THE PROPER APPLICATTION OF MARGIN, OR HOW KCCHONGNZ AND KOON YEW YIN GOT IT SO WRONG

Philip ( buy what you understand)

Publish date: Mon, 20 Apr 2020, 02:22 PM

I will choose to paraphrase, since some individuals can definitely write a better story than I obviously can.

In the third week of the month of March 2020, the stock markets all around the world crashed. Many investors, me included, had experience sharp drop of the value of their stock portfolios. I sympathize the predicament of every investor who suffered during this period. This article is written purely for sharing of an investing behaviour for readers to ponder about its merits and pitfalls in order to make informed decisions, rather for criticizing anyone’s investing strategy.

Now, as many of you know by now, I am a qualitative investor, meaning I use qualitative valuation (scuttlebutt, or simply understanding the business first and foremost) analysis to make decisions about how to invest in the market, then applying FA and TA to my buying/selling methodology.

Recently, I have seen more and more "sifus" coming out during crisis periods to talk about the dangers of MF, or MARGIN FINANCING. Especially those who have not used margin before, or understand it well, far less take advantage of it to generate gains. They see dangers everywhere, and are always thinking of safety of margin, and not being in debt etc etc.

However, that is what equity investing is all about: managing risk to generate a superior return.

Here are 3 mental models about investing that you may or may not be aware of:

1. Risk/Reward is always most dangerous when the markets are full of positivity, Bull mode is at peak. Even if it doesn't feel like it, the WORST time to invest is actually when EVERYONE IS MAKING MONEY.

2. Risk/Reward is always safest when the markets are full of negativity, Bear mode is at peak. Even if it doesn't feel like it, the BEST time to invest is when EVERYONE IS LOSING MONEY.

3. The biggest hindrance to an intelligent investors is not intelligence or hard work, but emotions. RATIONALITY is the INTELLIGENT INVESTORS BEST TOOL.

This is why, in howard mark's latest memo on calibrating,

https://www.oaktreecapital.com/docs/default-source/memos/calibrating.pdf?sfvrsn=6

A wonderful phrase immediately came up to me, "WHEN THE TIME COMES TO BUY, YOU WON'T WANT TO." It's never easy to buy when the news is terrible, prices are collapsing and it's impossible to know where the bottom lies.

BUT DOING SO SHOULD BE AN INVESTORS GREATEST ASPIRATION.

