与Eddie有关联的交易

revenueng

Publish date: Sun, 05 Feb 2023, 06:51 PM

https://revenueinsider.wordpress.com/2023/02/04/与eddie有关联的交易/

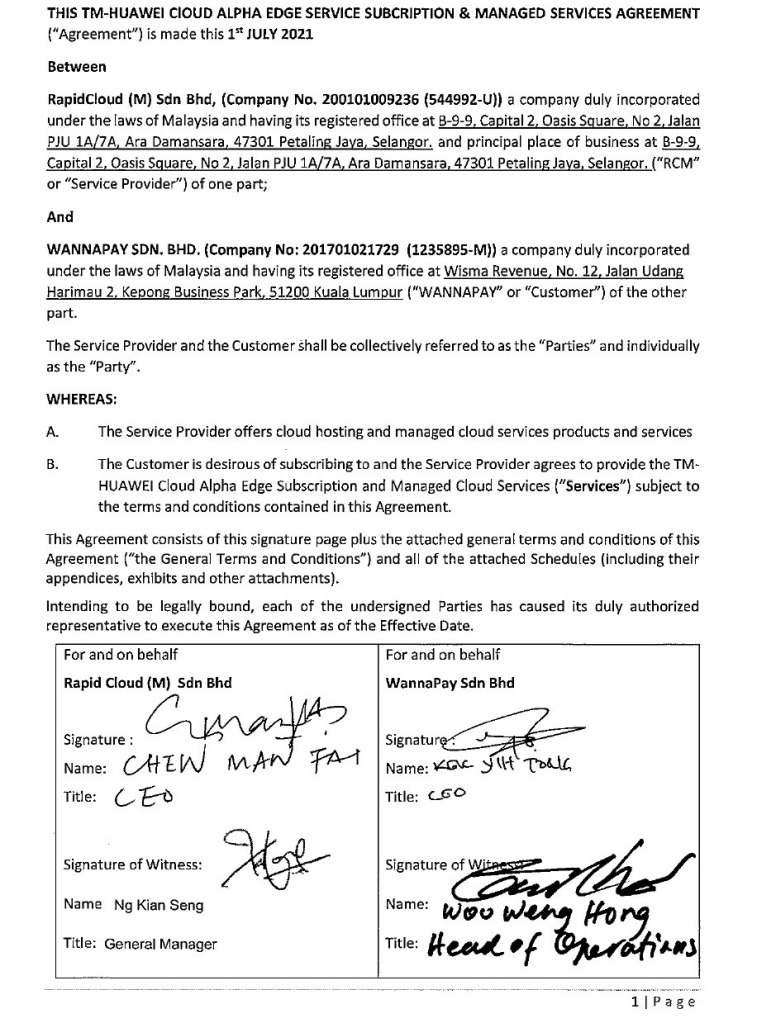

先让我们公开一个与 Eddie Ng 有关联的交易吧。我们也会公开银丰集团的董事会成员是如何被他操控及同流合污的。

这一篇文会有点长,希望大家能耐心读完。

内容将会包括证据,事件的时间顺序,以及公开那些教唆 Eddie Ng的董事会成员名字。

故事背景

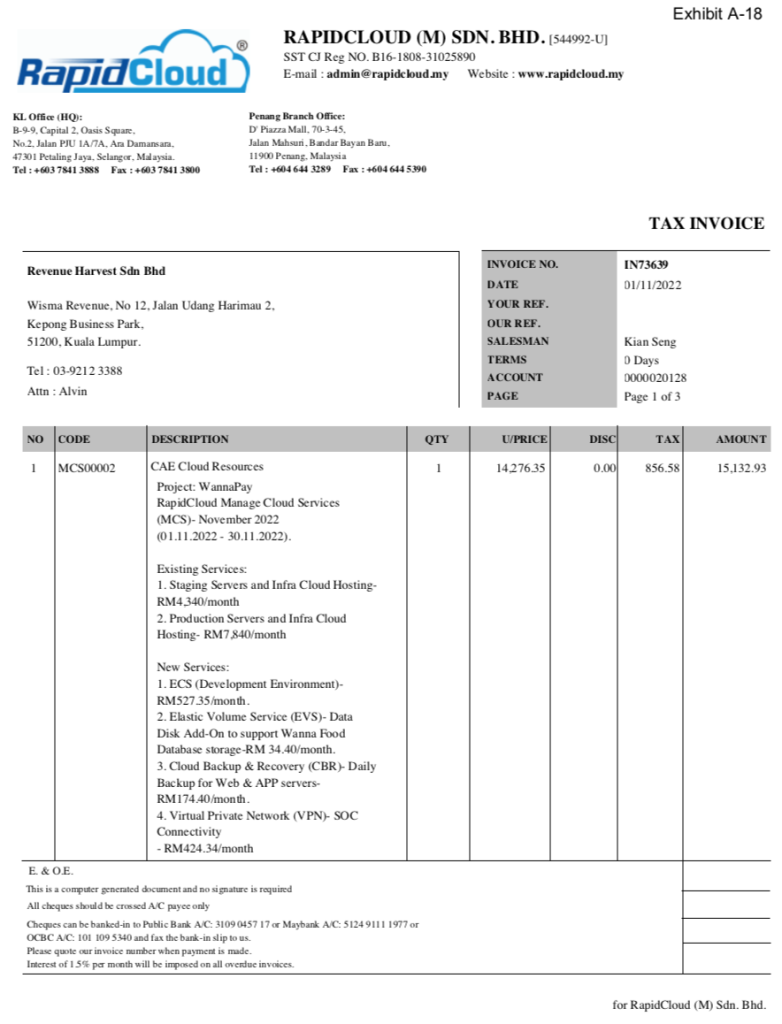

在2020年,Eddie 向所有人公布银丰集团即将拓展业务,开发一个称作 WannaPay 电子钱包的计划。

当时公司里大部分的员工都表达了抗拒,毕竟那时候市场充斥着太多的电子钱包,推出多一个新的电子钱包根本就无法在市场上一枝独秀。

由于当时刷卡机这个项目在急速成长中,公司把大部分的资源都集中于发展,开发及优化这一项业务。

这也导致公司里大部分的部门都不支持 Eddie Ng 突如其来的电子钱包项目。

但 Eddie 却选择忽视,一意孤行的要开始这个项目。

Eddie 就用着「公司内部资源不足」这个理由,把电子钱包的项目外包给了一个第三方公司。原本这也是正常不过的做法,我们看回公司员工提供的证据,公司向来都有跟一些外部承包商合作完成项目。

但是最令人震惊的是,电子钱包的外包公司竟然是 Eddie Ng,Connie Yong(Eddie 妻子),Felicia Ng(Eddie 女儿),Cliff Ng(Eddie 儿子),以及 Lai Wei Keat(银丰董事会成员) 通过代理公司持有的。

更令人乍舌的是,当中代表WannaPay Sdn Bhd (银丰集团的全资子公司)签名批准此外包项目的正是 Kevin Woo Wen Hong,此人就是 Eddie Ng 的姐夫。

