THE GROWTH STOCK OF THE FUTURE - HOW TO INVEST IN MALAYSIA

Philip ( buy what you understand)

Publish date: Wed, 07 Dec 2022, 05:24 PM

Hi all,

I am philip here, and again with my retorics and mental models on investment. Today we embark on a very interesting question, a new prime minister, a new unity government, and finally we reached the crossroads on the fate and future of our country.

Anwar is finally Prime minister.

Now, as things go the cabinet selection could be better (and oh so much worse), the goals now are not on collecting power or wealth but on making malaysia a country better run than the previous prime ministers, and as usual the question goes to investment and economic future of Malaysia.

As those who know how i invest, I always look for growing companies that I am able to predict with reasonable accuracy the growth of revenue and earnings over the years, and bet my horse and money that it will follow along that trajectory.

So, what do I do or think about for the long term along that trajectory. As you and I are usually minority interests in the listed company that we invest in, we have no option or choice in how the ship sails, we can only join along the ride and brave through beautiful seas, sun on the cheeks, and follow on the stormy weather and strong winds. Hopefully the ship doesn't capsize and we can arrive at our destination safely. Bearing that in mind, how do we navigate?

Mental models: Understanding the business.

What do I mean by understanding the business? I think many have made a mistake in that "understanding" a business means knowing the assets, the revenue, the profits, the liabilities, the management etc. As shown recently in my recent spectacular mistake in owning Serba dinamik, you can "understand" the business and still fall prey to simple fraud and faulty auditing and declaration. In the end, for them it is just pieces of paper, so how do we really "understand" the business?

For me it has been my lifelong lodestone to how i plan what to buy and sell. Take for example the ship analogy: Yes you cannot control the ship, but what you can do is choose to go on the ships with the track record of going there safely and with all passengers intact. So the first rule for me is to always look and all the ships going to the same destination, and see which has the better pedigree. It usually ends well. That is the first step of understanding the business: Comparative analysis.

Secondly, the one that everyone always fails to analyse in depth, usually taking at face value since it is so far away. For me it is of utmost importance, and one that I always try to get right as much as possible: TAM. Total addressable market. The key thing here though is this: in understanding TAM, one must understand the business model itself, and be able to think like a virtual CEO: how would I grow from here? For me this is what excites me in investing in companies in bursa and all of its listed and non listed companies coming in from ACE and LEAP etc. Yes you may not own the whole company, but you can become a "virtual" manager and think deeply on how a company planning to GROW into the next level should be acting like.

And the best thing about understanding a business is this: it doesn't have to be a listed company:

Observe:

This is a simple restaurant in Kota kinabalu, Sabah. Very delicious, very famous. And yet, just like any other shop everywhere in Malaysia. If you were to ask me if I wanted to invest in a business like this, the simple answer is NO! why? the chef, his recipe, his cooking etc are all his own concoction. The moment he is not working, flavour, timing etc changes, and turn the business into a bad investment all around. So, ask yourself this: What would make you want to invest in a noodle house like this?

For me: the obvious answer is opening franchises etc. That is the level 1 way of thinking, which will definitely give you a lot of trouble and make you work hard to manage all of the franchises. So for you: probably yes, for me: still no. In terms of understanding the business, what you really want to do is think of a way that if the owner is not around, the shops and franchises still thrive, and business still can grow and scale.

So, what would make me want to invest in a simple noodle shop?

Production of own handmade noodles! and selling around sabah

Production of own handmade noodles! and selling around sabah

This is how I look at investing. first try to understand a business, then build in your own mind what you think should be done for a business to go the next level. Then if you see that they are going along the same directions, and the management is able to handle the huge jump in the level of difficulty, invest more and follow. FYI the TAM for just a simple noodle shop in KK versus adding a production line and supply chain to supermarkets to sell their branded hand made noodles with no preservatives is on a totally different scale.

That for me is called understanding the business. Once you understand the business and where it should be going for it to grow in the direction you like, it is a simple matter of looking at the cash flow and balance sheet to see if the business if performing or drowning in debt.That was how I started my investment in QL, Yinson, Topglove, and now moving into Pchem, hartalega, kawan, skpres etc. I liked the business first and foremost: I understood the business model, and I liked the direction it was moving in and the growth plans.

All using the same mental models of being a "virtual manager", understand the business enough to think if I was CEO what would I do, and buying the companies that perform along the lines of what I am thinking of.