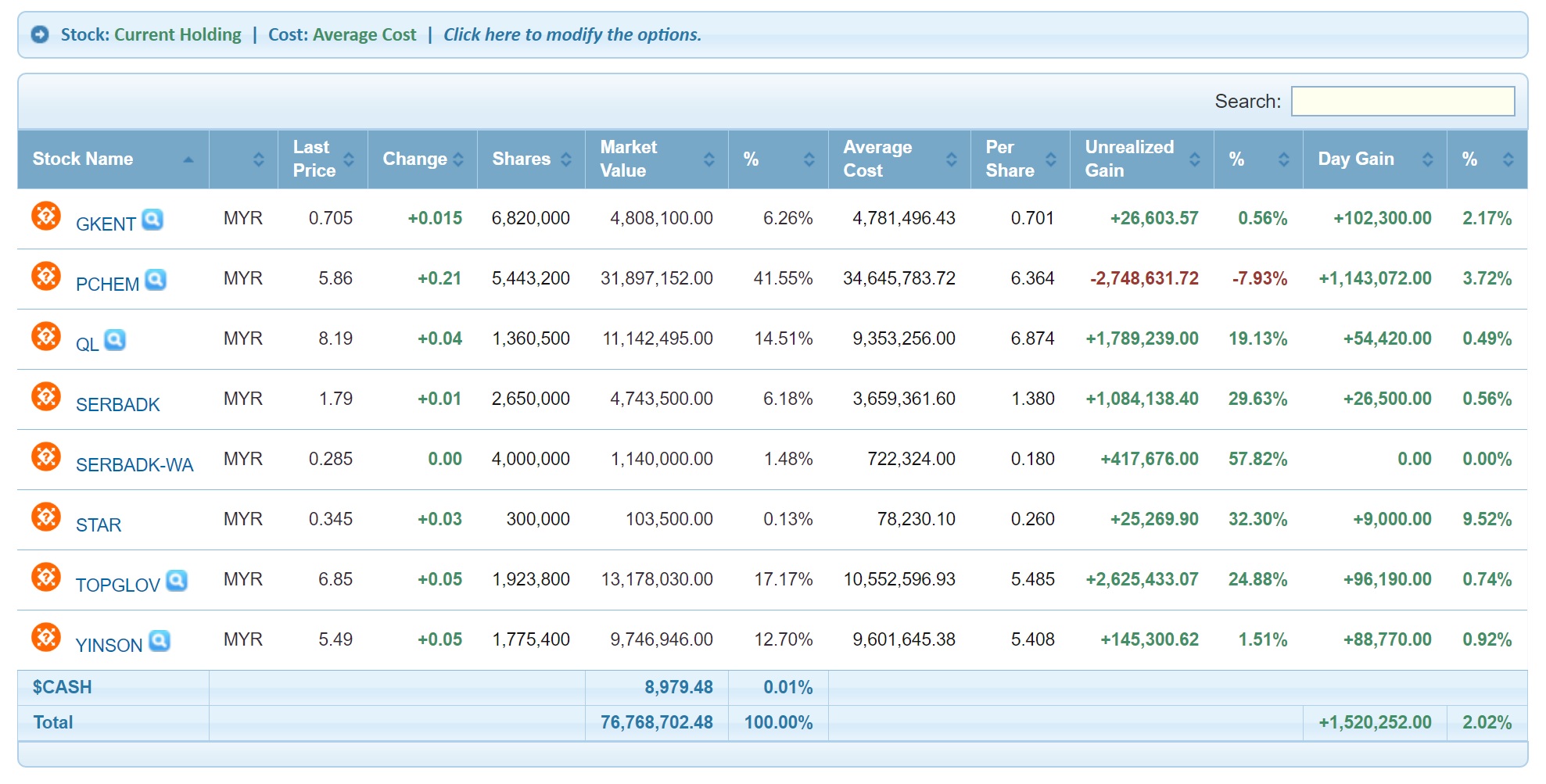

Now I have kept a trackable portfolio to explain my methodology and my actions to match this concept, and the results of my "storytelling" as sifu kcchongnz likes to put it, are here:

Now, before you go ahead to say that I am boasting or "showing off", please be advised that majority of the amounts is from a multiple sources, mainly MARGIN FINANCING. In essence, I personally believe in the power of margin financing, DONE RIGHT, can be a wonderful tool to generate debt that will drive superior returns in the long run.

DEBT can be a KILLER, or it can be a wonderul COMPOUNDER, if you know what you are doing.

Dont believe me? You can ask Warren Buffett on the application of COMPOUNDING OF BORROWINGS TO GET SUPERIOR GAINS.

Yes, that is 100 billion in borrowings, to grow a business. Does Warren Buffett shy away from applying debt to business? OF course not. Therefore, why should you avoid margin financing? Obviously, there is risk in borrowing money to put into a business that you know little about, but like in real life, you should never go into debt to borrow money for a startup, do a business you have no experience in, borrow to friends and family to help them start a business (unless you treat it as a donation from the beginning) etc.

But imagine if I could borrow you 1 billion for a year at 1%, and if you couldn't pay it back your entire family would be beheaded. Would you take the loan? I don't know about you, but I definitely would. I would simply put it in a fixed deposit for 12 months at 3%, and get 20 million free of risk (or as miniscule as you can plan it). The point I am trying to make is: if you know how to manage risk, and if you understand risk (not in a stock price action way, but in a real world business way) you would quickly know what businesses can be bought, which you can borrow money to, and which you should always avoid.