差不多可以说整家人都在里面和乐融融了。

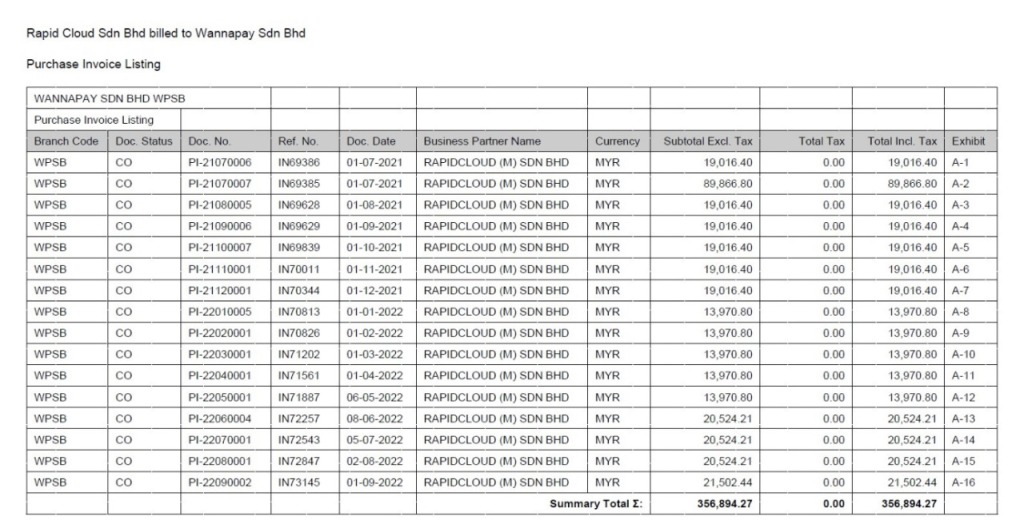

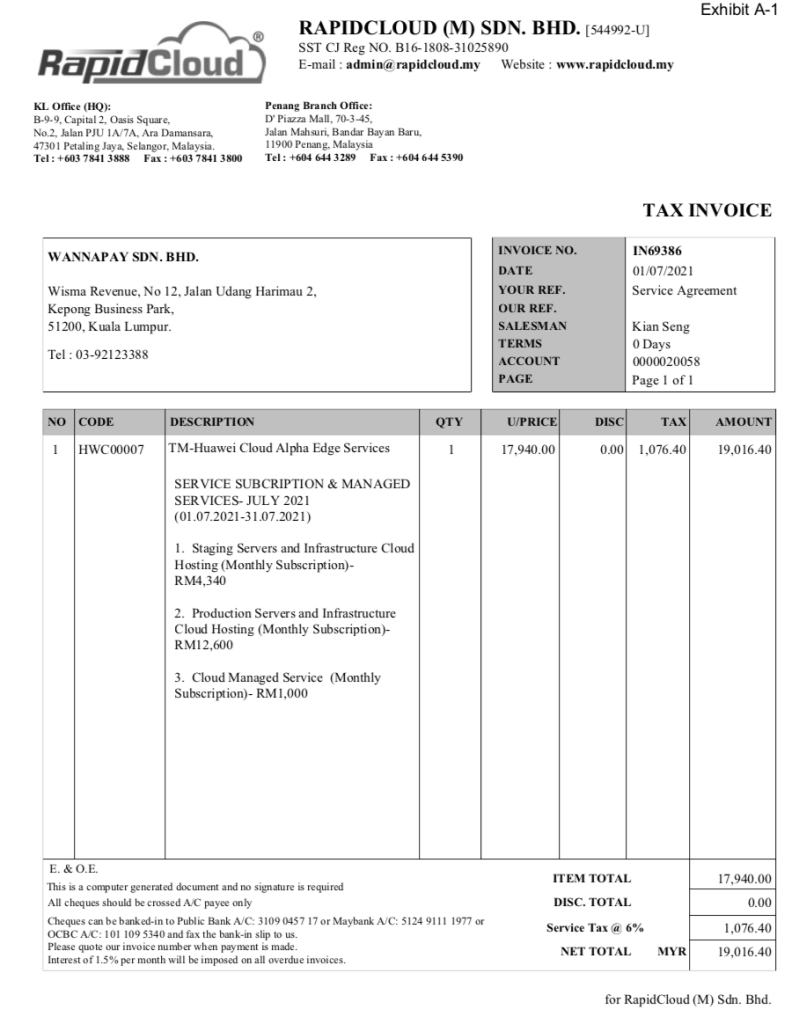

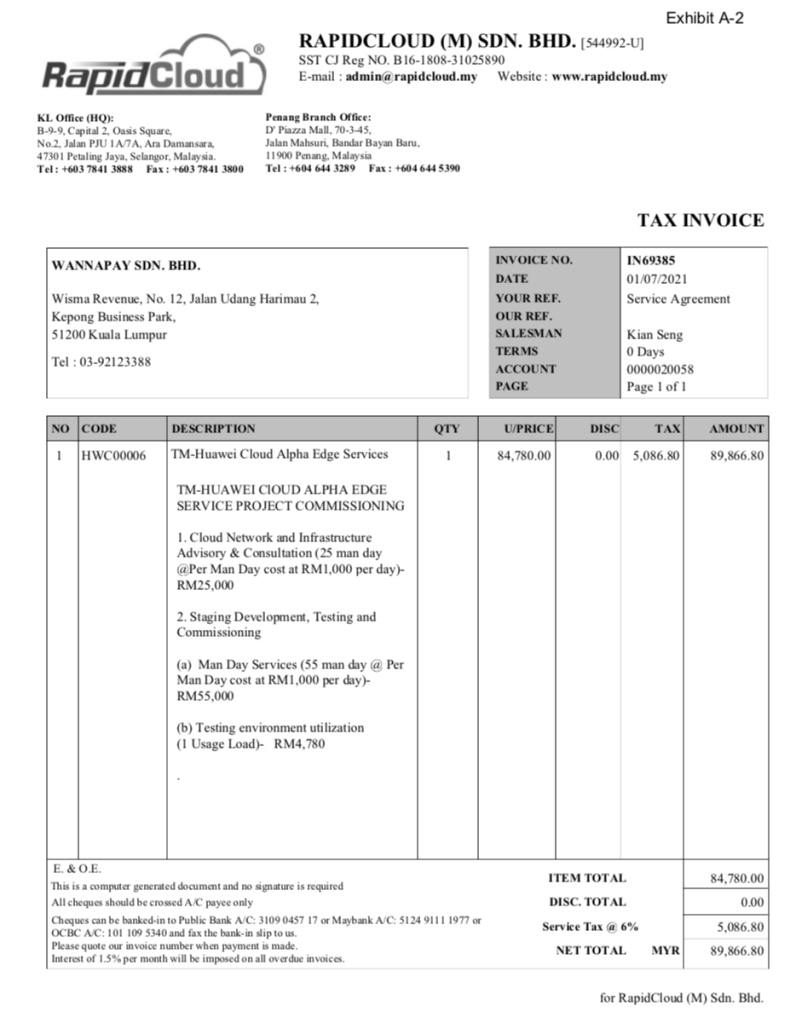

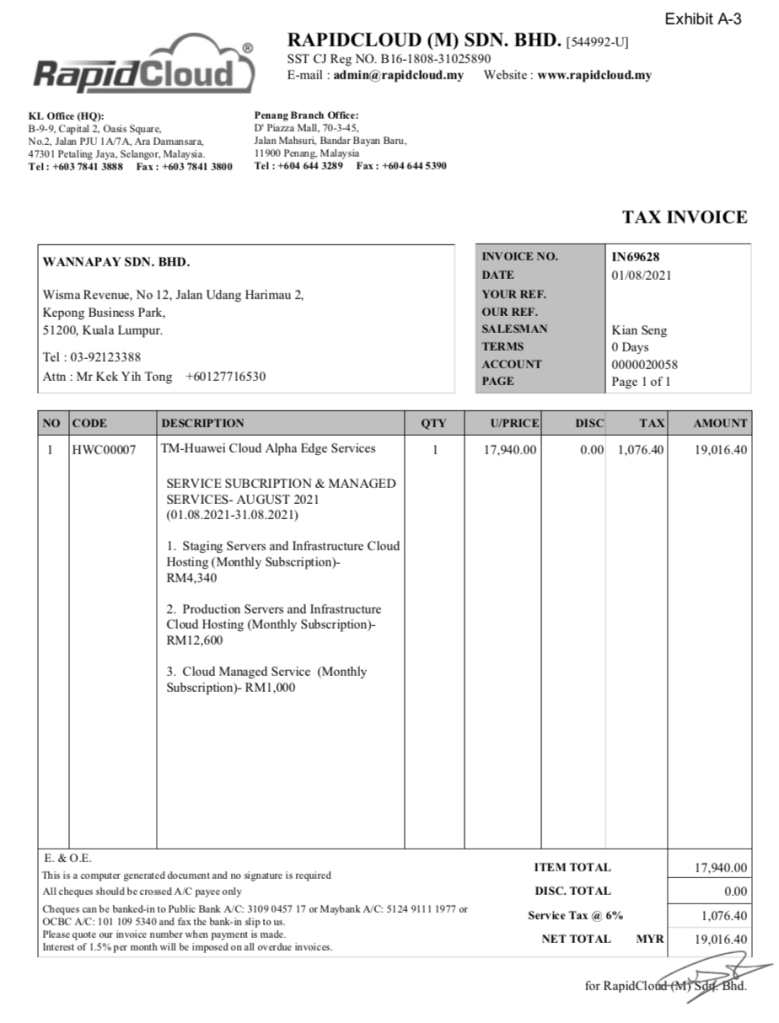

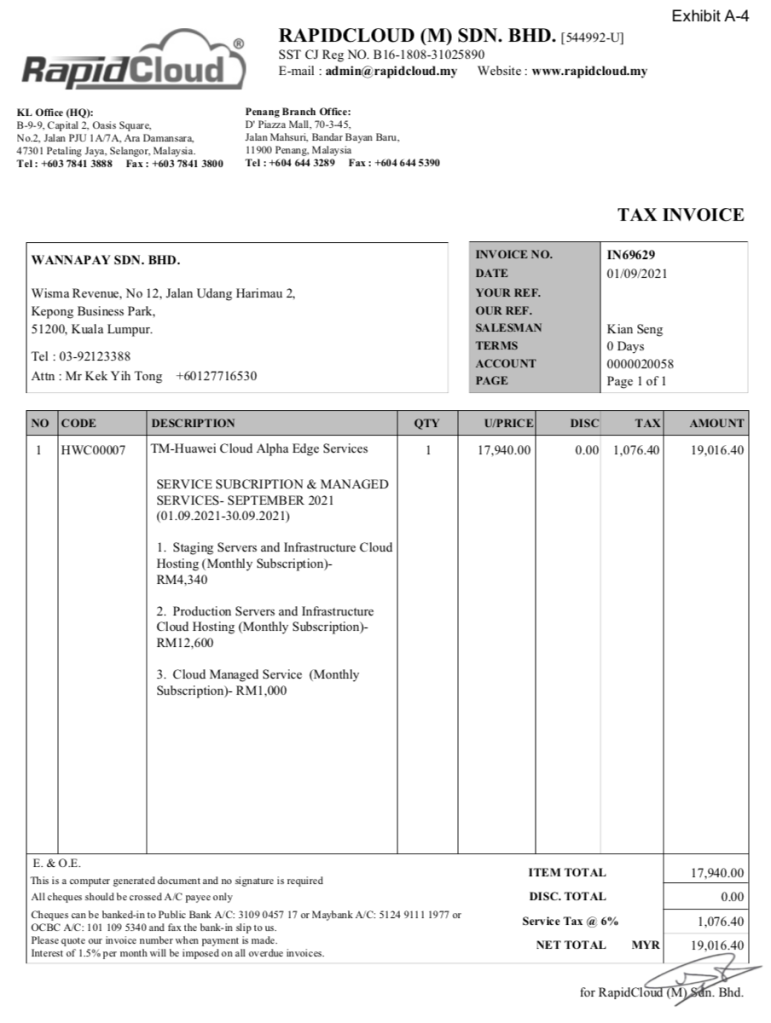

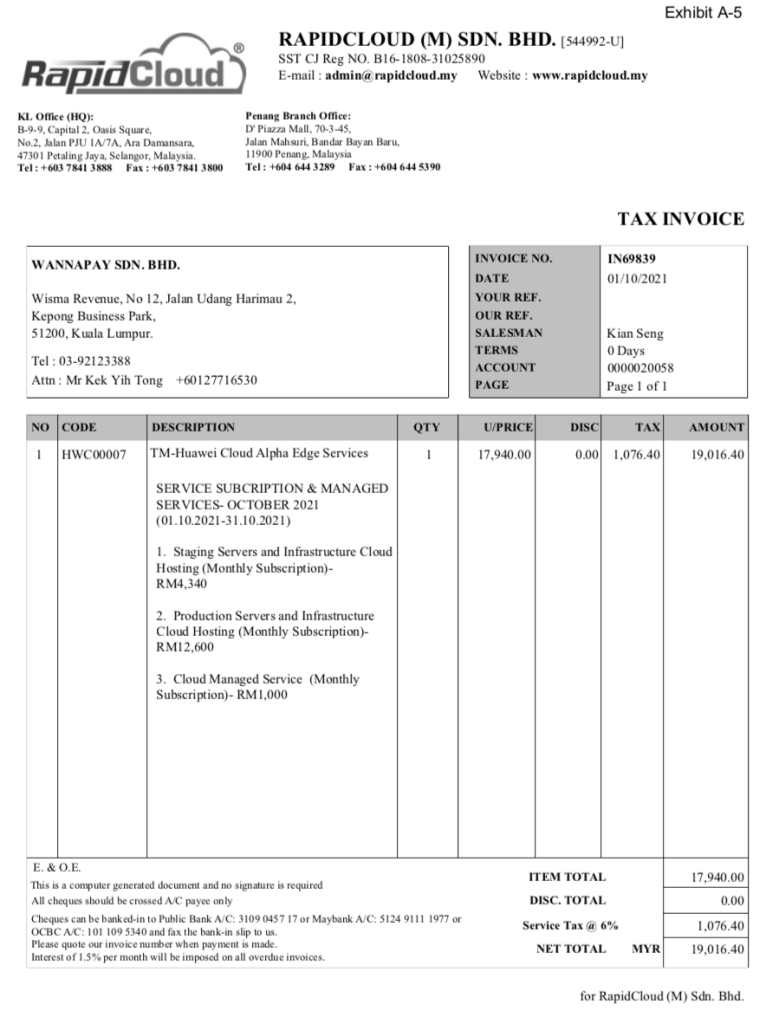

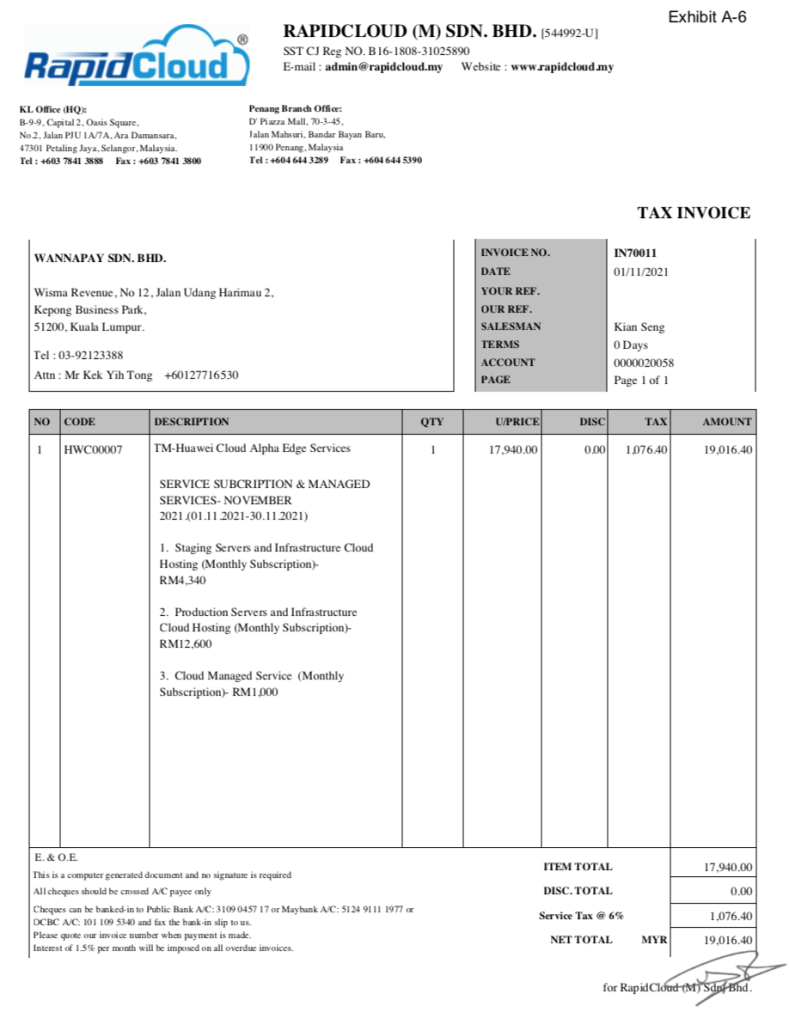

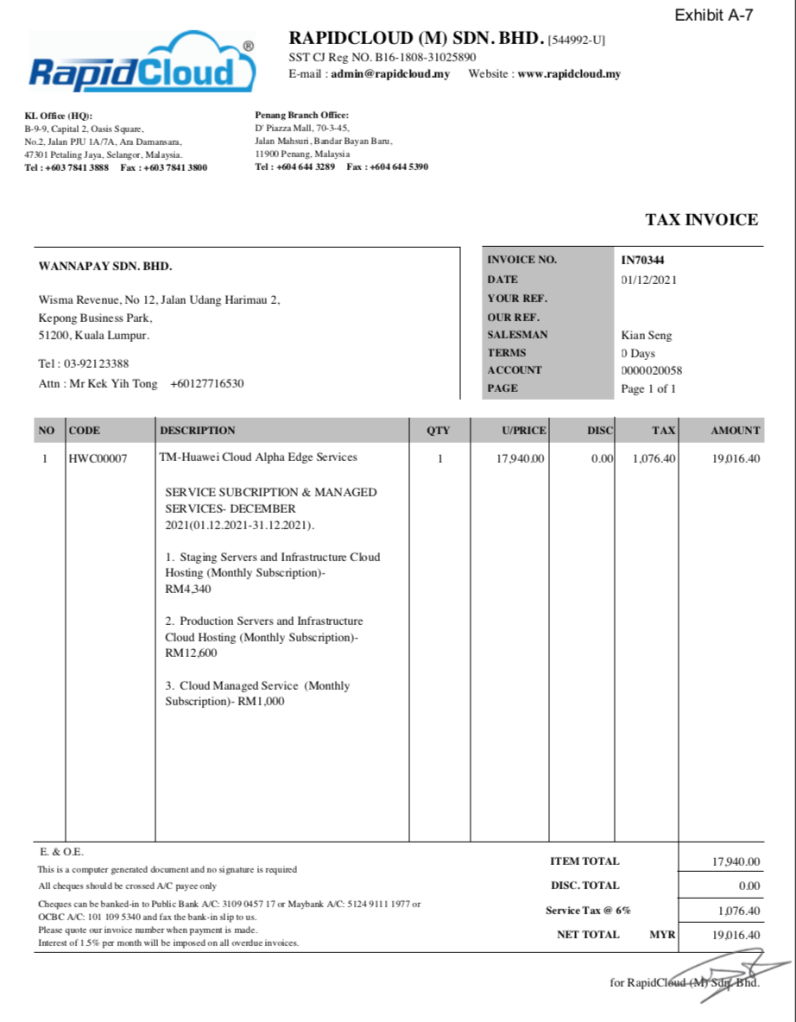

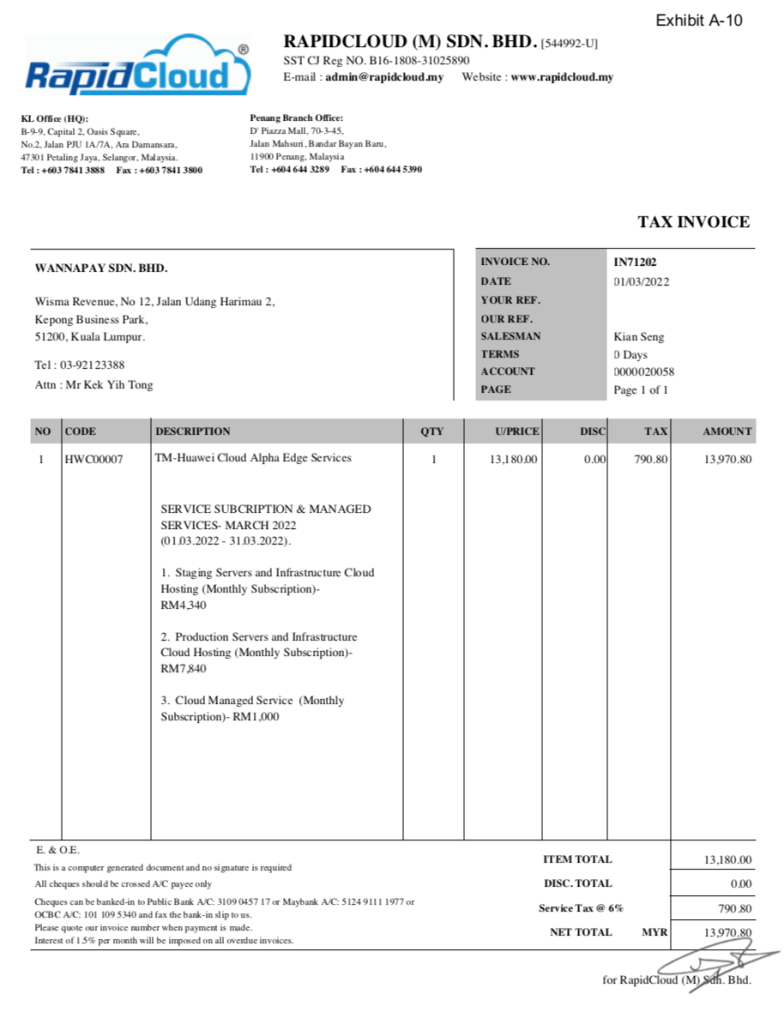

