E-mini Dow Futures - Still Positive

rhboskres

Publish date: Fri, 03 May 2019, 05:39 PM

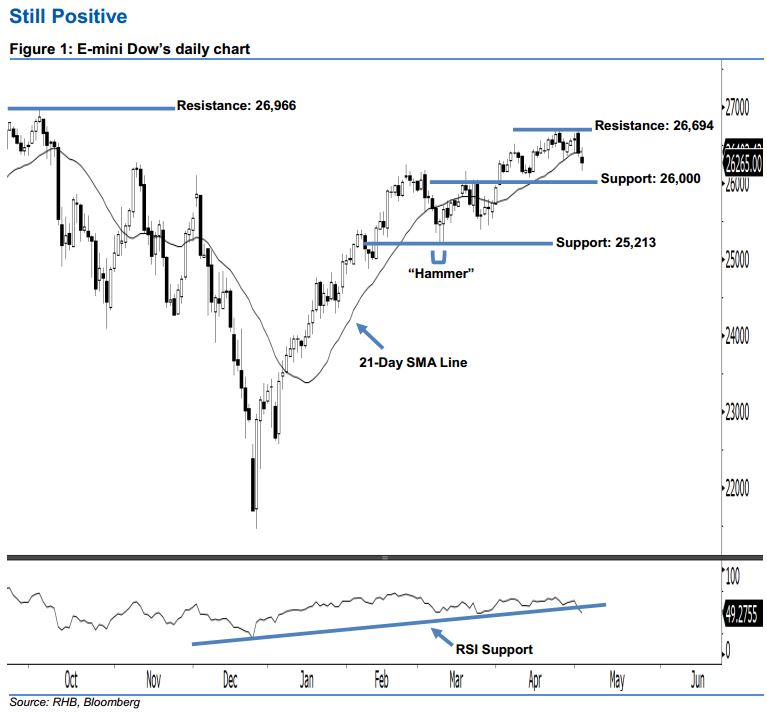

Maintain long positions, with a trailing-stop set below the 26,000-pt support. The E-mini Dow formed another black candle last night. It declined 125 pts to close at 26,265 pts, off its high of 26,461 pts and low of 26,148 pts. However, the appearance of 1-2 May’s black candles indicates a result of profit-taking activities following the recent gains. From a technical viewpoint, the bullish sentiment stays unchanged. This is as long as the index does not close below the 26,000-pt support mentioned since a month ago. Overall, we think that the market rebound – which began with 8 Mar’s “Hammer” pattern – is not over yet.

According to the daily chart, the immediate support level is seen at the 26,000-pt round figure, which was near the low of 11 Apr. The next support would likely be at 25,213 pts, ie the low of 8 Mar’s “Hammer” pattern. To the upside, we are eyeing the immediate resistance level at 26,694 pts, situated at the high of 24 Apr. Meanwhile, the next resistance is maintained at the 26,966-pt historical high.

Hence, we advise traders to maintain long positions, following our recommendation of initiating long above the 26,000-pt level on 2 Apr. A trailing-stop is preferably set below the 26,000-pt threshold as well, in order to minimise the risk per trade.

Source: RHB Securities Research - 3 May 2019

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024