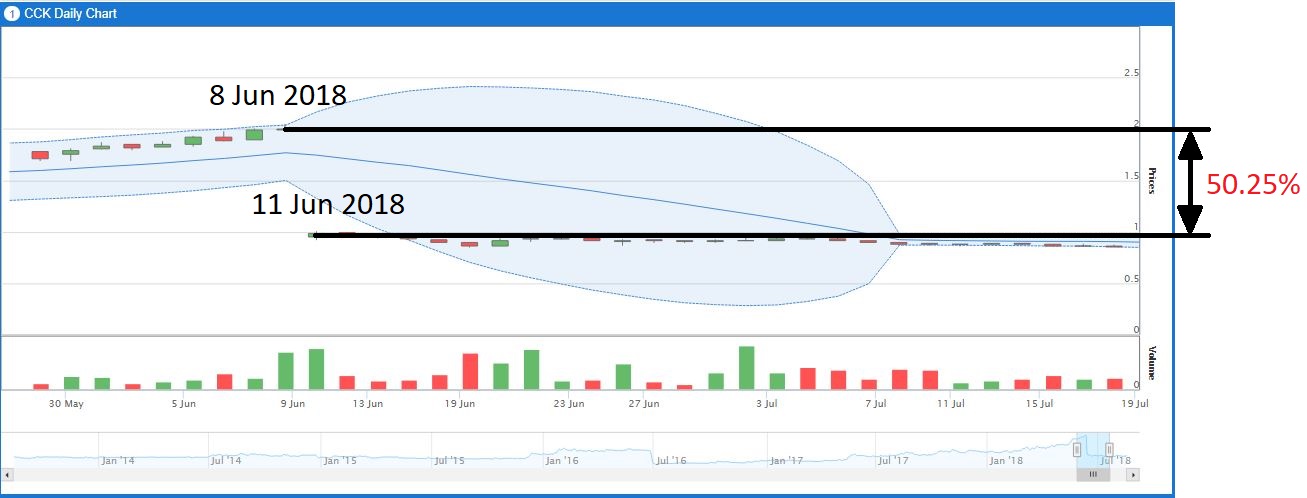

Figures below show the stock split example of CCK which its ex-date is 11 Jun 2018. The share price fell sharply by 50.25% within a day. For more information, please read [CCK] Subdivision on 30-May-2018. for viewing the technical chart, kindly visit CCK daily technical chart.

Consolidation / Reverse Stock Splits

A stock consolidation is the opposite of a stock split, as it is defined as a corporate action is used for reducing the amount of a company’s outstanding shares. At the meantime, the price of the share will increase proportionally, as the value of the share remains the same.

For example, if a shareholder owns 200,000 shares before the 1-for-10 consolidation takes place, the 200,000 shares will be divided by 10 into 20,000 shares after the implementation of 1-for-10 consolidation.

The impacts of consolidation:

- The minimum bid price of a stock is fulfilled for listing in the stock market.

- The lower availability of the stocks causes the stocks are harder to be borrowed for short selling

- Limited liquidity of the share widens the bid-ask spread

Figures below show the consolidation example of TIGER which its ex-date is 1 Jun 2018. The share price increased sharply by 220% within a day. For more information, please read [TIGER] Share Consolidation on 21-May-2018. for viewing the technical chart, kindly visit TIGER daily technical chart.

Dividend and Bonus Share

A dividend is a distribution of a portion of a company’s income to shareholders while a bonus share is an offer of free additional shares to existing shareholders based on the decision of the board of directors. Dividends are normally given in the forms of cash payment. It takes place monthly or quarterly and special dividends are issued individually or simultaneously together with a scheduled dividend. The equity of a company is influenced after the declaration of a dividend, as the distributable equity will be reduced.

For examples, shareholders who are entitled with cash dividend of RM 0.50 per share, they will receive RM 50 if they hold 100 shares. On the other hand, shareholders receives an additional share for every 10 shares owned when a bonus share of 10% is declared.

