HOW TO BUY BREAD - AND LESSONS TO LEARN FROM CATHIE WOODS

Philip ( buy what you understand)

Publish date: Thu, 12 Jan 2023, 03:00 PM

Hi all,

this is Philip again. I hope everyone is doing well, and I do hope that things are going to be good for all involved as this year is going to be brutal. In any case, with todays article I hope to show how I go about looking at investments, what I have recently bought, and to see how I look at the long term picture of things.

As most here would know by now, I rarely promote or buy small cap stock. I prefer to buy things with less risk as I no longer need to make nor chase the 10x and 100x that young investors are always hunting, not realizing that losses also compound just as much as returns. And as I am in my 60s and no longer in need of chasing returns to fund my lifestyle or pare off debts, I find that being able to think deeper and more broadly allows me to think far longer before I start buying pieces of companies.

In any case, one of the big sea changes that Howard Marks was talking about was the effect that interest rates will have on the growth and performance of companies moving forward, especially in the tech industry where the goal seems to be to build a certain scale whereby the monopolistic effect will burden new companies and competitors from coming in and disrupting the industry.

However, when buying into these "tech distruptor" companies, we also fail to realize if those companies can build themselves out of debt, or will ever become profitable, if ever. (here is me looking at you uber and doordashes of the world). With or without competition.

So thinking about it, I come back to my favourite ideas when investing.

What to buy.

And in thinking about it deeper, I realized something important. Before we even move into the financial reports and PE and graphs, we need to go back to basic principles:

1. Business model

2. Management

3. TAM

4. Risk/Reward

These are all not covered in your yearly reports, and even quarterly ones from the analysts buy/sell reporting.

So, how do we even begin? Maybe we can begin by my first investment in bursa this year for 2023. But as usual some background for my investments:

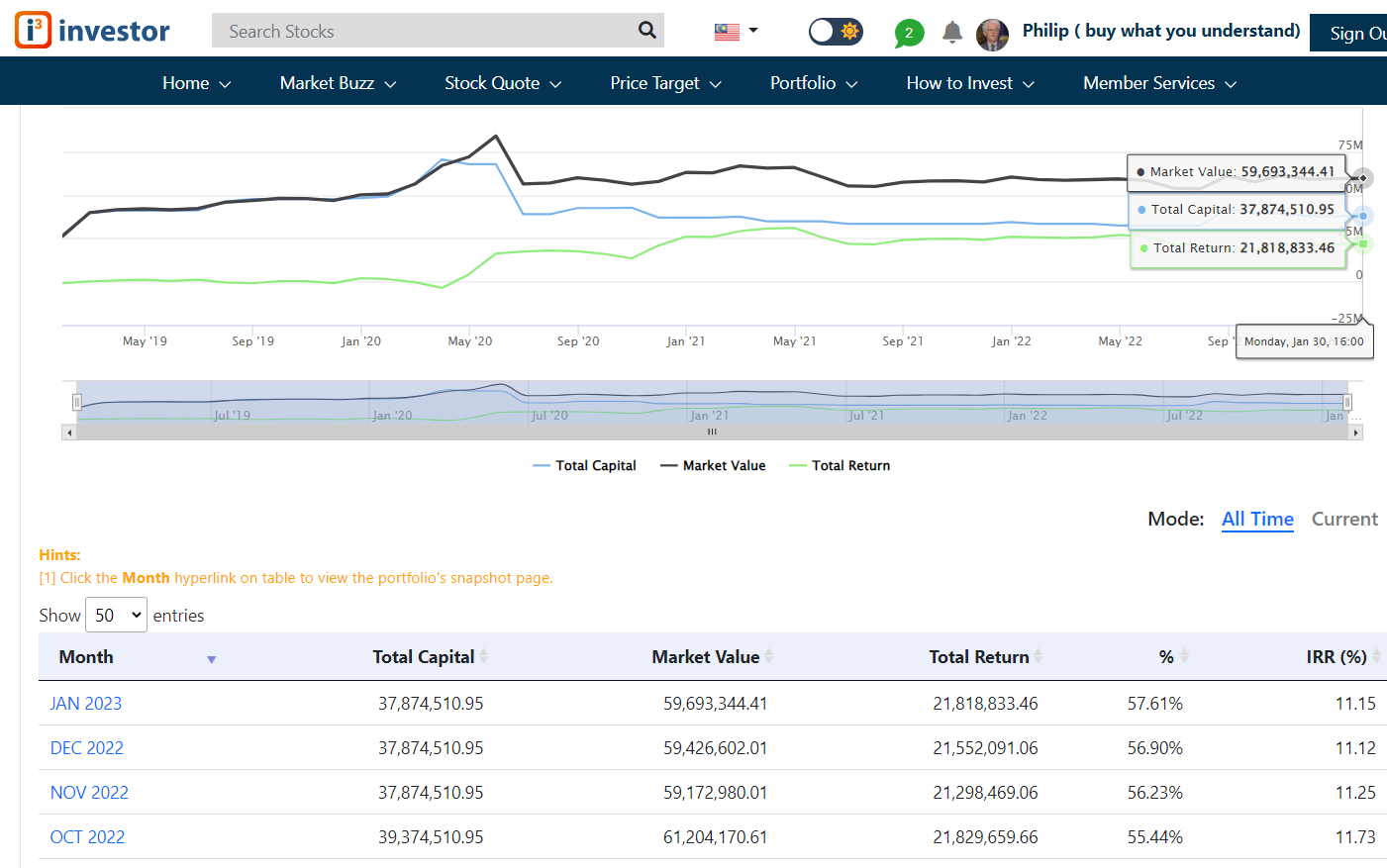

I have been investing since 1989, but keeping the online portfolio profile only recently since 2019. And since I have been actively posting all my investments and trades online, this is my long term results (4 years) and here is hoping I can continue to invest longer:

you can check my results and closely monitor the performance here:

https://klse.i3investor.com/web/portfolio/mypf/120720

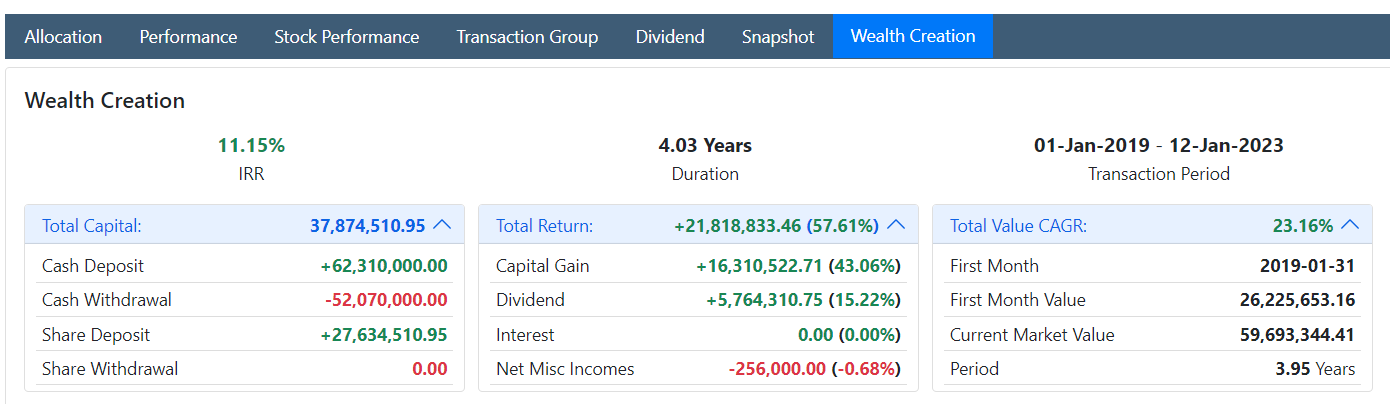

And yes, my 4 year performance since 2019 is at 57.61% returns to date until January 2023, and a net return of:

And so yes I can tell anyone interested to listen, I have kept an online trackable portfolio for the last 4 years, yes it is CAGR of 23.16%, and yes I do know what I am doing (as my full portfolio stretches all the way back to 2009 when I first invested in QL).

