E-mini Dow Futures - Stick to Long Positions

rhboskres

Publish date: Thu, 18 Apr 2019, 04:46 PM

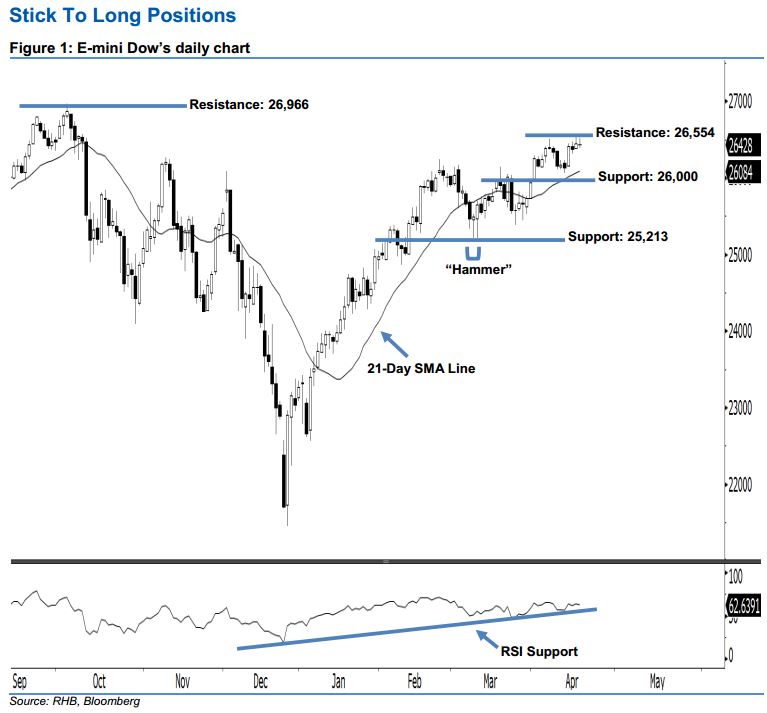

Bullish sentiment remains unchanged, stay long. The E-mini Dow formed a “Doji” candle last night. It settled at 26,428 pts after hovering between a high of 26,518 pts and low of 26,383 pts throughout the day. Still, the appearance of yesterday’s candle indicates that the buyers may be taking a pause following the recently-seen gains. As the index is still trading above the rising 21-day SMA line, this implies the bullish sentiment stays intact. Overall, we think that the rebound – which began with 8 Mar’s “Hammer” pattern – may continue.

Based on the daily chart, we are eyeing the immediate support level at the 26,000-pt psychological spot. The next support is likely at 25,213 pts, ie the low of 8 Mar’s “Hammer” pattern. Towards the upside, the immediate resistance is seen at 26,554 pts, which was determined from the high of 16 Apr. If a breakout arises, the next resistance is maintained at the 26,966-pt historical high.

Therefore, we advise traders to maintain long positions, given that we initially recommended initiating long above the 26,000-pt level on 2 Apr. A stop-loss is advisable – set below the 25,213-pt threshold – to minimise the risk per trade.

Source: RHB Securities Research - 18 Apr 2019

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024