You would be surprised how useful it is, having a unobstructed 3rd party view of a business which is not directed by fear of loss or shareholder pressure or family peers, and growing just for the sake of growing without thinking about sustainability and efficiency. you may not believe it, but we common shareholders do have an advantage versus the ceos of companies and the stock analysts and fund managers who have totally different outlooks on things.

And now that the lengthy introduction into how I look at companies is over and done with: Lets go to the big issue:

WHAT, HOW AND WHEN MUST MALAYSIA CHANGE BEFORE IT WILL BECOME INVESTIBLE INTERNATIONALLY?

As it is right now, the malaysian ringgit is not accepted in many countries, and demand for malaysian goods is limited to only a few major, and more importantly our reliance on oil will end in a matter of decades which will cause more problems if we do not pivot.

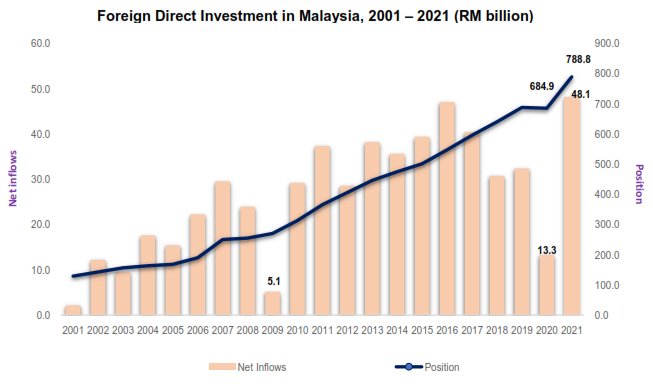

Foreign investment in Malaysia has actually recovered in recent times due to China issues with foreign investors with investors moving into SEA countries:

And yes "Mark chandran" more foreigners are investing malaysia than leaving:

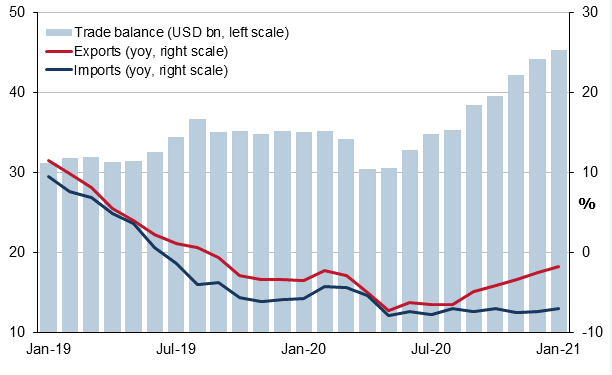

And thanks to our industries in tech, oil and palm, our export values are more than our imports which is a good result:

We have a strong balance sheet, and good trade balance. As of today the USD/MYR exchange rate:

So far from the doom and gloom that we are all facing, Malaysia still has one of the "new" 7 sisters in Petronas giving dividends, we have a good ratio of land to population (32m people to 329k KM space), we have marginal competition, lack of war and our main concern is how to be efficient in growing the country.

Now that everyone has a more or less clearly understanding of Malaysia and its salient points, as a "virtual" manager, what would you do if your were prime minister to grow and MMGA? (please no trump jokes here). The important points here is that once you see what is going on, you will be more involved in looking for what Malaysia is doing versus should be doing, and we can be part of the process of growth.

first things first: Efficiency. What do we look at when we look at efficiency? Improve your strengths, cut down on the weaknesses. This is a bit odd compared to the usual wisdom of working on your weaknesses and maintaining your strengths, but for a country like malaysia that needs to show the biggest change in the shortest period, I think concentrating on efficiency is important.

What do I mean here?

