(UPDATE) Is Shell Refining Berhad Really A Good Buy?

mystockdeck

Publish date: Tue, 19 Jan 2016, 11:42 PM

Royal Dutch Shell has been planning for exit of its 51% on Shell Refining Malaysia since last year as the company having difficulties to turn into black since 2013.

Today, news broke out that Shandong Hengyuan Petrochemical Company limited got the approval from China authority to acquire the RDS's 51% stake in Shell Refining for USD 130 million.

So, it works out to be RM 3.74 each share for 153 million shares RDS holding. Now, the question is will RDS accept the offer?

Let's look into Shell Refining Company balance sheet and cash flow since the last article we have looked into their revenue, net income, stockholding loss and impairment loss.

The reason for RDS looking for the exit door seems apparent. The company is purchasing oil to burn cash. Cash in the balance sheet has been depleting fast, and the only way to continue the operation for past few years is borrowing debts.

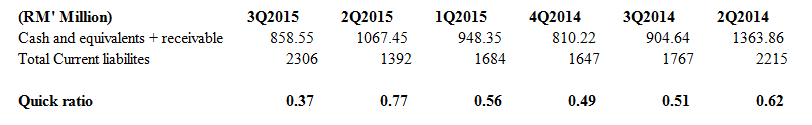

Quick ratio has been consistently below 1 every quarter which means the company do not have enough liquid assets to cover its current liabilities.

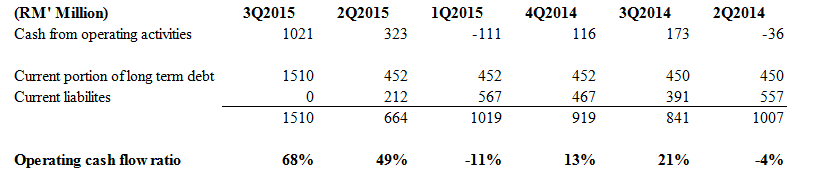

Cash flow generated from operation also unable to cover the current debts as we can see fro the operating cash flow ratio. This causing them to burn their cash in hand even faster.

So, if RDS do accept the offer, Hengyuan Petrochemical must come out not only USD 130 million but also financial package to service the company debts. Besides, they need to launch mandatory general offer to buy those shares they do not own. EPF is the second largest shareholder with around 15% stake follow by PNB 12%. Perhaps this is why EPF keep selling on strength while price on the way up and hit the $6 mark since last week.

But, will RDS accept the offer of RM3.74? (Shell Refining Company historical low was RM4.40 on 7 July 2015)

More articles on MyStockDeck

Discussions

Hi mystockdeck,

THX for your timely write up.

SHELL is becoming a tougher nut to crack.

A big time foreign name stock can sting just as bad.

2016-01-20 00:57

haha...rds got cash flow problem??... but can acquire BG group for USD 70 billion!!....

http://www.wsj.com/articles/shell-to-buy-bg-group-1428473660

rds is damn rich la mystockdeck....don't simply post write-ups without research...semua syiok sendiri

2016-01-20 07:11

oil n gas are lucrative biz...that's why they are heavily regulated...the BG group acquisition is creating a Shell giant in the world....that's why it requires the approval of many countries as many are worried that shell will monopolize this sector...dont write something that you don't know...it just shows the writers credibility and ethics is zero!

2016-01-20 07:17

Probability

2Q-15 to 3Q-15 Crude Inventory ($$) increased by 200 over millions (that one not money meh?)

CFFO over long term Debt increasing at an exponential rate woh!

Like this can overtake Debt by next quarter...

Aiyoo...ammma...I didn't know RDS is having financing problem!....samo thinking of buying BG Group PLC!

2016-01-20 00:14