The difference between Trading & Investing (and how to think about Trading long term)

Philip ( buy what you understand)

Publish date: Sun, 05 Jul 2020, 12:26 PM

Good Sunday everyone,

As today seems a good day to update the mental models, I would like to share my thoughts on Mr Market. After meeting and many heated discussions with some very good traders, I have realized the big major differences between trading and investing and why I have failed to do both over a long period of time.

Let me set the stage.

This is a popular cartoon that has been used for a very long time and gives a very funny account of investor sentiments. The fact is, individual investors are unpredictable, but over a longer period of time this herd mentality is a lot more predictable and forms the basis of trading strategy.

PRICE ACTION THEORY

When looking into trading the main criteria is not what you think the stock is going to do or what the earnings are, but it is more important to study how the investors will react to results and performance of stocks or news. Therefore, when looking into trading of stocks, you avoid the boring predictable businesses and concentrate on the volatile and newsworthy businesses to form the core return of investment of your trading strategy. Simplified, you don't care about the underlying business itself, but how investors BUY and SELL based on THEIR PERCEPTIONS of the stock.

REFLEXIVITY THEORY

While not really being a theory (only major proponent is George Soros), it has propelled George Soros to billionaire status by virtue of him using this mental model to the maximum. His grand concept (similar to value investing by Ben Graham), is this:

In economics and stock market, there is a feedback loop where investors perception affects economic fundamentals, which in turn changes investor perception.

The idea is centered around there being two realities; objective realities and subjective realities.

Subjective realities are affected by what participants think about them. Markets fall into this category. Since perfect information does not exist we make our valuation as to what stock should be valued at. Our collective thinking is what moves markets and produces winners and losers. This means that what we think about reality affects reality itself. And that reality in turn affects our thinking once again.

Take for example glove stocks. With some good earnings, the market has a positive view of the market, and goes in buying. The buying causes the price to rise, which reinforces the good feelings and pushes up the price higher. This feedback loop can go on for a while until a new piece of information comes in, which cause the price to go higher or lower.

HOW TO TRADE SUCCESSFULLY

Now, I have come to realize there are examples of successful trading strategies out there, from Ray Dalio, Jim Simons and George Soros. But they do have very different concepts of trading from the usual methods that we look at. Lets explore them here:

REDUCE DAY TRADING, AND FIND SHIFTS IN PERCEPTION INSTEAD OF SHIFTS IN PRICE

For traders like Ray Dalio and George soros and their funds, they look more at reflexivity and shifts in perceptions instead of pricing arbitrages. For example one recent case is pershing capital manager Bill Ackman, he made a huge trade which earned him 2.6 billion from 27 million in corporate bond hedge bankruptcy bet.

These type of trading reinforces the fear that someone is buying a huge bankruptcy insurance, therefore the market bankruptcy will increase. This creates a feedback loop that as defaults increase, the number of bankruptcy trades will also increase.

INDIVIDUAL PERCEPTION IS UNDETECTABLE, BUT HERD PERCEPTION CAN BE PREDICTED OVER TIME

As Michael Burry has shown, looking at the preformance of individual companies will show that everything in the market is doing wonderful. However if you look at the bigger picture, it will give you a much better and clearer picture unfolding. This is the buy and sell signal for traders, not price action.

This is the same case with George soros break the Bank of London 1 billion pound trade, here in 1992:

https://en.wikipedia.org/wiki/Black_Wednesday

If you look at how the trade was structured, this made a far easier methodology for long term trading that was more apparent and clear.

The stubbornness of a group of people that were unwilling to accept reality ( that inflation in UK was rising) and forcing it down by padlocking with Germany formed a huge convergence where objective reality meets subjective reality. I believe this a more consistent and powerful way of structuring trading odds of success in your favor, aka trade when one probability has a far higher chance of occurring, but Mr market is setting market prices as if that objective reality will not happen.

INCREASE DATASETS

In Jim simons interview and book, he said he hired more than 20 scientists whos only job was to collect data and scrub it "clean" of anomalies. For them to do daytrading of more than 2000 trades per day on all markets from commodities to forex to stocks, the key consideration is not the trading strategy as told by many technical analysis out there, but the datasets collected and organized.

