(MSD) Defensive Stocks in Bear Market

mystockdeck

Publish date: Mon, 25 Jan 2016, 12:02 AM

When we talk about stock price movement in a healthy bull market, 50% of the movement is influence by the overall market, 30% by the industry and 20% by the stock characteristics. Unfortunately, this is not true when we embrace our self in the grueling bear market, 90% of the price declined will be dominating by the overall market sentiment and only 10% is determined by the stock characteristics.

So, when investors are advised to hold defensive stocks while in the bear market, I beg to differ. There are no such things as defensive stocks when market really let go and deleveraging kicks in. The real definition of defensive is being in cash. Retails have the luxury of selling since the holding of certain stocks are minimal compared to majority shareholders or even fund management. Some funds even have the mandate to keep on invest even it’s in bear market.

When in the bear market, stock markets are often driven by purely emotions and even the quality stocks get destroyed. When margin calls triggered, you will notice quality stocks hammered and the sell down will propagate to other stocks as well. Of course the brokerage houses and fund management companies would want you to shift to defensive, as they do not want the funds to leave the market.

Let’s look at the recent bear market started in 2008 when KLCI index hit the highest at 1524.69 on 14th January 2008 and ended at 801.27 on 28th October 2008, plunging 47.45% from its peak. We can see that a lot stocks plummeted during that period, including those quality and defensive stocks.