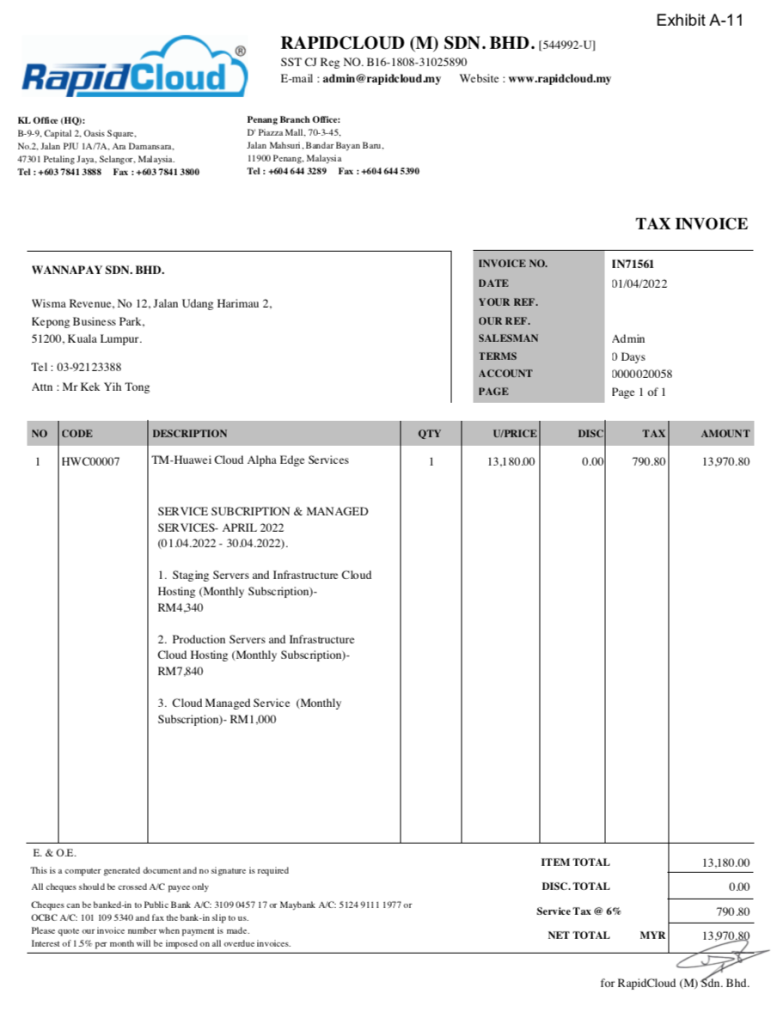

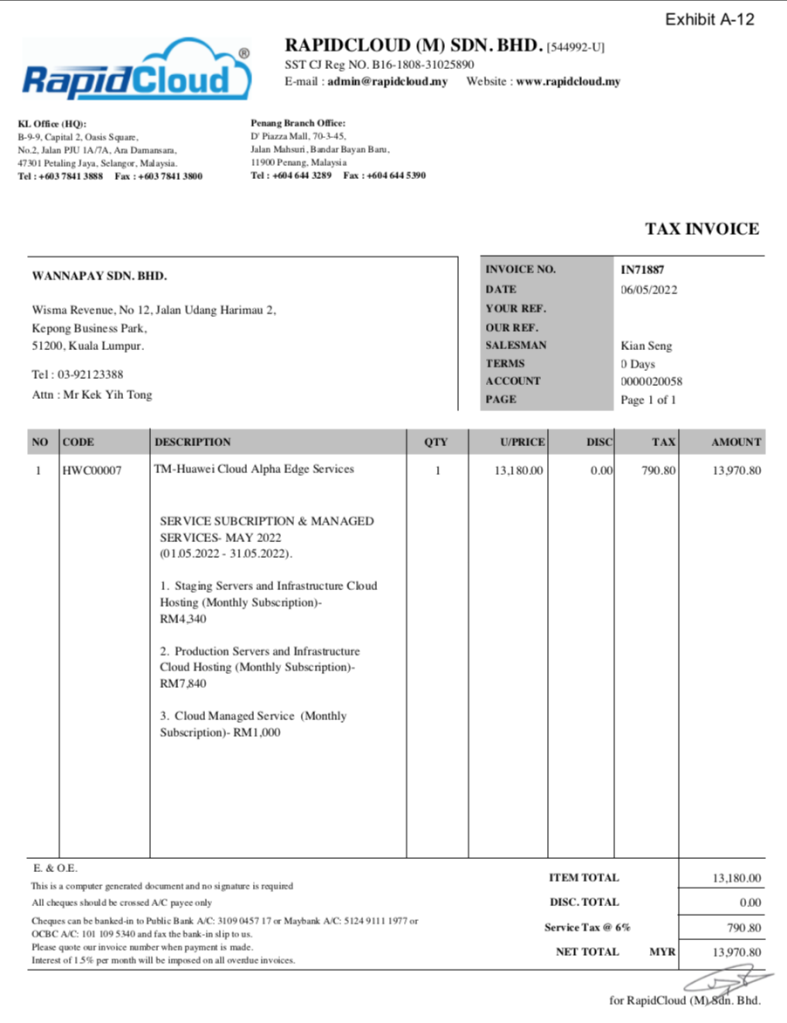

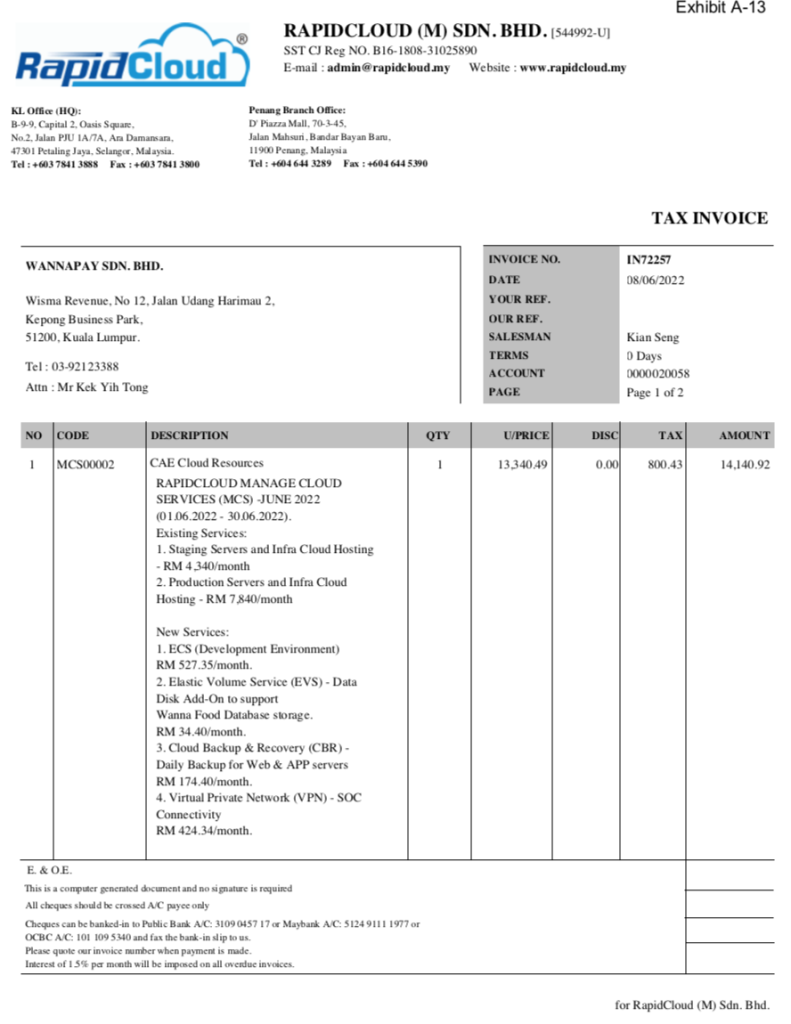

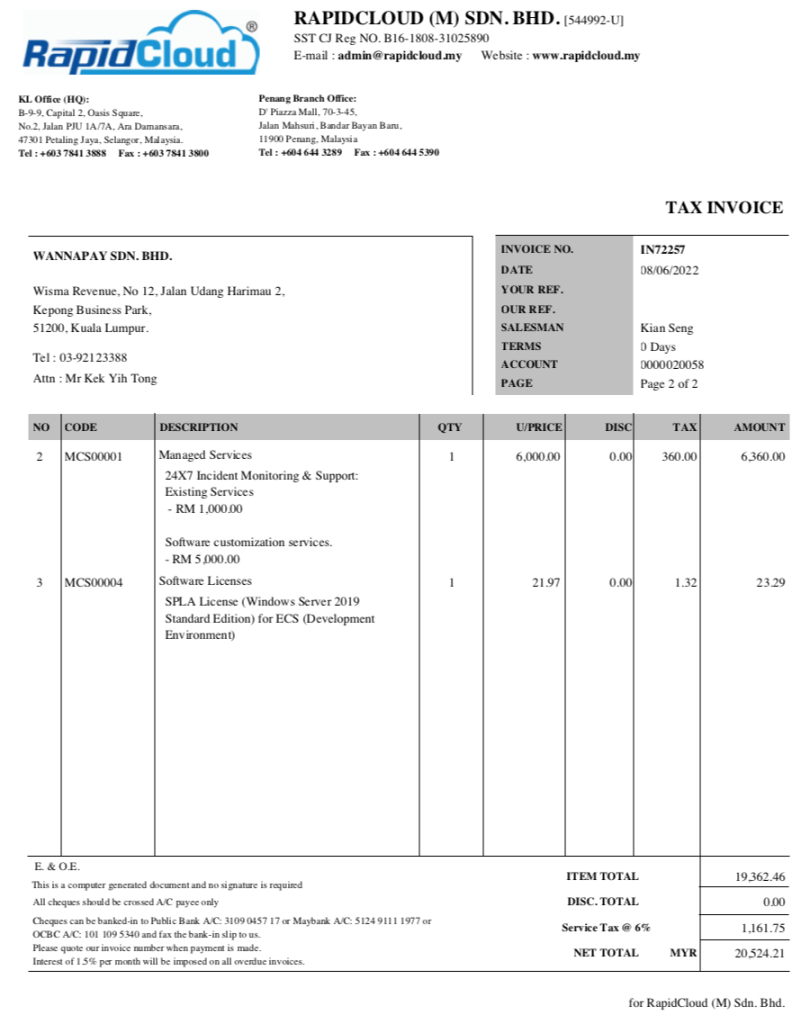

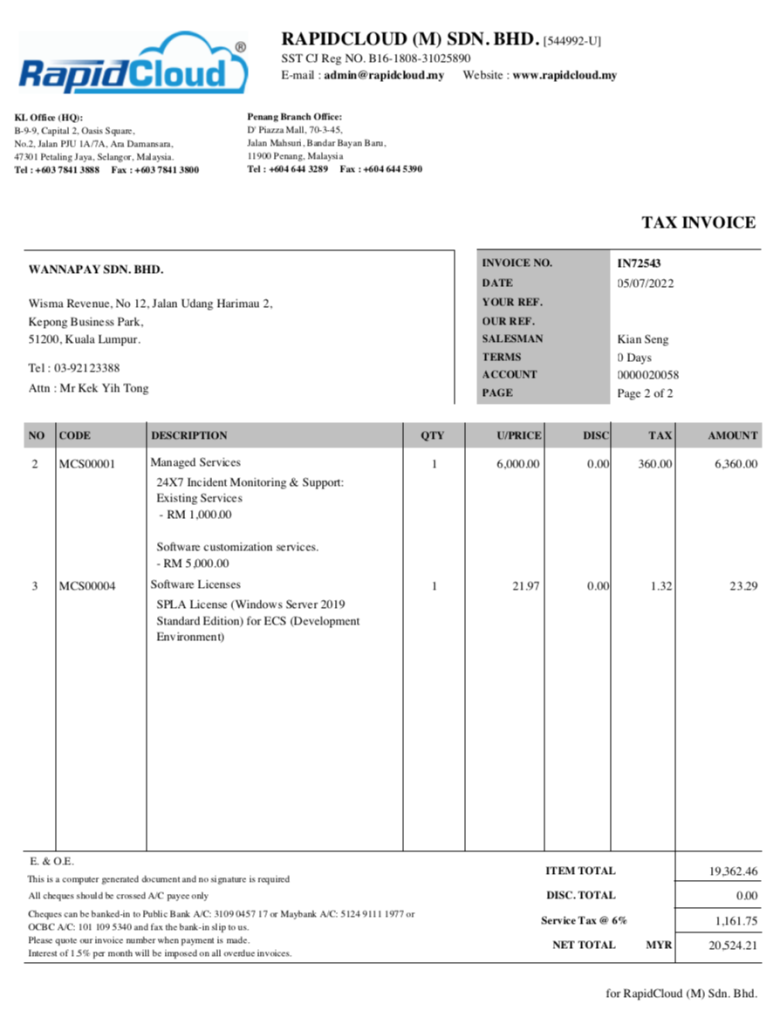

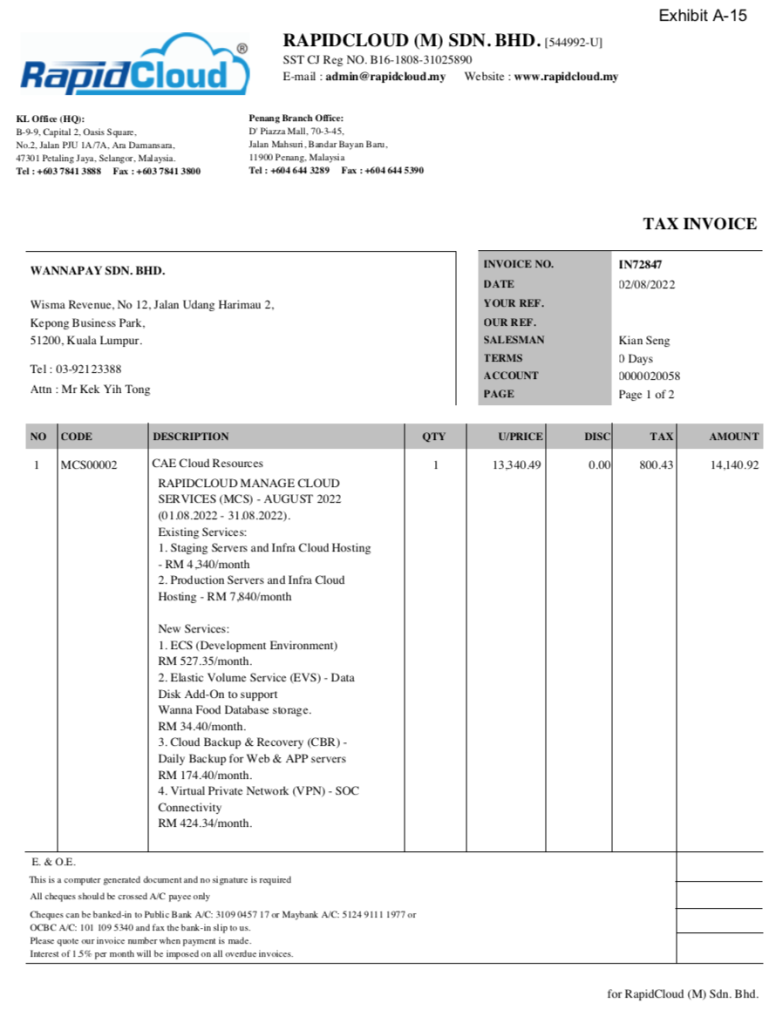

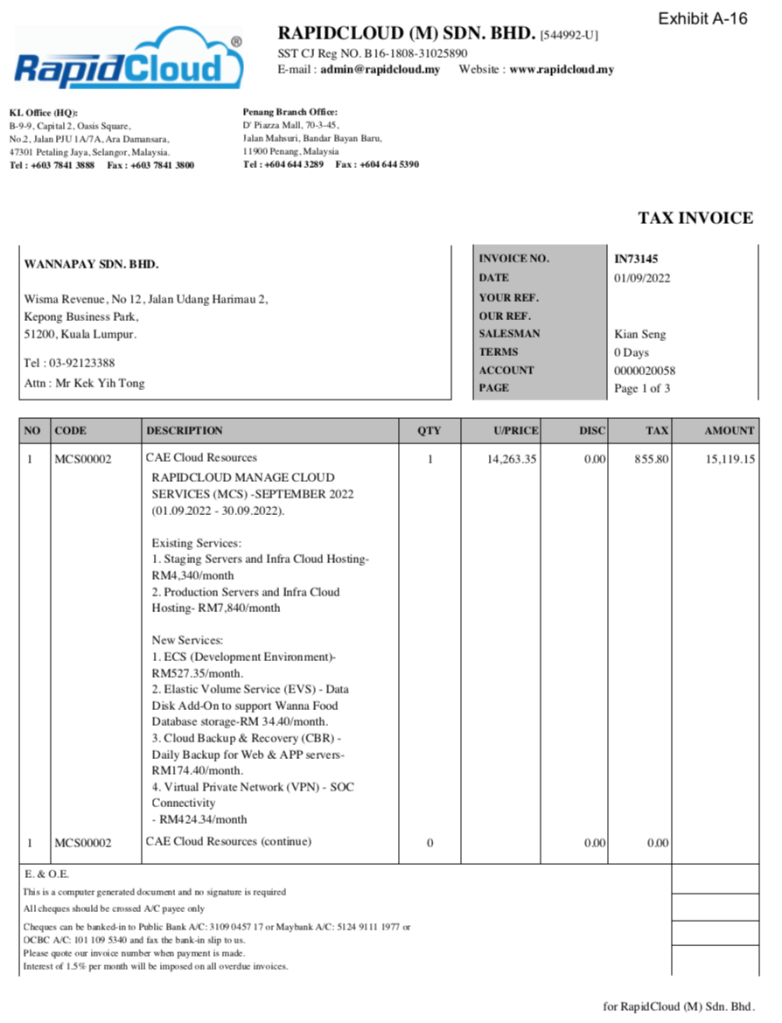

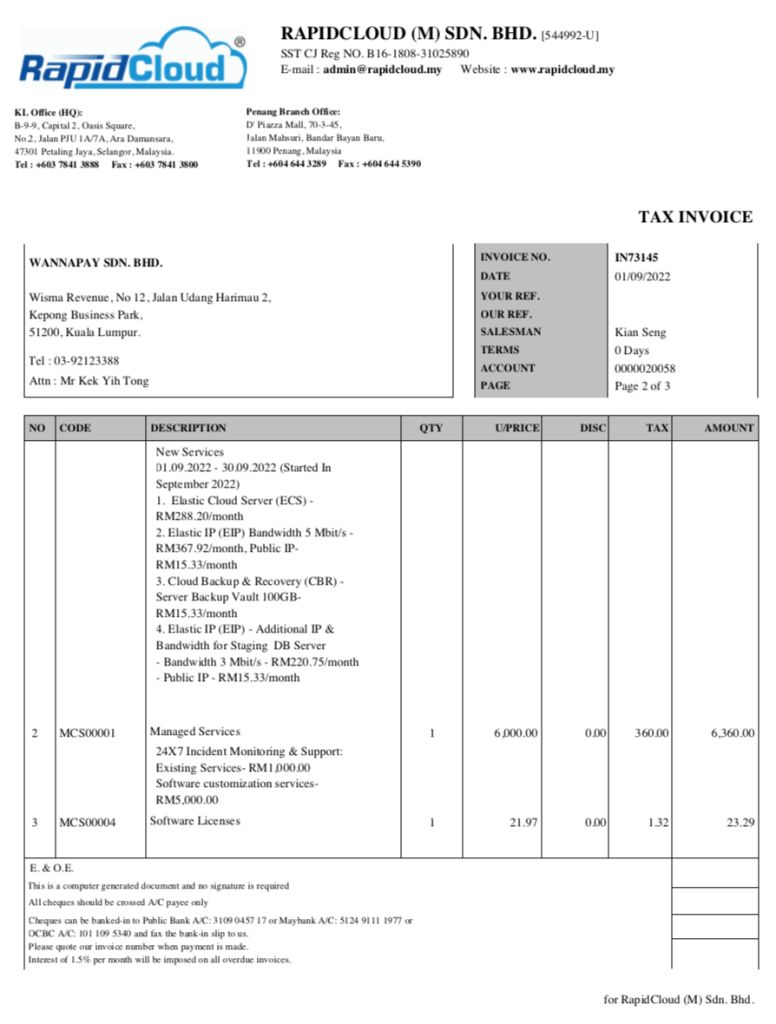

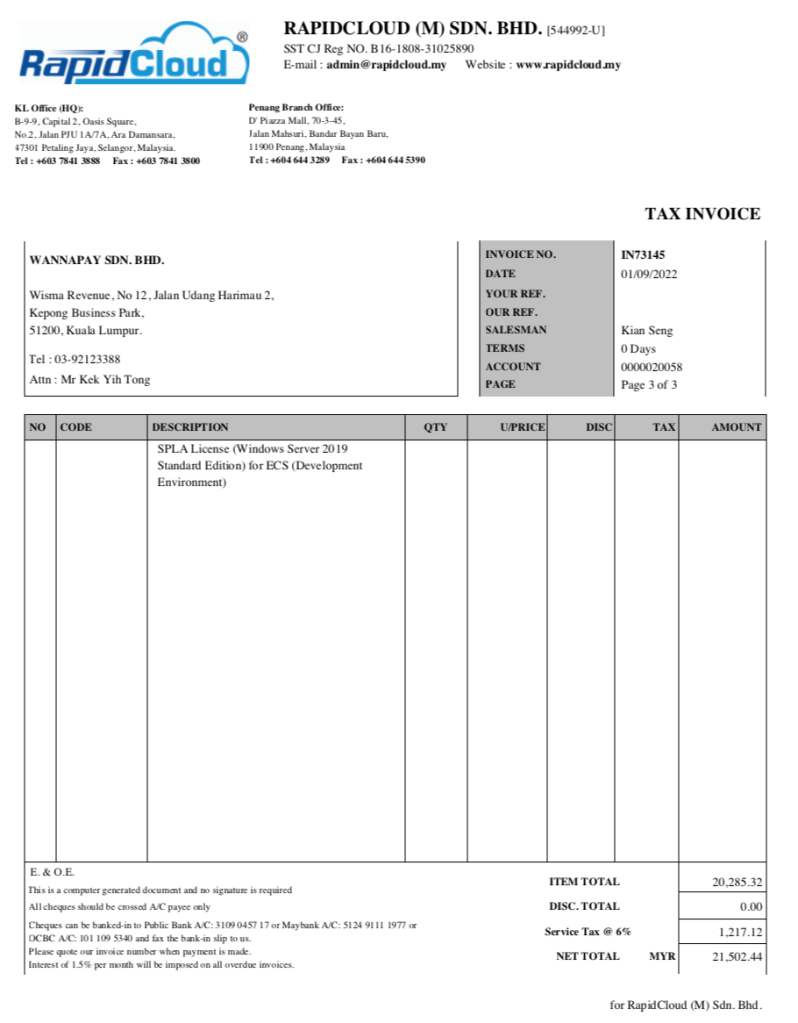

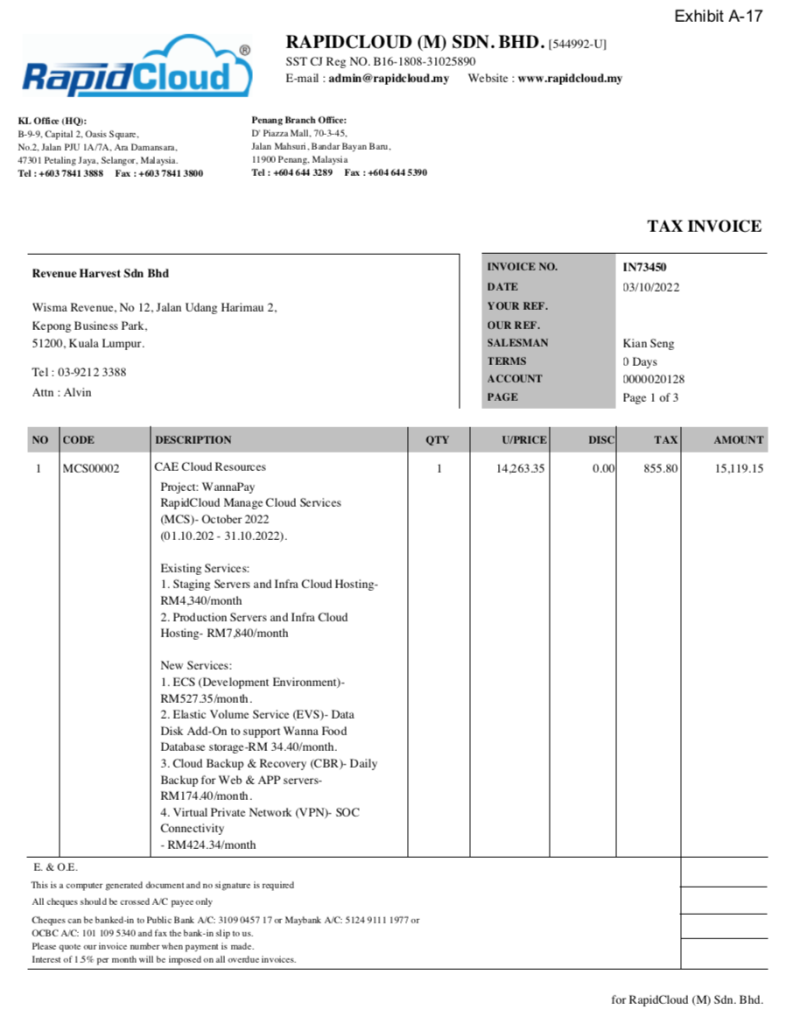