Similar in vein to how Charlie munger and warren buffet build up their mental models to decide what stocks to buy, jim simons build up the mental models of the huge computers not with complex TRADING STRATEGIES, but with complex HISTORICAL DATASETS that are not available to the rest of us. The pc's cross reference datasets from:

Forex data from ALL exchanges

Stock market price action from ALL exchanges

Commodities prices from ALL markets

Meteoroligical data

Production and gdp data

News broadcasts and information data

that go all the way back to 1900's that were meticulously tracked and written down and isolated to form their concept of buy/sell. Its a hugely complicated database and trading philosphy, and even then they only get it right 50.74% of the time. Of course in that 50.74% they are correct 100% of the time, which is incredible. That makes them their billions.

What chance does the individual retail daytrader have against these competitors?

In summary, investing long term is easy in comparison where you try to understand the long term economics of a particular business and the earnings generated over time. But trading requires one to anticipate perceptions over a shorter period of time, while using leverage to maximize the gain of volatility. Not easy at all.

I believe that the best chance of trading still is to do it with a longer frame of view and minimize the number of trades but with a larger room to maneuver.

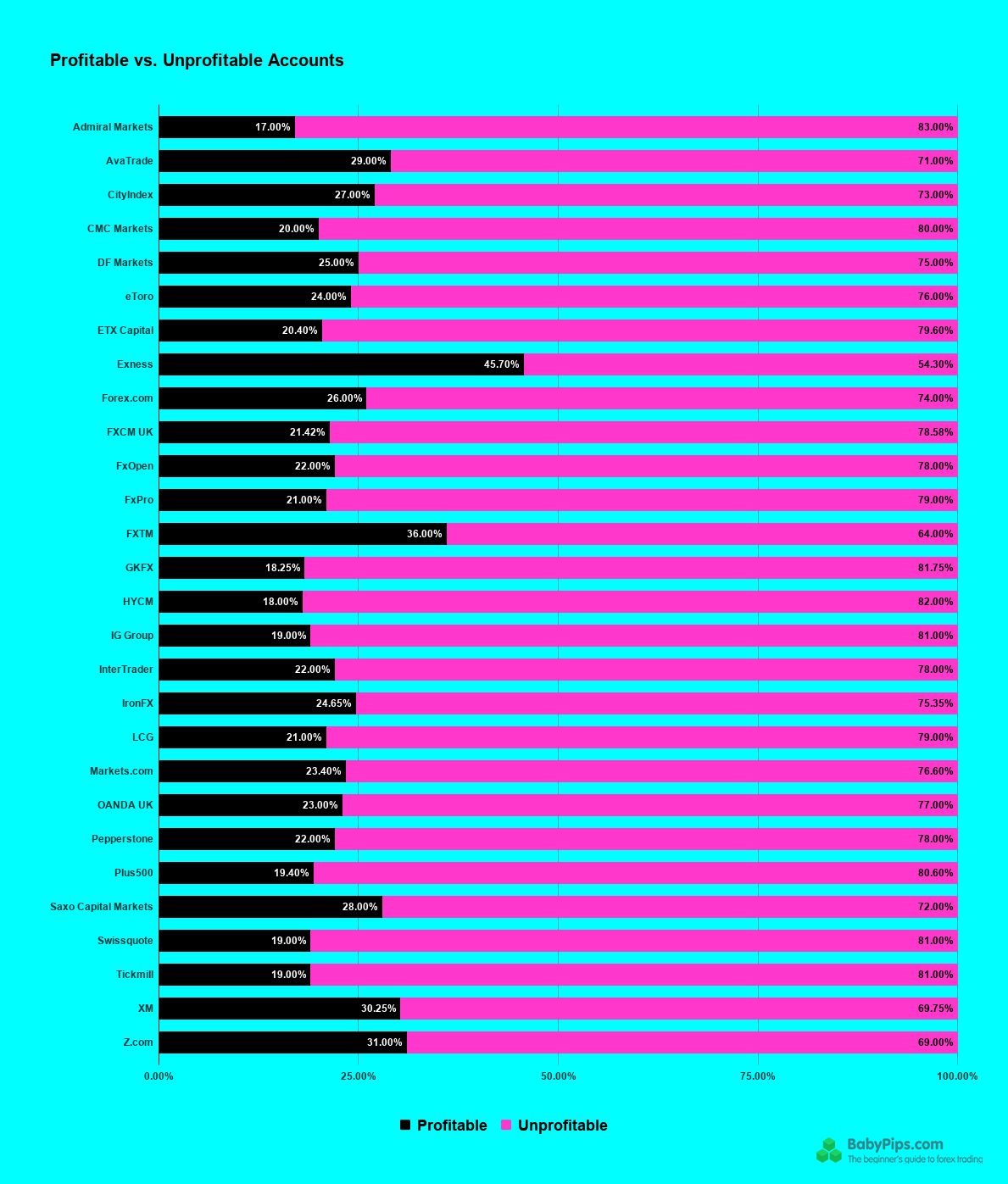

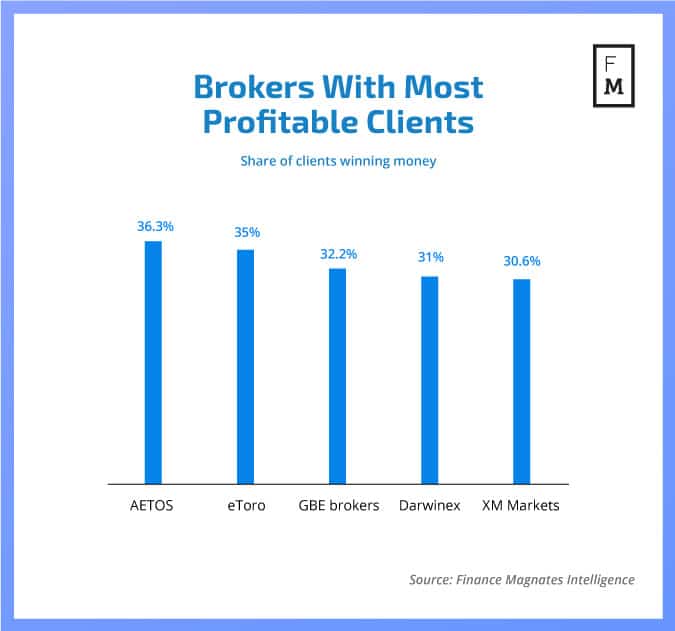

I hope you learned something today. One last picture on the real statistics of trading short term.

