How To Survive The End Of The World

Philip ( buy what you understand)

Publish date: Wed, 25 Mar 2020, 04:24 PM

Hi to all investors on I3,

This is Philip here.

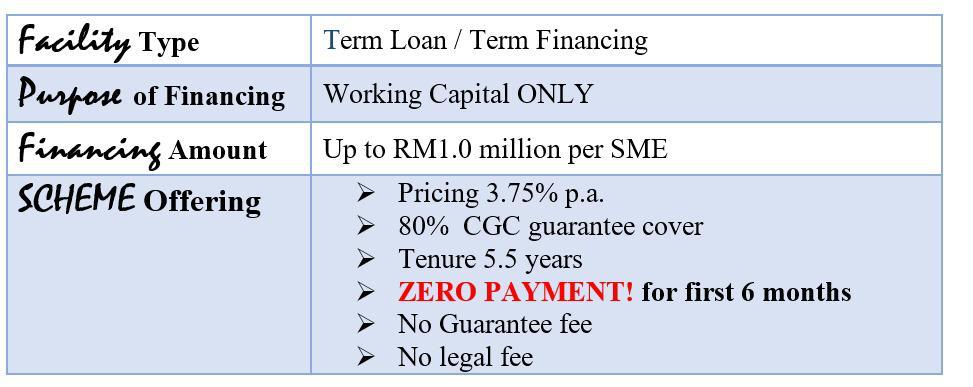

I would first like to humbly apologize and empathize for all the sufferings that we are going through during this Covid-19 crisis. As I have previously mentioned before, I have received a special loan as part of the SME to survive through this trying period. I have also previously extended this loan of 3.75% to individuals who are unable to get the loan approvals from various banks. Sad to say, it was quickly filled up with many in need of financial assistance. My apologize to those who have sent in their applications, I am very sorry that I was not able to come to your aid.

However, it seems that Bank Negara has also come to see the need to keep the economy going and have directly put in more cash into the market, via assistance from local banks.

Among them,

The key detail here is no collateral needed, and zero payment for the first 6 months. Simplified, these are exactly the terms that are needed to keep everyone alive instead of more debt difficulties. Plus, no legal fee, no guarantee fee. I would applaud the government for the action taken. And I would advise anyone with the ability to service the loan in the short term to take it up, as much as you can.

Do not fear the generation of debt. Fear only the generation of debt to purchse frivoulous items or bad investments. If you are sure that you are putting money into good investments, then debt can be the thing between surviving the end of the world, or failure.

More breathing space. The government is pulling all the stops to give us liquidity by controlling the banks to give us 6 months of living space. Bad news for the banks (6 months can be very bad for a retail lender like public bank and maybank on their loan interest profits).

But this is only half the story.

Now that you have bought yourself time with borrowed money (and borrowed time). You need to make the best of your opportunities. With some liquidity, we need to chase long term alpha.

What stocks to buy? More importantly, when should we buy them?

This is going to be a crisis where ALL stocks, no matter good or bad, will be badly affected. Companies with bad results, good results, will all suffer unexpected results on the share price which will have no relation whatsoever with the current business fundamentals or long term results. So if you buy, do not expect just because you are buying it cheap, that it will go cheaper.

The first critical question: When should you be buying stocks. The obvious answer is of course: at its LOWS. This only applies if you have a crystal ball or your future self goes back from the future and tells you what to do. For the rest of us who are not so lucky, you can only rely on rationality. How do we apply rationality to business? It is the same as if you were to ask your boss the following questions.

1. Will your boss pay your salary this month ( how much CASH/ DEBT does the stock have)

2. Did everyone rush to place in the order before the lockdown? (how much demand is in the market for the product, did revenue drop or remain steady or increased during the past 1 year?)

3. Did your boss cut salary or force unpaid leave this month? ( how confident is the stock in itself aka buy back shares, give out dividend)

4. Did the company lose money or boss snappish this month? (what is the history of losses for the company and how is its quarterly performance historically?)

5. Did any of the bosses catch the virus and is in critical care? ( Was there any structural or fundamental problems in the company that is causing the long term prospects to be dim).

By using scuttlebutt and understanding that stocks are not just a piece of paper or a ticker symbol, but are actually part ownerships of a business, one can put real world applications and valuations to understanding what stocks and businesses to buy. As someone who has been through multiple crisis and stock crashes, all I can tell you is this. There will always be a cycle of occurences, and wonderful businesses cannot be put down forever. The sun will shine again, they will find a cure, and business will return and flourish even more.

Until then,

Keep safe and keep buying and holding wonderful businesses.