Simple enough? EXACTLY.

The problem is many sifus try to use hard to understand concepts like magic number, golden rule, SMA200, cup and handle etc to try to sell books and subscription classes and stretch a course learning length. The simple fact about investing is that long term wealth is made via the simple application of understanding a business, rationally investing in it, and participating the long term growth of the business. That is how buffett did it. That is how jeff bezos did it. That is how zuckerberg did it. Imagine what would have happened to them if they sold out early just because the price was going up? How do you know the future?

Now, to the title, let us understand what KCCHONGZ is doing and what KYY is doing with respect to applying margin financing.

Let me take a favourite sport of mine to give some "storytelling",

KCHONGNZ

KOON YEW YIN

Now if you were around in the 80s and 90s you would be familiar with these two and their playing styles. One is a very defensive player, who enjoys long rallies and defensive services to stretch the game and win via stamina battles. The other one is world famous for his heavy smashes and aggresive playstyle, which have captivated the world. Obviously one playstyle is more effective than the other in the real world (guess who has his own badminton racket company and won olympic gold medal).

But the point I am trying to make is this: Foo Kok Keong is famous for his defence, of not taking risk or the fancy play. He is someone who does not use smashes (lets call it MF here), but uses long rallies (value investing) to make drop shots and wear his opponent down. He doesn't win big, but he does win some. (you have to give KCChongnz credit here, for him to have the guts to write a stock investing book, it must be because he does have some returns to supplement his book writing activity). But the sad truth about Foo Kok Keong is this:

His results have always been less than spectacular, and his victories have always been marred because of the calculated risks that he did not take. And that is what winning(investing) is about in the end, taking calculated risks for a superior reward.

On the other hand, we have the legendary Yang Yang to proxy KYY. Everybody knows who Yang Yang is around the world, even today. He won the first Gold Medal for Badminton in the Olympics, he has an awesome badminton racket, and he is legendary for his smashes. A smash is a good analogy for taking on margin. A one shot, all in jumping body raised hit with all your strength to get the point. Yang yang was always famous for his cross court super smash. His multiple golds came from his dominance (golden rule), which led to many individuals preemptively fearing his smash (pump) and the followed by the dropshot (dump) that somehow no one seems to expect and are always suprised when it does happen. The problem with Yang Yang is also the same correlation, his smashing power and the aggresiveness of his play shortened his playing career. His success was followed by a very steep and sharp drop in competitiveness due to multiple injuries, which made him retire early after a string of losses and turned instead to coaching. ( a few successes in Liihen, hengyuan and Latitude tree followed by duds in JAKS and Dayang)

Of course the similarity ends here, KYY is no Yang Yang, and KCCHONGNZ doesn't even know who foo kok keong is. The point I am trying to make is simple, too much application of margin ALL the time will not give good results, as we now know. And the reverse is true as well, ZERO application of margin will also not give good results, especially if you take into account opportunity costs and loss of time (the most important commodity), when investing returns in the long run.

SO HOW TO USE MARGIN?

To dive down to the exact dates of my investments and purchases, you can go here:

https://klse.i3investor.com/servlets/pfs/120720.jsp#tabs_group2

I posit a more consistent way of using margin financing, that has worked for me over a long time. My first two investments that have allowed me to go into heavy margin (and the fact the the prices did not go down at all during the Covid19 crisis shows the importance of business prospects rather than accounting valuation, or PE50 companies are bad), is QL resources in 2009, and Topgolve in 2010. Now, I am not advocating you to buy these stocks at all, as I have owned them for a very long time, and I usually just reinvest dividends into them instead of outright purchase( which I neglected to do in topglove, due to my anger at their previous botched M&A activity).

However, owning these stocks was a godsend, as the collateral for these stocks were set at full price (by the bank unlike certain penny stock counters) instead of lowered valuation. I was therefore able to gain a lot of margin financing that I was able to deploy at high prices to average down on stocks whose valuation was cheap when I first bought them, and became more and more discounted during the crisis. As these two stocks buttressted my entire portfolio, I was able to continuously do my buying and averaging down on good wonderful stocks.