What does this tell you? Over a period of 12 months, on average 76% of retail traders lose money. And of that, on average they lose 30% of their capital. I don't need to tell you that is a zero sum game, where those "losses" are absorbed as costs and expenses to those 24% of winners with far better preparation, technology and knowledge, and the also to pip spread and costs to the platforms that are making hand over fist in earnings from trader commissions, fees and margin lending.

How much is Robinhood revenue per year? Last year they generated 100 million USD in fees and generations. This is from its 2+ million customer accounts, who we assume have around 1K of trading capital on average, is doing on average 2 billion USD in trading per year.

More articles on Investing theory 4 - Mr Market

Created by Philip ( buy what you understand) | Feb 07, 2022

Created by Philip ( buy what you understand) | Feb 04, 2019

Discussions

In short, traders just aim to win a small battle in the shortest possible period while trying to minimize loss of 'soldiers'

On the other hand, investors are committed to a longer term engagement in order achieve a remarkable victory.

Both employ a totally different tactics, strategies and mindset.

2020-07-05 14:05

Trading & investment strategy is not mutually exclusive of each other mah....!!

Take for example of Sohai Philip selling pre maturely all his topgloves recently & lost the opportunity of making another 100% gain loh..!!

If only sohai Philip know...how to use trading strategy....he would have sold off 20% & hoping to buy back at 10% lower loh...!!

But if the price keep shooting up another 30%...he would have sold another 20% hopping to buy back 10% lower mah...!!

In this way Philip would at least reduce & recouped some of his lost opportunity in topgloves mah...!!

