HOW TO INVEST IN BABIES... IN CHINA!

Philip ( buy what you understand)

Publish date: Wed, 29 Apr 2020, 08:03 PM

First and foremost, I would like to thank Mr. TEOCT for introducing me to the milk powder industry in PRC.

Now, as usual, to set the stage:

If you take a look at this graph, you will see the breakdown of leading infant milk formula companies in China as of 2019.

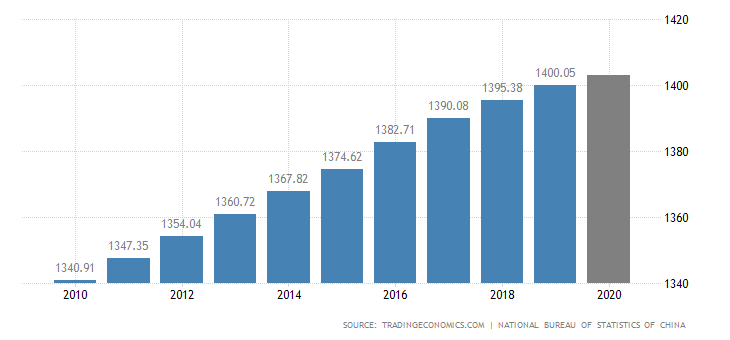

Now, we take a look at the Total Addresable Market.

https://en.wikipedia.org/wiki/Demographics_of_China

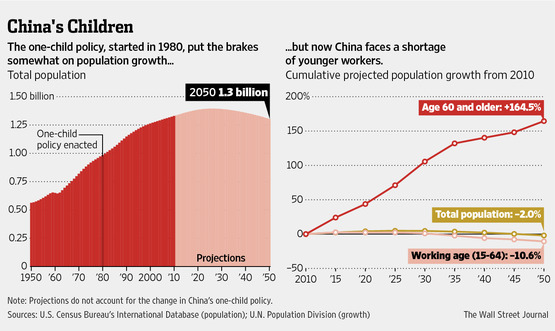

This is a picture of the largest group of people to live in one country, the People's Republic of China. Now, with the "One Child" policy ending, and families growing, the market for infant formula should be growing right? Well... not exactly.

As you can see from the curve, China's population is expected to continue growing, for the next 10 years before the cost of having kids and family become to stressful and population decline will become a huge issue, similar to Japan and Singapore.

So, why invest in Babies?

Firstly, two things are happening in PRC. First, more wealth is being acumulated in China than at any time in its history, and this time, that wealth is being tapped at the middle income family level, instead of being concentrated at the top while its majority population is starving. Secondly, the One Child policy has ended, and more families are having more kids in China, something that for the better part of the 21st century was unheard of.

Add a sudden spurt in demand and you have many factories producing baby formula to flood the market right? Not exactly.

The severity of the cases caused a massive consolidation and exit of many of the more unsavoury sorts, and those that wanted to stay in business had to upgrade a lot of facilities to meet stringent requirements or purchase their baby formula from overseas like Netherlands and Australia.

This caused a huge shortage with many families and agents no longer trusting local suppliers and importing from overseas suppliers, which had detrimental effects to countries such as Australia having a shortage.

The upshot of it all is with milk producer sanlu demise, it led to a huge consolidation and heavy controls on the quality of product. Remember the graph that I posted at the top? Let's study it again.

Almost all of the major suppliers are foreigners. Almost... which brings us to my latest investment, one which made me sell a big portion of my position in Topglove ( when individuals like Calvin Tan Eng Yee and Koon Yew Yin have started to come in and speculate in Glove counters, you know its time to sell).

I have started a position of 500,000 shares bought at HKD15.30 in Feihe.

