MARKETS CAN STAY IRRATIONAL LONGER THAN YOU CAN STAY SOLVENT, SO WHAT TO DO?

Philip ( buy what you understand)

Publish date: Mon, 09 Mar 2020, 04:14 PM

Dear new and old investors,

READ THIS BEFORE YOU PANIC AND START SELLING YOUR STOCKS!

Today there are a lot of rumours and market drops due to factors which may not even effect your businesses.

The following combination of 4 horsemen:

1. USA-CHINA trade war. (WAR)

2. CHINA COVID-19 VIRUS.(PESTILENCE)

3. MALAYSIA POLITICAL CRISIS. (DEATH)

4. RUSSIA REFUSAL TO CUT OIL PRODUCTION (FAMINE)

The big news today, https://www.bloomberg.com/news/articles/2020-03-08/oil-in-freefall-after-saudis-slash-prices-in-all-out-crude-war

Yes, oil price has dropped by 31% due to the OPEC disintegration as Saudi Arabia and Russia begin their battle to cut production. Russia has flat refused, possibly aiming to kill the USA shale oil producers with low prices in a price war to end all price wars.

What does that mean to you as an investor in Bursa Malaysia?

If you think about it using qualitative data,

https://www.treasury.gov.my/pdf/budget/budget_info/2019/revenue/section2.pdf

the petroleum revenue for Malaysia in 2019 is 18 billion or 6.9% of the entire federal government revenue. Of course this is not the full picture, as you also have 59.5 billion of investment income from dividends etc what makes up 22% (not all are oil and gas related). This is from a total revenue of 261.8 billion ringgit in 2019.

This tells you that, unlike countries like saudi arabia and brunei, Malaysia is a multi pronged country with many sources of income.

No need to jump of the roof or expect a bankrupt country.

So, firstly, we need to understand our malaysia government expenses.

"Total government expenditure is forecast to be RM297 billion in 2020, compared with RM277.5 billion in 2019. Total government revenue is expected to be RM244.5 billion in 2020, an increase of RM11.2 billion from 2019; however, if including the RM30 billion special dividend from PETRONAS in 2019, revenue is down 7.1 per cent in 2020."

Here we are looking at a few major problems with expenses versus revenue generation, meaning many projects will not have the budgetary to be expensed in 2020, as revenue will be much lower than the 244.5 billion expected in 2020, and a a deficit of almost 50 billion that needs to be addressed somehow.

This is the reality of the situation.

As a retail investor, you may have been caught unawares, and panicking as the share prices drops to incredible lows as everyone is trying to conserve cash and maintain business liquidity in this trying times. As you have no way to predict the FUTURE, all you can do is monitor quarter to quarter and plan your investments accordingly.

Here is my advise:

1. Everything is going to be cheap, so plan your investments carefully. Understand your businesses carefully. Choose those that have very strong cash positions, a strong history of 10+ years of profitable growth. A market or customer base where they have a market competitive advantage.

2. Avoid companies which do not have a strong cash position, have short term projects that rely on the price of oil, or projects that depend on government connections to win.

3. The first rule of investing is to NOT lose money. The second rule of investing is to follow the FIRST rule. Avoid usage of margin investment in averaging UP. Only consider usage of margin when averaging DOWN. The folly of this method of averaging up (win big lose big) by Mr KYY should be more than enough to dissuade you of this investing method. Martingale system is not for the faint of heart, nor for the intelligent investor. Always be prudent and buy quarterly after understanding the financial report. This way, if you made your investment decision correct at the first time of purchase, then any subsequent drop of price (but not of long term business fundamentals) should only give you more confidence to your analysis (assuming the fundamentals do not change).

4. Investing over the long term should be as boring and standardized as possible. Let profits take care of themselves. As long as you pick good boring but hyper efficient companies, you will do well. That reduces your margin of risk in changes in business fundamentals. I find that my best longest term investments are firstly in companies in very predictable and simple to understand businesses, and secondly they are the best at what they do in that industry. You have to pay more to invest in those companies, but I find it becomes worth it, especially when you can buy more during downturns.