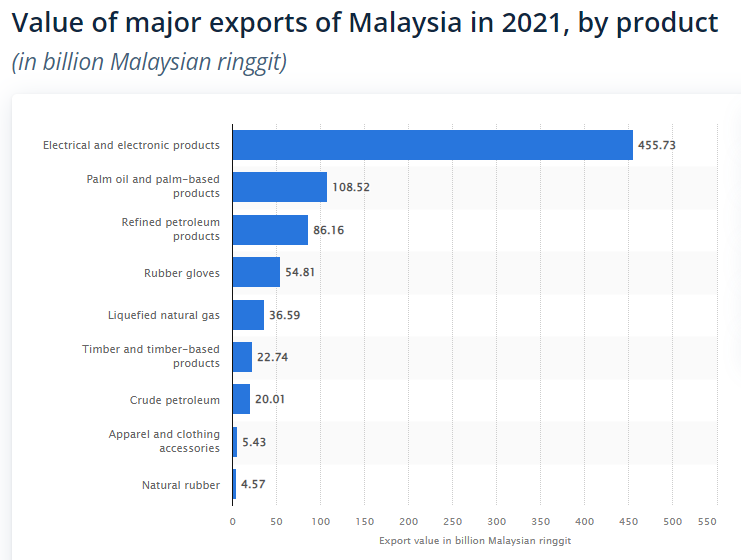

This is what Malaysia is good at. This is what we export (although services and tourism is also a huge part of our economy) but if you look at it, this is what makes us huge money for Malaysians.

In trading we have something called cut your losses, ride your winners. I think for Malaysia to have the biggest growth of revenues in in the shortest period, this is what they should be looking into:

1. We have midstream of E&E products, doing ATE and chip testing equipments. We should be looking to concentrate on this with the biggest budgets and grants into the raw material production of for faber and chip manufacturing (hydro power tapping for bakun and more into producing power for generation of silica from sabah, producing more plastics from petroleum products and aluminium for making those molds for dyson and apple etc) with full support from the government to grow out the E&E industry into full fledged upstream industries capable of making use of all the capabilities that we have today in place producing that 455billion of revenue a year. In fact, if I am economic minister, I would change the operation of Khazanah and some of the large investment portfolios of Malaysia (Khazanah = 134b, KWSP = 954b,Petronas =635b) and put 10% of their AUM (roughly 40b usd) into buying in totality a few international SP500 companies that are competing well internationally within the E&E space. What would I buy for 40b that would serve Malaysia? Strategic companies and holdings that I can then levearage Malaysia resources to share knowledge, cheap labour and capabilities. Lets forget small players like inari and concentrate on really strategic investments.

What would I buy to support this huge industry market to push forward for malaysia?

1. ADI (SP500 company selling semiconductor and chip solutions) analog devices Inc - Malaysia is not competing on the high end of semicon, which is where the big boys tsmc nvidia samsung dominate, but I believe there is still a huge market for consumer products and the mid range chips. with revenue of 12b, net earnings of 3b, and asking price of 84b, I think this is a huge strategic deal for malaysia. a 51% ownership of this company would allow the malaysia government to share resources and transfer knowldege and price control to malaysian companies that will surely benefit from a 30% yearly growth in revenue and earnings every year. Much better than investing in serba dinamik.

2. Dyson - Although I suspect James Dyson will never sell this company, but a huge grant from Malaysian Government and a 51% ownership interest in this company which makes 7.3b and with earnings of 1.5b I think would make a huge synergy for Malaysia and its budding manufacturing talents. With the help of Malaysian resources, I think offering a 51% stake for 18.75b (PE25) would be a fair price and wonderful link to grow malaysia further. James dyson of course holds full creative control.

3. Johnson Controls (JCI) - In terms of strategic holdings, owning this company at 45b (or 51% for 25b) would be a very strong benefit for Malaysian companies that goes for the future of IOT, sensors, HVAC, controls etc due to Malaysia connections with other arab countries as well as the patent holding of JCI. Yes it may no longer be as profitable as before due to pricing expectations and competition, but I believe relocating JCI facilities to Malaysia as the producer of all the automation control equipment with the strong reliability and quality control that Malaysian companies have is a home run in terms of pushing Malaysia further in the export of manufacturing equipment space.

4. KLA corporation (KLAC) - If you wanted to build a new seven sisters in malaysia that can compete with Petronas, I think KLAC is the way to go. If you take all the vitrox and greatec and inari etc and put them together and work with KLAC, I think owning a 51% share of this 54b giant will be an excellent choice to push the local semicon industry forward.

5. Western Digital (WDC) - Instead of asking them to come invest in Malaysia, I personally think we should just buy the company at 10b which is a steal for a company that made 19b this year and gave you earnings of 1.5b. I think there is still a future for HDD and a market where Malaysia seems to be making its money. By simply buying over this company and relocating the resources and production to Malaysia, I think we can push more startups and profits into making a better push ahead. And by building a Malaysian R&D center in Sarawak together with cheap labour and trasnportation to China and Hongkong as well as consistent and huge power from Bakun Dam, I think we can get even more leverage and power to grow the business internationally.

