5 Must Have Tech Stocks - FRONTKN, DUFU, PENTA, FPGROUP, and TIME

InsiderShark

Publish date: Mon, 20 Jul 2020, 03:16 PM

Join our Telegram Channel BursaBets

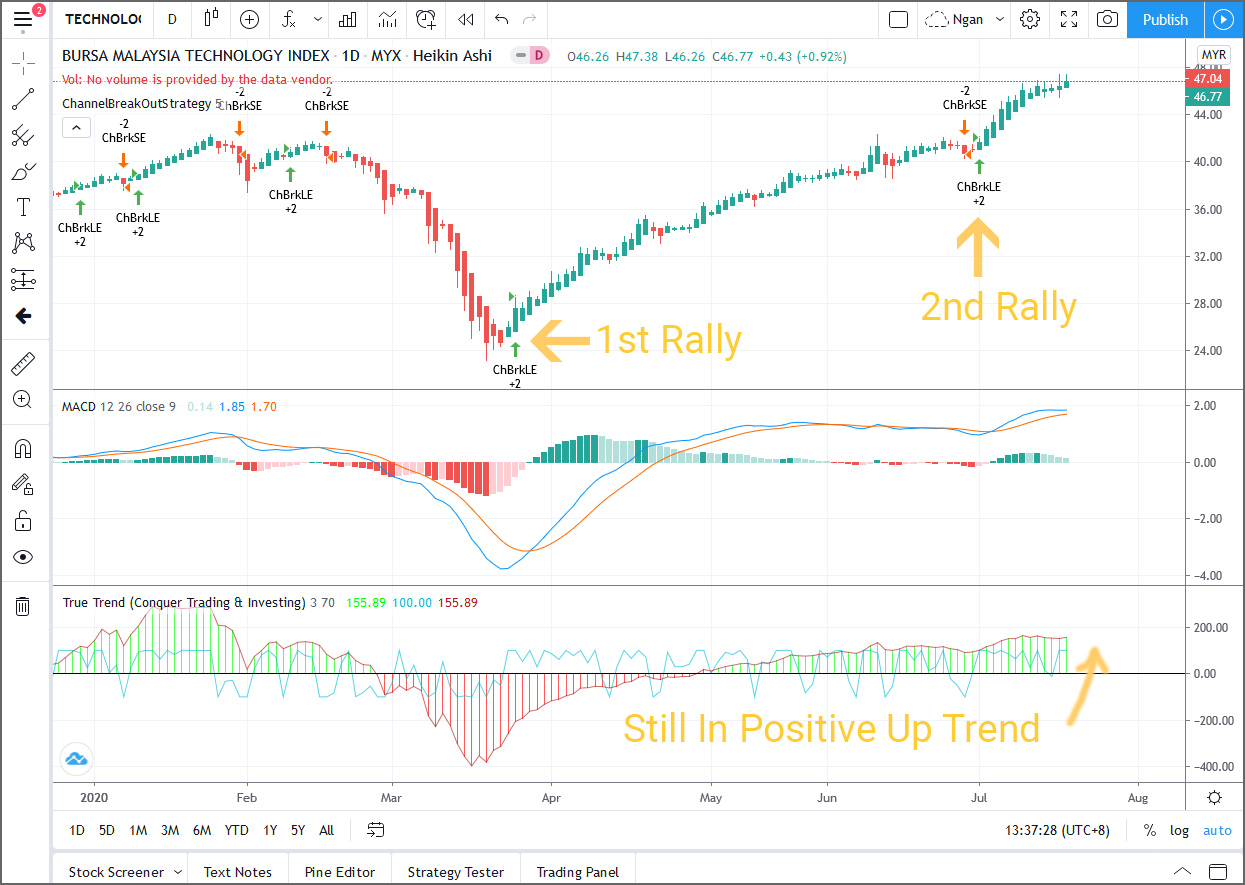

Which stocks have the potential for massive growth? (Higher growth = higher revenue = higher stock price), they are Semi-Conductors, Internet of things, A.I., and Industry 4.0 stocks. These companies export their products and services all over the world, they are not limited to the small Malaysian market, therefore the growth potential is enormous once the economy rebound. A recent survey by CSG-CIMB reveals that most investors are bullish on the semi-conductor and technology sector.

- Growing Revenue + Growing Market + Growing Profits = Growing Stock Prices.

- USA Vaneck Vectors Semiconductor ETF Index Fund (SMH) is breaking out and on uptrend.

- These companies are "Buy and hold" type, for long term capital gains, not for trading or speculating.

- These companies are well managed and profitable, reasonable PE, low debt or net cash.

-

CoVid has accelerated the adoption of tech.

-

Semi-conductor and internet will be the next stock rally once the glove bubble pops.

-

Please use dollar-cost-averaging investment strategy, don't gamble, don't use margin.

-

Global semicon manufacturing equipment billings up 13% y-o-y in 1Q2020, says SEMI

-

Tech (Semi-Conductors) demand powers Taiwan export order growth to 2-year high in 2Q 2020.

Social Capital CEO Chamath Palihapitiya's case against stock buybacks, dividends.

Dividend stocks are companies that gives up on growing, they are telling the investors that we do not know what to do with the cash or how to use the profit to grow the company. In the long run, dividend stocks will lose market value. Good examples are YTL, Genting, Digi, Maybank, Public Bank, these dividend stocks gives good dividends but their market value over the years will continue to decline, remain stagnant or increase very little compared to growth stocks. Don't believe me, look at their 10 years chart, what is their capital appreciation since 2009's bottom? Go check the chart.