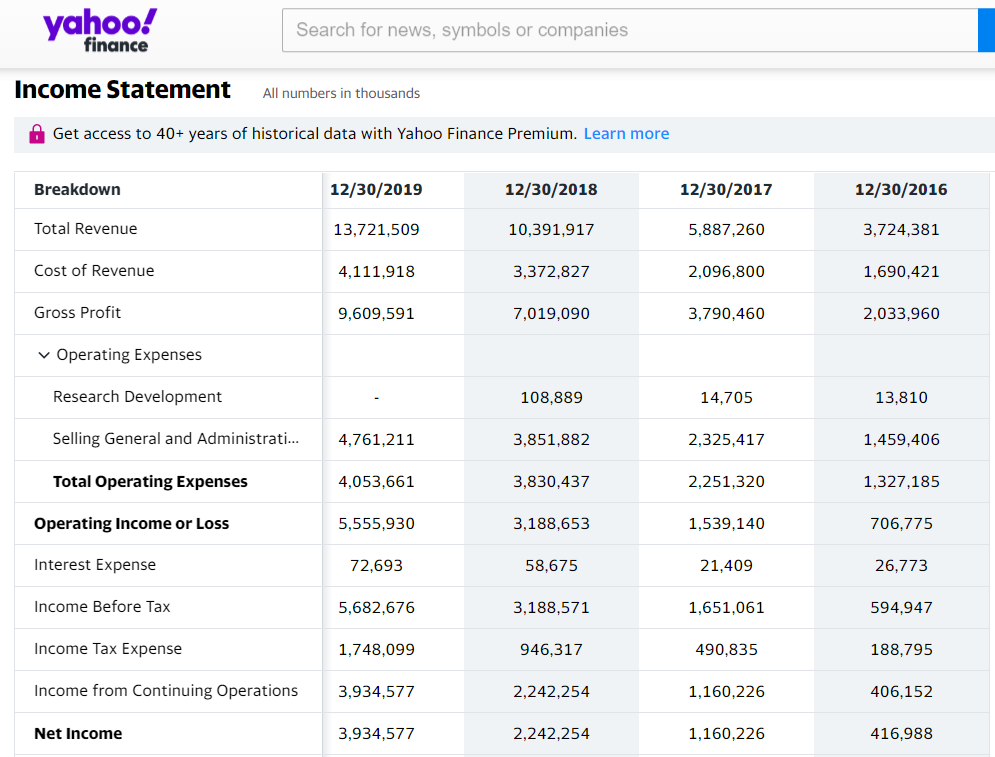

Looks amazing? The entire industry is similar, from Ausnutria, to Inner mongolia Yili, to junlebao to all of them. All are hugely cash positive, all are very very profitable, and all require very low capex to expand their facilities in terms of revenue earned.

Now, I must thank Teoct here for introducing me to this field. I had started by dipping my hands in ausnutria at HKD12.50. But after reading further, I have decided to sell my shares (which jumped up after the profit indication by management, legal in China) at HKD 15.50, and bought 500K shares of Feihe at 15.30. What has gotten me so bullish to start a position barely a few days after reading up on the recommendation?