More articles on the bursa journey that worked for me. 2000-2019

Created by Philip ( buy what you understand) | Oct 29, 2024

How to invest in Bursa Malaysia long term.

Created by Philip ( buy what you understand) | Dec 07, 2022

Created by Philip ( buy what you understand) | Mar 02, 2020

Created by Philip ( buy what you understand) | Jun 30, 2019

Created by Philip ( buy what you understand) | May 20, 2019

Discussions

some say buy wonderful business but wonderful business never fun to trade

2020-03-26 14:03

I give u an alternative..... Scib and Kpower are affiliated to a wonderful business but not wonderful as yet... and also fun to trade.

2020-03-26 14:06

Scib and Kpower gave u the best recovery and earliest recovery..... good reasons for that

2020-03-26 14:07

people think share prices of wonderful business first to recover.... but no. why Leh? because maybe there is no really wonderful business in Bursa

2020-03-26 14:10

market telling u a bottom has been found..... but the rally cannot and will not be led by blue chips..... the market has changed fundamentally

2020-03-26 14:13

traditionally market recoveries are led by banks and good wonderful businesses..... but this cannot be the case anymore

2020-03-26 14:15

haha,

someone already "sailang" or all in with K-factor stocks now trying hard for someone to buy high from his hand so that he can have some capital to trade again.

2020-03-26 14:17

that is where is Scib and Kpower found their niche.... they really are not even in business

2020-03-26 14:19

ss

don't like scib and kpower nevermind.........

i teach u how to fish, u can go fishing yourself..................

2020-03-26 14:25

then either stop trading,

or trade but trade to own strength , ....never pretend to be somebody u are not..................................

2020-03-26 14:40

YOU BETTER STOP THIS UNLESS YOU GOT MONEY LENDER LICENSE!!!

YOU CAN BE REPORTED

LICENSING OF MONEYLENDERS

5. Licence to be taken out by moneylender 5A. Application for licence

5B. Grant of a licence

5C. Duration of licence

5D. Conditions attached to licence

5E. Renewal of licence

5F. Requirement to display licence

6. Particulars to be shown on licences

7. (Deleted)

8. Offences 4 Laws of Malaysia ACT 400

http://www.commonlii.org/my/legis/consol_act/ma19511989233/

2020-03-26 14:56

Philip ( Write To Me If You Need Help)

Sorry, I dont like those 2 companies, I have gone through it already. too manipulated.

>>>>>>>

Posted by qqq33333333 > Mar 26, 2020 2:07 PM | Report Abuse

Scib and Kpower gave u the best recovery and earliest recovery..... good reasons for that

2020-03-26 14:58

philips............not for u lah............

for people curious to know why SCIB and Kpower..............

2020-03-26 15:00

Philip ( Write To Me If You Need Help)

The agreements were structured as a bond holding agreement. Personal lending agreement. In either case, we have already used our 15 million to help very resourcesful individuals and hard working families from bankruptcy. The clarion call by the government forcing the banks to do the same thing(with 6 months moratorium of payment) is exactly the same thing I would do in their position (i gave them 1 year before paying me back, while I paid the banks first on their behalf).

I highly doubt I will get sued, as I am not earning a single cent, not making a profit, and taking all the risk by guaranteeing the payment to the banks on behalf of those individuals caught during the worst period in recent years.

In other words,

I would rather use 15 million to help malaysians, then put a single cent into your netx and buy 50% ownership of the company.

Netx is a trash company speculated by pump and dumpers like you.

You are a disgrace to christians.

And a lousy investor too.

FYI, I have made doubly sure that every borrower is able to feed and pay the salary of the hundreds of workers under them, and of course, every company that borrowed is of a strong work ethic and has a good strong long term future.

Unlike NETX and Calvin Tan.

>>>>>>

Posted by calvintaneng > Mar 26, 2020 2:56 PM | Report Abuse

YOU BETTER STOP THIS UNLESS YOU GOT MONEY LENDER LICENSE!!!

2020-03-26 15:05

THE END DOES NOT JUSTIFY THE MEANS

THINK ROBINHOOD OK TO ROB RICH HELP POOR?

YOU HAVE DONE ILLEGAL THING AND STILL WANT TO JUSTIFY IT?

2020-03-26 15:08

Philip ( Write To Me If You Need Help)

Did you see Yinson revenue this quarter? that is no error. Lease for FPSO Helang started this quarter, profits and huge earnings to come soon, when billings are up.

>>>>>>

qqq33333333 in the era of corona, every sector is damaged.

26/03/2020 2:17 PM

2020-03-26 15:11

yinson business model do not include US$ 20 oil...................

at his rate, they better off sleeping than doing business.