Examples of companies that I have held for more than 5-10 years

- Public Bank ( very simple structure, no big corporate or investment banking to worry about. Just pure hire purchase, individual mortgage backed by huge collateral. The best savings and fixed deposit holdings base in Malaysia).

- QL Resources (Chicken and eggs. Huge market and easy to understand. But the outperformance is legendary, especially when they grow organically from just feedmill operator, then adding chicken and eggs to feed their operations, then adding fishmeal and surimi for grow the feed market, then moving into fish farming and seafood catching and freezing operations, then expanding farming activities into palm oil plantations and finally no into owning family mart end user retail. No other chicken and egg company in malaysia is that efficient in growing organically as most take the easy way and pump retained earnings into property development.

- Topglove ( it doesnt get easier to understand than producing rubber gloves). 25% of world market, currently tripling its capacity to produce nitrile gloves.

- Yinson (bus operator turned into barge operator producing and transporting oil barrels over a 25 year contract period. Nothing to do with selling oil and producing oil unlike bumi armada or sapura. Just simple, basic shipbuilding, operating and freightworks)

5. Don't go for the long big bet or the speculative deals. Many investors lost money on gambling projected scenarios from hengyuan and sumatec over a few quarters of good results but fail to see the overall long term business fundamentals. If it sounds to good to be true, just shake the hand of the guy who made millions from it and wish him well. Don't compare your bowl and his bowl to see how much you "could" have made if you bought. Instead consider the risks involved qualitatively (not quantitatively), ever seen a dead cat bounce? Neither have I.

6. Do not avoid the oil and gas industry. The fact remains, the best time to buy a stock is when everyone is leaving it. There are many companies that have a wonderful long term business fundamentals, but are covered in dirt when that rising tides that raises all boats go out. But that big boat is still there, and when the tides comes back (dont worry, it always does), those that bought those wonderful companies at cheap prices will never regret it. Years later, many will bemoan the fact that "Oh! If only I bought Apple at 7, Bank of America at 2.50, Amazon at 15."

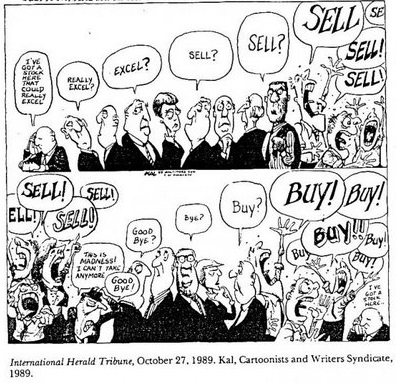

7. The biggest rewards go the rational investor, not the ones that run around screaming in panic all of the time. As long as you bought a wonderful company at the fair price when you first bought it, when the price drops you will be more than happy to collect more of it. Those that buy bad companies with lossess on quarters, no dividend, high debt with the assumption that they will suddenly outperform and have good results in the future based on speculation will not have a good weekend.

I hope you stay sane and rational,

Philip

More articles on the bursa journey that worked for me. 2000-2019

Created by Philip ( buy what you understand) | Dec 07, 2022

Created by Philip ( buy what you understand) | Mar 02, 2020

Created by Philip ( buy what you understand) | Jun 30, 2019

Created by Philip ( buy what you understand) | May 20, 2019

Discussions

one more thing.....talking with stocks is better than talking heads talking in very general terms about wallen the bufalo and long term investing........... when already clearly drowning in troubled water...................

2020-03-09 16:36

Paper loss is fine as long as you have sufficient funds to add and switch around. If those who use margins then sayonara!

2020-03-09 16:50

Nothing is cocksure in the market whether based on FA or TA. Respecting Mr. Market is the best way for survival to minimize risks exposure unless you got plenty of money to invest.

2020-03-09 16:55

Up_down > Mar 9, 2020 4:55 PM | Report Abuse

Nothing is cocksure in the market whether based on FA or TA. Respecting Mr. Market

=============

there is nothing wrong with charging in , when it is time to charge in.................and charge out before everybody also want to charge out through a narrow door...............

market easy or hard?

https://klse.i3investor.com/blogs/qqq33333333/2020-03-09-story-h1484773483-stock_market_all_about_attitude.jsp

2020-03-09 17:01

Haha qqq3,

I just withdraw one of my FD due on 9/3/2020. Tomorrow which stocks to buy?