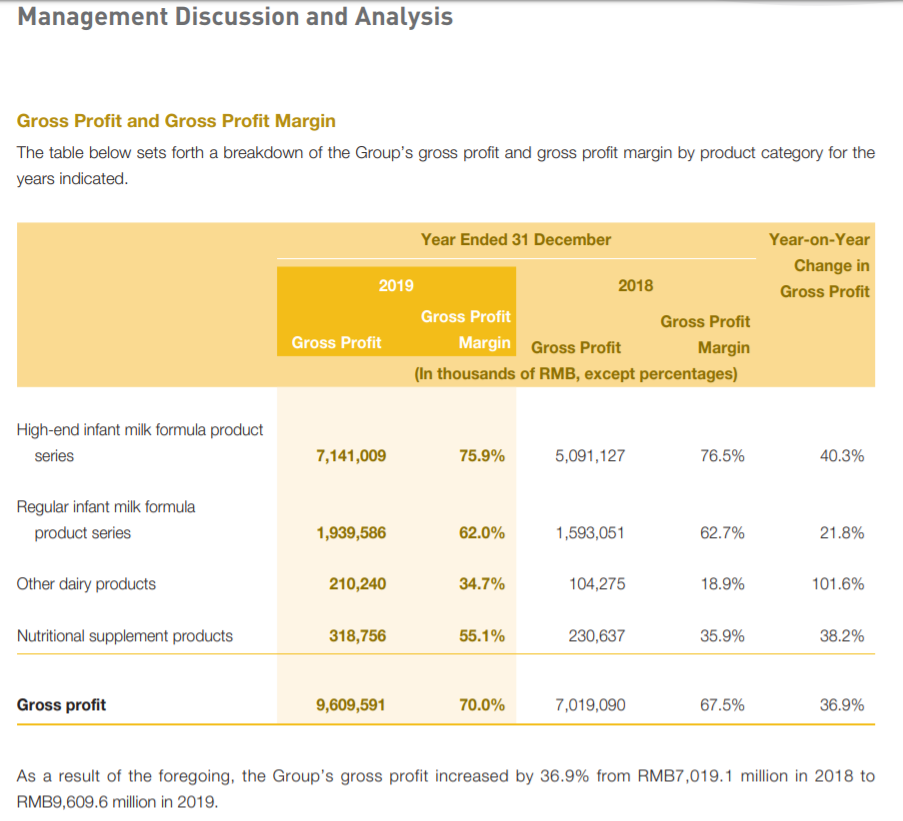

Look at the gross profit. 70%.

Now this is amazing for any business, and Feihe is the highest so far in industry and market size, even amongst its peers. Now, how is this possible you say? 30% increase in revenue YoY coupled with 70% gross margins and 28% NP?

Here is how I look at it, even in Malaysia you see baby formula locked in chest cabinets. As a parent with 3 kids myself, you learn not to mess around with your babies health. Whenever possible, if you can afford it you ALWAYS want the best for your babies. Baby formula has been proven to make babies grow bigger, healthier and possibly smarter growing than average, and you do not want to mess with that. Happy wife, happy life.

So here, branding and trust issues are far more important than anything else when selected baby formula. If there is a high-end infant milk formula product? Well, yes please send two tins thank you. So, with PRC government intervention, trust in baby formula has been slowly repaired (albeit at foreign label benefit, like Nestle).

So why am I choosing Feihe?

Firstly, it has a dominating market share, 13.3% market share, which is good for second in the market, next to Nestle. Secondly, they are a fully chinese company with PRC government support and producing their own local milk (with one of the oldest and longest running dairy farms in heilongjiang, and also the biggest importer from yst dairy farms), and have expanded to Kingston Canada to build their milk powder production facility.

Thirdly, I like their focus on targeting the super premium brands of milk powder, and to conquer that part of the market, which gives very high margins, that allows one to spend on more R&D, marketing and product centric focus instead of merely competing on price alone. As babies in China start to slowly reduce (13 million babies born in 2019),what we can quickly notice is that the middle class of China is steadily becoming wealthier. Now, I don't know about you, but when my son went shopping for baby formula, he was not sure what brand to choose or which product was actually better. However, in the end he just chose the most expensive and famous brand available, just to be safe. I believe most families will also follow the same path, to select the most expensive, reliable and recommended brand of infant formula, and even the poorer families know that the path out of poverty is through their children, and will act to the best of the ability to give their children the best. Most will not know what is the key ingredients for baby growth, other than to avoid lactose and gluten alergies. Note that as more women are entering the jobs market in China, it will become increasingly more efficient to reduce the breastfeeding cycle for babies and increase the infant formula cycle. In china, the rate of infants being fed exclusively on mothers breastmilk in the first 6 months was a very low 29% in 2018. I believe this number will continue to decline as women start to get back to work earlier, and the lack of breastfeeding rooms, or the community view of women breastfeeding in public as negative will drive this number lower in the years to come.

Fourthly, I believe the entire industry is enjoying a 10-20 year period of increasing sales and price hikes as consolidation, rise of income level in PRC and a very controlled market. So you can pick many infant formula companies out there to invest in. However, I believe the approach of Feihe is very unique and more China-centric.