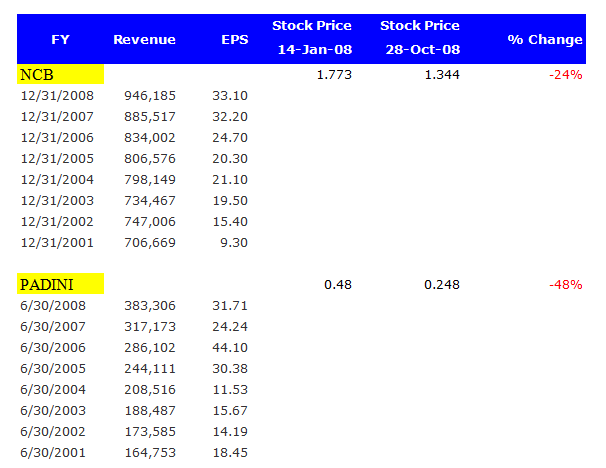

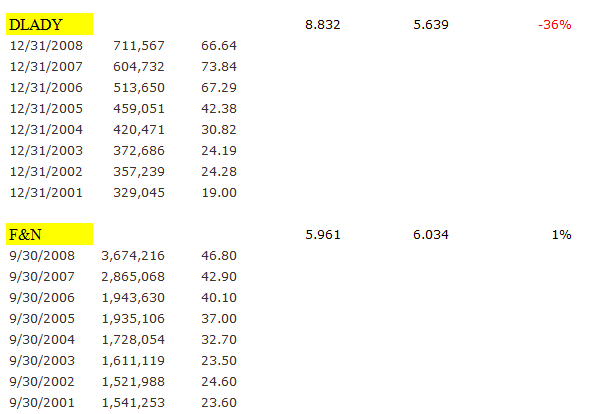

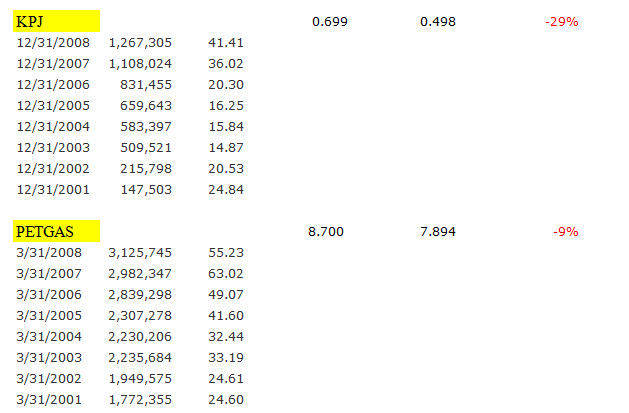

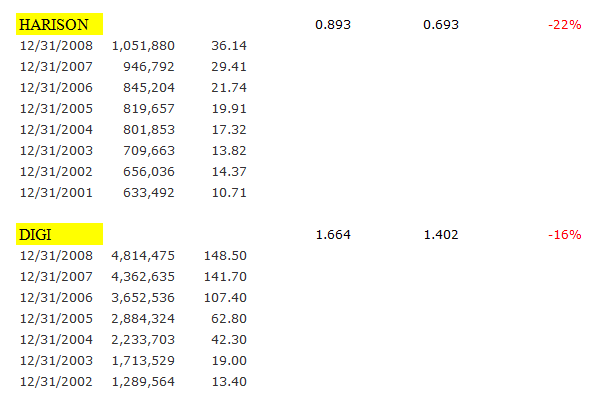

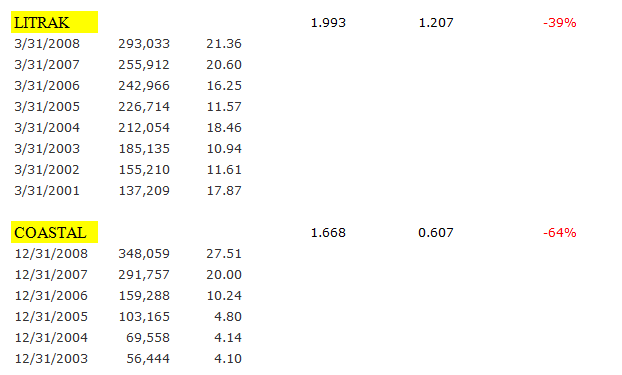

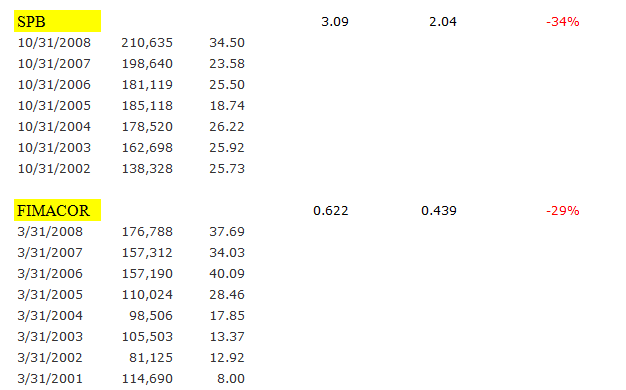

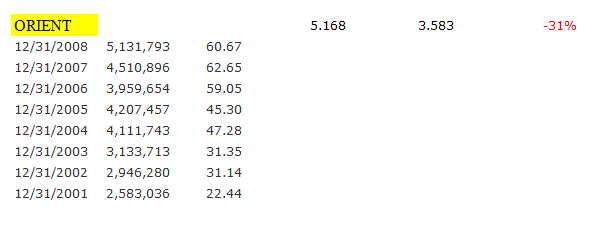

Here are the list of some stocks with impressive growing EPS year over year from year 2001 to 2008. After KLCI reached its peak on 14th January 2008, all this quality stocks (except F&N) declined until the bear market ended.

Even though, they had the growing EPS yoy which is one of criteria in value investing, all these stocks can’t even succumb the pressure of bear market. P/E is getting more and more attractive during bear market, but it doesn’t mean it won’t get any cheaper.

Lastly, I would like to reiterate there is no such thing as defensive stocks in bear market and when deleveraging kicks in, and there is one old sayings, “Cash is king”.

More articles on MyStockDeck

Discussions

I suppose defensive stock is less cyclical (not speculative) and lower beta. Agree, during crash, everything drops. Even utilities stock like TNB, but, when market recover, their share price will come back unlike speculative stocks (without earning support), will remain collapsed.

2016-01-25 09:27

one have either to be mainly a market trader, investor, timer, speculator...over the long term, investors more likely to make $$$ than others? No right or wrong method, so long happy, make profits and harm nobody. Good luck!

2016-01-25 10:51

A lower beta stock, i.e less than 1 would theoretically "outperform" the market with the magnitude of decline lesser than the overall market.

2016-01-25 10:58

Kevin, I agree. There are probably thousands of ways making money in the market. Warren Buffett and George Soros both have different ways of approaching the market, but both of them are successful.

2016-01-25 11:07

But recently, the price of the share seldom down even the market sentiment is so weak. Feeling weird! Compare our Market with Singapore, their price is really dropping even bank sector such as OCBC, DBS and UOB. The PE is ard 8 only, but for HL Bank and PB Bank, they still enjoy double digits PE.

2016-01-27 15:40

Those are the index counters that the invisible hands are defending. Imagine what will happen to the market if the these index counters also collapse.

2016-01-27 17:43

914601117

No wonder Jib gor said CASH IS KING, even before the oil crisis

2016-01-25 00:59