2020-03-09 17:09

Many investors love watching or reading the news from the official medias trying to get in touch with the market trend. It has become an obsolete idea to do so.....how to escape before market crashing whilst majority of the people doing the same thing? ...Must watch and read unofficial news to get in touch with the real situation development. It will not be 100% correct but it provides certain high degree of reality of the information.

2020-03-09 17:15

I am shocked,

shocked that the KGB and Putin took so long to arrive at conclusion

and decide that in centralised planned economy, Russia's production cost = Zero

cost of printing of money is easy.

any additional USD can be used to import food and other products into Russia.........

2020-03-09 17:20

Philip ( 2.3% fatality rate, 80% recovery rate age 10-40)

If you thought insas was a good buy at 1.00, there is a 30% discount for you now.

>>>>>>>>

Sslee Haha qqq3,

I just withdraw one of my FD due on 9/3/2020. Tomorrow which stocks to buy?

2020-03-09 18:24

Just close your eyes n sapu any counters bcos the whole mkt is very chip now.

2020-03-09 18:27

Sslee Haha qqq3,

I just withdraw one of my FD due on 9/3/2020. Tomorrow which stocks to buy?

===================

my daughter asked me same question............my response via whatsapp.........

"long term buys................u can take your time............no need hurry."

this is time for traders....................

shares I bot this morning.................Kpower, xxx, xxx, Topglove, supermax...........................

2020-03-09 20:03

Philip ( 2.3% fatality rate, 80% recovery rate age 10-40)

When traders start losing money, then they start becoming long term investors.

I don't see any problems, if you buy wonderful companies you will see the share price will be more crisis proof versus speculated ones.

QL was 6.90 last year, now still holding steady at 8.

Topglove dropped to 4.5 last year, now up to 6.11.

Yinson last year my lowest purchase was 4.09. today still at 6.

Stoneco was 20, today still at 36.

Magni was 2.02, today still 2.09 and enjoying dividends.

Liihen was 2.62, today still at 2.68 and enjoying dividends.

Contrast that to companies that are speculative, with huge debt and high interest payments or buyout plays which didn't happen.

Sapura - 30 cents to 10 cents.

Armada - 23 cents to 16 cents.

Insas - 78 cents to 68 cents.

Bjland - 28 cents to 16 cents.

The fact remains, during good times a lot of speculation on stocks so many share are buoyed by sentiment. During bad times, then suddenly everyone looking for security and safety, and everyone looking for the floatation device.

That is why I always ask investors to buy into wonderful companies ( they always reply everyone got their own methods of making money). During good times everyone complains about the good companies as overvalued and can make monies with speculating penny stocks. However, it is during the bad times that you see the power of investing in wonderful companies.

So continue buying good companies at low prices instead of bad companies at rock bottom price.

As for gkent and Pchem,

Gkent and PCHEM still having good dividends and share buyback, so sleeping well at night should not be a problem.

2020-03-10 08:28

Dear qqq3,

"long term buys................u can take your time............no need hurry."

Your advice noted with thank. Will standby 500K in my hlebroking trading account and waiting for buy signal to emerged. No hurry.

2020-03-10 08:34

Remember Yinson is not a wonderful company loh...most of their client production cost above USD 40...u think they don play tricks on yinson in order to survive loh ??

Some more Alot of Yinson project are at preliminary pre production stage with no income (meaning yinson spend on huge capex but customer just relax loh!} thus it is no brainer to just cut or defer on these contracts mah....!!

As yinson is overvalue...u know what is going to happen on its share price going forward loh...!!

Run b4 EPF stop buying mah....!!

Posted by Philip ( 2.3% fatality rate, 80% recovery rate age 10-40) > Mar 10, 2020 8:28 AM | Report Abuse

When traders start losing money, then they start becoming long term investors.

I don't see any problems, if you buy wonderful companies you will see the share price will be more crisis proof versus speculated ones.

QL was 6.90 last year, now still holding steady at 8.

Topglove dropped to 4.5 last year, now up to 6.11.