Their marketing plan positioning of putting their infant milk powder as formulated locally and " More suitable for Chinese Babies" is a master plan and goes diametrically opposite of almost all the peer competition. Using Zhang Ziyi as a brand ambassador in China is also not to bad either. So they have local production centers, local R&D centers and fully localized supply chain, which is very interesting as back in 2008 during the melamine almost all the PRC formula producers went under, and the PRC government has since tried to look for a champion of local production to insulate the country for the future.

Now, for the investment risks and bad parts.

Even though I have participated in the investment recently, there are still many issues and problems that have circled this company.

Firstly, it is not a new company with a new IPO. It had previously IPO'd before in the US, under the stock name American Diary (which is funny for a company that exists and does business purely in PRC). The majority shareholder decided to privatise the company and relist in HK stock exchange. The issues then were quite worrisome, as despite very high profits and huge growth on accounting financials, it had not paid a single dividend. Even the re-IPO 40% of the proceeds were used to pay for the pre-ipo investors. However, management is very confident and cognizant of the past complaints from american investors on this and has already guided towards paying out 30% of their earnings out as dividends. At 4 billion RMB earnings a year and fast growing, the dividend payout is real and I believe that worry is now in the rear view mirror.

Hope we have a good weekend, let us monitor quarterly and hope every learns something new every day. I certainly learned something new from Teoct. I currently own 500K@15.30 HKD shares.

Cheers,

Philip

rylakk2016@gmail.com

More articles on Investing theory 2 - IPO valuation

Created by Philip ( buy what you understand) | Oct 11, 2024

Created by Philip ( buy what you understand) | Jan 12, 2023

Created by Philip ( buy what you understand) | Jan 30, 2022

Created by Philip ( buy what you understand) | Sep 02, 2020

Created by Philip ( buy what you understand) | Feb 25, 2019

Discussions

Haha,

Now Philip learn how much growth rate 30% revenue and 28% NP compare to his QL low single digit growth rate.

2020-04-29 20:50

https://www.gmtresearch.com/en/research/china-feihe-fake-or-fab/

Have you read the GMT short report?

2020-04-29 22:32

Philip ( Random Walk Theorist)

Yes I already posted it up at the bottom, regarding their complaints on fraud and fake money because they have not given back any dividends in the last 5 years. I thought it was refuted when management has guaranteed 30% of profit payout as dividends to shareholders. If and when the dividend payout is not given out, then we shall see.

As for market share and sales claims , I believe Nielsen 3rd party and very reliable market reports has already refuted this fact.

2020-04-29 22:53

Philip ( Random Walk Theorist)

Sslee, you never give up do you? What makes you think QL growth rate is going to be low? Ql is still one of my major holdings.

FYI, please give up on trying to bring down QL. It will still outperform INSAS. It will still return shareholder value far above what INSAS can it has ever done. And the consistent growth of QL is something that I appreciate and look forward to far more than the stocks that you peddle.

QL is a far safer, more consistent, more stable company with guaranteed growth over many many years compared to your INSAS.

Please give up commenting on my page, if you have nothing worthwhile to comment.

Full stop.

As you still have much to learn about investing, I recommend you talk less and read more.

>>>>>>>

Sslee Haha,

Now Philip learn how much growth rate 30% revenue and 28% NP compare to his QL low single digit growth rate.

29/04/2020 8:50 PM

2020-04-29 22:59

Philip ( Random Walk Theorist)

In any case I find the report very frivolous. Why is a stock based just because they did not pay dividends for 5 years? Berkshire Hathaway hasn't paid a dividend ever.

Only cheap investors keep begging management to give out dividend without thinking about the big picture in terms of the business.

I believe if the company is able to turn 1 dollar of retained earnings into many more dollars of growth than I can by giving out a dividend, then I believe the company should not give out a dividend and instead grow the business and capture market share.

