One thing I learned early in my investing journey was to find three signs for a strong business.

It’s simpler than what most investing gurus make it out to be. It also serves as a good check as to whether a business is worth investigating further.

To make things really easy, I have made the 3 rules of thumb I look for into a 3 x 3 matrix.

A Simple Measure to Determine the Strength of a Business

Imagine you own a simple business producing $100k cash profit annually. Let’s check out some details of this business.

- You have to invest $20k to add shelves (or repair broken shelves)

- You have to re-pay $20k where the repayment is made up of $10k in interest and $10k in principal

- You invested $250k of your own personal savings into the business

- You borrowed $50k to buy inventory and other items. Nothing has been repaid yet.

So how do you determine whether this is a good business or not?

Here’s my 3×3 matrix for this example (best viewed from a desktop, not mobile)

| Operating Cash Flow | Free Cash Flow | Return on Capital Employed (ROCE) | |

| Definition | How much real cash the company generates from its core business | How profitable the company is after spending on capital expenditure, repaying the loans. | Indicates how efficiently the company employs capital.The ultimate proof for the owner/shareholder. |

| What it means | The real cash that the business generates.This is after all the goods sold, expenses and inventory purchase. Note that the cost of inventory is often overlooked. |

Take the operating cash flow and subtract:

Financing costs

|

Calculate ROCE

|

| Rules of Thumb | At least 12% of the total capital invested. Rising consistently year over year. | FCF positive at least 5 out of the last 10 years | Above 10% consistently for a good business. Above 15% indicates a strong business. |

So, let’s understand if the business is good or not.

You make a profit of $100k with a capital base of $280k (equity + debt). That’s an ROE of 35% (100/280 x 100%)

If you compare the 35% with the approximate 4% you get from T-Bills, that’s a really good return.

Do the Same for a Public Company

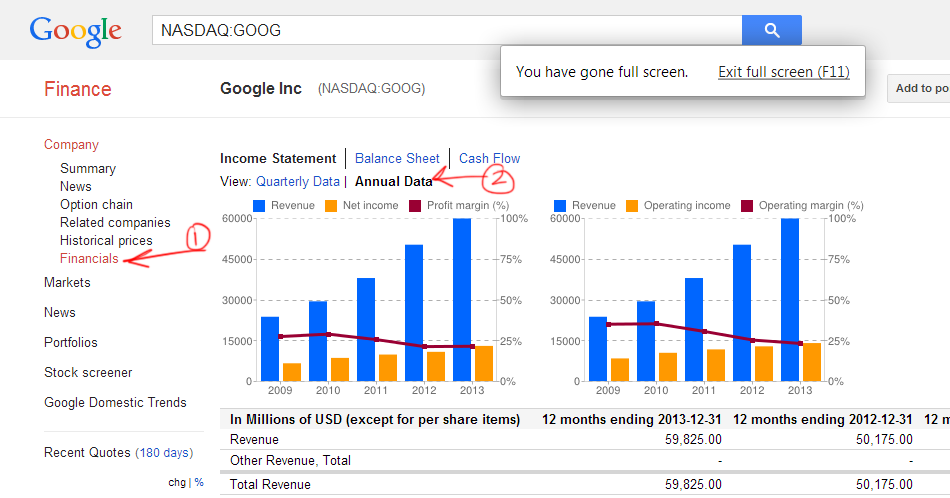

Try applying these principles to a public company like Google (GOOG).

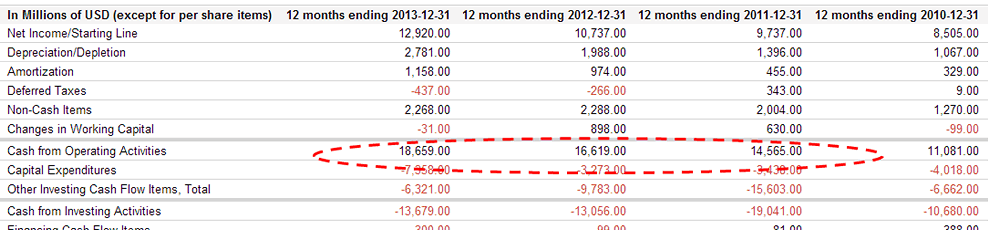

I’m using Google Finance in this example. Type in GOOG and then click on financials. Choose annual data then select Cash Flow.

See how Cash from Operating Activities has increased from $14.57B to $18.66B in two year.

That’s a healthy CAGR growth rate of 12.35%.