Yinson last year my lowest purchase was 4.09. today still at 6.

Stoneco was 20, today still at 36.

Magni was 2.02, today still 2.09 and enjoying dividends.

Liihen was 2.62, today still at 2.68 and enjoying dividends.

Contrast that to companies that are speculative, with huge debt and high interest payments or buyout plays which didn't happen.

Sapura - 30 cents to 10 cents.

Armada - 23 cents to 16 cents.

Insas - 78 cents to 68 cents.

Bjland - 28 cents to 16 cents.

The fact remains, during good times a lot of speculation on stocks so many share are buoyed by sentiment. During bad times, then suddenly everyone looking for security and safety, and everyone looking for the floatation device.

That is why I always ask investors to buy into wonderful companies ( they always reply everyone got their own methods of making money). During good times everyone complains about the good companies as overvalued and can make monies with speculating penny stocks. However, it is during the bad times that you see the power of investing in wonderful companies.

So continue buying good companies at low prices instead of bad companies at rock bottom price.

As for gkent and Pchem,

Gkent and PCHEM still having good dividends and share buyback, so sleeping well at night should not be a problem.

2020-03-10 08:34

haha Philip,

Please read INSAS Financial Report. Insas is cash rich. A lot of dividend and interest income. Dividend 2 cents and will ask for more.

Also check QL Financial Report. How much debt and financial cost per year?

2020-03-10 08:38

MARKETS CAN STAY IRRATIONAL...by irrational, u mean drop too much? How about irrational exuberance?

market hard or easy?

https://klse.i3investor.com/blogs/qqq33333333/2020-03-09-story-h1484773483-stock_market_all_about_attitude.jsp

the 4 horsemen....did it come out of the blue?

with the shutdown down of entire China, airlines stop flying, no need brain also know oil price under pressure.

political chaos in Malaysia, people calling it potential failed state.

smart meh if no proactive selling in last several weeks?

market hard or easy?

2020-03-10 09:44

nobody will ever warn people to take proactive steps against bear market.......never.....

everybody will tell u about wallen the bufalo.

is that the only way to play share market?

2020-03-10 09:47

several weeks ago......I made the comment that I may sell my scib and Kpower....but don't expect me to use the money to buy any other shares, sell and go cycling , don't even look so as not to be tempted.

That looked like an inspired piece of writing...before the big crash.

I wished I had followed my own advice to the letter...but I didn't.

10/03/2020 10:02 AM

X

the camel's back has been broken................what is the best thing to do?

when the back is broken, it will not be the same for a long long time.

I don't think trading is advisable....go cycling and don't even look probably is best advice for most..................................

10/03/2020 10:05 AM

2020-03-10 10:06

a lost is not a lost until u sell them...........

good attitude or not?? true or false?

2020-03-10 11:18

TopGlove, Harta, ..........pretty little can go wrong.........

scared of over - valued?

scared of profit taking?

scared of exit of funds?

exit of funds, I have no control.

but exit of funds every thing also die.

but export counter and gloves ( nitrile) means super profits coming........

2020-03-10 12:37

stock market.............hard or easy?

I have Super max and Top glove.................3 months money.............if I make money on Supermax, Top glove, 3 months money...........it proves, once again, stock market is easy...................

2020-03-10 12:47

Philip ( 2.3% fatality rate, 80% recovery rate age 10-40)

If you dont understand how their contracts are structured please dont comment. It is written clearly and binding contract, before project begin the client will advance payment to buy the ship for conversion (sunk costs already paid), in eventuality of contract dispute, yinson will own the FPSO plus the penalty of early termination fee.

https://www.offshoreenergytoday.com/yinson-gets-fpso-contract-termination-notice/

They used the free FPSO and the advance cash from nippon JX to do conversion for FPSO helang in malaysia.

So who is the fool now? The contracts is straightforward and not based on production, just a simple delivery and transport.

You think Yinson business model like your sapura? Think again loh. Sapura income based on production, share sales per barrel of oil sold. Yinson business model is straight 10 year/25 year contract, per day rate for delivery, with O&M services optional and separate calculate.

Tell me I am wrong.

