Posted by stockraider > Dec 16, 2017 06:18 PM | Report Abuse ![]()

IT IS NOT UNREASONABLE HENGYUAN RM 22.00 TO RM 42.00

Posted by 360Capitalist > Dec 1, 2017 04:33 PM | Report Abuse

My Target RM37.00 within 36 months.

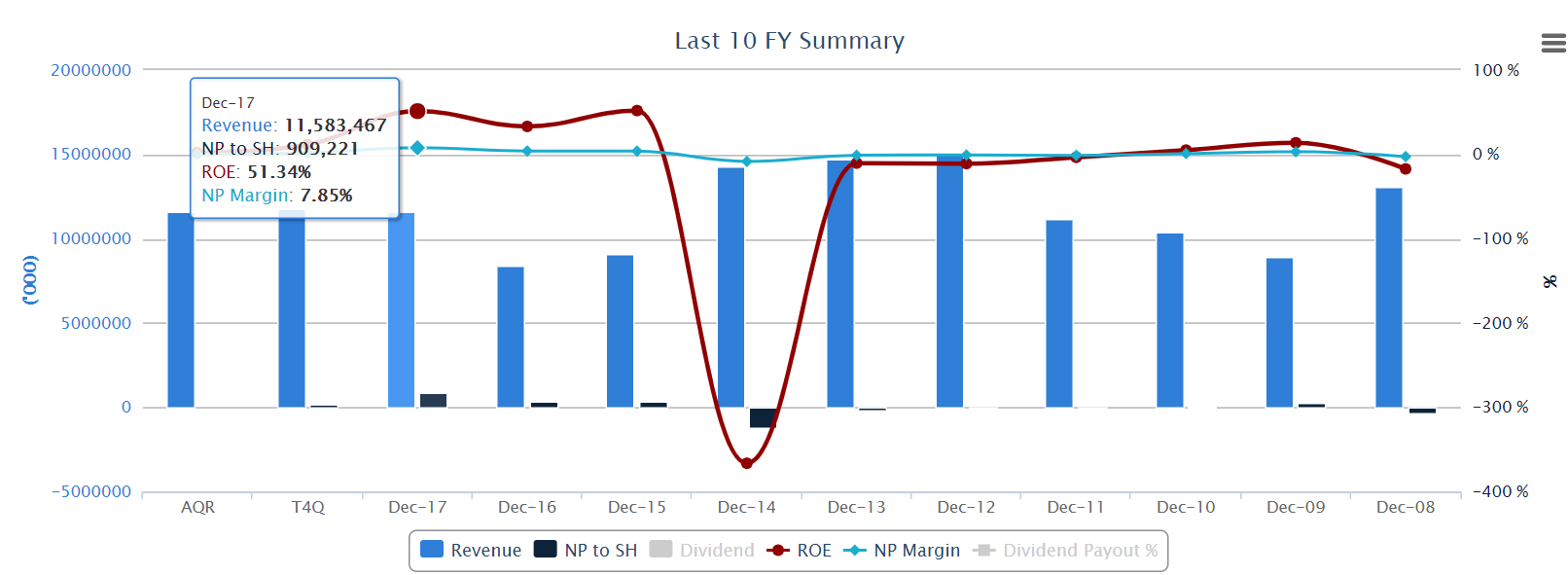

Heng Yuan just announced the quarterly earning with EPS RM 1.20 yesterday.

In fact when I said, HengYuan has capability of making EPS RM3.00 this year not many people believe including OTB.

With yesterday announcement, HengYuan is ranked among the Top 5 Best Stocks listed in Bursa Malaysia with EPS above RM2.00. Anyone can challenge, argue and comments in whatever manners they would like to, but time will tell the true value of this super undervalued stock.

Posted by Livermore > Dec 27, 2017 03:15 PM | Report Abuse ![]()

50 also no problem, now waiting to hit 30 first...i just bought in more today...my average cost only 12...is my big win stock

Posted by pang72 > Dec 27, 2017 03:16 PM | Report Abuse ![]()

Rm21 by Chinese new year. Thanks you!!

Posted by stockraider > Dec 30, 2017 01:59 PM | Report Abuse ![]()

I do agree with Felicity 's article that Hengyuan cannot be compared with Nestle , Dutch Lady which has a PE of 30x .

However , KYY did not ask HY to be accorded a PE of 30x but only 1/3 of it at 10x only .

Now . Can HY be compared with small caps like JHM and Penta which are favoured by many IB s ??

Both Penta and JHM did not make profits before 2015 .

THese companies are very similar to HY which started to make profits from 2015 onwards with record profits in 2017 .

These companies were accorded PE of more than 25 now by the markets with very optimistic views of strong growth in automotive and semicon sectors in 2018 .