As a side note, I beat Cathie Woods recently, her 5 year performance is -2.17%, I did 57.61%, so yes there is hope for all the investors who are non professional. You have an edge over people like Cathie with her army of researchers and endless access to CEOS of companies.

I GUARANTEE IT.

One thing that cathie did teach is that despite what her "ETF" is meant to say aka diversity and choices in multiple industries... you realize now that many things that she has bought is actually very interrelated with performance and returns and capital expenditures. Despite creating many "funds", in the end all she did was create an avenue for money to be invested in the same groups of stocks, tech, of which it is only now that we realize we do not know anything about. It turns out that I many of us are idiots who bought when everyone was crazily buying and as such made money and thought we were geniuses. And later when the market crashed and interest rates went up, we learned that those businesses were all just a group of cash burning industries that just outcompeted by throwing price without actually adding any innovation as such. come one... carvana? Carsome? Really?

And so now, when the world is demanding that real returns from business performance (as compared to fake earnings from stock manipulation) to manage real world expectations, we realize that we actually become frozen when the market falls and suddenly everyone becomes a seller.

Not so smart now are we NFT fans?

And that was how I started to buy bread, and thinking about bread as the antithesis to tech. you see, bread as a technological invention and wonder ended something like 10000 years ago, but as yet has not yet been able to be replaced by any form of new innovation. Stop eating bread? Eat what?

That is the beginning of thinking about business models. Simple business models. Profitable business models, with consistent growth, branding and long term flavour and growth post covid.

Inflation proof? check. See how much the price of your daily rice and bread has gone recently. Can you do anything about it? Nope. Nada. zip.

I was eating at my regular coffee shop, and realized that due to covid, many small players have closed leaving a huge headway for the bigger players to build more shops and gather groups of hungry eaters in the new year.

Take for example fook yuen, one of the most popular bread eateries in sabah. Privately owned (the owner has one of the few cullinans in town) the family keeps to simple dishes. Bread, panggang with kaya and butter, kimchee noodles with the all important HALAL branding ( of which there are multiple in malaysia with green, black, and blue. I have no idea why or how they even begin to regulate). With a system like this which generates wonderful cash flow, cash only business, they will slowly take over the humble kopitiam around malaysia sooner or later just like how family mart and speedmart are taking over the mom and pop convenience store and the indian shops around. Mark my words, one day all you will see is the malaysia equivalent of macdonalds selling nasi lemak, roti and pau everywhere in malaysia. I used to think it would be steven's corner at my old place, but today I think the market is still ready for a new entry. Still worth a very good visit.

So, having built this mental model of the business that I would like to be the owner of :(who wouldn't want to be the owner of a 24 hour stevens corner or fook yuen right?) I try to go around looking at businesses in bursa that fit a similar discription: I realized, the hard part is in finding the right management. Dastardly hard indeed, but at least I found one:

And brothers too no less. elder brother is 65, the other is 60. But look closely and you will realize a singularly interesting point of fact: One has been baking bread and in the bakery business for 51 years.. meaning he has been working since he was 14 (which is illegal, but back in the day who cares? I also started working when I was 13 helping my father delivery spare parts and materials in cheras back in the day). The other started working when he was 18. Between the two of them they have 93 years of baking experience, which means a lot when these days you have revenue directors stealing documents from offices, and young people like CC puan constantly pushing "ideas" that never actually lead you somewhere good.