If in 5 years just by not giving out a dividend feihe is able to grow to 13% of the market, then I believe it is the right thing to do.

>>>>>>>>>>

https://www.gmtresearch.com/en/research/china-feihe-fake-or-fab/

Have you read the GMT short report?

29/04/2020 10:32 PM

2020-04-29 23:07

Good morning Philip,

https://www1.hkexnews.hk/listedco/listconews/sehk/2019/1030/2019103000013.pdf

DIVIDEND

We did not pay or declare any dividend during the Track Record Period. On October 14, 2019, the Company declared a special dividend of HK$3 billion out of its historical retained profit to its shareholders. Based on the proposed funding and special dividend distribution plans, the distribution of the special dividend shall not have any material tax implication to us. We intend to distribute to our Shareholders no less than 30% of our net profit for each financial year going forward after Listing, subject to our future investment plans. Our Board may declare dividends in the future after taking into account our results of operations, financial condition, cash requirements and availability and other factors as it may deem relevant at such time. Any declaration and payment as well as the amount of dividends will be subject to our constitutional documents and the Companies Law.

HISTORICAL NON-COMPLIANCES

Administrative Sanctions on Feihe Zhenlai.

Social insurance and housing provident fund contributions.

Inter-company loans.

So Philip must hold the BOD accountability to “We intend to distribute to our Shareholders no less than 30% of our net profit for each financial year going forward after Listing”

By the way do you think a business model that did not pay a fair price to their material suppliers and then raping their customers to reward themselves, their distributors and retailers is a win-win business model.

I would be surprised later on like Xingquan; the BOD will blame some imaginary fuck up with the formulation causing the recall and destroys of 6 months imagination production batches and massive write off of receivable and stocks.

2020-04-30 08:34

I am humbled Philip. This is a thorough analysis of the milk industry in such a short time.

Am very happy for you and hope that this investment will be most fruitful to you.

Happy investing, stay safe especially with the impending relaxation, keep to at least 1.5m (in-fact 2m is better) physical distancing.

2020-04-30 10:27

comfort $ 1 to $ 1.40 is still the best ....beating every other choice............

2020-04-30 10:53

Fair point. Very interesting call.

Thanks!

====

Philip ( buy what you understand) Yes I already posted it up at the bottom, regarding their complaints on fraud and fake money because they have not given back any dividends in the last 5 years. I thought it was refuted when management has guaranteed 30% of profit payout as dividends to shareholders. If and when the dividend payout is not given out, then we shall see.

As for market share and sales claims , I believe Nielsen 3rd party and very reliable market reports has already refuted this fact.

29/04/2020 10:53 PM

2020-04-30 10:54

Philip ( buy what you understand)

There are cheaper options in the markets, why do Chinese still choose to buy astrobaby in large growing numbers? The fact is PRC Chinese are becoming much wealthier, and for them children are the most important future asset in their old days. Willing buyer willing seller, and no one is complaining about there business model but you.

I'm very interested however, what is a fair price for material suppliers to you?

>>>>>>>>>>>

By the way do you think a business model that did not pay a fair price to their material suppliers and then raping their customers to reward themselves, their distributors and retailers is a win-win business model.

2020-04-30 14:33

Philip ( buy what you understand)

Ok. But I will recommend you to open up your mind and look at businesses instead of locality. In every country ( USA and Malaysia included), there are always bad and good companies. However

Munger invested in BYD.

Warren buffet invested in Petrochina.

Alibaba is one of the world's biggest companies.

Jim Rogers had this to say about China.

https://news.cgtn.com/news/2020-03-27/Investor-Jim-Rogers-I-would-rather-buy-from-China-than-the-U-S--Pb3cWwJ6xi/index.html

The idea about investing is to look at critical areas that are undervalued. Stock fraud carry many alerts and red marks. But to assume that all stocks in China is a fraud is to lock yourself out of a huge fast growing market that will recover out of covid-19 faster than any other major country.