Shouldnt HY be give only a PE of 8 ( 1/3 of Penta and JHM PE) with an optimistic crack spread outlook and high demand of refined oil products ?? A PE of 8 will give HY a price of RM 3.11 x 8 which is 24.88 ???

29/12/2017 20:08

THE ABOVE COMMENT IS VERY REALISTIC WE ARE ASKING HENGYUAN TO BE GIVEN A FAIRER PE RATING WE ARE NOT ASKING ABSURB NESTLE PE RATING OF 40X MAH..!!

Why you can success as me.

2017 Fact.

1. Hengyuan rank no2 gainer in bursa.

This likely to repeat on 2018

Day 90 - The Fear of Man

It is at this point that if you took the time to understand carefully, the price of crude oil is sure to go up more than down in the long run. As your raw material prices go up, your profit margins and costs are sure to drop. Once you add it the refinery upgradeds works, your revenue and sales in 2018 is sure to suffer. And thus the panic selling begins. More popcorn:

Posted by paperplane > Jan 1, 2018 01:20 PM | Report Abuse ![]()

And no matter what kind of fake bullshit u all making now, I can happily avoid and forget it. I know things you all dunno what is happening next yr and years down the road.

China is definitely going to pump more.money to hengyuan to make it one of the biggest investment in China

You all can fly kite and talk all kind of nonsense. I don't give a damn now. After much reading this few days, I know something big is lining up for hengyuan. Rm 50 is not even a dream considering China govt strategic plan. Go fuck yourself naysayers. I dun fuck care.

You all can happily said crash lah, die lah, sell down ,melt down. What ever fuck lah. I am holding it.

Posted by stockraider > Jan 1, 2018 12:25 PM | Report Abuse ![]()

RAIDER TAKE ON UNCLE KOON ;

I THINK UNCLE KOON AND OTB HAD DISPOSE ALL ITS TRADING PORTION 0N HENGYUAN LAST FRIDAY .

THE MAIN REASON; IT ALREADY HIT THEIR SHORT TERM TP RM 18.00 AND THEY DO NOT WANT HOLD A LARGE POSITION OVER THE LONG WEEKEND HOLIDAY LOH...!!

THIS GENERAL RAIDER UNDERSTAND LOH, IT IS PART OF RISK MANAGEMENT, U DO NOT WANT TO OVER EXPOSE ON MARGIN, NO MATTER HOW GOOD THE SHARE MAH..!!

BUT THE POSITIVE INFO RAIDER DERIVE FROM KYY POSTING IS THAT THEY ARE BIG BUYERS TAKING OFF FROM THEIR HANDS, THIS ARE NOT MUM & POP, BUT LONG TERM FUND BUYER MAH....!!

GOING FWD, UNCLE KOON IS STILL HOLDING ON, TO HIS INVESTMENT POSITION ON HENGYUAN WHICH HE THINK GOT GREAT PROSPECT LOH...!!

AS RAIDER SAY, HENGYUAN SHARE PRICE ADVANCE NO LONGER DICTATE BY INDIVIDUAL ANYMORE GOING FWD, IT IS DRIVEN BY GROWTH IN EARNINGS AND IT IS EXPECTED IN Q4 AND THE RERATING OF PE TOO LOH...!!

UNLIKE SMALL SMALL COUNTERS...U NO LONGER DEPEND ON KYY ANYMORE LOH...!!

JUST BE BRAVE AND BELIEVE IN YOUR LONG TERM FUNDAMENTAL JUDGEMENT FOR HENGYUAN MAH...!!

Posted by probability > Jan 12, 2018 10:13 PM | Report Abuse ![]()

EITHER the management were super smart

by prudently foreseeing the upside of oil price was higher compared to getting lower about 9 months ago and thus stocked up a lot of inventory far ahead,

OR

they were forced to stock up refined products to cater the needs of Shell retails during mandatory turn around period end of 2018.

simply brilliant this Chinaman...

Posted by satan118 > Jan 21, 2018 12:43 PM | Report Abuse ![]()

Come on Nekosan, 3ii and others, it is still good year ahead for HY. We invest HY becoz we can understand the business thru various info from all of the sifu here. We are so blessed that everybody can share around the facts and figures. Even the petron will also spend more BILLIONS than HY in urgrading.Their BODs are not stupid too. Do u think someone who wrote the article (JUST WANT TO CARI MAKAN NIA) is better than those professionals in the oil field meh?We may also estimate their profit easily. So, if you want to make more $$$, just joint us in HY loh. Get in before those BIG FUND MANAGERS, there are still plenty $$$$ to collect loh. We don mind to collect together mah.