To simplify, NEVER use margin when the stock is going up, as you will never know when it is going up naturally or due to being manipulated. I find that the best use of margin is in averaging down, especially if you know the businesses and the companies that you are investing well in advance.

Remember rationality? When applying margin, you use it the same way, to collect undervalued stocks and cheap downtrodden prices. What fish did I shoot in the barrel? Imagine buying PCHEM at 4.09 (below IPO price, 12b in net cash), GKENT (0.46 almost nett cash), the STAR media (0.26, when cash is 40 sen per share), boon siew honda (oriental at RM4.62, genting RM3.05, hapseng RM7.02 my wife's personal bet). All of the wonderful companies in Bursa Malaysia, with huge cash positions, monopolies and long history of earnings.

If you want to apply margin, buy the guaranteed companies. The blue chips. Those with long history of making money, and cash pile to survive the crisis. Buy low, Sell High (don't forget to clear the debt, it is still borrowings). It is my long term experience to know that during the good times, the fastest and craziest to rise are the penny stocks that everyone is speculating on. During the bad times when the tide is up and everyone is swimming naked, the ones to recover fastest are those companies with huge cash pile, good balance sheet, wonderful management and good continous orders.

Before you know it, you would have slapped your forehead and asked why you didn't buy more of your stock when you could have. It is your fear, your misunderstanding of the word debt, and how to correctly apply it.

WHEN THE TIME COMES TO BUY, YOU WON'T WANT TO.

Philip

And just to end, lets support a creative writer in our midst:

More importantly, in order to be successful in investing, one must treat buying a stock as investing in part of a business. He must understand the business, its performance, finally if it is offering at an attractive price. There are some good investment books in the market to provide you with some guidance. This book below is one of them.

If you are interested to purchase one and posted to you within a few days during this lockdown period, you may email him. Just don't expect him to provide proof of investment results.

Happy investing.

KC Chong - ckc15training2@gmail.com

More articles on Investing theory 4 - Mr Market

Created by Philip ( buy what you understand) | Feb 07, 2022

Created by Philip ( buy what you understand) | Feb 04, 2019

Discussions

Just a reminder. Thou shall not ask or teach ppl to use margin.

Margin is for professional.

Even professional also many jump building using margin.

U can continue tok kok about on which stock or business to invest.

But margin is not something u wan other ppl to play with. Because u dunno wat other ppl ability or availability. Unless u agree to take responsibilty to those who follow u to use margin. Mean they die, u must die together. Are u ?

Below is a simple but yet very powerful philossphy on margin written by someone very respectable in investing world. Sekian.

https://klse.i3investor.com/blogs/WTF/2015-01-13-story68322-WTF_about_SHARE_MARGIN.jsp

2020-04-22 11:01

Philip ( Random Walk Theorist) > Apr 21, 2020 9:44 PM | Report Abuse

As for salty and whacking kc for no reason, I feel I am justified more and more each day.

==========

hahaha........

all in the name of diversity of opinions.......

supply and demand........as long as there is demand for such services, there will be somebody who will supply the services..........$ billion industry.

asymmetric relationship between the paid teacher and the students. Yet, they have the gall to tell their students ( who no doubt are novices) , final decision is yours. And they assume no responsibilities for losses incurred.

"Don't listen to tips..........but I got tips, u want or not?"

"Don't use margin because they want to project a responsible conservative image."

" Rice bowl - why u want to disturb my rice bowl?"

why?

2020-04-22 12:13

Philip ( Random Walk Theorist)

1. Cats should never use margin.

2. Cats should never use margin to buy INSAS.

3. Self promotion is very good. Another one without any portfolio but say he is very respectable in investing world.

Sekian.

