StoneCo IPO - How I use business sense to understand why Berkshire finally bought into an IPO

Philip ( buy what you understand)

Publish date: Tue, 22 Jan 2019, 04:04 PM

For those who are interested, refer here.

Hi all, my name is Philip. Today I would like to explain on my views and strategy of evaluating a company, especially an IPO. This IPO is particularly interesting, as it is backed by both Alibaba(ant financial) and berkshire hathaway. So the big question is, what do they see in Stoneco? And how you should use business sense to understand your bursa stocks?

https://www.sec.gov/Archives/edgar/data/1745431/000119312518309043/d580263d424b4.htm <<- for the SEC prospectus

https://www.stone.com.br/ <<--- the sales website

Step 1. Understand the Business

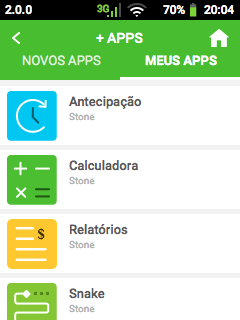

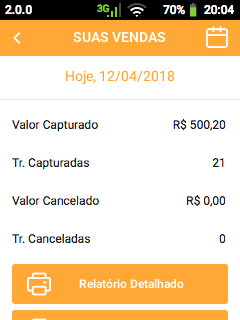

Now, what is so special about stoneco products? Firstly, you have to understand where stoneco lies in the scheme of things. Stoneco basically does simplified payment, monitoring and tracking of of your business. They do very quick and painless of multiple sources of transactions (vouchers, web payments, credit cards, bank transfers) into a cloud based POS system that you can easily track, automate payments and transact in one single application via phone or computer. You no longer need to have multiple tools that clog up your business (a standalone POS system, a payment gateway for web payments, and a merchant id for credit card local payment, and an invoicing and taxing system), saving you much time and money, especially for small to medium business with minimum funds to run a business. All this for a simple price of RM150 per month, with additional fractional fees per transaction. It becomes a godsend for people running simple businesses like hairdressers, stall owners, small one man show contractors who can have the benefit of running a credit card payment system, pos system, invoicing system all in one simple product,.

Meet the S920N, the simple gateway that is cloudbased, and is applinked to your smartphone, allowing you to do different formats of payment easily.

Now, to understand the VALUE PROPOSITION of stoneco, you must first understand your basic financial mechanisms in terms of credit card payment systems.

The order of banking is such:

FINANCIAL INSTITUTION ( or banks that hold deposits and arrange loans and payments with central bank) In malaysia these are big banks like PBB and Maybank that only deal with large or trustworthy clients. If any of you have tried to do a small business and found out how difficult it is to arrange for a credit card payment solution, then you know what I am talking about.

MERCHANT ACQUIRER (or basically a merchant bank that has a contract with the financial institution, basically the front end of a bank or saleseman) These are small volume entites who would find those customers traditionally ignored by big banks and offer them processing capability.

MERCHANT PROCESSOR (or basically the back end that goes around and does the cool website and payments) These would be your processors like boost, alipay and apple pay etc, which conduct within a specific transaction method.

Why is Stoneco so interesting? It started out as a merchant processor, selling its receivables to banks to raise money, and providing value added services of POS and credit card processing to SMB or small medium businesses. Basically this is a boon for the 8.8 million small businesses in Brazil, all of which are using a cash and carry business model. With the arrival of Stoneco and its listing to MERCHANT ACQUIRER status in 2017, it has allowed them to give these business the ability to deal with credit cards and online payments easily and flexibly.

You can order your stone machine online, it has a strong battery with 3G signal and get it delivered to you. If you have a smartphone, you can basically run your business from the street anywhere and have instant credibility to customers that wish to pay via credit card, hiper and other payment methods. all the payment notifications and approvals are linked with your phone or web, making transactions extra safe and secure.

With its cloud based architecture, you do not need multiple bank branches and clunky systems, everything can be done via the green angels consultants, email and telephone without stepping into a single bank branch. And best of all, with their upgrade into a full merchant acquirer, they can create for you an online banking account that is safe, secure and you can withdraw your money from any ATM in brazil.

Sounds amazing? it is. Stoneco is now the 4th largest in terms of volume transacted in brazil, and it is growing at a huge pace.