For Palm Based businesses, our major problem as a country has always been the we have been concentrating on the bottom end of the supply chain, with agriculture and processing of raw materials to send to the large brand goods around the world. they and the round table are the ones who are vexing on the "sustainability" of palm oil industries and destruction of forests etc while in their own countries, they have basically raped their own forests to destruction and turned it into steel jungles. In my opinion, if the Malaysian government were to do a directive to invest in companies that have the capability to turn all of these things around and bring us up the supply chain, say to the very top of production, I think we can do a lot of good synergy between mpob and final prodcut testing and research to produce more end user products that malaysians can directly use to reduce living costs. In my opinion, just a redirection of 5% of Malaysia pension and sovereign funds utilization of 20b USD, we can buy over many interesting companies that can assist malaysia in this activity.

1. Bunge International - At only 14b market cap, taking 51% ownership for around 8b we will have access to 60 billion or revenue, and 2 billion of earnings a year. They are one of the largest edible oils and margarine companies in the world, and making huge dents in feeding the hungry in the world. By having access to their incredible management and supply of goods, we can leverage our own malaysian palm oil resources and world class reasearch into palm oil agriculture into pushing the regional malaysian agribusiness to overdrive.

2. Kelloggs company - As a company that is valued at 25b, you get access to 14b a year of revenue and 1.5b of earnings, with all their branding and products and the goodwill that comes with nutritional food for children for almost 150 years. Imagine linking malaysia to Kelloggs as a sustainable and growing agrigiant. Malaysians are already eating kelloggs brands like pringles and cornflakes, but the fact that most of it is imported with no local growing and production in South East Asia means that it has always been the healthy meal for the rich and. In my opinion, this is where things get very interesting if we can get a hold of one of the largest multinational brand companies that supplies the world over.

3. Yamazaki baking - This I think would be an excellent investment for malaysia funds that are looking to synergize the growth of palm oil industries with end user products. As many have realized today, palm oil is an excellent raw material that is used in the baking of bread products. If not for the ESG lobbying to stop palm oil (and increase wheat and corn etc usage which is less efficient and far more destructive to nature in my opinion), palm oil would be a wonderproduct. In any case, yamazaki baking is the worlds largest baker. 10 billion revenue, with 120m earnings, but huge growth. At a asking price of 2.5b usd at PE27 and with 107,000 stores worldwide, I think this will be an amazing collaboration as they are very forward thinking in their use of materials ( still using potassium bromide in their production, very not ESG friendly)

4. Lets go local now: in my opinion, Malaysia funds should support the latest entry into FBMKL30 - QL. with asking price today of RM13.5b (3b usd) and a whopping PE44 which is higher than most tech firms today, you would be wondering how Malaysia can benefit. In my opinion, if our funds were to do a share deal and pump in 49% more or 6.7b to the company, I believe QL could grow even faster in all avenues. If you look at the nearest competitor which is CP foods (charoen pokhand) which is the worlds largest producer of shrimp, worlds largest producer of animal feed, top 5 in pork, and yes they also own 7-11. for some history on this amazing thailand company, https://en.wikipedia.org/wiki/Charoen_Pokphand. In any case, I personally believe that QL is one of the few companies in malaysia that can consistently grow earnings and revenues over time with unlimited capital in a organic way. If you think about it, many companies have a maximum TAM which after reaching end of cycle find it hard to grow further (welcall, orient, public bank etc) It is not to say that these companies are good or bad, but as their market has already been saturated, and their managers are not equipped to tap into different markets and scale the entire business, you will find that these companies are best suited to just give out dividends and let the business run as it is instead of "growing" as it will just diworsify the business. For me, QL as a business is just as amazing as CP foods. Their history is eerily similar, starting from a simple feed company into chicken and eggs (except in thailand they had a virtual monopoly in that business) and growing along the same trajectory (family mart instead of 7-11). I think QL has the necessary pedigree (brothers and family business) just like CP foods in growing the business. The best thing is the lack of competition of the same scale in malaysia, and their ability to compete internationally. think about that, if QL can reach the 54B usd valuation of CP group and do 16b usd of revenue a year, how much would Malaysia benefit from having another petroliam nasional berhad v2 with their 245b myr revenue a year that can compete and grow internationally.

