It Is Raining Money - Invest In UTDPLT, YINSON and SERBADK

InsiderShark

Publish date: Wed, 22 Jul 2020, 10:41 AM

Join our Telegram Channel BursaBets

Long Term Investment, not for Trading - These stocks are highly recommended if you believe a repeat of 2010 to 2015 commodities boom. Right after USA's Fed massive QE in 2008-2009, also known as helicopter money, the system is flooded with so much money that it eventually founds it way into the commodities market. Wall Street bid up the prices of Gold, Oil, Vegetable Oil, Wheat, Copper, and etc.

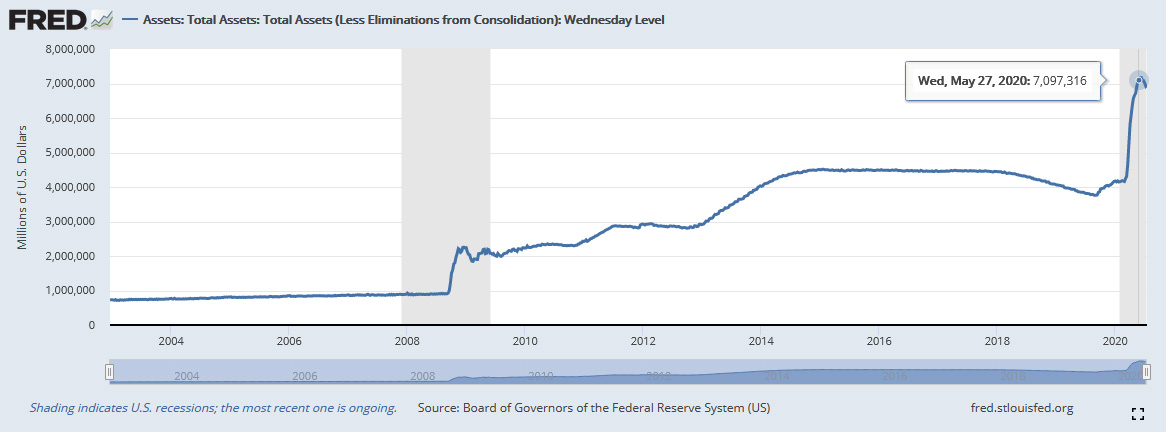

Due to the Pandemic, in a short 3 months duration, the Fed's balance sheet grew to USD7 Trillion from USD4 Trillion. Unlike the last recession, governments all over the world over-stimulated their own economy, an unprecedented move. If history repeats itself, we will be witnessing the craziest commodities boom ever in 2021 or 2022. These are good stocks and you can start accumulating them now.

- Growing Revenue + Growing Market + Growing Profits = Growing Stock Prices

- These companies are "Buy and hold" type, for long term capital gains, not for trading or speculating.

- These companies are well managed and profitable, reasonable PE for tech, low debt or net cash.

- Please use dollar-cost-averaging investment strategy, don't gamble, don't use margin.

- China Buys Record Commodities Haul to Fuel Post-Virus Recovery

- JPMorgan predicts a $190 oil, it sounds crazy but might be true.

Look at the spike in fed balance sheet during 2008, now, compare it to 2020's spike. All of these monies will eventually find its way into the commodities market, the only question is when, not if.

UTDPLT 2089 [ QE Effect on Soybean Oil & Inflation ]

What happens right after the 2008 recession when USA stimulate the economy with massive money printing? Prices of commodities went up. If Soybeans oil prices goes up, this means Palm Oil will follow too. UTDPLT is one of the best run palm oil plantation among all the plantation in Malaysia, they are small but their yield is one of the highest, and good dividends too. If you believe global vegetable price will go up due to QE stimulus and inflation, then investing in palm oil companies will give you good returns when it happens. No guarantees but potentially X2 or X3 of your investment in the coming years if commodities inflation took off due to QE.

