Press Release: Greatech Makes Its Debut on the Ace Market

newswire

Publish date: Thu, 13 Jun 2019, 01:20 PM

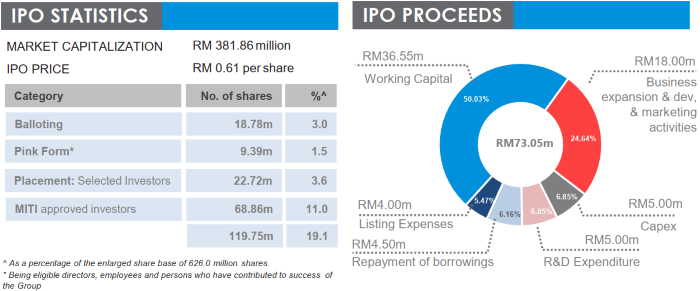

KUALA LUMPUR, 13 June 2019 – GREATECH TECHNOLOGY BERHAD (“Greatech” or the “Company”) <阁代科技有限公司> an industrial automation solutions provider made its debut on the ACE Market of Bursa Malaysia Securities Berhad (“Bursa Securities”) today. The Company began trading at 9:00 a.m. this morning under the stock name GREATEC and stock code 0208. Greatech’s Initial Public Offering (“IPO”) price was RM0.61 per share, with listing market capitalisation of RM381.86 million.

Greatech’s IPO attracted strong interest, with the offering to the Malaysian public being oversubscribed by 9.41 times. Greatech raised approximately RM73.05 million from its IPO where RM18.00 million will be utilised for business expansion & development and marketing activities, RM5.00 million respectively for capital expenditure and Research & Development (“R&D”) activities and RM36.55 million for working capital. The remaining proceeds of RM8.50 million will be used for repayment of bank borrowings and defrayment of IPO expenses.

Commenting on the listing, Chief Executive Officer (“CEO”) EK Tan <陈荣棋> said: “We have grown from humble beginnings as a fabricator of machine parts and components into an industrial automation solutions provider serving top tier global clients. Industrial automation is inevitable and is rapidly changing the face of manufacturing. Having established a strong platform and international track record with brands such as First Solar and Panasonic, I am very confident that we will be able to tap into other opportunities from continuous adoption of industrial automation. Moving forward we are looking at bringing our automation solutions across industries and geographies.”

Greatech and its subsidiaries (the “Group”) are involved in the design, manufacturing, installation and commissioning of customised single automated equipment up to production line systems for industrial process automation. The Group is backed by its in-house design and machining capabilities to customize unique solutions to fit clients’ requirements. For financial year ended 31 December 2018, the Group recorded revenue of RM219.58 million and profit after tax of RM31.72 million with approximately 90% of revenue derived overseas. On 10th of June 2019, the Group has reported its result for the first financial quarter ended 31 March 2019, with revenue of RM58.73 million and profit after tax of RM12.55 million, closing the quarter on a positive note and setting the pace for the financial year.

Alliance Investment Bank Berhad is the Principal Adviser, Sponsor, Sole Underwriter and Placement Agent for Greatech’s IPO.

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on News Wire

Created by newswire | May 06, 2024

Created by newswire | Apr 19, 2024

Created by newswire | Mar 29, 2024

Kuala Lumpur, 29 March 2024 – Oil palm plantation player, MKH Oil Palm (East Kalimantan) Berhad (“MKHOP” or the “Group”) has successfully launched its prospectus in conjunction with its upcoming IPO..

Created by newswire | Feb 02, 2024