COMEX Gold - a Possible Bounce

rhboskres

Publish date: Wed, 08 May 2019, 05:42 PM

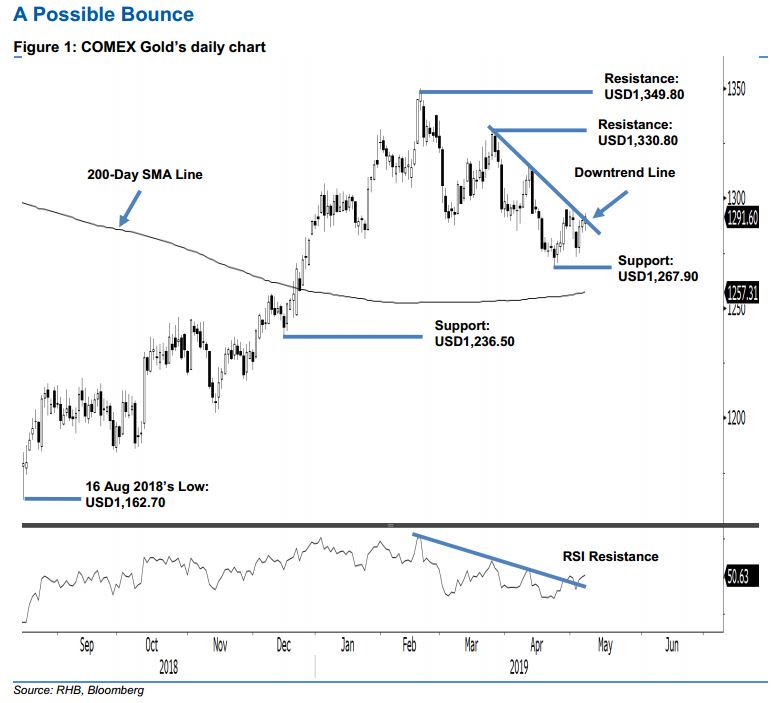

Maintain long positions. The COMEX Gold settled USD1.80 better at USD1,291.60, this was after it ranged between USD1,285.10 and USD1,293.10. While the rebound that started from the low of USD1,267.90 on 23 Apr is considered as still weak, it has not signalled the end of the commodity’s multi-week correction phase (a firm breach above the downtrend line and the recent high would signal such possibility). For now, we are keeping our positive trading bias until there are negative price actions that could signal otherwise.

As the said rebound is still showing signs of developing – although not as strong as we had expected – we continue to recommend traders stay in long positions. These were initiated at USD1,290.20, which was the closing level of 1 May. A stop-loss can be placed below the USD1,267.90 level.

The immediate support is set at USD1,267.90, or the low of 23 Apr. This is followed by USD1,236.50, ie the low of 14 Dec 2018. On the other hand, the immediate resistance is expected at USD1,330.80, which was the high of 25 Mar. This is followed by USD1,349.80, or the high of 20 Feb.

Source: RHB Securities Research - 8 May 2019

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024