>>>>>>>

stockraider Remember Yinson is not a wonderful company loh...most of their client production cost above USD 40...u think they don play tricks on yinson in order to survive loh ??

2020-03-10 17:02

Just remember Armada also know how to structure contract previously b4 crude oil price collapse, but in the end the customer always look at any area & loopholes that they can escape from the contract obligation, when they knew they will lose monies if they honor the contract mah...!!

The same thing will apply to this Yinson this time mah....be prepare for potential impairment losses due to contract termination coming soon loh..!!

The key is, can yinson survive, after signing & borrowing billions to build fpso, when their customer refuse to honor leh ??

Very dangerous situation for yinson mah....!!

2020-03-10 19:25

Philip ( 2.3% fatality rate, 80% recovery rate age 10-40)

What do you mean armada know how to structure contract? Read back again, they have the exact same contract details as sapura. Look at their Claire. Same contract. You compare that with yinson contract and tell me it's the same thing.

Don't be stupid, read first then say. You always like to say say before verifying, very dangerous like that...

2020-03-10 21:29

Philip ( 2.3% fatality rate, 80% recovery rate age 10-40)

Stop beating a dead horse and be fair.

QL debt and financial cost is being used to fund huge growth. The return on assets and equities justifies it. It is not like lhi or layhong or insas where ever cent spent produces negative returns, failed businesses and lossmaking projects.

This is the reality.

The simple fact of why QL is stable and INSAS is not is because one has a much brighter long term business prospects than the other.

One is targeted to build 1000 family mart stores after which the debt and financial cost will be paid from the earnings and continuously making profits. The other cannot grow tribecar without losing money, cannot build a new dome outlet without losing money on each new shop cannot grow biotech business because revenues not enough to cover expansion.

Just answer this: why in the last 5 years insas share price, revenues and earnings going down and stagnate, while ql share price, earnings and revenues going up?

Simple answer.

Public expectation. Is it justified?

Based on past results, very justified. Ql has been increasing revenue every year and growing net assets.

Simple question to you: who will you support?

The rich spolit kid with 1.7 billion trust fund but only use inheritance money to spend buying frivolous things while waiting for trust fund?

Or the hardworking kid who built 1.7 billion assets out of nothing, has 4 billion revenue every quarter, profitable every year, and tells you trust my performance, I am not done yet, I have more I want to do. I want to double my quarterly revenue to 2 billion and double my earnings.

>>>>>>>>>>

Sslee haha Philip,

Please read INSAS Financial Report. Insas is cash rich. A lot of dividend and interest income. Dividend 2 cents and will ask for more.

Also check QL Financial Report. How much debt and financial cost per year?

10/03/2020 8:38 AM

2020-03-11 06:44

Philip ( 2.3% fatality rate, 80% recovery rate age 10-40)

Here is the thing about financing debt and financial costs for growth. Is it sustainable? Is the growth in revenue per dollar spent making sense?

And here is the thing about depreciation and amortization. Capital expenditure and assets that you need to understand, and I am sure you do.

Accounting land versus real world.

1. What is the value of an apartment in the middle of nowhere? You build it, it is valued on the books at 200 million. Every year property price goes up.But no one buys it, no one rents it, no one wants it. So, can it be worth 200 million in real world? No. It is worth whatever anyone will pay for it.

2. What is the value of a palm oil mill built in the middle of nowhere? You build it, it is valued on the books at 200 million. Every year it depreciated and is amortised. But everyone needs it, if will run and maintained will bring you huge income and is a must have in a plantation. But after amortisation and depreciation it is worth zero. So, do you throw away your lorry after 4 years?, Do you throw away your crusher, boiler and other machinery after it is fully depreciated and amortised? What is it worth in the REAL world?

https://www.depreciationrates.net.au/machinery

Therefore, accounting value is just a guide for you to understand real world. The problem many investors have is to replace accounting figures with real world understanding.

So, INSAS has a lot of cash? Major shareholder of inari? Financial accounting left right and center? Sure, no doubt. 1.7 billion in accounting value.

Now try to step out into the real world for a bit.

What happens when major owners decide to liquidate inari immediately tomorrow to fund a new project. Will they get full value as in accounting land or only a fraction due to share price cash as in real world.

