FKLI & FCPO: FKLI: Tightening Up Trailing-Stop

rhboskres

Publish date: Thu, 11 Apr 2019, 04:50 PM

FKLI: Tightening Up Trailing-Stop

Maintain short positions while still awaiting an immediate term rebound signal. The FKLI posted an intraday reversal in the latest trading. It managed to edge up 2 pts to close at 1,644.5 pts – the low and high were posted at 1,635 pts and 1,646 pts. Overall, the retracement leg that started from the failed attempt to break above the 1,729 pts is still firmly in place. Based on the recent sessions’ performance, on an immediate-term basis, there is a likelihood that the index may be able to test the downtrend line (as drawn in the chart). This would only be confirmed should the latest session’s high be breached in the coming sessions. As such, we maintain our negative trading bias.

Until there is confirmation of the said downtrend line being tested, we continue to advise traders to stay in short positions. These were initiated at 1,698 pts, the closing level of 1 Mar. To manage risks, a stop-loss can be placed above 1,646 pts.

Towards the downside, the immediate support is eyed at 1,600 pts. This is followed by 1,550 pts. Meanwhile the overhead resistance is set at 1,656.5 pts, the high of 26 Mar. This is followed by 1,694.5 pts, the high of 19 Mar.

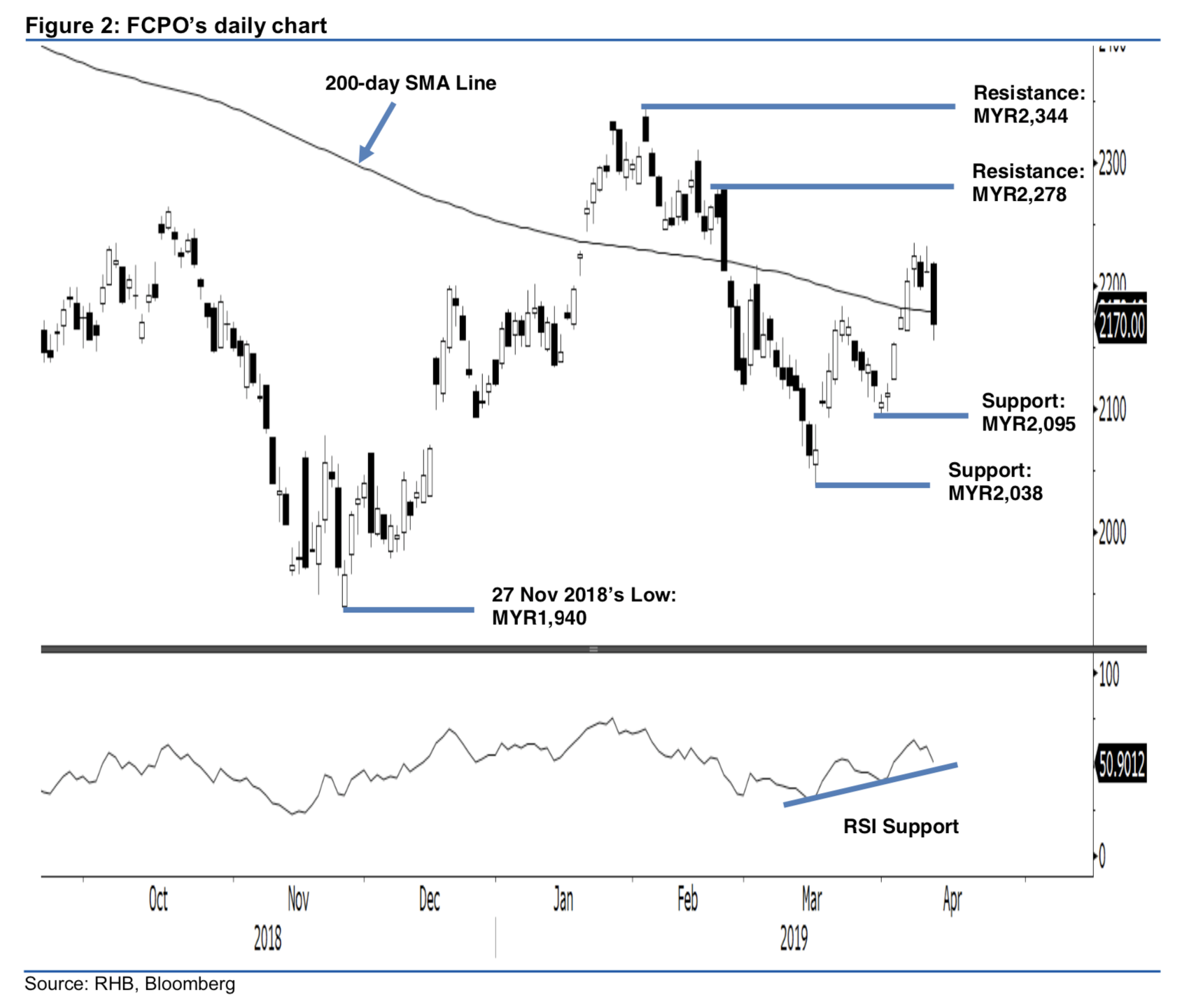

FCPO: 200-Day SMA Marginally Gives Way

Maintain long positions until a retracement is confirmed. The FCPO weakened sharply in the latest session and at the closing, it marginally breached the 200-day SMA line. The session’s low and high were posted at MYR2,155 and MYR2,219, before it ceased at MYR2,170, indicating a decline of MYR42. With the giveaway of the said SMA line, there is an increased likelihood that the commodity may retrace further. However, to confirm this, from our perspective, the intraday low has to be breached in the coming sessions. Until this happens, we are keeping our positive trading bias.

Pending further negative price actions to confirm a deeper retracement is developing, we continue to recommend that traders stay in long positions. These were initiated at MYR2,164, the closing level of 21 Mar. We revised our stop-loss lower to the latest intraday low of MYR2,155.

The immediate support is still expected at MYR2,095, the low of 29 Mar. The following support is eyed at MYR2,038, the low of 15 Mar. Conversely, the immediate resistance is now at MYR2,278, or 25 Feb’s high. This is followed by MYR2,344, the high of 7 Feb.

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024