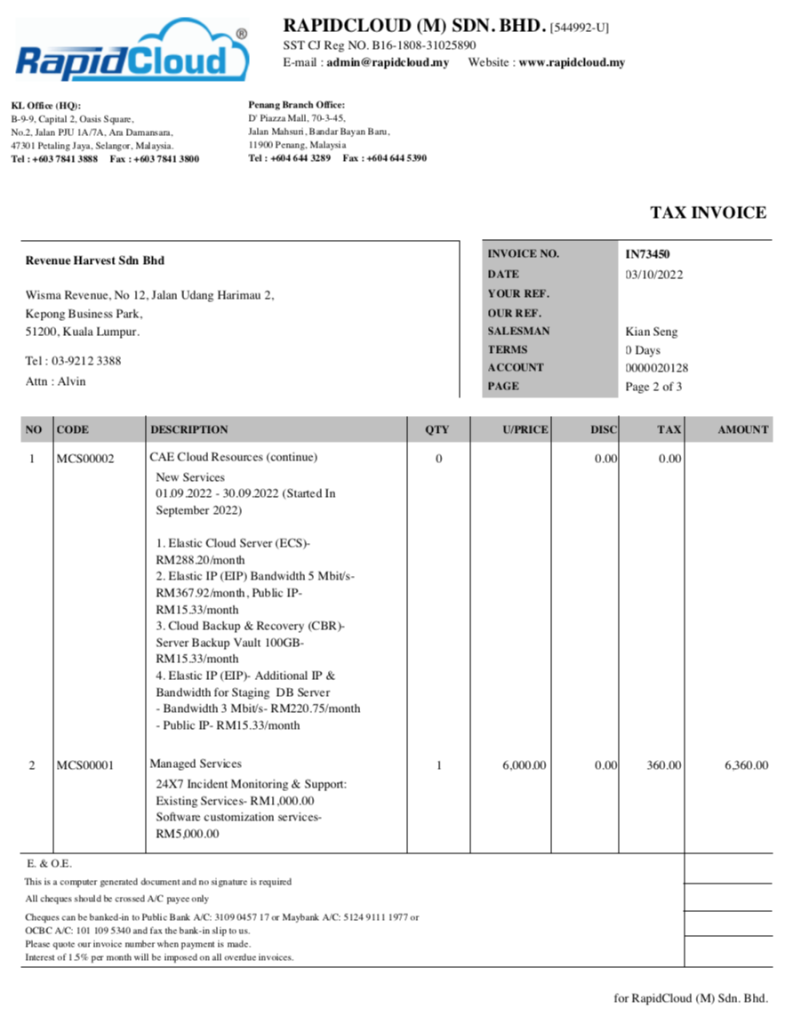

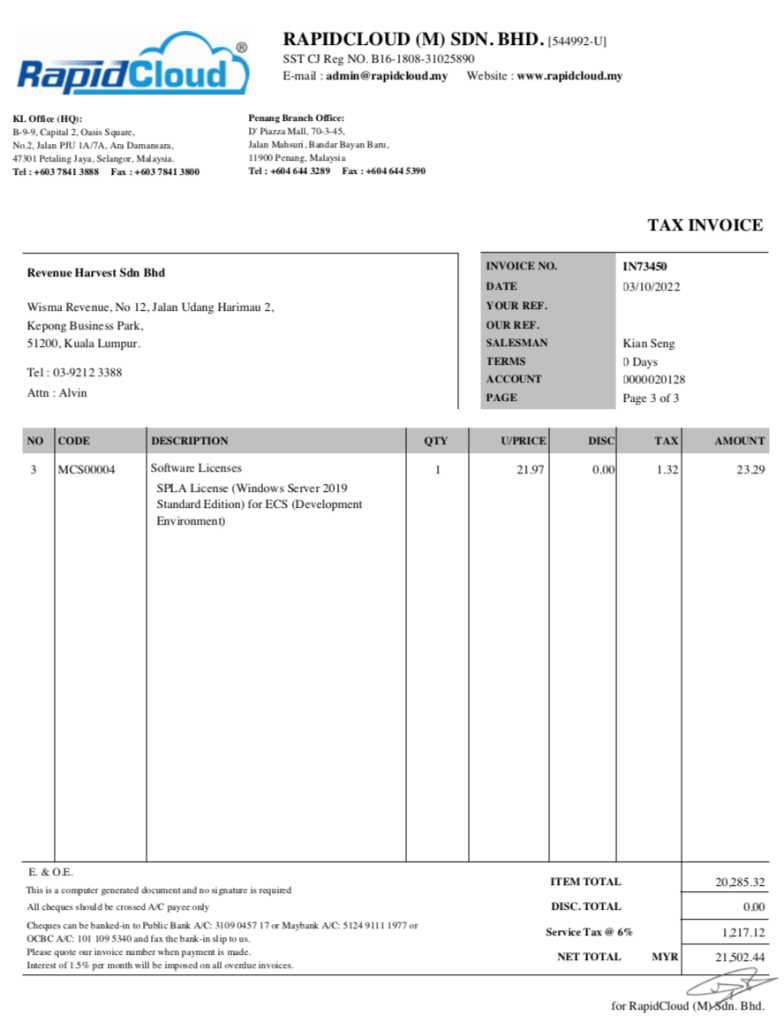

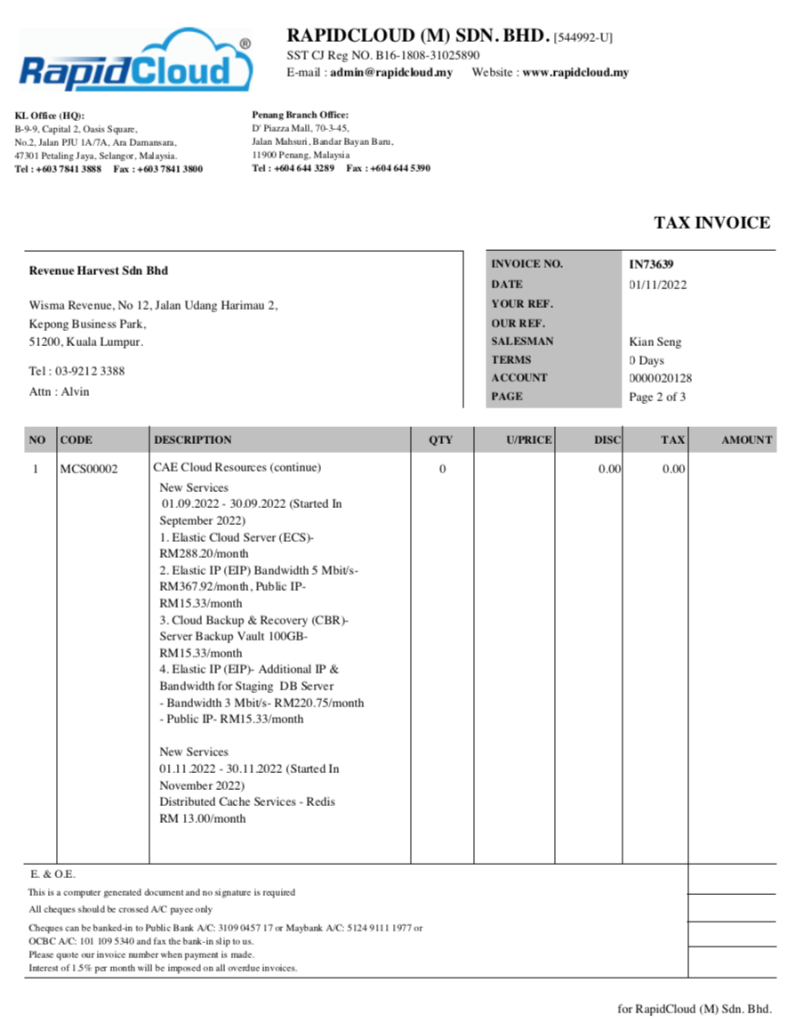

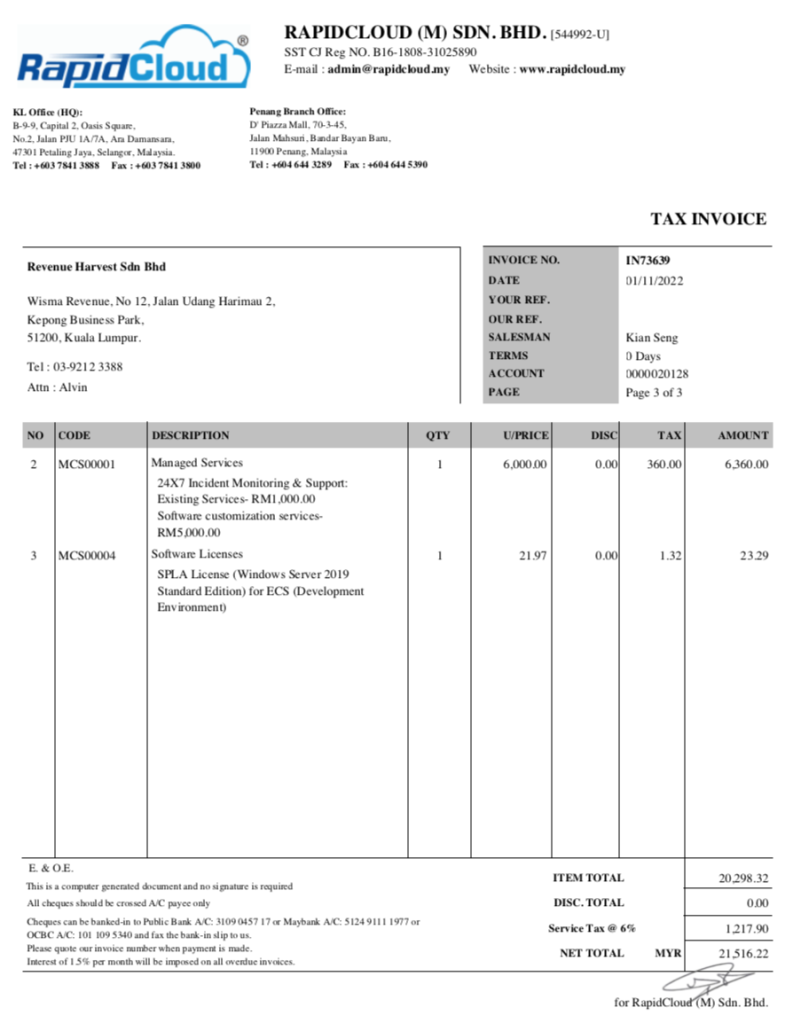

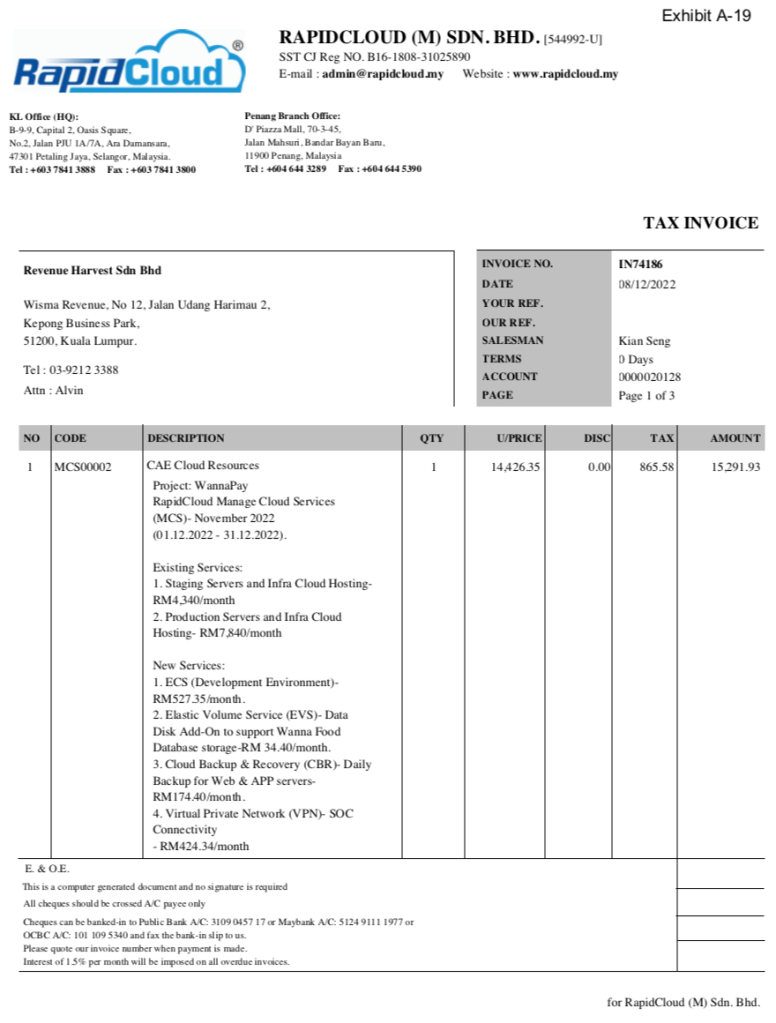

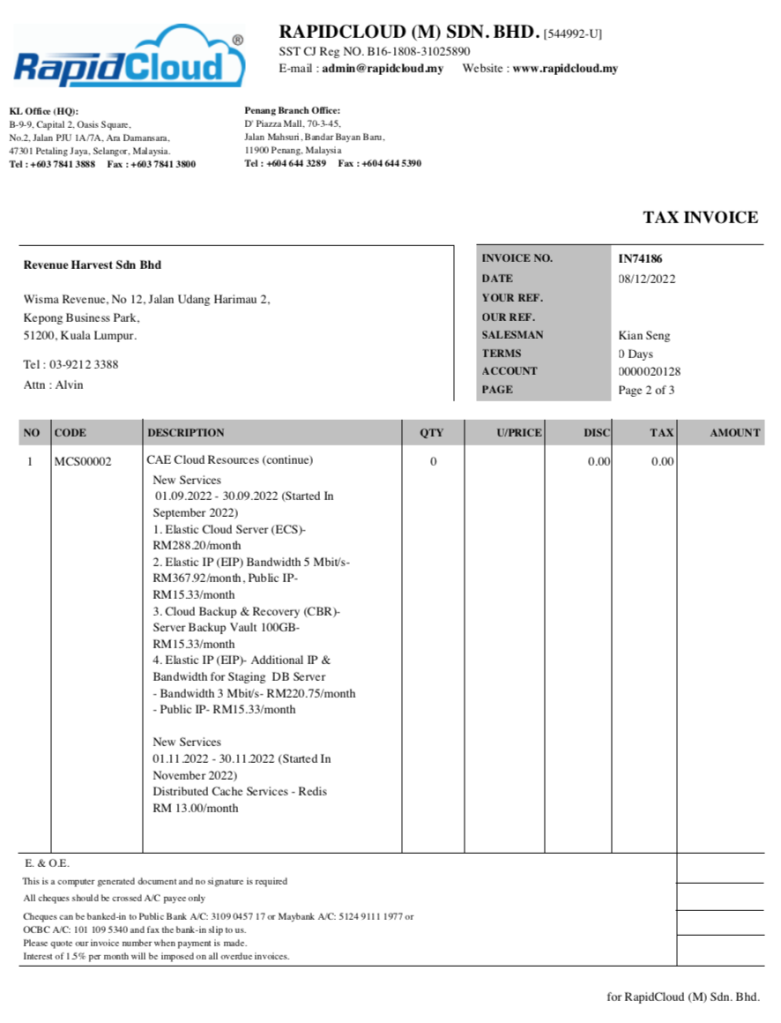

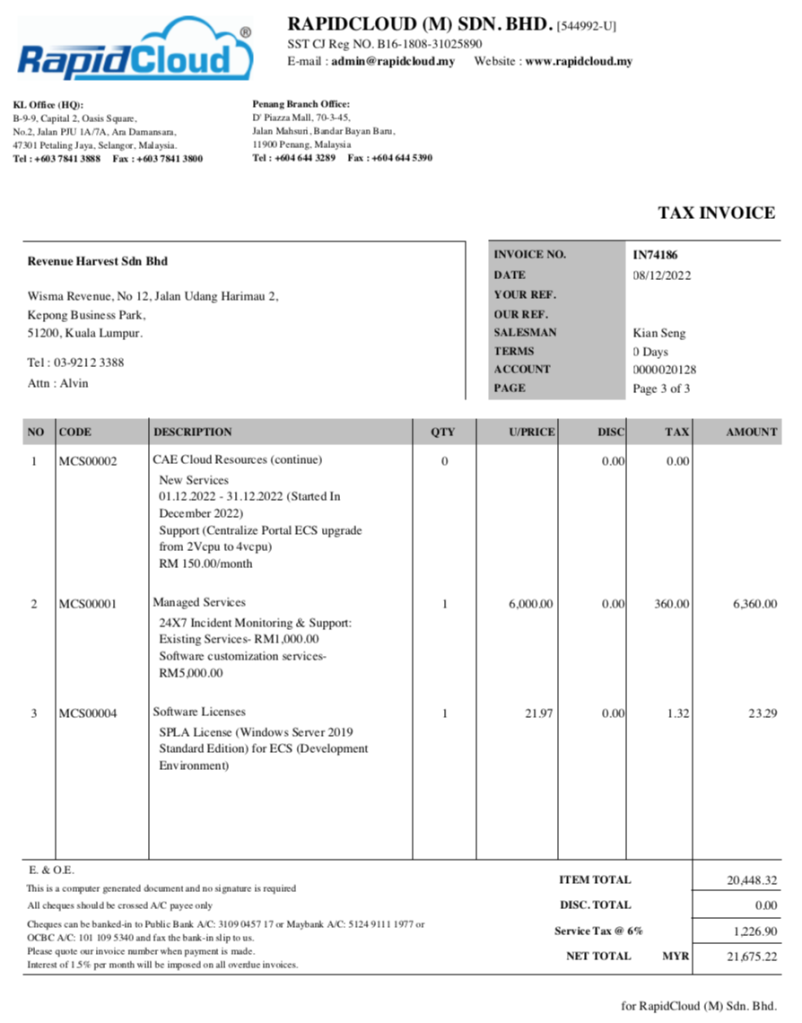

从2021年7月至今,WannaPay(银丰集团)已支付总额超过RM420k 给一家叫作 Rapidcloud(M)Sdn Bhd 的公司。