>>>>>>>>>

Posted by leno > Apr 22, 2020 11:01 AM | Report Abuse

Just a reminder. Thou shall not ask or teach ppl to use margin.

Margin is for professional.

Even professional also many jump building using margin.

U can continue tok kok about on which stock or business to invest.

But margin is not something u wan other ppl to play with. Because u dunno wat other ppl ability or availability. Unless u agree to take responsibilty to those who follow u to use margin. Mean they die, u must die together. Are u ?

Below is a simple but yet very powerful philossphy on margin written by someone very respectable in investing world. Sekian.

https://klse.i3investor.com/blogs/WTF/2015-01-13-story68322-WTF_about_...

2020-04-22 13:27

never take out money never inject new money into it for many years already.... for me, it's just a toy box

2020-04-22 14:24

Like that how to get rich leh ??

If u act like a pondan, u always will be a pondan mah...!!

Posted by qqq33333333 > Apr 22, 2020 2:24 PM | Report Abuse

never take out money never inject new money into it for many years already.... for me, it's just a toy box

2020-04-22 16:26

Posted by stockraider > Apr 22, 2020 4:26 PM | Report Abuse

Like that how to get rich leh ??

=================

never see rich pondans? I have...........

2020-04-22 16:28

proper application of margin is the same as proper application of cash transactions.....................no difference.....

do not understand why kc says can buy but cannot margin............

logically.........can buy means can margin.................cannot margin then cash also cannot buy..................

kc.........correct or not?

2020-04-22 18:23

Haha qqq3,

I have not see rich pondans but I heard of a story about well to do gay. The story go round like this:

For four friends who finally got to see after such a long time, the achievement of their sons was the center of discussion, and the success story of one of them trumped that of others by a wide margin.

Thirty years is a long time gone without having to see one’s childhood friends. Such was the tale of four grown men who finally set eyes on each other after a long period. The first port of call for these men after the necessary and warm greetings happened to be the bar and it is there that the story unfolds.

The four men are drinking and chatting happily. While they are at it, one of them excuses himself as he needs to urinate. The others kept on discussing, and the success of their sons was their topic of discussion.

The first man gave glowing praise to his son, saying how he is such a joy to him. He explains how his son rose from the bottom of his company to become the president of the company. His son is now so rich to the extent that he gave his best friend a high-class Mercedes for his birthday.

The second man is amazed at the feat and tells about his son too. He also reveals that his son is his pride and joy. His son became a pilot after attending flight school, and then rose to become a significant partner in the company; he is now so rich that he bought his best friend a brand new jet for his birthday.

The third man is overly impressed and gives accounts of his son’s success. His son is a successful engineer who started his own engineering company, becoming a multimillionaire in the process. Now he is so rich that he bought his best friend a 30,000 square feet mansion for his birthday.

At this juncture, the fourth man is making his return from the restroom and meets his friends congratulating each other on their sons' successes. He asks why they are doing this, and they explain to him that they are proud of their sons. They then ask him about his son.

He smiles and reveals that his son is gay. The others are thrown back and feel for their friend, saying he must be sad about the development.

To their surprise, he says he is not, that he loves his son in spite of all that and that he is also doing well for himself.

He goes on to say that his son’s birthday was two weeks ago and that he received a beautiful 30,000 square foot mansion, a brand new jet, and a high-class Mercedes form his three boyfriends.

2020-04-22 18:28

philips...............world CEO, realists and myself included expects a U shaped recovery with a long recession...........

with this in mind.......what to do? what can buy?

You can divide shares into two groups..........

- A> the beneficiaries.......medical supplies, gloves, telecommunications

- B> the harmed/ risky sectors..............

all the money will be going to Group A ( eventually , if not already, making this group highly over valued)....and one day will crash.

the contrarians will hunt in Group B............and be disappointed when things are down longer and more severely affected than anticipated.

with this in mind.......what to do? what can buy?

me? I stick with Group A..............

2020-04-22 18:44

world CEOs....................not I say one..........its from a reputable survey..............