NOW - SOME NOTES:

I am in no way condoning the takeover of these companies and putting in idiots like in the case of proton for many decades, NFC, banks pertanian etc with no talent in growing income. Instead I would say leave the management intact, let them do their work. Let the Malaysian Government and the rakyat benefit from having a well run international company with huge trajectories and amazing quality grow and send those dividends and retained earnings back to malaysia in the form of 51% ownership. We do not EVER take control, however we do expect to share in the skill sharing, leardership, management etiquette and building of facilities in malaysia for those international companies so that we can catch up far far faster.

In effect, I am proposing for a New Economic Policy. Call it a new Malaysia Chaebol concept if you will, where the best performing companies pull us up as a country to compete internationally. With this business model and long term thinking of growing what we have and where we should be going, I think we can grow malaysia further. Or at the very least, we can get sslee to stop contributing to the growth of indonesian capital, and to come back and help malaysia palm industry grow further. That would be the dream, which I am sure many Malaysians living abroad and cursing malaysia as a dead go nowhere country.

If those international famous companies overseas start building and investing in Malaysia (because we own them), with the strategic location (since parameswara days) and culture (malaysians by default are minimum dual speakers, with general 3 language speakers minimum for chinese, and 4 language speakers for my own children), I am DEFINITELY sure those smart malaysians working abroad will come back. imagine indeed if Malaysia owned Dyson, how much our local industry would benefit.

That is the dream, and I hope you learned something new today.

Philip

More articles on the bursa journey that worked for me. 2000-2019

Created by Philip ( buy what you understand) | Mar 02, 2020

Created by Philip ( buy what you understand) | Jun 30, 2019

Created by Philip ( buy what you understand) | May 20, 2019

Discussions

thats exactly how KYY got cheated to buy Jaks, same method.

KYY was promised retirement funds will buy.

Reality Forum Show Live demo coz you asked for it.

2022-12-15 23:22

No Resolution Vote for (Number of Shares) % Vote against (Number of Shares) %

1. Ordinary Resolution 1

- To re-elect Dato' Azman Bin Mahmood as Director

151,141,628 53.8799 129,374,200

46.1201

2. Ordinary Resolution 2

- To re-elect Dato' Razali Merican Bin Naina Merican as Director

150,832,928 53.7698 129,682,900 46.2302

I was there during the AGM and if I know before hand KYY going to vote against the reelection of directors, I would have stand up and urged all the attendees to vote against the reelection and forced the Board to appoint nominees from KYY as directors.

What a wasted opportunity.

2022-12-16 08:17

I think KYY lose a lot of money in Jaks and Sendai.

By the way at least Philip is smart enough to overall still make some money from Karim-factor stocks.

All those stocks are recommended by you know who.

2022-12-16 08:27

Posted by Sslee > 1 hour ago | Report Abuse

I think KYY lose a lot of money in Jaks and Sendai.

By the way at least Philip is smart enough to overall still make some money from Karim-factor stocks.

All those stocks are recommended by you know who.

------------------

Mrs Koon always told me and Mr Koon on this statement.

"Mr Koon, if you have listened to OTB on stock investment advice on Jaks, Sendai and Dayang, you would have saved 300 to 400 million at least. I feel sad you did not listen to OTB. Moreover, you still scold OTB to discourage you on these bad investments. Please note that OTB is the only one "sincere friend" who dare to tell you when your investment is wrong. Koon, your ego is very high to cause this downfall".

Thank you.

2022-12-16 09:40

thats PrisonerKu mentality.

Its not ok to cheat anybody whether rich like Govt or Bank or sslee or poor like MikeCheatYouCrazy de JalanAlor buy 5 lots of HRC at 4.40 [below EOQ].

cheating is cheating no matter who you cheat.

2022-12-16 10:03

i3lurker,

I already take profit on my armada. What will be the good price to reentry armada again?

By the way this morning just grab some DRBHICOM at 1.55

2022-12-16 10:16

stop talking about me and focus on what I write.....u know nothing about me....and all lies.

2022-12-16 22:11

Sslee and Philip,

Just a question, how to know whether any person is a millionaire ?

Any suggestion !!