So step into the real world for a bit. Your "cash" has a amortisation cost which will be realized the moment you sell it. Therefore you real work value is only the interest you can get out of inari aka 5.9 million.

By the way, what is it doing in Australia?

2020-03-11 07:09

Philip ( 2.3% fatality rate, 80% recovery rate age 10-40)

Classic case of those who can't reach for the grapes say it is sour.

My topglove, yinson, stoneco and ql still doing super.

Your stock picks all Holland. Show me one that is still doing well in this environment. You fake Holland sifu think he knows so much but in the end knows nothing.

How is your abmb doing? Success? Iqgroup? Lctitan? SAM?

All your stocks 1 year lows.

Who is the real loser here. If you follow all my picks

Topglove

Ql

Pchem

Gkent

PPHB

Stoneco

Yinson

You would still be up during this time and have ample access to margin to buy attractive stocks.

So, shut up. Everyone at abmb already cursing your mother.

I'm still profitable.

>>>>>>>

con8888 QL growth fuelled by debt

Classic growing itself into bankruptcy

11/03/2020 6:52 AM

2020-03-11 07:39

Dear Philip,

I agree:

MARKETS CAN STAY IRRATIONAL LONGER THAN YOU CAN STAY SOLVENT.

And MARKETS CAN STAY INEFFICIENT LONGER THAN YOU CAN STAY PATIENT

I may be no good in the game of stocks picking but I was once Business Development Manager helping Owner Boss looking at Business to buy over with Bank support.

Just a very simple test:

1. Present the last 10 year INSAS Financial result to any Bank and project next 5 year yearly profit remain (80-100 million) and the latest Balance sheet on the quality of assets and then apply for 100% bank loan to buy over INSAS

2. Do the same for QL

Tell me what will be the Result?

Thank you

PS: Please be careful with your Margin Finance. I only invest with money I can afford to lose.

2020-03-11 08:53

Philip ( 2.3% fatality rate, 80% recovery rate age 10-40)

I can tell you the result.

MGO failed.

If it was that easy to do your beloved CEO would have long ago converted warrants and trigger MGO and borrow money from Bank to buy over INSAS.

Why did they NOT do it? Cannot borrow money mah. Simple and easy and true.

If INSAS real value was 2.67 as you say, then answer me a simple question. Why did banks not borrow money to CEO to take over INSAS, do MGO and realize "true" value.

Maybe you should ask this question directly to CEO instead of asking for more dividend.

Assuming including forced selling,

600 million, at 10% the bank interest cost per year is 60 million. He owns 30%, so he only borrow and pay 40 million in interest cost per year. Take out cash and can pay everyone off. Even at rm1.80 he got money to earn.

In accounting land.

But in real world why doesn't bank borrow money to do this corporate

2020-03-11 09:06

Philip ( 2.3% fatality rate, 80% recovery rate age 10-40)

Action?

Yes you are right. Because we live in the real world. And banks see dangers which you are blind to.

2020-03-11 09:07

Dear Philip,

The MGO even at RM1.00 will definitely failed for the simple reason that the independent advisors verdict will be the offer price is unreasonable and very unfair and the BOD will concur to the advice to shareholders to reject the offer.

Once the offer failed Dato’ Sri Thong will be forbided to trigger another MGO for one year period and in this one year period any other big shark can then make a hostile take –over.

Thank you

2020-03-11 09:16

Philip ( 2.3% fatality rate, 80% recovery rate age 10-40)

So, many stories and many speculation. But fact remains. No one wants to take INSAS private.

Why?

Because INSAS is only valuable because it is undervalued. At fair value insas is worthless because no long term prospects.

Many people are willing to pay through their nose for ql, topglove and yinson.

Why?

They have shown their ability to perform historically and promise impressive long term prospects.

That is why QL is overvalued, because they know it will be undervalue 10 years from now.

2020-03-11 10:10

Philip ( 2.3% fatality rate, 80% recovery rate age 10-40)

If you don't believe me and still think INSAS is with it, by ask means use another year to prove your love and buy more of insas at discount price ( same as last year) and collect more and put your entire net worth into it.