2020-04-22 18:45

Philip ( Random Walk Theorist)

As for me, it really doesn't matter to me if it takes longer or shorter to recover, 3 months to recover or 3 years for the market to recover.

I'm not a trader and I don't buy something just because it is cheap and sell something just because the price went up.

I try to buy a business or pieces of a wonderful business at a fair price. Therefore in this case, I don't really care what the long term market is like, as I invest in businesses that can make money over a long period of time.

Most of the time, I hope to never sell a wonderful business that I own.

In any case, investment is about paying money today for a return in the future.

The future that I am betting on will not include covid. When it will be I don't know, but I do know it won't be tomorrow.

But in any case, what to buy is a relative term, as your investment philosophy and mine are totally different.

I wish you good luck, you can choose to stand aside, watch the world burn, or buy stocks when everyone is running away. Selling a stock today should not be an option, unless you need money to survive.

Your choice.

2020-04-22 18:50

Posted by Philip ( Random Walk Theorist) > Apr 22, 2020 6:50 PM | Report Abuse

As for me, it really doesn't matter to me if it takes longer or shorter to recover, 3 months to recover or 3 years for the market to recover.

====================

3 years later, no covid...........

but if it is the 1930s charts...............have u seen the 1930s charts?

they say , what we have witnessed the last several weeks is dead cat bounce of 1929.....................................

shares as pieces of businesses...........

businesses such as yinson will not be able to survive..............not with $ 20 oil......

and valuation of assets changes..............

2020-04-22 19:29

there is no off shore oil driller that can survive at these prices......asset prices are still expecting US $ 40 - US$ 50 oil in a few months......

2020-04-22 19:35

I not gay But, there are gays in this world because a certain percentage of gays is needed for survival of the species...............

mathematicians can even calculate the optimum size of gay populations........hahahaha

2020-04-22 19:40

Dayang? This one u have to pray very hard...........All service providers in Texas ham kar chan already...........................

2020-04-22 19:42

just as ebola is still here

so the future will include covid-19, ebola and HIV

if not handled properly Malaysia will have lockdowns also for months of June and July and also Sept and Oct

the 1 month gaps for meant for people to go for kenduri, weddings funerals etc and deputy ministers to have makan makan to spread the virus around.

2020-04-22 19:45

me? The whole world is following the Wuhan model but there is only one China...........and so I think the rest will not have the fast successful out come like China................................................

2020-04-22 19:48

in Malaysia the ministers and deputies and warlords will be very busy spreading the virus around.

Expect more lockdowns for the months of June+July and Sept+Oct

this is assuming May and August to be frantic virus spreading months

2020-04-22 19:54

covid 19 will ONLY be stable once everyone (100%) has been infected and Malaysian deaths exceed 100,000. estimated to be around 150,000 deaths

once everyone infected, those who will die has already died then ONLY life in Malaysia will become normal.

after that business as usual.

until covid-19 randomly mutates again. Then history repeats itself.

2020-04-22 20:05

y Philip ( Random Walk Theorist) > Apr 22, 2020 6:50 PM | Report Abuse

As for me, it really doesn't matter to me if it takes longer or shorter to recover, 3 months to recover or 3 years for the market to recover.

I'm not a trader and I don't buy something just because it is cheap and sell something just because the price went up.

I try to buy a business or pieces of a wonderful business at a fair price. Therefore in this case, I don't really care what the long term market is like, as I invest in businesses that can make money over a long period of time.

Most of the time, I hope to never sell a wonderful business that I own.

In any case, investment is about paying money today for a return in the future.

The future that I am betting on will not include covid. When it will be I don't know, but I do know it won't be tomorrow.

But in any case, what to buy is a relative term, as your investment philosophy and mine are totally different.

I wish you good luck, you can choose to stand aside, watch the world burn, or buy stocks when everyone is running away. Selling a stock today should not be an option, unless you need money to survive.

Your choice.

