MQ Trader - Introduction of Corporate Actions (Part 2)

MQTrader Jesse

Publish date: Tue, 14 Aug 2018, 05:34 PM

Introduction

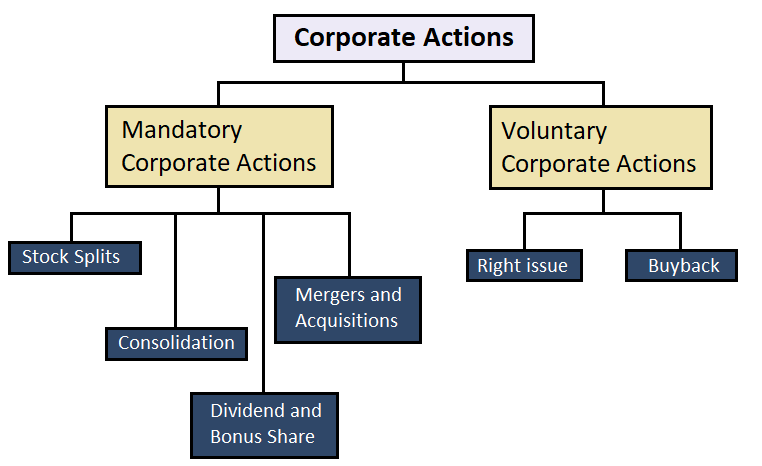

This topic is the second part of our previous blog post – MQ Trader – Introduction of Corporate Actions (Part 1), so we are going to explain in details on the Voluntary Corporate Actions in this article.

What is Voluntary Corporate Action?

A voluntary corporate action is an action that depends on a decision from the investor on whether or not to participate in the action. These actions will not be applied to shareholders automatically unless the shareholders choose to take part in the actions. If shareholders prefer not to take the action, their securities will be unaffected by Corporate Action.

Right issues

A right issue is the right but obligation offered to existing shareholders to purchase additional shares at a discounted price which is lower than the current market price based on a specific ratio to their existing holdings. The existing shareholders are given an opportunity to grab advantages from a new promising development of the company.

Companies usually issue a right issue to raise additional capital while some of the companies use right issue to settle their liabilities and debts. Hence, it is important to read the news regarding to the purpose of the issuance of right issue before investors decide to subscribe for right issue of a company.

The impacts of right issues:

- Earnings per share (EPS) decreases as a result of share dilution

- The share price falls proportionally to the number of right issues

- Higher capital gains for shareholders if the extra capital is used for companies’ expansion.

Shareholders are allowed to trade the rights in the market until the listing of the newly purchased shares. This is an advantage of right issues, as they can help to compensate the current shareholders for the dilution of their existing shares value in the future.

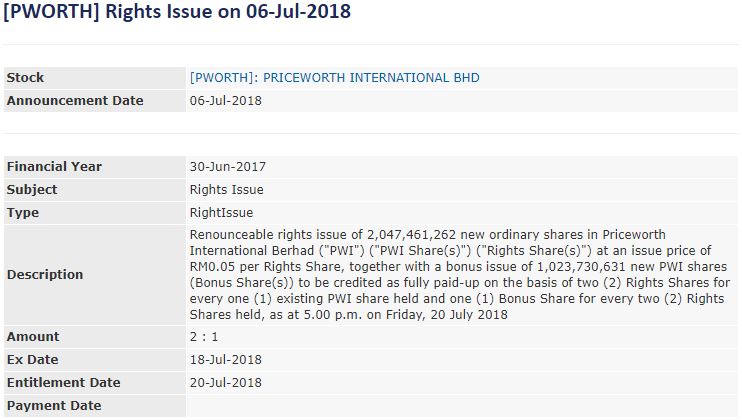

Figures below show the right issue example of PWORTH which its ex-date is 18 July 2018. The share price fell sharply by 58.14% within a day. For more information, please read [PWORTH] Rights Issue on 06-Jul-2018. For viewing the technical chart, kindly visit PWORTH daily technical chart.

Buyback

A stock buyback is known as a share repurchase when a company buys its own outstanding shares to scale down the number of shares available on the stock market. There are several reasons contributing to the implementation of a share buyback:

- Increasing the value of the remaining shares available when the supply of shares is cut down

- Avoiding dilution of control over the company

- It involves high cost of equity when the shareholders demand for returns in the form of dividends.