If no conviction on the future long term prospects of INSAS, stop repeating and comparing it to QL.

You and I know which company is 13 billion and which one is 460 million.

2020-03-11 10:12

ted by qqq33333333 > Mar 9, 2020 8:03 PM | Report Abuse X

Sslee Haha qqq3,

I just withdraw one of my FD due on 9/3/2020. Tomorrow which stocks to buy?

===================

my daughter asked me same question............my response via whatsapp.........

"long term buys................u can take your time............no need hurry."

this is time for traders....................

shares I bot this morning.................Kpower, xxx, xxx, Topglove, supermax...........................

============================================

5 out of 5..............not bad, some more makes sense one............

2020-03-11 12:06

Remember for the whole 2019 insas was leading QL, now for just 1 mth in 2020 when this QL is leading...this Philip start to lansi loh...!!

Of course the table may turn, bcos we still have 9 mths to go mah..!!

osted by Philip ( 2.3% fatality rate, 80% recovery rate age 10-40) > Mar 11, 2020 10:12 AM | Report Abuse

If you don't believe me and still think INSAS is with it, by ask means use another year to prove your love and buy more of insas at discount price ( same as last year) and collect more and put your entire net worth into it.

If no conviction on the future long term prospects of INSAS, stop repeating and comparing it to QL.

You and I know which company is 13 billion and which one is 460 million.

2020-03-11 12:11

Philip ( 2.3% fatality rate, 80% recovery rate age 10-40)

Icon8888 asked a simple question, I highlight my stocks to him.

funnily enough,

PE60 stock QL - went up (23% of last year price) 6.9 to 8.11

Yinson - went up (45% of last year price) 4.43 to 6.46

Topglove - went up (45% of last year price) 4.32 to 6.28

Stoneco - went up (26% of last year price ) 31.97 to 40.31

how about my investment yesterday of 700K shares ?

PCHEM - went up (8.5%) 4.35 to 4.72

Did you LEARN something new today holland sifu icon8888?

>

What other stocks don’t get hit in this recent bear market ? Would be happy if you can highlight a few

11/03/2020 10:40 PM

2020-03-11 22:42

Posted by Philip ( 2.3% fatality rate, 80% recovery rate age 10-40) > Mar 11, 2020 10:42 PM | Report Abuse

What other stocks don’t get hit in this recent bear market ? Would be happy if you can highlight a few

===============

wrong question. The right question is not what other stocks....but who can avoid the big crashes without giving up?

2020-03-11 22:50

Philip ( 2.3% fatality rate, 80% recovery rate age 10-40)

My portfolio is still good and solid, my 700K stocks in pchem made 8.5% over the short term (I'm not sellling) as I believed I bought a good chunk during the height of the speculation on disaster.

Now the Russia has realized their mistake and caused the crash of the oil prices, they realize they can never compete with saudi arabia and middle east countries.

Middle east production cost per barrel is around USD5, no one can even begin to compete. Russia onshore is 30.

Russia has capitulated, and back to negotiation table.

https://knoema.com/vyronoe/cost-of-oil-production-by-country

2020-03-11 22:59

Hi Philip. I agree with your stock picks except Serba. I am in O&G business. I like your thorough research and definitely have same approach with stock picking. However, i might lack your detailed analysis. Now, one stock i am eyeing and wanna invest substantially is Sapura Energy for future prospect from 2023 onwards. I wanna seek your opinion on Sapura.

2020-03-14 13:50

Philip ( Write To Me If You Need Help)

In my opinion sapura energy is very complex and dangerous. Firstly if you are in O&G business, may I know which part? O&M? H&S? Production? Exploration? Manpower? QC?

In either case I repeat my previous analysis

"As you probably know in upstream business,

There is,

Engineering & construction,

Drilling and completion,

Exploration & production,

Operation & maintenance

Back in the early years of 21st century when price per barrel hit 90+, doing exploration and drilling was a very very profitable thing so do. Companies like Sapura and Armada structured very bad deals due to greed, where they had joint ventures with oil field concessionaires and countries to do PROFIT SHARING on exploration and extraction activities. As you now know, this was a very bad idea because as the share price drops, their profit margin drops. I believe their BREAK EVEN costs were something like 50 or 60 per barrel for deep water production. So as of today with advances in fracking and oversupply the price per barrel had been dropping by a very huge amount, causing huge long term losses and impairment with those companies. In the long run the price per barrel will surely recover, but like WorldCom back in the day planting undersea telecommunication cables everywhere, the one to profit in the next cycle will not be them.