================

very good mentality...........but better if u don't have yinson..........this one cannot survive if oil below $ 30 for long because if drillers die, yinson also die................and right now, all off shore drillers die...........

2020-04-23 00:29

Yinson is currently valued on basis that oil will recover to US$ 40 - 50 range within a few months.........if not, its not sustainable.......

2020-04-23 00:34

its pro active, consistent and confidence..............any share, anyone with all 3 should be ok..............

2020-04-23 00:47

group A or Group B shares?

this is the best way to look at stock market.

On the basis that it is a U shaped recovery, not a V shaped recovery....only Group A shares makes sense.............

Outside Group A..........it does not make sense no matter how cheap it looks on various metrics.................

2020-04-23 00:51

Philips..............your QL also hitting a block in the form of Tesco going to CP Group.........They are going to stock their eggs not your eggs..........so how?

2020-04-23 09:17

Philip ( Random Walk Theorist)

Aiyoh, please take another look at yinson contracts again. Why everyone including yourself still assuming yinson business model is the same as armada and sapura?

I repeat to you one more time ya, the contracts written are based on man labor day rate. Their contract is a 8-25 year TRANSPORTATION contract and storage contract, which everyone is looking for now to store the unsold oil.

They are not a driller or epcc where they have a share in the profits of oil sold, like armada and sapura.

You are comparing a offshare Dialog Vs a oil explorer.

Fyi not all O&G firms are all the same thing. You really need to understand what you are buying, otherwise you will think hibiscus,carimin,dayang,sapura and armada all do the same business, which is very far from the truth.

Most importantly, you need to understand how the penalties are done if they cancel there contract with YINSON.

Delay I don't see an issue because their existing orderbook in Brazil and Africa will only come online in 2023. And their existing contracts their ships are being used to store the oil, since they can't pump it back into the sea.

So I don't see why they would cancel, especially since cancellation penalties would give yinson free FPSO that the can deploy to store I'll for other clients.

Get your business sense right, YINSON is not a driller, YINSON is a floating DIALOG.

>>>>>>>>>>

very good mentality...........but better if u don't have yinson..........this one cannot survive if oil below $ 30 for long because if drillers die, yinson also die................and right now, all off shore drillers die...........

2020-04-23 09:34

Philip ( Random Walk Theorist)

Just in case you missed it,

FPSO stands for floating production STORAGE and offloading.

What happens when there is no buyers? Everyone is rushing to find a place to STORE oil ( and can't just simply find a warehouse to put it ya, very flammable).

Why do you think I avoid sapura and Armada like the plague?

2020-04-23 09:42

Philip ( Random Walk Theorist)

Gdex boy still with your fantasies? Have you had enough fun shorting star yet?

>>>>>>>>

Posted by i3lurker > Apr 22, 2020 8:05 PM | Report Abuse

covid 19 will ONLY be stable once everyone (100%) has been infected and Malaysian deaths exceed 100,000. estimated to be around 150,000 deaths

once everyone infected, those who will die has already died then ONLY life in Malaysia will become normal.

after that business as usual.

until covid-19 randomly mutates again. Then history repeats itself.

2020-04-23 09:43

y Philip ( Random Walk Theorist) > Apr 23, 2020 9:34 AM | Report Abuse

Aiyoh, please take another look at yinson contracts again

==========

I know what u are saying but I stand my ground.......

everyone saying their contracts are ring fenced........but when their principals die , they all die...........

asset price assumes that crude will go back to viable price within a few months............I guess that is what everyone assumes...........

be proactive means think ahead and If I am correct........they all die.

The last time, Sapura and the rest died, Yinson stand tall, they say all their contracts are ring fenced and very good management , very good planning and did not over extend themselves....and their principals did not die.

I am telling u........their business model never assumed oil price below $ 30............me? I think all off shore operations will die as a result of the virus.