Google Has Great Operating Cash Flows | Click to Enlarge

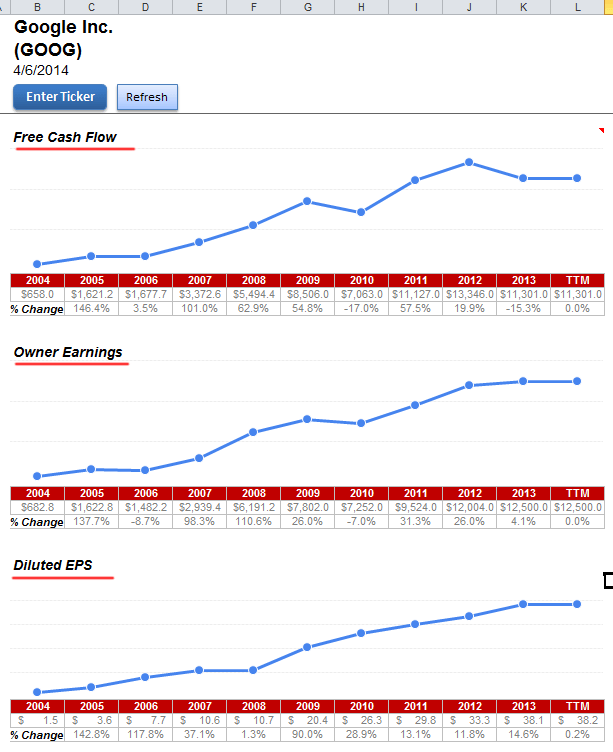

Free cash flow has increased steadily every year. I mentioned in the matrix that a company has to have at least 5 positive years of FCF in the last 10 years.

Google passes this test easily.

Google Outstanding Free Cash Flow | Taken from Old School Value’s Stock Analyzer

This is the ultimate test for any company. Think of it as the fuel efficiency of a car.

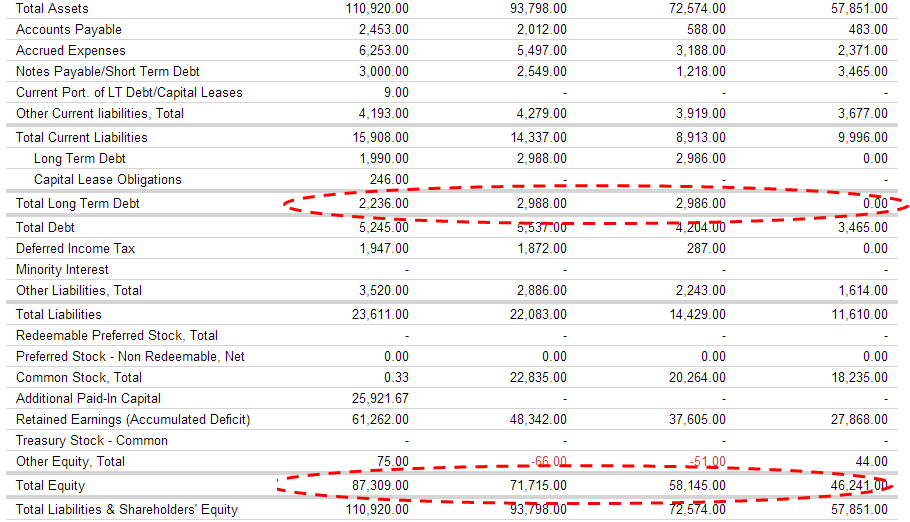

Balance Sheet Numbers for Google | Click to Enlarge

Why add debt and equity to calculate total capital?

If you start a business and you think of your bank as your partner who just gave you capital to grow the business, the total amount of money used in the business is the equity you put in plus the loan you received. I.e. the debt.

That’s why the total capital invested is referred to as owners equity + debt.

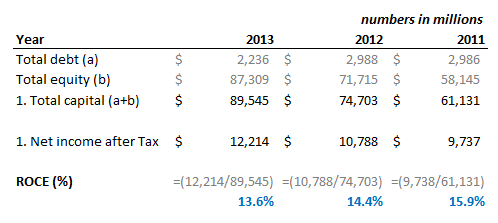

With this in mind, take a look at the last three years of ROCE.

ROCE is consistently above 10% and hitting 15% in certain years. My rule of thumb is 10% for a good business and anything above 15% is an excellent business.

Consider The Law of Large Numbers

Look at the sheer size of the numbers. Google is deploying $89 Billion of capital at more than 14% return.

That’s amazing.

But back in 2003, Google’s ROCE was a mind boggling 65%. They made $34M in profit with $58M equity. As Google grew, their ability to support the same level of efficiency has come down for sure. Although ROCE is still in the mid teens, you can see the law of diminishing returns come into play.

One of the greatest companies sacrificed more than 80% of its capital efficiency for growth.

A Warren Buffett Company?

Google grew its net profit from $4B in 2004 to $12.9B in 2013. A CAGR of 41.6%.

Free cash flow grew from $658M to $11.3B at an equally impressive CAGR of 32.9%.

Now you know what Warren Buffet meant when he said

There are very few businesses that can deploy large bases of capital at high rates of return over a long period.

Check These Three Rules of Thumb Next Time

- Check to see Operating cash flow is at least 12% of the total capital invested. Rising consistently year over year.

- Look for ROCE (Return on Capital Employed) above 10% as a benchmark. Anything above 15% consistently is spectacular. Also, smaller companies and companies from emerging markets should also exceed 15%.

- FCF positive at least 5 out of the last 10 years

What’s your favorite rule of thumb?

kcchongnz

Don't you see the same story?

Good cash flow from operations with CFFO/IC>12%

Good free cash flows

High return of invested capital > 10%

Like Buffet says, "I always know that I will be rich"

2014-04-07 18:50