Basic, boring and a start from 5 employees to more than 1200 staff today with 265 1 tonne vehicles delivering bread, cakes and happy carbohydrates around malaysia. For me, I realized johor has lead to many old timer groups of manufacturers and producers with class, character and trustworthiness. I have had the joy to invest in companies like liihen, skpres, pchem, ijm, kpj, etc etc which have a certain quality of management that breeds more like minded people when they realize that the like mindedness leads to more wealth. (serba dinamik on the other hand is a huge blemish on anyone that is interested in investing, and have brought down faith in investing in bumiputera listed companies by a few more decades)

anyway, back to boring businesses: We are looking for a transfer for this well managed company that has finished the new factories and distribution centers in kedah, and growing on a consistent basis (with long term TAM comparatively over the years) by using high5, silverbird, massimo, and gardenia as a comparative analysis point. so what is the TAM for Malaysia bread and buns?

https://www.theedgemarkets.com/article/bread-maker-gardenia-mitigate-higher-production-cost-pandemicdriven-inflation-seen-likely

based on gardenia from QAF alone, we are looking at a billion dollar industry. And since SDS has not even begun to expand to the market that is East Malaysia where I expect more growth to occur, we can safely assume that the entire wedding cake, festivities bread, burger and rolls, and daily bread market to be around a 2 billion a year market industry conservatively. at 270 million a year revenue estimate growth from recent quarters and a expectation of 25 million a year in profits, a 3x - 5x growth in revenue within the next 5-10 years is a fair estimate, especially for boring predictable businesses like this, which i love (please note how many times I repeat boring predictable business, you will notice making money in stock market and buying complicated technical stocks have ZERO correlation).

Finally the most important point which many fail to look at: as MJ gan said which had my brain running, if you have high interest rate environment, making the risk free rate more dangerous ( I mean think about it, if FIXED deposit rate was 10%, if everything else was equal, would you rather put your money in the bank or buy strange stocks?), how differently would the general public invest? Because in the end, as a minority shareholder you are not privy to the earnings of the company, but only from the dividends and the stock buybacks and market valuations of the company. Many risk/reward aspects to look at. you could be buying a "safe" company like INSAS. But if the directors are not interested in growing the company or giving out the unused earnings back to shareholders, you will just be sitting on a value trap. So looking a the risk/reward of the company we have to ask ourselves, how risky is company taking its earnings and reinvesting into more lorries, factories and taking on debt, and how much returns are they getting for every cent of earnings and debt they have taken. In my opinion, if you do comparative analysis of all the manufacturing companies, you will find that the return on equity applied is usually very low. Take panasonic malaysia for example, for every 100 million of equity they invest in machinery, equipment and capital, they get back 6 million. this is the norm and usually very consistent with asset heavy companies like csc steel, panasonic, lion etc. The more valuable companies have higher ROE like inari, QL, harta, skpres etc where they get more back for buck with 10-15 cents for every dollar deployed.

For consumer products and convenience stores like MR diy, seven eleven etc which are very asset light, they can make 20-25 cents for every dollar deployed. Amazing businesses, although very hard to replicate. I think SDS has a chance of reaching it, and I am happy to start investing a little bit. For me the long term comparative goals are very clear:

1. SDS needs to be the supplier and fabricator of choice to 7-eleven, CU and/or Family mart. They need to learn how to make tasty and valuable products and cakes which the general public are more interested to purchase. If they start doing this en mass for their wholesaler arm, I will invest more.

2. It also need to start to franchise/commit to a certain trend with its new retail store as the menu currently is too bloated, and the choices too much. I think it needs a good theme to get going, like a mcdonalds, (upper star in sabah), swensens, family mart, etc which can build its own fanbase. If it is able to capture this theme (like breadstory in singapore or a food republic concept), this company can go far.

3. A successful transition from ACE market to 1st board will almost guarantee more investment dollars from me in this company. With their type of boring, predictable business model, you would be surprised how many people will start investing.

4. Follow old town coffee to export their business overseas. This will be the big one (which I missed with old town when it went up huge). The numbers then become exponential, easy to sell, and easy to market. Big Big drive for me to invest.