There is no off shore operator profitable below $ 40............operator die, lessor die.........just basic reality.

if world go into recession/ depression, oil price above $ 40 for long term?

last time oil came down drastically was for technical reason and therefore temporary....well managed companies unscathed.........

if oil price go down for fundamental reasons.........even the best managed lessor also go down.

ring fenced or no ring fence............

2020-04-23 10:16

Posted by Philip ( Random Walk Theorist) > Apr 23, 2020 9:42 AM | Report Abuse

Just in case you missed it,

FPSO stands for floating production STORAGE and offloading.

============

storage....storage problems will be solved within 2 months............that is what forward contracts are telling you..........Aug deliveries got $ 10 premium over June deliveries......but even March 2021 wti price is only $ 30.

2020-04-23 10:27

turn the FPSO into storage tanks for third parties........I have no idea how much can be recouped that way..............but surely the shortage of tanks will not be so acute in a few months...........

2020-04-23 10:55

In US when storage tank for fresh milk full. They will pour the fresh milk to the drain so that farmers still can go on and milk the cows.

2020-04-23 11:07

IM WAITING THE STUPID POST OF

WHAT I LOSE XXXX FUCKING AMOUNT MONEY, HOW I LEARN MY SORHAI , STUPID LESSON post........

2020-04-23 11:09

Philip ( Random Walk Theorist)

Standing your ground is a perfectly acceptable position as you are keeping everything cash and do not have any exposure at all.

Me? I will be putting my money to work just when everyone rather than is leaving the building, and investing more at wonderfully low valuations.

Now that blood is in the streets, then it is easy to buy low sell high, but no one is willing to do it. If you want to be a contrarian, now is the time to do it.

I will be one of the few that pile in cash and margin during this period.

Who is wrong or right? I will tell you next year.

All I know is, last year yinson was 4.20. today it is rm5. Since the price today is still higher than when I first bought it, I will choose to hold on and let quarterly results tell me what you do, and not newspapers, Facebook and i3 comments telling me what to do.

Let's see who is right.

>>>>>>>>>

I know what u are saying but I stand my ground....

2020-04-23 13:06

reports say all independent drillers die or dying, only ones to survive are the oil majors...........of course off shore drillers and Texas drillers first to die.

people holding Hibiscus, Dayang etc ought to be shot.

Yinson , how far away?

Yinson principals are the Exxon and BPs?

2020-04-23 13:36

still waiting,...... i LEARN MY STUPID LESSON, SHLD NOT USE TOO MUCH MARGIN BLAH BLA BLAH. macam old ladies nagging

2020-04-23 23:18

maybe I should take back my comments on Yinson as it appears all counter party risk of Yinson are sovereign risks with Ghana, Nigeria, Brazil, Vietnam , India no independent drillers...................

execution risks are minimum based on their track records.......

2020-04-24 01:41

Philip ( Random Walk Theorist)

Since choivo seems very well versed with rimjob ( I did not even know such a word exists?), I will let him to continue on enjoying such activity. Please keep it to yourself and 1 meter away from others.

As for salty and whacking kc for no reason, I feel I am justified more and more each day.

First whackjob KC says don't listen to stock tips while all the while running a stockpick subscription service. Wow, the audacity. Almost as bad as a kid selling a research report for 5K, while never profiting from his own research report.

Then he goes around and talks bad about OPM, a topic which he has admitted zero knowledge about other than vague concepts and bad things that have happened to other people ( while avoiding the fact that his great heroes Warren buffet, Peter lynch, basically every fund manager out there is benefiting greatly from OPM).

After all, what is OPM but using other people's money ( debt) to generate a superior return compared to using cash alone.

I mean if I started writing books and articles based on phony track record and results of xx share here and XX share there, and my sister or wife or best friend started buying recommended stocks from kcchongnz/choivo based imaginary/nonexistent results, I'd be very "salty" too.

No reason? Really?

>>>>>>>>>>

But the tone of it, and how Phillip just cannot bear but to whack kc etc for no reason.

2020-04-21 21:44