2020-03-26 15:35

Philip ( Write To Me If You Need Help)

What cartoons have you been watching? What robbing rich? Came me one rich person I am robbing? You are fraud using church to collect money from families for your own nefarious purposes using the name of God.

Shame on you. When people call and need help you talk about useless brainless things.

What end justifies what means?

If we can help people to turn the corner and recover from corona viruse, then it is the right thing to do.

Unlike you leading people into NETX knowing full well they will not benefit from NFCP and it will be delayed until the crisis is over and economy can recover.

Just look at the stimulus projects announced for Sabah and Malaysia today.

Now is not the time for frivolous investments when many small companies lives are at stake.

NFCP?

Not

For

Calvin

Profit

>>>>>

Posted by calvintaneng > Mar 26, 2020 3:08 PM | Report Abuse

THE END DOES NOT JUSTIFY THE MEANS

THINK ROBINHOOD OK TO ROB RICH HELP POOR?

YOU HAVE DONE ILLEGAL THING AND STILL WANT TO JUSTIFY IT?

2020-03-26 20:46

@ Philip

Could you enlighten us on why you think Scib and Kpower is over manipulated?

2020-03-27 12:51

I thought it would be very obvious. Microcap stocks with valuation of USD 25-30 million. With revenues and earnings with no historical basis of growing earnings and revenues jumping to incredibly high PE's with not so amazing results. Cash flow, debt, return on equity, contract awards all give indication of manipulation.

Those are the companies that I totally avoid. Not because it is not a money earner, but because illiquidity, small valuation and the lack of long term results are a recipe for trading that gives big results and bigger losses that cannot be predicted.

I don't know how to make money from stocks like these, so I prefer to keep to my area of competence.

2020-03-27 15:23

Posted by Philip ( Dr. Fauci my Hero) > Mar 27, 2020 3:23 PM | Report Abuse

I thought it would be very obvious.

=========

we call it factor X............don't know what u call it..............

2020-03-27 15:29

Hi Philip,

I have learnt a lot from your comments and blogs. I share your life philosophy of hard work,honesty, life time learning and knowledge sharing. Thank you.

2020-03-27 18:38

Dear Philip,

Since you are familiar with oil and gas O&M operation, can I ask you the following questions?

Refer SERBAK financial end 31th Dec 2018

Total workforce as at 31th Dec2018: 1,242

Q1: Total revenue: RM3.28 billion or revenue: RM 2.64 million per workforce is this possible for O&M?

For financial year end 31th DEC 2019

Cash and cash equivalent: RM 1,306,590,000

Loan and borrowing: RM 2,946,699,000

Net proceeds from Sukuk: RM 1,211,478,000

Q2: What is the purpose of fund rising from Sukuk to end up as Cash and Cash equivalent?

Q3: Do you know what Serbak going to do with cash hoard of RM 1,306,590,000?

Refer

https://klse.i3investor.com/servlets/stk/fin/5279.jsp?type=last10fy

Can a company doing RM 1,408 million in 2016 growth so fast to RM 4,528 million in 2019

Thank you

2020-03-27 21:00

Comparing 2 similar companies which I used to deal with in baker Hughes and Schlumberger in Labuan and Brunei

In the same period,

Schlumberger had 32.8 billion USD in revenue on 67,000 staff.

Baker Hughes did 22.6 billion USD in revenue on 49,000 staff.

For the same job scope of oil field services team. I would say it is very possible and reasonable considering Serbadk is a fully bumiputera team compared to European resources.

>>>>>>

Refer SERBAK financial end 31th Dec 2018

Total workforce as at 31th Dec2018: 1,242

Q1: Total revenue: RM3.28 billion or revenue: RM 2.64 million per workforce is this possible for O&M?

2020-03-30 20:20

In that same period USD MYR exchange rate went from 3.8 to 4.4. their growth went from 400 million USD to 1 billion USD in 3 years, which is not that much considering Schlumberger and baker Hughes both left qatar as per requirement from Saudi to continue doing business with them. So currently now Serbadk is basically having a monopoly there in terms of business ( their biggest growth market).

If you consider Malaysia devaluation, a ride in orders in USD denomination is not a lot.

Q3: Do you know what Serbak going to do with cash hoard of RM 1,306,590,000? 300 million USD is a cash hoard? Expanding facilities, buying equipment and getting a workshop ready, the money will disappear in a blink of an eye.

>>>>>>>>>>

Can a company doing RM 1,408 million in 2016 growth so fast to RM 4,528 million in 2019

2020-03-30 20:53

Philip ( Write To Me If You Need Help)

Looks like we are turning the corner, stock market is up big.

2020-03-26 13:19