I hope that one day SDS does actually show the ability to go to the next level. It has the right mix of old generation and new generation and seems to have the hunger to grow and invest that I like in young companies. It has been a while since I invested a larger sum in a small cap company, but I think this may just be the one. I hope this is interesting enough.

And as usual,

I hope you learned new things today, as it is the only way to move forward in life. Join me in a nice chat any day. That's the only thing retired people can do these days.

Philip

https://t.me/joinchat/TR4av30CaHKc9Rhe

P.S. I HAVE BEEN BUYING THIS COMPANY, AND I HAVE FRONT RUN BY BUYING IT FIRST BEFORE WRITING THIS ARTICLE. BUY AT YOUR OWN RISK, IN FACT, DO POINT OUT ALL THE RISKS INVOLVED THAT YOU HAVE SPOTTED IN THIS COMPANY TO ME.

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Investing theory 2 - IPO valuation

Created by Philip ( buy what you understand) | Jan 30, 2022

Created by Philip ( buy what you understand) | Sep 02, 2020

Created by Philip ( buy what you understand) | Feb 25, 2019

Discussions

Philip ( buy what you understand)

Pau is also bread. Roti is literally bread.

But yes less processed food is better in life.

2023-01-12 21:40

We Msian still don’t have big Bread culture like in Vietnam. We have only familiar Roti Kaya or some calling it Roti Kahwin. Bread to me is a intermittent weekly food. SDS must have other options other than Bread.

2023-01-13 09:17

Like cake culture, we Msian doesn’t have this culture. That’s why Secret Recipe menu from cakes changed to cakes plus noodles and rice dishes in its shops.

2023-01-13 09:21

What's new? Users may not know all its features. https://howtoscreenshot.co

2023-01-13 10:45

Philip ( buy what you understand)

Income

And they do. Their recent factory upgrade and expansion which increased the QoQ results so much were for the wholesale portion of making cakes, burger buns, rolls etc for other customers. They also do wholesale cake and festival (mooncake etc) products for their own retail and other shops in the peninsular region. Which is why they are targeted to do 250 million in revenue sales for this financial year. I think it is those type of predictable boring business that will do well in the coming years.

>>>>>>>

We Msian still don’t have big Bread culture like in Vietnam. We have only familiar Roti Kaya or some calling it Roti Kahwin. Bread to me is a intermittent weekly food. SDS must have other options other than Bread.

2023-01-13 11:32

Tech disruptive companies are like speculators!

Hit and run after making huge profit.

2023-01-13 20:13

Thanks, ive been out of msian markets for too long, only holding, hibiscus, mfcb and yinson. And missed this.

Very interesting, thanks. Look at oppstar when you have the time.

2023-01-14 03:57

Philip ( buy what you understand)

I would be careful with oppstar. I have more working assets in my palm oil farm than they do with their rented offices in penang, and yet somehow they profitability that they can make is amazing compared to debt and capital employed. How a company can do so is truly amazing to me.

It may or may not be real, but for a company that was setup in 2021 and where the collective major shareholders are of such a young age, I somehow find it very suspect as a long term investor.

It may or may not be the next apple, but for me I think I prefer more conservative investments.

2023-01-14 10:35

Philip ( buy what you understand)

But good to hear from you again. Its been a while since I've read your articles as well. How are you doing?

2023-01-14 14:14

Philip ( buy what you understand)

It would appear that a lot of people like eating bread. Far better bread steady and boring compared to buying myeg

2023-02-10 15:40

Sslee

Maybe I am too old fashion as I still enjoy my normal hawker foods for breakfast. (Hokkien Mee,

Wonton Mee, Char Kuey Teow, Kuey Teow suop, Curry Mee, Laksa, Chee Cheong Fun, Pau, Fish Noddle, Roti Canai and etc) but never Bread.

Should I change my breakfast to eat in Bread with Milo?

2023-01-12 20:34