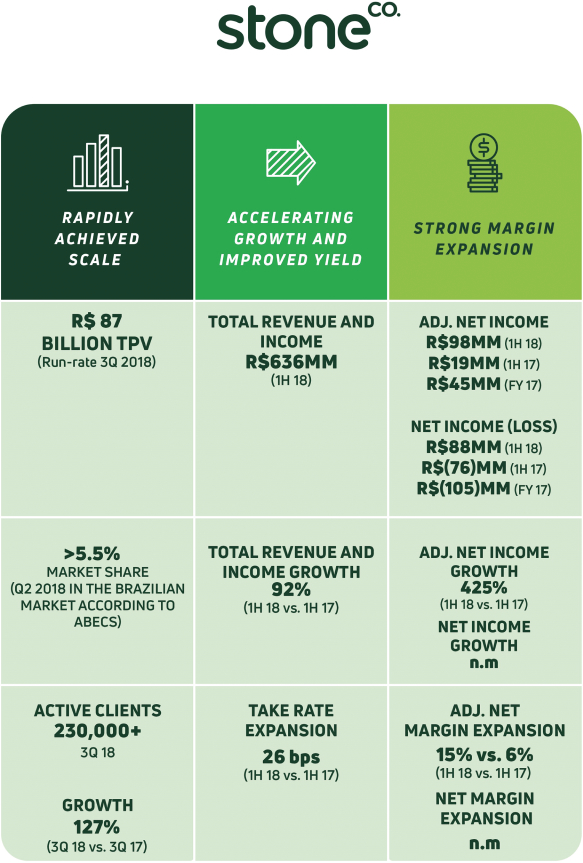

Step 2. Look at the financials and the asking price

Recently Stoneco IPO was fully oversubsribed, it raised around 1.1 billion usd dollars and is listed in NASDAQ at 22 times trailing earnings.

if you look at its revenue, IN MILLIONS

2016 2017 2018(1ST HALF)

REVENUE 439 766 635.7

NET INCOME -122 -106 87.7

ACTIVE CLIENTS IN THOUS 81.2 131.2 200.6

The net income negatives at first glance appears to be worrisome, until you realize that in building a centralized system you have a high capex cost, but for each transactional client gained in the future, your take up cost becomes much lower in the long run.

TERMINAL VALUE OF BUSINESS : As announced in the prospectus, the main focus is to service and gain the business of the 8.8 million SMB's currently being ignored by the large banks today. if you do a simple estimate, when they hit 8 million active clients, you will be looking at roughly 25 billion in revenue, 3.6 billion in net income. How accurate this will be is a matter of debate, but paying pe22 for a business that has grown by double every year with a vertical intergration, simple business model and a very easily replicable system outside of brazil, gives much hope for the future. And with a 1.1 billion dollar warchest to do accelerated growth and expansion in multiple fronts, we know where the growth will be and where the money will be used.

Step 3. Look at the technicals

There are no technicals other than the fact that the ipo was oversubsribed, it went from 24 to 32 to 17 to 21. Make of that what you will. Personally, my advice is to stick to the next quarterly report to give a head of the earnings and profits of the company, any future headwinds, and if the business story has changed or affected in any way.

Personal disclosure: I have purchased 200K shares in NASDAQ: STNE since 4 january 2019.

Cheers,

and hope you learned something

Philip

More articles on Investing theory 2 - IPO valuation

Created by Philip ( buy what you understand) | Jan 12, 2023

Created by Philip ( buy what you understand) | Jan 30, 2022

Created by Philip ( buy what you understand) | Sep 02, 2020

Created by Philip ( buy what you understand) | Feb 25, 2019

Discussions

Also note that for financial systems, the system is easily replicable, but the government approvals and funding requirments are not. Best business to be in.

2019-01-22 16:09

For So long Mr Long trying to equate stoneco to QL....i thought it is same type of business...but now it is found out totally irrelevant loh...!!

One QL with pe 50x is old type of commodities business another is payment system platform settlement PE 24x Stoneco loh...!!

I m wondering What QL got to do with stoneco, other than Mr long bought n own both of it loh...???

2019-01-22 16:16

So you have approximately 12m invested in Stone Co then?

How much is your net worth?

2019-01-22 16:40

I buy cheap durable business I can easily understand AFTER it has reached vertical integration, making it much harder to disrupt. You try to disrupt QL business model see? tell me 1 company doing same thing as QL in bursa and doing it better. Or tell me one company similar to QL in bursa with better ROE.

I bought into topglove after it held a 18% share of the WORLD MARKET in gloves.

I bought into PBB after my wife told me so. Always listen to the wife. Oh it also has the best ROE in the market, for big banks.

I bought Yinson fully after it had pivoted from a lousy transportation company into a fully FPSO charter company, now 6th biggest FPSO in the world with 99% utilization rates, unheard of in the fpso market. just ask bumi armada.