我们查了这一家叫 Rapidcloud 的公司,发现收取这一笔 RM420k 巨款的公司董事竟然是 Eddie Ng 和 Lai Wei Keat(银丰集团董事)。

Rapidcloud 是 100% 属于一家名叫 Work At Cloud Sdn Bhd 的公司。我们从 SSM 及 Experian 查询后得知 Work At Cloud 的股东分别是 Worldory Sdn Bhd,Pama Solutions Sdn Bhd,及Exceez Technologies Sdn Bhd。

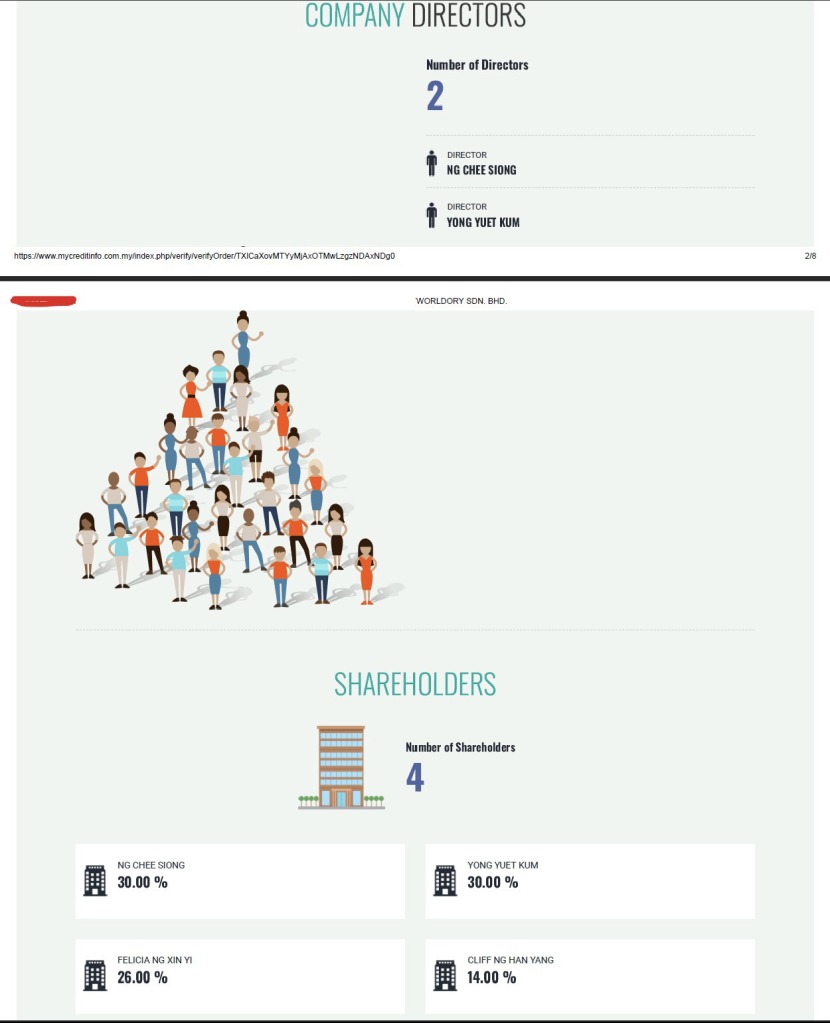

Worldory 是股东是 Eddie,他的妻子 Connie,女儿 Felicia,及儿子Clifford。哇佬,整家人都在里面!

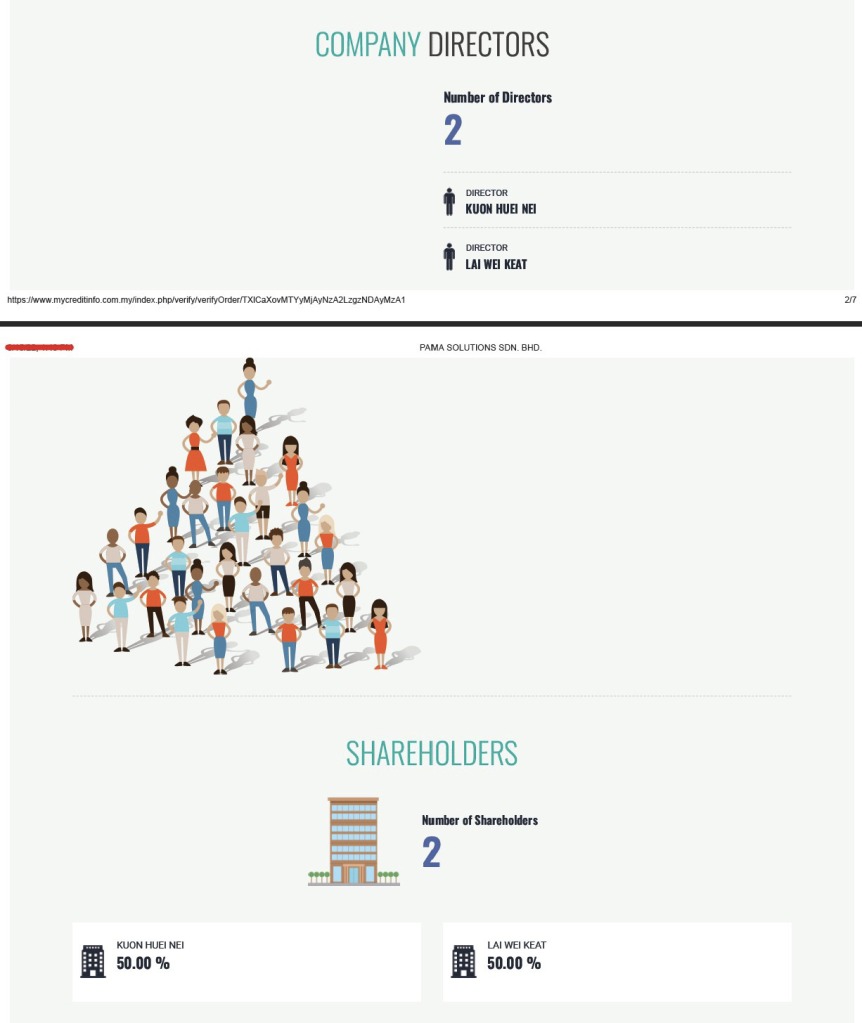