FRONTKN 0128 [ Precision Cleaning Services ]

TSMC's subcontractor (Biggest chip manufacturer in the world), Frontken services their chip making machines. Apple outsource their chips to TSMC, and Apple is moving towards their own Apple Silicon chip, this means even more business in the coming future. A growth stock. Will we be using more or less chips? If the answer is more chips in everything from cars to smartphones, from TV to aircon, then invest now for long term growth! Most of the leading fabless semiconductor companies such as Advanced Micro Devices (AMD), Apple Inc., Broadcom Inc., Marvell, MediaTek, Nvidia, and Qualcomm are customers of TSMC.

- Precision Cleaning Services Market to See Huge Growth in Future by 2020-2028

- Frontken 2Q net profit rises 23% to RM20.33m even In lockdown/MCO

![]()

FPGROUP 5277 [ 5G Test Sockets ]

They make key test components for 5G. In the next few years, we will be moving towards 5G networks, this means guaranteed growth as the entire world gradually move towards 5G. Unlike 3G or 4G, the 5G network requires even more towers, this means the demand for their product will be high. Will the world upgrade their networks to 5G or continue to use 4G forever? If the answer is we will move to 5G, then invest now!

- FPGROUP vs JFTECH - This little-known Malaysian company may be a trade war prize

- Test Socket Market Is Projected To Grow Vibrantly In The Upcoming Years 2019-2027 (Impact of COVID-19)

DUFU 7233 [ Enterprise Hard Disks ]

Hard Disk Spacer maker for Seagate, Toshiba, Western Digital. HDD is slowly being replaced by SSD, but with the super growth of cloud computing, HDD will still outsell SSD in the enterprise market because a 16TB SSD is 10X more expansive than a 16TB Enterprise HDD, and High Performance HDD for cloud servers uses 3 or 4 times more spacer components than the typical consumer PC. It is Estimated that Enterprise HDD market value will double from 2020 to 2025. Massive growth as more people get used to the new internet lifestyle. All digital content created and consumed online, including this website, video streaming, apps, gaming, eBooks, music and more are stored in the HDD cloud server. Will we be using more or less internet? If the answer is more and more people will use the internet daily, then invest now!

- Enterprise SSD vs Enterprise HDD [ Enterprise HDD shipment grew faster than Enterprise SSD ]

- Portable Hard Disk Market to Eyewitness Massive Growth by 2026 | Toshiba, Seagate, WD, Hitachi

PENTA 7160 [ Robotic Automation ]

They are hardware makers, automation is one of their key selling point. As labour becomes more expensive, automation is the solution. They are the biggest robotic automation company in Malaysia with a global footprint. Study shows world population will decline in 2050, we are entering an aging population, this means we need more automate machines due to the lack of labours. Currently they are expanding into EV and the medical industry by offering automated equipments for the related field, potential growth as the company is always seeking to expand and grow.

TIME 5031 [ Submarine Cables / Cloud ]

They own quite a number of internet submarine cables around the world. As more and more people use the internet, this means they earn even more money. They are continuously laying down more cables around the world. They are also moving towards cloud computing, data cloud, securities and more. Potential growth as more and more companies adopt the internet first policy. Will everyone use more internet or less? If the answer is more, then don't wait, invest now!

More articles on BursaBets [ Rabbit Trader Turtle Investor ]

Created by InsiderShark | Oct 01, 2020

Created by InsiderShark | Aug 07, 2020

Discussions

Best of the best is Mmsv

Mmsv has the best dividend support

Automation plus semi-conducter

Govt now clamping down on 5 million foreign workers and tell all companies to go up automation chain will be very good for Mmsv

Malaysia 15 years tax free status for new FDI will be fantastic for Mmsv as it caters to the Malaysia market

Topglove also got 12.5% of it's gloves stuck in US port because of rumour about slave like labour

All these point to more need for automation for Mmsv

But best of the best is the low undemanding price of Mmsv compared to others now quite bloated up in price

Better buy MMSV

2020-07-21 00:06

sigh, why singaporean is always all about dividend, dividend, dividend?.... Top Glove give bonus shares they say why give bonus? it's useless, better give special dividend.... hopeless... better you go help them.....

2020-07-21 02:32

Posted by chopstick > Jul 21, 2020 8:06 AM | Report Abuse

i just wondering do malaysian retail group ppl till had that much of CASH to buy such a good value high price share? should suggest lower value share, i doubt in this forum , a lot of us just had millionHAIR but posting like billionHAIR.

Never look down on malaysia "black" money.....& undeclare money....now most of them in bursa.

2020-07-21 08:09

In my opinion, Penta a cash rich company and PE still low compare with others, this company still growing! This is like topglove but it's in tech sector! The second is FPGROUP...with it growing up trends earning and price at around RM1 is very attractive!

2020-07-21 09:20

In my opinion, UWC a growing company is another tech stock that you can not miss in your tech stock's portfolio as well!

2020-07-21 09:24

Penta vs mi tech?

Why not consider mi tech? They are better profit margin compared with pentamaster

2020-07-21 11:18

Penta the best with its innovative technological solution. Also, need to consider Uchi Tech as I believe it will come out with new things in the future.

2020-07-21 13:05

penta, mi, uwc, greatech, vitrox etc all good lah, no need to compare.... good things not cheap, cheap things not good - this is reflected in market right now....

2020-07-21 13:21

blood7

only left FPGROUP that has not move up too much yet....

2020-07-20 17:49