2022-12-16 23:14

My humble suggestion:

A multi-millionaire will not waste time arguing with an ass. You see the biggest waste of time is arguing with a fool and fanatic who doesn’t care about truth or reality but only the victory of his or her believes or illusions. Never waste time on discussion that makes no sense, that there are people who for all the evidences presented to them do not have the ability to understand. Not that they won’t understand they just wanna to argue. Others who are blinded by ego or hatred and resentment, the only things that they want is to be right even if they aren’t. The saying goes, when the ignorant screams intelligence moves on.

2022-12-17 10:31

sslee is right and talking about those who claim to be multi millionaires.

2022-12-17 10:54

IB call that retail research.....................as opposed to institution research.

2022-12-17 11:02

The main (or the only) objective in stock mkt is to make money.

U can be a so called 10 years long term value investor

U can be a Koon Bee gamer (or speculator)

U can be a chicken rice trader

U can be an impotent TA Trader

Or whatever method helps you to survive in stock mkt for long run

2022-12-17 11:05

The main (or the only) objective in stock mkt is to make money.

U can be a so called 10 years long term value investor

U can be a Koon Bee gamer

U can be a chicken rice trader

U can be an impotent TA Trader

Or whatever method helps you to survive in stock mkt for long run

=========

I can accept that explanation...how come tan and his people behave like a gangster when I say the obvious truths?

2022-12-17 11:08

I can accept that explanation...how come tan and his people behave like a gangster when I say the obvious truths?

so what do u call people who behaves like gangsters when the truth is told about them? too shy? too embarrassed? cannot tolerate the truth?

2022-12-17 11:18

Why? R you looking for someone fm stock mkt who can always put money into your pocket for free?

2022-12-17 11:29

There are two person in this world who may do that for you.....your own parent (maybe lah)

2022-12-17 11:29

Sifu should have made tens of Millions fm stock mkt since Koon Bee in play (2013 or 2014?)

I believe he has diverted a lot of his money into properties n other safer modes of investments and kept a portion of it in stock mkt only

Even he lost all his money in stock mkt also can eat abalone happily everyday

2022-12-17 11:43

Even the recent 2 years most of his Rm1K poor subscribers can hardly make money I think Sifu is still doing ok in steel co but lose some in HY

2022-12-17 11:45

Infact I will not surprised at all if Sifu actually didnt lose money in HY

2022-12-17 11:49

Posted by CharlesT > 24 minutes ago | Report Abuse

Sifu should have made tens of Millions fm stock mkt since Koon Bee in play (2013 or 2014?)

I believe he has diverted a lot of his money into properties n other safer modes of investments and kept a portion of it in stock mkt only

Even he lost all his money in stock mkt also can eat abalone happily everyday

---------------

You are very right on the spot.

I think sifu made more money in 2020 on glove stocks than 2013/4.

But 2013/4 are the years that he built his capital base.

Sifu is always very grateful to Mr KYY, he just kept quiet even Mr KYY attacked him in I3.

He has the huge capital to sailang in 2020, he withdrew all his FD to load and he is lucky to make at least a few hundred percent gain.

He is so smart to place all money back into FD again after 2020 huge gain.

2022-12-17 12:18

Posted by Sslee > 1 hour ago | Report Abuse

My humble suggestion:

A multi-millionaire will not waste time arguing with an ass. You see the biggest waste of time is arguing with a fool and fanatic who doesn’t care about truth or reality but only the victory of his or her believes or illusions. Never waste time on discussion that makes no sense, that there are people who for all the evidences presented to them do not have the ability to understand. Not that they won’t understand they just wanna to argue. Others who are blinded by ego or hatred and resentment, the only things that they want is to be right even if they aren’t. The saying goes, when the ignorant screams intelligence moves on.

--------------

Sslee, you are right totally.

Do not waste time arguing with this ass hole.

This ass hole talks without facts and figures.

2022-12-17 12:21

Philip ( buy what you understand)

very interesting how you noticed this and people like sslee and stockraider did not.

One of the first things I learned as a contractor is to ask yourself this question: when you developer want to make housing or condo in some rural area... who are the buyers? Because in the end the buyers of the units are the ones that will decide if you get paid or not for your work.

Very important lesson i learned that day. Before you buy a company like INSAS, you have to make sure you know who will buy? If institutions are not buying INSAS, why? if big whales do not want to take part in your company, then who will?

>>>>>>

brightsmart

retirement fund are interested in blue chips like Pchem, yinson ql not in value shares like insas.

55 minutes ago

2022-12-15 14:06