The effects of Bonus Share/Dividend:

- An indication of a high performing company that can develop the confidence and interest of more investors

- The share price usually declines linearly with the level of bonus share/dividend paid per shares in the short term

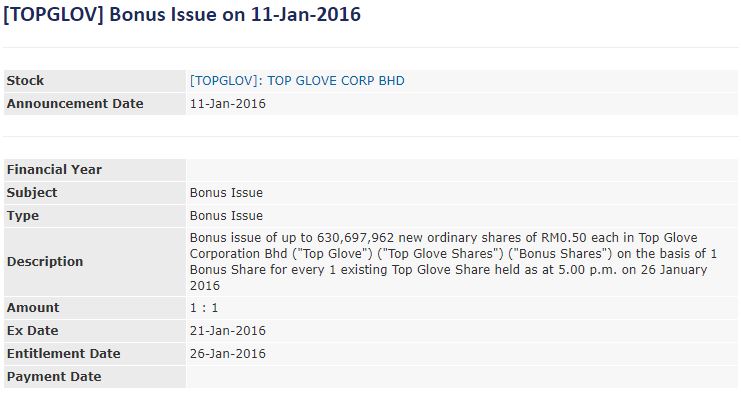

The figure below is the example of TOPGLOV's bonus share which is ex-date is on 21 Jan 2016. Accirding to this Figure, its share price drop sharply by 57.14% within 1 day. For more information, please read [TOPGLOV] Bonus Issue on 11-Jan-2016. For viewing the technical chart, you can visit TOPGLOV daily technical chart.

Mergers and Acquisitions

A merger occurs due to the combination of two or more companies into a single company when all related parties agree to the terms of the merge. This action usually takes place due to the surrendering of stocks by a company to another which has the greater ability and confidence to control more companies.

The impact of a merger:

- The target company’s stock price rises, as the acquiring company has to pay premium for the acquisition

- The acquiring company’s share price drop during the acquisition because large amount of cash is used for acquisition

Conclusion

It is essential for an investor to understand various types of corporate actions to make a wise decision in the investment. In the next blog - MQ Trader - Introduction of Corporate Actions (Part 2), we will be sharing the details of the voluntary corporate actions.

Community Feedback

We encourage traders to try out and evaluate the MQ Trader system and provide us feedback on the features you like to see in the system. We have received many positive feedbacks so far, and we are currently compiling and reviewing them for possible inclusion into the next release of the system.

We would like to develop this system based on community feedback to cater for community needs. Thanks to all those who have provided valuable feedback to us. Keep those feedbacks coming in!

Disclaimer

This article does not represent a BUY or SELL recommendation on the stock covered. Traders and Investors are encouraged to do their own analysis on stocks instead of blindly following any Trading calls raised by various parties in the Internet. We may or may not hold position in the stock covered, or initiate new position in the stock within the next 7 days.

Join us now!

MQ Trader stock analysis system uses Artificial Intelligence (AI), various technical indicators and quantitative data to generate accurate trading signals without the interference of human's emotions and bias against any particular stock. It comprises trading strategies which are very popular among fund managers for analysing stocks.

MQ Trader stock analysis system is SPONSORED for MQ Trader members. To use this amazing tool, you can sign up via MQ Trader Sign Up!

Contact us

Please do not hesitate to contact us if you have any enquiry:

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

2024-07-07

TOPGLOV2024-07-07

TWL2024-07-05

TOPGLOV2024-07-05

TOPGLOV2024-07-05

TOPGLOV2024-07-05

TOPGLOV2024-07-05

TOPGLOV2024-07-05

TWL2024-07-04

TWL2024-07-04

TWL2024-07-04

TWL2024-07-04

TWL2024-07-04

TWL2024-07-04

TWL2024-07-04

TWL2024-07-04

TWL2024-07-04

TWL2024-07-04

TWL2024-07-04

TWL2024-07-04

TWL2024-07-04

TWLMore articles on MQTrader Education Series

Created by MQTrader Jesse | Apr 13, 2023

Created by MQTrader Jesse | Aug 06, 2021

Created by MQTrader Jesse | Nov 01, 2019

Tiong Kung King Zien

Tiger con family

2018-09-09 04:24