Contrast that to yinson, their business model is very straightforward. FPSO charter per man day fixed contract only. Also an initial down payment to pay for ship conversion, and a fixed sum penalty in case of early termination of contract.

Very simple very straightforward. Their specialists are from Europe ( they bought over entire European company to start the FPSO business a long time ago), and they don't have to worry about the price of oil per barrel, as their contract can be bareboat charter or inclusive of operations & management.

Simple, clean and easily understandable. While Armada and sapura are hit by lawsuits ( due to not understanding what they were caught in, blinded by greed and just expanding for expansion sake), every YINSON deal is like the bus company which they started out as. Although in this case the passengers pay to build the bus, then pays a daily rental, and send in their own mechanics, conductors and driver to run the bus. Yinson jobscope is just to provide the bus. Slightly simplified, but you get the gist of it.

I like simple things that I can understand."

2020-03-25 13:53

Philip ( Write To Me If You Need Help)

Also, your concept that if the government has a large holdings in the company it will ALWAYS step in to help it out can be a very dangerous assumption if things go bad.

https://www.malaysia-today.net/2015/09/22/the-perwaja-steel-scandal/

You have to look at Sapura in totality and understand it as a business. How are its revenues structured? Where is it coming from? what are its dead weight assets (the OSVs) How efficient are its FPSO? What are the margins are they getting from their O&M, drilling and exploration profits? And most importantly, is it enough to pay their loans and debt obligations and give a profit to investors at these prices?

To simplify, you cannot look at revenue and orderbook alone to judget the quality of Sapura. Since you are in O&G business, I am sure you have been to easier to navigate locations and high risk areas? I have heard horror stories from old classmates who worked in North sea, so when you want to study sapura you need to understand a few core concepts:

1. Cost of oil extraction and production (russia is USD 30, Saudi is USD 5. Sapura so far seems to be in the region of USD50)

2. Efficiency of equipment and team (return on capital employed)

3. Profit margins and Net margin

For sapura, their quarterly revenue has remained steady around the 1.7b range quarterly. Out of this:

1. Their operating expenses were 1.69 b (very very high ratio compared to revenue)

2. Out of this, their finance cost is 150 million every quarter (meaning they have to pay 600 million in interest and debt reduction every year), not to mention taxes.

3. They have already sold many assets and profitable businesses (https://www.thestar.com.my/business/business-news/2018/11/30/sapura-to-sell-stake-in-drilling-division). Meaning they will not be growing, but are in serious cost cutting measure. When oil war is going on, how will they sell their under utilized assets?

4. How long can their cash in hand last before they need another influx either from private placements, sales of businesses and assets at force sell prices, or more debt increases?

5.Continuing operations:

Revenue Operating profits

E&C 1,592,166 16,089

Drilling 185,860 (48,151)

E&P - sold 14,277

In a nutshell, their operating profits from engineering and construction is 1%!! and their drilling will always be a negative amount. And since they already sold their profitable exploration and production to OMV ( which was supposed to be the big help), you have a company that is only hoping to survive by selling assets to people who do not want them (thus selling at cheap prices), while trying to get whatever contracts at hand just to keep going (instead of doing profitable contracts at good prices).

I think understanding the business directly, will give you a deeper outlook to the company's future, instead of just betting on the accounting land figures which can be massaged anyway you like.

Real World Numbers never lie.

2020-03-25 14:41

tough lah..............brent at less than US$ 30 sure tough..............

2020-03-25 14:44

Philip ( Write To Me If You Need Help)

that is why i like companies like serba and yinson, no relation to price of oil but a fixed multiyear contract for serevices rendered at manday labour.

2020-03-26 12:02

Up_down

Let’s see how the developments of Coronavirus in the next few weeks. The risks of locking down city in US.

2020-03-09 16:31