2020-07-05 14:18

Philip ( buy what you understand)

If this strategy work for you how come you still driving myvi and can't pay for your kids college?

>>>>>>>>>>

Take for example of Sohai Philip selling pre maturely all his topgloves recently & lost the opportunity of making another 100% gain loh..!!

If only sohai Philip know...how to use trading strategy....he would have sold off 20% & hoping to buy back at 10% lower loh...!!

But if the price keep shooting up another 30%...he would have sold another 20% hopping to buy back 10% lower mah...!!

2020-07-05 15:49

Philip ( buy what you understand)

Hmm actually no.

Traders like ackman, Soros and dalio also won huge battle. Trading does not necessarily man daytrading. However those who do short term daytrading on average have 70% chance of losing money.

The most important implication is however mindset. Those that make real money trading do it based on either long term datasets, or long term perception changes in investor mentality. In a way it is similar to how investors look at long term business prospects, but instead looking at market perception of reality.

That is why I have never agreed with "technical" analysis mumbo jumbo to use simplified metrics like price action and moving averages to define trading rules.

Using this concept would have ruined you when tg probe dropped to 14 after qr good results, and take you offguard when price go up from 14 to 18.

This is because looking at the share price to base your perception instead of trying to understand market perception of reality would give a lot of false signals.

>>>>>>>>>

Posted by EngineeringProfit > Jul 5, 2020 2:05 PM | Report Abuse

In short, traders just aim to win a small battle in the shortest possible period while trying to minimize loss of 'soldiers'

On the other hand, investors are committed to a longer term engagement in order achieve a remarkable victory.

Both employ a totally different tactics, strategies and mindset.

2020-07-05 16:07

Good morning Philip,

Interest read but you are an investor if you are like Karim able to buy into Kpower and SCIB appointed himself as directors and start to steer the direction on the company. Or you play active role in changing the behavior of the Board or getting your private resolution vote at the AGM.

As traders, we are trying to ride on the success of investor.

So as trader you can make your luck by following ways.

1. Contra-player with the help of TA, the hottest stocks, big volume, big daily volatility with strategy of q buy, q sell, cut loss, cut win base on moving average daily volatility band.

2. Short term trader base on TA up-trending, good quarter profit and good news (breakout)

3. Mid-term trader cyclical stock with this quarter earning better than last quarter and next quarter should be better that this quarter.

4. Mid to long term bottom fishing with recovering stocks

5. Long –term Growth stocks with 673 shareholders hold 95.08% and Top 30 shareholders holding 72.078%

So Philip are you an investor or trader?

2020-07-07 08:58

Philip ( buy what you understand)

I am trading in STAR, and investor with my other long holdings.

The point here is when you use TA or technical analysis (price action theory) to define your investment philosopy, uptrend and downtrend. In the long run, short term technical analysis trading gives you a lot of false signals. The shorter the time frame the more false signals you get.

the best way to "trade" if there is any good way, is to identify market perceptions based on news and results and to buy/short based on that market perception.

Investing is about ignoring share prices and market perceptions and trying to understand the earnings and growth prospects of the business.

Two very different modes of thinking.

Can you tell the difference?

2020-07-07 11:48

If investing is about ignoring share prices and market perceptions and trying to understand the earnings and growth prospects of the business.

Then what do you think of Tesla since IPO in 2010 at USD17 and had hardly make any significant profit yet and in such a competitive car manufacturing business?

2020-07-07 13:01

Philip ( buy what you understand)

Very simple question and very simple answer. Would you pay usd1000 to book a car which you have never driven before or seen before or exists? If the answer is yes, then you will know how Tesla is valued.

When you have 500k people paying usd1000 with non refundable usd300 service fee to book a cybertruck, you realize you have just made usd500 million in bookings just on reputation alone.

How many car companies can claim that?

2020-07-14 18:25

![[MQ Raya Campaign 2022] Guideline of Joining the Campaign | Let's Join Now!!!](https://mqac.i3investor.com/img/video_thumbnail/433/thumbnail.jpg)

Philip ( buy what you understand)

I will try to expand more, as trading can be a very very complex method.

2020-07-05 12:27