Hang Seng Index Futures - Uptrend Stays Intact

rhboskres

Publish date: Fri, 19 Apr 2019, 04:49 PM

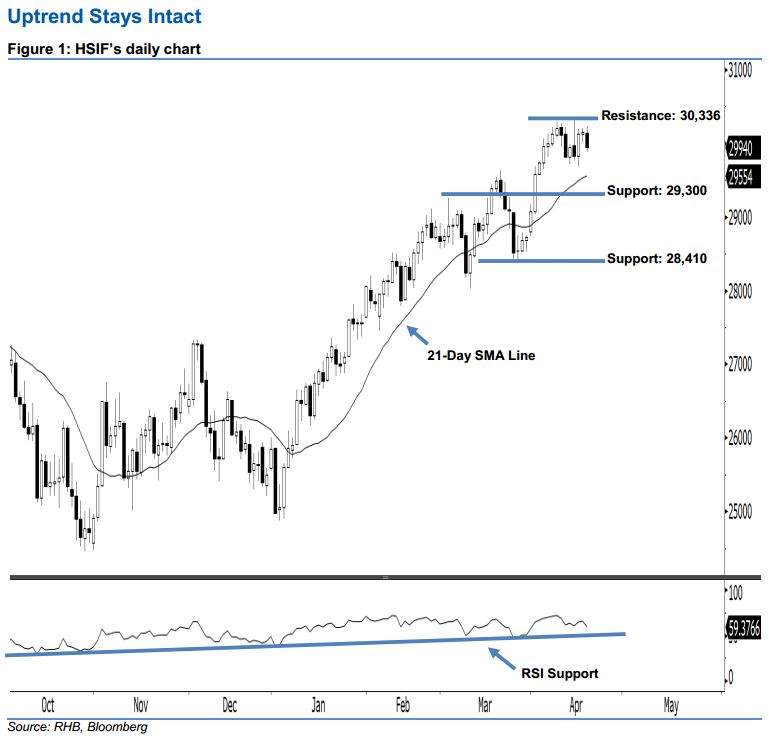

Stay long, with a new trailing-stop set below the 29,300-pt level. The HSIF ended lower to form a black candle yesterday. It dropped to a low of 29,882 pts during the intraday session before ending at 29,940 pts for the day. Still, the formation of yesterday’s black candle can be viewed merely as a result of profit-taking activities that followed the recent gains seen over the past three months. On a technical basis, the bullish sentiment remains intact, given that the HSIF is still trading above the rising 21-day SMA line. Overall, we believe the market rebound, which started in early-January, is likely to persist in the coming sessions.

As seen in the chart, we are now eyeing the immediate support at 29,300 pts – this is situated near the midpoint of 1 Apr’s long white candle. The next support will likely be at 28,410 pts, ie the previous low of 26 Mar. Towards the upside, the immediate resistance is seen at 30,336 pts, which was the high of 15 Apr. If a decisive breakout arises, the next resistance is maintained at 31,544 pts, ie the previous high of 7 Jun 2018.

As a result, we advise traders to stay long, given that we initially recommended initiating long above the 29,039-pt level on 20 Mar. For now, a new trailing-stop can be set below the 29,300-pt mark in order to limit the risk per trade.

Source: RHB Securities Research - 19 Apr 2019

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024