For stoneco, I decided to buy it after reading that it has received merchant aquiring institution by the central bank of brazil. I wouldn't expect you to know what it means, except that it is now a full merchant bank entity with all the perks and access to the high table.

All i bought and held since 2009, 2010, 2012 and 2013.

And now in 2019, I have 5 stocks in my portfolio. Stoneco is a small portion, around 200K shares done at USD19.

What have you done lately?

2019-01-22 16:49

raid...it is not about QL...it is about a connected world....opportunities every where for those with the skill set.

now playing in the oceans not just small pond.

2019-01-22 17:10

What so special of buying into stoneco leh ??

U mean Warren Buffet give a call to Mr long & says koh kohchai i m buy into stoneco ah....!!

I read Warren Buffet buying into Petrolchina long time ago, what happen to petrolchina now leh ??

Do not be a follower loh, better learn to invest independently....copying other people....when the originator change course....U will not know loh...!!

Posted by qqq3 > Jan 22, 2019 05:10 PM | Report Abuse

raid...it is not about QL...it is about a connected world....opportunities every where for those with the skill set.

now playing in the oceans not just small pond.

2019-01-22 17:23

Temasek bought into GDex....Gdex becomes PE 100 stock for years and years....until recently when earnings disappoint.

Anybody with that Bufalo and Temasek as shareholder sure adds to its reputation la....until / unless they disappoint.

2019-01-22 17:31

Yes loh....this is precisely how greater fool theory works loh...!!

If u follow margin of safety principle disciplinary u will never buy gdex at PE 100x mah....!!

Posted by qqq3 > Jan 22, 2019 05:30 PM | Report Abuse

Temasek bought into GDex....Gdex becomes PE 100 stock for years and years....until recently when earnings disappoint.

Anybody with that Bufalo and Temasek as shareholder sure adds to its reputation la....until they disappoint.....

2019-01-22 17:34

from 2010 to 2016, Gdex shareholders already harvested multiple baggers....

Business world....reputation and a good story to tell is worth a lot of money......

2019-01-22 17:41

Did termasek manage to lari kuat kuat or not leh ??

Posted by qqq3 > Jan 22, 2019 05:41 PM | Report Abuse

from 2010 to 2016, Gdex shareholders already harvested multiple baggers....

Business world....reputation and a good story to tell is worth a lot of money......

2019-01-22 17:43

Posted by qqq3 > Jan 22, 2019 05:31 PM | Report Abuse

Temasek bought into GDex....Gdex becomes PE 100 stock for years and years....until recently when earnings disappoint.

Anybody with that Bufalo and Temasek as shareholder sure adds to its reputation la....until / unless they disappoint.

Will that happen to my SAM??? Hahahaha

2019-01-22 17:45

@10154899906070843

So your net worth is approximately 150m-200m then?

Oh me? Nothing much. Still living with my parents, the occasional sex, the occasional movie, I go to the gym and walk my dogs. Not much really.

2019-01-22 17:50

Fabien Extraordinaire > Jan 22, 2019 05:45 PM | Report Abuse

Will that happen to my SAM??? Hahahaha

=========

I doubt it....GDEX had a good story to tell...from 2010 to 2016 with ecommerce explosion. Gdex is led by private sector...

Is Sam a state enterprise or a private sector, I also not sure....anyway...how to give the best to Malaysia when Singapore has their own sector to protect? Singapore Technologies will still get the prize.....

2019-01-22 17:52

Hi Fabien, for SAM or any other company you need to understand where your growth is coming from, how much revenue they can generate, and most importantly what they will do with that growth. As 50% of their business is aerospace, its a very predictable and easily measured growth ( you can just compare how many planes are in the pipeline from Boeing and Airbus). The growth trigger is what they do with the other 50% of revenue, which is in sam precision and meerkat. I'd monitor my quarterly reports closely on the performance of those business units. If they dont grow well, I'd say you would reach terminal value pretty soon. you can have a pretty clear idea of the growth prospects of the aerospace portion of A320 neo,

the jigs manufacturing part, I dont know.

2019-01-22 21:59

Long numbers guy, wonderful article as always. Do consider starting a blog away from i3. I will be among your first follower!

2019-01-23 07:21

What long numbers guy suggested in his earlier comments was buying into a company that has attained critical mass. The appropriate size of the company where they are small enough to grow further and big enough to kill the market competitive force with whatever moat they built.

2019-01-23 07:25

How to spot a company that has attained critical mass? We look for company with first signs of above average return on equity way beyond the cost of capital.

2019-01-23 07:28

10154899906070843

having said that, never ever buy into an IPO. It is still for idiots. It listed for 24 USD, and I bought it at 19. Go figure.

2019-01-22 16:04