WTI Crude Futures - Trend Is Encouraging

rhboskres

Publish date: Thu, 18 Apr 2019, 04:45 PM

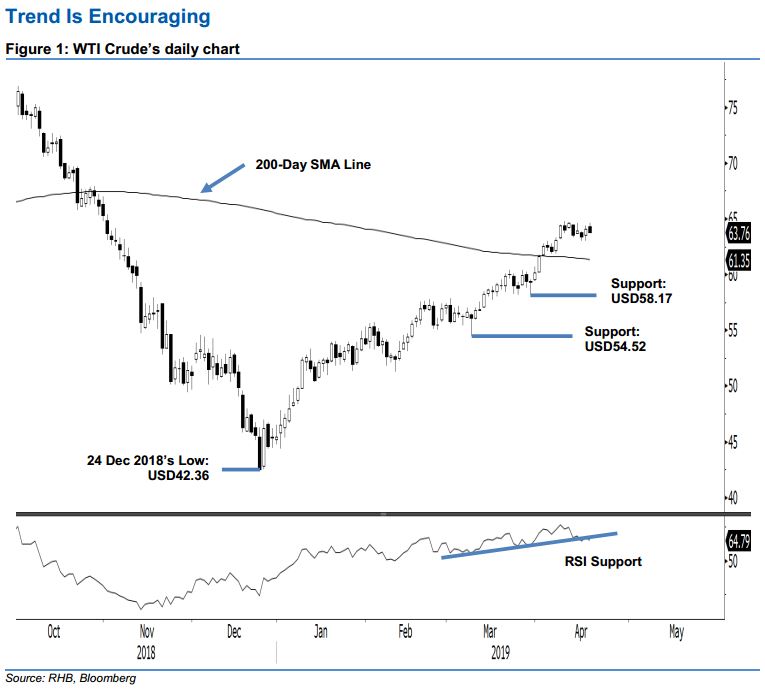

Maintain long positions. The WTI Crude eased USD0.29 to close at USD63.76. This was after it swung between a low and high of USD63.66 and USD64.61. The negative session indicates there was no positive follow-up from the prior session’s white candle – thus the commodity is still confined within its 1-week minor consolidation zone. Once this narrow consolidation is completed, chances are high that the commodity would extend its upward move, which started from the low of USD42.36 on 24 Dec 2018. Maintain our positive bias.

On the observation that the commodity is merely undergoing a narrow consolidation after the recent rally, we continue to recommend traders stay in long positions. These were initiated at USD49.78, or the close of 8 Jan. For risk management purposes, a trailing-stop can be placed below the USD61.82 level – the low of 5 Apr.

Immediate support is set at USD58.17, which was the low of 25 Mar. The following support may appear at USD54.52, or the low of 8 Mar. Moving up, the immediate resistance is set at USD66.86, which was the low of 7 Sep 2018. This is followed by USD70, a round figure.

Source: RHB Securities Research - 18 Apr 2019

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024