SERBADK 5279 [ $190 Oil Per Barrel + Diversifying ]

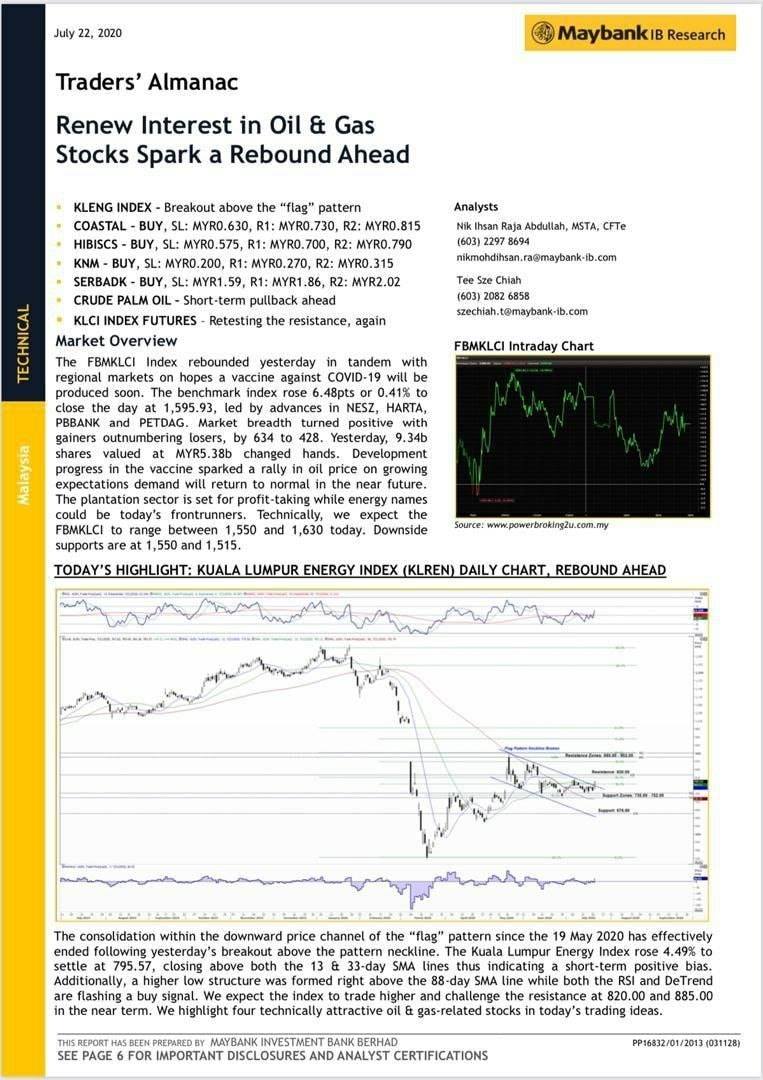

Maybank IB has a trading buy of RM1.80 to RM2.00. Oil price is somewhat low now, but it won't be low forever. Serba Dinamik is one of the few oil related companies that is showing positive revenue and profit in today's low oil price climate, something rare. The other oil related companies that are good are Yinson and Hibiscus Petroleum, you can pick them if you do not like Serba Dinamik. Anyway, oil prices won't stay low forever, JPMorgan predicts a $190 oil, it sounds crazy but might be true.

Taken from CNN: "Somewhat counterintuitively, JPMorgan's Malek said the BP write-down and gloomy forecast are "one of the most bullish" developments he's seen. That's because oil companies must spend heavily just to maintain production, let alone increase it. If they do nothing, output will naturally decline. And BP's weaker outlook suggests even fewer long-term oil projects will make the cut. That in turn will keep supply low -- even as demand rises. "It validates our point," Malek said."

Oil prices can't possibly go any lower, and with so many oil companies cutting CAPEX for this year at 15-year lows, this means once demand is back, there will be a shortage of oil as it take years for none OPEC+ countries to increase output. OPEC+ on the other hand can increase output very quickly but won't, this is because they need a high oil price as their economy relies on it.

Warren Buffet was right, only in a recession do we see which companies are well managed and which isn't. Serba Dinamik and Yinson still reports a healthy balance sheet and profit. If they are able to make money in a recession, we are willing to bet when the commodity boom returns, they will be in a much better position to grow even faster and bigger.

YINSON 7293 [ $190 Oil Per Barrel + Renewable Energy ]

Yinson is a well managed upstream O&G company. Just like Serba Dinamik, they are diversifying into other industry such as trading of construction materials, rental of properties, and renewable energy. They have a solar park in India. In this recession, they did not face any financial constrain, this goes to show they are a well managed company that prepared for the worst and planned for the future, example renewable energy.

More articles on BursaBets [ Rabbit Trader Turtle Investor ]

Created by InsiderShark | Oct 01, 2020

Created by InsiderShark | Aug 07, 2020

Created by InsiderShark | Jul 20, 2020