而 Pama Solutions 的股东则是 Lai Wei Keat 及一位名叫 Kuon Huei Nei 的人士,许多人认为这是 Lai Wei Keat 的妻子。

为了方便大家,我们在此提供这几家相关公司的名字及公司注册号码:

Rapidcloud (M) Sdn Bhd – 200101009236 (544992-U)

Work At Cloud Sdn Bhd – 201901027075 (1336402-A)

Worldory Sdn Bhd – 201901013041 (1322369-P)

Pama Solutions Sdn Bhd – 201901034006 (1343336-M)

背信罪,信托过失及重大的利益冲突

那银丰集团的董事会成员是否知情呢?

而 Eddie Ng 和 Lai Wei Keat 又是否有对此利益冲突事先发表声明呢?

倘若董事会当时是批准的,那就表示银丰集团董事会里的每一名成员(包括 Brian 和 Dino)都在教唆 Eddie 把公司的资金拿出去。如果是这样, Brian 和 Dino 就应该离开。

但根据告密的员工表示, Brian 和 Dino 对于 Eddie 动用公司资金的事情是毫不知情的。因为当员工们发现时,他们第一时间把事情告诉 Brian 和 Dino。Brian 和 Dino 当下也觉得非常震惊,并立刻吩咐员工们进行更深入的调查。但在他们能够采取任何行动前,Eddie 已经暂停了他们两位的职责。

告密者在 Brian 和 Dino 被反贪会逮捕后再也无法与他们联络。

所以他们决定把资料交给我们,希望我们能把证据公开。

假设整个银丰集团的董事会对此事毫不知情,那就代表 Eddie 和 Wei Keat 存心拿公司的钱,这完全违背了他们身为上市公司董事的职责及信托的责任。

那,现在谁才是那个坏人呢?