Posted by Stockhunter85 > Feb 4, 2018 12:51 PM | Report Abuse ![]()

eps going to be rm 3.40 to rm 3.70 after coming qr being release

PE 7 x EPS 3.50 (average) = rm 24 minimum?

Posted by tehka > Feb 20, 2018 04:37 PM | Report Abuse ![]()

Fundamentals is intact..

2017 EPS is exceeds Nestlé Dutch Lady British Tobacco Panasonic. 2017 king of EPS

Posted by lizi > Feb 21, 2018 07:30 PM | Report Abuse ![]()

HUAT AH HUAT AH HUAT AH, HENGYUAN PASTI HUAT !!!

Posted by stockraider > Feb 26, 2018 10:56 AM | Report Abuse ![]()

THE TRUTH IS HENGYUAN IS THE TRULY WORLD CHAMPION STOCK ITS EPS RM 3.40 EXCEED THE MOST EXPENSIVE STOCK IN KLSE NESTLE WITH EPS RM 2.75 LOH...!!

PLEASE NOTE WE ARE PREVENTING FALSE AND FAKE NEWS FROM NAYSAYERS FROM CAUSING, BIG BIG LOSSES TO LONG TERM INVESTORS FROM SELLING TO PREMATURELY LOH;

Promoters should not be tearing their shirts and hairs because others have alternative views.

REMEMBER THE STORY OF SAD ADMIRER OF 3iii AHMOI UNABLE TO AFFORD TO SEND HER SON TO AUSTRALIA TO STUDY BCOS LISTENING TO 3iii SELLING HER HENGYUAN AT RM 3.66 LOH..!!

AHMOI BEST FRIEND AHFAH HANG ON TO HENGYUAN DUMB DUMB, TODAY BASED ON HER PROFIT, IS ABLE TO FINANCE HER SON STUDY IN AUSTRALIA, JUST BASED ON HENGYUAN INVESTMENT ALONE LOH...!!

DO NOT LET Dragon & 3iii TO DO THIS TO U, LIKE WHAT HAPPEN TO AHMOI LOH...!!

DO NOT LET PONDANS....PONDAN U LOH...!!

The Voice of Reason, never listened to but Put to Blame

Posted by 3iii > Jan 2, 2018 10:20 PM | Report Abuse ![]()

>>>>Henyuan Good people with good intention to help others like stockraider and probability will earn a lot in stock market, good karma for them like sifu OTB. 3iii is sick with evil intention, that's why he told ah moi to sell at 3.60. Very bad karma. Whoever is sincere amd honest in this forum, many i3 members can feel it. 3iii you must ask yourself why people HATED you so much in the first place?

02/01/2018 21:52<<<

It is not over until the fat lady sings.

Let me decipher your post.

Good and bad people.

Hated you.

Don't you think this has a lot to do with your perception?

If you focus on the issues, you will not need to feel like so.

There is a group of people who discussed that hengyuan is great and is worth $32. There is another group (maybe smaller) who think that hengyuan is doing well today but its earnings may not be sustainable and is worth a certain valuation. If you look at this from the issues discussed, you do not need to be personal.

So, I suggest you examine your own thinking.

Tan KW | Publish date: Fri, 29 Dec 2017, 04:27 PM

Don't be misled, Hengyuan is no Nestle, Dutch Lady, BAT. Not even Oldtown. It is not even Top Glove or Hartalega or Airasia. Hengyuan is Not near.

In investment, the most popular word as provided by Warren Buffett is the "moat" - which means certain strength - being special i.e. in another words think of it as a brand cult aka Nike, Nestle (Milo, Nescafe), Starbucks, Google, Facebook. In those companies, we do not even look at NTA value.

What is Hengyuan? Before the rapid share rise - less than 10% in Malaysia I guarantee would not even heard of the name. It has a 10 year supply contract with Shell. Luckily, at this moment due to global oil supply constraint, margins for refineries (oil processing) has gone sky high. That is in playing cyclical stocks, and one gets lucky or may not through luck but perhaps some level of manipulation these stocks goes up. Sometimes certain companies may see profit performance goes up but the share price does not rise the same.

A Nestle or Dutch Lady has sustainability. They can control their own destiny. They can control supply i.e. in Nestle's case milk, coffee beans, cocoa and put back the price control into the market i.e. consumers like you and I. Companies like Nike for example may price their products much higher than a much lesser branded goods, but they still sell. There are still people who buys.

Hence, companies like Hengyuan will not get the 30x PE. This is crazily manipulative. Nike, Nestle, Dutch Lady, Maxis can get the 30x PE.

The Lesson to learn from all this

probability

ok the objective is to sleep well at night..zzz

2019-01-26 17:30