2020-04-30 14:48

Philip ( buy what you understand)

One thing that I can pretty much guarantee is that there will not be a reduction in the consumption of baby formula over this covid-19 period.

2020-04-30 15:23

Dear philip, thank you for your generous sharing. I had reservations about the infant formula industry in china but changed my mind after reading your article.

I was intrigued by their extremely high gross profit margins. The purchase of fresh milk accounts for 85% of their cost of goods sold. They receive their milk supplies from YST group, who also supplies to Mengniu. From my checks on ecommerce websites, the retail price of Feihe and Mengniu milk are comparable. Yet Mengniu only achieves a 37% GP margin. Perhaps Feihe is able to procure fresh milk at much cheaper rate (sslee might be right about supply chain bullying)

2020-05-01 08:56

Feihe seems to be very popular among the parents judging from the number of reviews on ecommerce platforms vs competitors. I believe there’s some moat in the business and their growth will come at the expense of international brands, looking at how the younger generation have shown an increasing domestic brand bias and some degree of “nationalism”. Their expansion in Canada would be another growth trigger.

Thank you once again. I like the business and have decided to invest in Feihe as well.

2020-05-01 08:59

Philip ( buy what you understand)

if you look under other dairy milk products RMB210 million which includes packaged and processed butter, fresh milk packed etc their GP margin is also around 36%, so there is no supply chain bullying.

The difference is in the high in milk formula powder series. Those have very high margins (similar to Apple iphone) due mostly to brand recognition, market perception of quality and marketing efforts, and high R&D to produce quality results. As it is very hard to quantify the eficacy of milk powder (so just take my word for it and buy the most expensive formula milk available in the market for your baby), long term branding is very very important.

Contrast that to our local products, dutch lady. The price sold is very high compared to other local brands (in sabah we have SID and ecoyap), if the price was the same or even slightly more expensive, when it comes to your baby, would you feed them ecoyap, SID or Nestle? Why? Did you look at the label and compare what actually is beneficial for your kids when you bought the milk powder formula? Or did you listen to you wife and just bought the more expensive brand, for the added reassurance and quality reputation?

That is why feihe has 70% gross margins. Because they sell every thing out at 70% margins, so why sell it cheap?

And personally, i think the milk formula industry is funny that way. A reduction in price does not equate to an increase in sales. In PRC most individuals are more afraid of fake products and labels than even malaysians due to the prevalence and lack of quality control in the past (not so today though). My experience of PRC individuals, if something is expensive, then the general belief is it must be good.

Even when they come to Malaysia, my PRC friends always look for the most expensive durian like musang king, instead of enjoying other not so famous ones, which is cheaper but not necessarily worse.

FYI I stand by my claim that red prawn and XO durians are BETTER than most varieties musang king. At half the price, I love it even more sometimes.

>>>>>>>

Yet Mengniu only achieves a 37% GP margin. Perhaps Feihe is able to procure fresh milk at much cheaper rate (sslee might be right about supply chain bullying)

2020-05-01 09:34

mengniu milk seems quite pricey as well. Feihe astrobaby (step 1) sells at ¥46/100g, mengniu organic milk (step1) priced at ¥49/100g. but yes, parents of newborns, particularly if they have their first child tend to be less experienced and buy the more expensive formula. I believe the consumer psychology in china would be similar. many mothers who are unable to breastfeed for the recommended period would just buy the "best" (ie the most expensive) infant formula on the shelf. Feihe would benefit from the increased sales of high end formula.

2020-05-01 09:54

Philip ( buy what you understand)

With tesco selling nestle NAN at 113.99 per 800g (the price my son bought for my granddaughter), you can understand why I am so bullish on this. My daughter in law stopped breastfeeding almost as soon as she started going back to the law firm.

>>>>>>>>>

https://eshop.tesco.com.my/groceries/en-GB/products/7004958942

2020-05-01 10:08

Philip ( buy what you understand)

But in any case I don't make the prices. I have also gone through extensive reading of YST farms annual reports and their production and selling prices to plot the growth rate to feihe.