- Issuance of the buy back shares to the employees and management as a reward

Generally, companies can buy back their shares in a few ways as below:

- Shareholders might be given a tender offer where they have the option to submit or tender all or part of the shares within a given period at a premium to the current market price. This offer is able to compensate investors for tendering instead of holding the shares.

- Companies acquire the shares from shareholders through stock market within a specific period of time.

The effect of buybacks:

- Short-term spike in the share price

- Higher Earnings Per Share (EPS)

- To maintain the market price from further drop

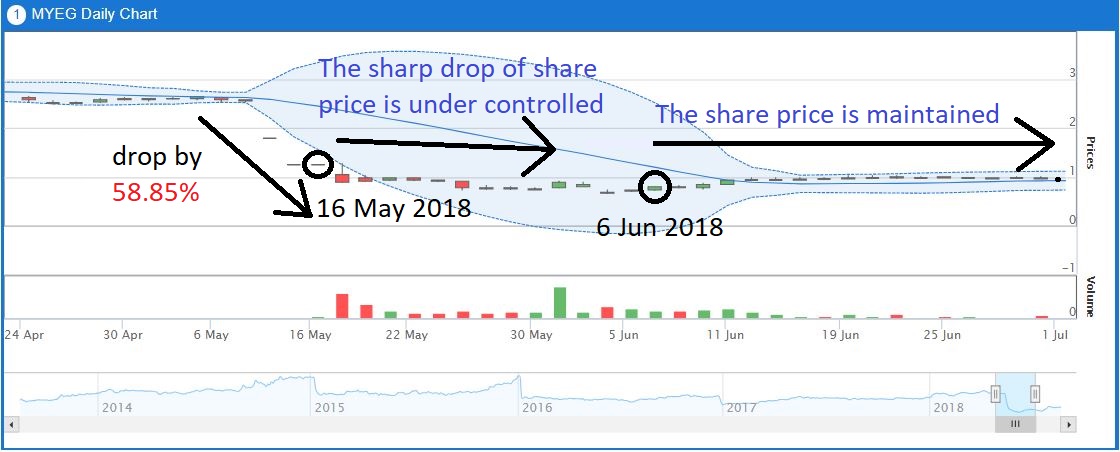

The figures below indicate the example of share buyback of MYEG on 16 May 2018 and 5 Jun 2018. The implementation of share buy back in this scenario has successfully prevented the share price from dropping seriously. For more information, please read [MYEG] Share Buyback (Immediate) on 05-Jun-2018 and [MYEG] Share Buyback (Immediate) on 16-May-2018. For viewing the technical chart, you can visit MYEG daily technical chart.

Conclusion

Share price increases or decreases sharply, but the value of the shares remains unchanged when corporate actions take place. Hence, it is important to be aware of the declaration of any corporate action to avoid oversold position or panic selling to happen. For knowing more on how to mitigate the effect of corporate actions on share price, please proceed to the next article – MQ Trader – Introduction of Adjusted Price.

Community Feedback

We encourage traders to try out and evaluate the MQ Trader system and provide us feedback on the features you like to see in the system. We have received many positive feedbacks so far, and we are currently compiling and reviewing them for possible inclusion into the next release of the system.

We would like to develop this system based on community feedback to cater for community needs. Thanks to all those who have provided valuable feedback to us. Keep those feedbacks coming in!

Disclaimer

This article does not represent a BUY or SELL recommendation on the stock covered. Traders and Investors are encouraged to do their own analysis on stocks instead of blindly following any Trading calls raised by various parties in the Internet. We may or may not hold position in the stock covered, or initiate new position in the stock within the next 7 days.

Join us now!

MQ Trader stock analysis system uses Artificial Intelligence (AI), various technical indicators and quantitative data to generate accurate trading signals without the interference of human's emotions and bias against any particular stock. It comprises trading strategies which are very popular among fund managers for analysing stocks.

MQ Trader stock analysis system is SPONSORED for MQ Trader members. To use this amazing tool, you can sign up via MQ Trader Sign Up!

Contact us

Please do not hesitate to contact us if you have any enquiry:

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on MQTrader Education Series

Created by MQTrader Jesse | Apr 13, 2023

Created by MQTrader Jesse | Aug 06, 2021

Created by MQTrader Jesse | Nov 01, 2019