两名首席财务官(CFO)的离职

这也带出了两名首席财务官离职的故事。

根据银丰集团员工与前员工所提供的资料,第一名离职的首席财务官是 Ng Kuan Horng,他在银丰集团上市时开始就职。Ng Kuan Horng 因为无法再与 Eddie 狼狈为奸挖取公司的资金而选择辞职。

这是否代表他在辞职的时候是有罪的呢?

然后第二位首席财务官 Adron Leow Weng Kiat 就上任了。但是 Adron 任职的时间很短。根据线索, Adron 在查看了公司的账务并知道 Eddie 所做的事情后,就拒绝继续下去,并且提交辞职信。

连续有两名首席财务官的辞职对一间上市公司来说肯定不是一件好事。Brian 和 Dino 两兄弟也因为这件事而变得更加警觉及开始调查,从而发现 Eddie 背着他们做了对公司不利的事情,然后发展成今天的局面。

以下是告密者在调查 Eddie Ng 与家人(包括姐夫 Kevin Woo Weng Hong)及 Lai Wei Keat关联方交易的全部证据。

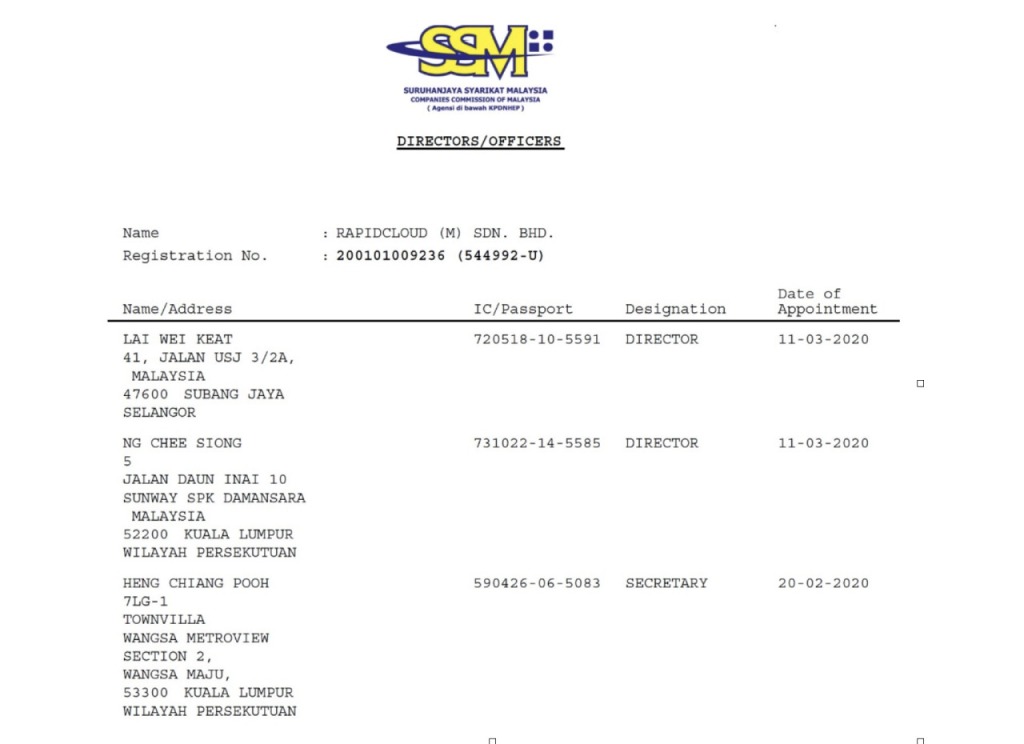

SSM查询Rapidcloud(M)Sdn Bhd,当中显示了Eddie Ng 和 Lai Wei Keat 从 2020 年开始已经是该公司董事。

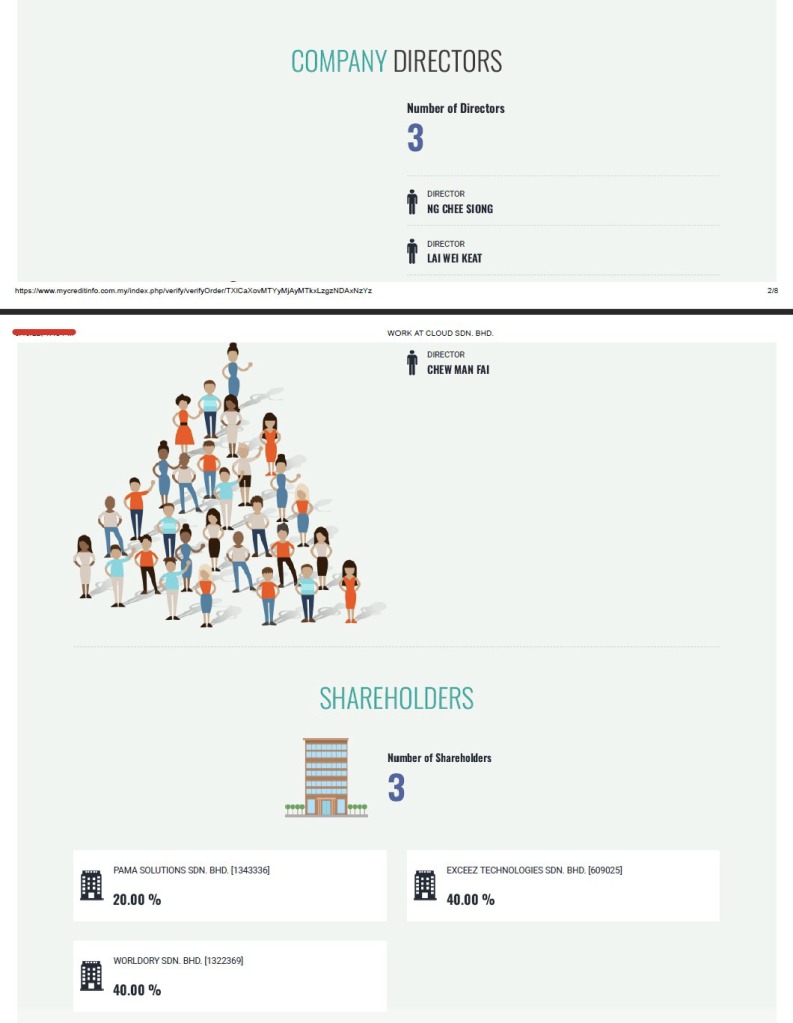

Experian查询关于Work At Cloud的报告,当中显示Worldory Sdn Bhd为Eddie一家人拥有,Lai Wei Keat为Pama Solutions股东。

Experian查询关于Worldory的报告,当中显示了Eddie,他妻子Connie Yong,女儿Felicia,及儿子Cliff都是该公司股东。而Worldory则是Work At Cloud的股东公司。Work At Cloud 100% 持有的Rapidcloud就是收取了银丰集团RM420k的那间公司。而签名批准的该款项的其中一人就是Eddie的姐夫Kevin Woo。

Experian查询关于Pama Solutions的报告,当中显示了Lai Wei Keat及假设其妻子的人士为公司股东。Pama Solutions也同样是Work At Cloud的股东。Work At Cloud 100% 持有的Rapidcloud就是收取了银丰集团RM420k的那间公司。而签名批准的该款项的其中一人就是Eddie的姐夫Kevin Woo。

Woo Weng Hong,又称Kevin Woo,Eddie Ng的姐夫。

Ng Kian Seng,Revenue Harvest的前首席科技官,现任职Eddie 和Lai Wei Keat所持有的公司 – Rapidcloud的总经理。

Ng Kian Seng,Revenue Harvest前首席科技官

Kevin Woo,营运主管及Eddie Ng的姐夫

我们得知Ng Kian Seng之前任职银丰集团子公司Revenue Harvest的首席科技官时表现不达标,也得不到科技部门同事们的支持。

不用说也大概能知道当中的原因。

银丰集团这段时间以来所支付给Rapidcloud的总结

据告密者透露,第一名辞职的首席财务官Ng Kuan Horng把款项的数额设得比较低,不让当时监管集团财务及业务的Brian Ng察觉,以测试看看有没有人发觉。

我们也不清楚他离职的原因到底是内疚,还是Eddie给的钱不到位。

但是第二位首席财务官一上任就对这笔交易提出质疑,他也因为此事而决定离职。

以下是这笔款项从开始到现在的发票。

如果你已经阅读到这里,我们相信你已经看见所有确凿的证据了。

我们一点一点揭开收到的资料时也觉得很恶心。

所以,你觉得谁才是银丰集团里的大奸人呢?

我们将会在下一则文章告诉你银丰集团里跟Eddie Ng狼狈为奸,试图把公司榨干的所有人。

V敬上

revenue-insider@tutanota.com

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on Revenue Inside

Discussions

To be honest, I would not imagine that the fight for power in the group would go to such drastic level, as to some inside-insider information was published to the public.

There was one article in particular that highlighted that there are suspicious related party transaction to a company called RapidCloud (M) Sdn Bhd, where the ultimate beneficiary would be Datuk Eddie Ng Chee Siong.

I think that the article provided much info on the transaction with RapidCloud (M) Sdn Bhd, but I still have my doubts on it.

1. According to the article, the author mentioned that Brian Ng Shih Chiow and Dino Ng Shih Fang is completely unaware of the transaction made with RapidCloud (M) Sdn Bhd. I mean, really?

It is very hard to believe the two brothers are completely unaware of the transaction.. to be honest, if they are unaware, then it is their negligence, which is very disappointing as they themselves are the major shareholders of the company.

2. The article had also mentioned a total transaction value of RM356,894.27 billed to Wannapay Sdn Bhd by Rapid Cloud (M) Sdn Bhd. It is a very strange and weird to say the person who was in-charged of finance did not know about this.

Anyway, since the issue of related party transaction (RPT) was mentioned… yours truly here wore student hat and downloaded the bursa guideline (link here) and look up the section on RPT. Ok, the threshold for reporting RPT is RM500,000 according to bursa… so these transactions below the reporting amount and do not need announcement.. hmm, this explain why it is not disclosed in the annual report.

Also, my own research on the company had shown that RapidCloud (M) Sdn Bhd had RM4.2 million in revenue for their financial year 2021 on CTOS.

2023-02-07 18:53

I think any novice person like me can buy the report to study also lol, and I got inspired by the article.

Anyway, the transaction with Wannapay Sdn Bhd stands below 10% of RapidCloud (M) Sdn Bhd total revenue. Now, this is an important point.. this means >90% of sales come from other customers. Further check on the company website says that RapidCloud has been in existence since 1999 and has provided solutions to over 46,000 clients. You can check out the website here.. look like this is a legit company.. not a RM2 company set up to solely serve Revenue. So it could just be ordinary business transactions at arms length. Agree? Now come to think abt it, the author didn’t mention in the article what law was broken..

Well, I do not know if the value of the cloud server and other services provided are at market rate, discounted or premium, readers please let me know if you know the market rate.

3. Art of distraction?

If you work the article backwards, the writing seems to have the intention to increase the odds of winning for the two brothers prior to the EGM. To me, that is questionable, but I will still attend the EGM.

To me, and perhaps to all minority shareholders, the most critical part of the whole EGM is actually on the diversification into property. Once it is approved, then Revenue can participate in any construction and property related activities lol, then definitely I’m not holding the shares anymore.

Please do not attack me as I’m just stating some of the observations from the article that does not make sense to me, see you at the EGM. Let’s vote and make our voice heard!

A Revenue investor who is holding 100,000 units and continues to pray for share price to recover.

2023-02-07 18:53

GreatGerald

https://klse.i3investor.com/web/blog/detail/Ermmmmm/2023-02-07-story-h-299158988-The_Great_Revenue_Group_Saga_sincere_comment_coming_from_a_small_shareh

2023-02-07 18:47