The prices that YST is selling at is quite low, but it is on the higher side compared to the market sales prices of the dairy farmers in china.

So, pricing power is not there due to market competition. For Feihe, it is almost the opposite way around.

Since I can't force feihe to pay higher prices for milk or sell lower price for astrobaby, I will just follow them as a minority shareholder and participate in the long term growth of the company.

2020-05-01 10:11

hi philip, the luckin coffee accounting scandal makes me a little worried about feihe. starting to be wary China companies with high profitability but unable to payout dividends. what do you think?

2020-05-08 08:49

Philip ( buy what you understand)

Here is how I look at luckin. Firstly, they were a very new chain in a world dominated by Starbucks and friends. There was no r&d or differentiating capacity about them. So a few red flags that make me instinctively worried would be:

1. Impossible growth speeds with a clear differentiator.

2. It was founded in 2017.

3. The coffee wasnt even that good. I tried it in Guangzhou during my last trade Fair trip before to see what the fuss was about.

4. They were giving out free coffee everywhere. Why give free if you can sell it?

5. It was revenue growth all the way without even looking at profitability.

https://www.fastcompany.com/90487535/embattled-luckin-coffee-sees-wild-surge-as-customers-scramble-to-cash-in-on-free-drink-vouchers

When it was founded in 2017, it was already losing a lot of money. In 2018 revenue was up but they were still burning 400 million in cash. In 2019, the jig was up.

On the other hand, feihe was founded in 1964. The sales and production can be easily corroborated by the income tax payments, production figures from it's suppliers, and industry journals of market reach.

In terms of profits, as you say it is a red flag for me also. But as they have guided towards paying 30% of their profits as dividends I am content to wait and see.

But more importantly the competition level and requirements are in a entirely different level compared to coffee.

Anyone can make coffee, even my son.

How many people can make baby formula?

>>>>>>>>

Founded in 2017, Luckin has opened stores at a breakneck pace. Even on its now discredited numbers, Luckin was heavily lossmaking. It was primarily valued on revenue growth and its ability to show a path to profitability.

2020-05-08 09:05

Philip ( buy what you understand)

Luckin was never profitable.

/>>>>>>>>>

China companies with high profitability

2020-05-08 09:33

if u are not Philip or Philip standard , don't play play in China stocks.

China stocks like pretty women who are very cunning .....not familiar don't do.

So many early China bulls, I wonder what happened to them....people like Jim Rogers.....

China is a pretty woman.........

..On China perspective.............In 1980, China economy one twentyth of USA, by 2030 China economy twice USA ( by purchasing power) and forms 30% of world economy, USA 15% and EU13%...............In 1820, China economy was 30% of world economy........

If u are not Philip, can u tame the pretty woman?

2020-05-08 10:04

Bursa is the kampong girl ......but kampong girl cukup lah for most of us............

2020-05-08 10:06

thanks philip, appreciate your thoughts as always.

qqq, thanks for the reminder. i dont think any of us are in philip’s league. i only own 2 china based companies (Baba and Feihe). Sold vitasoy, felt feihe has higher growth potential. yah, need to be careful with china companies. Cant monitor so many, need to pick and chose the best.

2020-05-08 12:23

Philip ( buy what you understand)

So far this has been another one of those, pump and dump with a conscience stocks, as after I sold feihe for palantir, it is one of those where growth is assured, but since we have limited time and limited resources, we can only choose the stocks that will perform the best in life.

2021-01-31 12:53

Philip ( Random Walk Theorist)

That is not to say Ausnutria is not the company to invest in, as their margins and growth are equally spectacular and not to be scoffed. But I believe as one company imports almost exclusively all its baby formula from netherlands and australia and another produces it locally, one will definitely make far higher margins than the other.

Plus the locally produced one is selling the high end series at absurd prices (and huge growth rates) and the marketing tag of "better for chinese babies", that just killed it for me. How do you compete foreign brands with that?

2020-04-29 20:09