FCPO - No Reversal Signal

rhboskres

Publish date: Thu, 09 May 2019, 05:38 PM

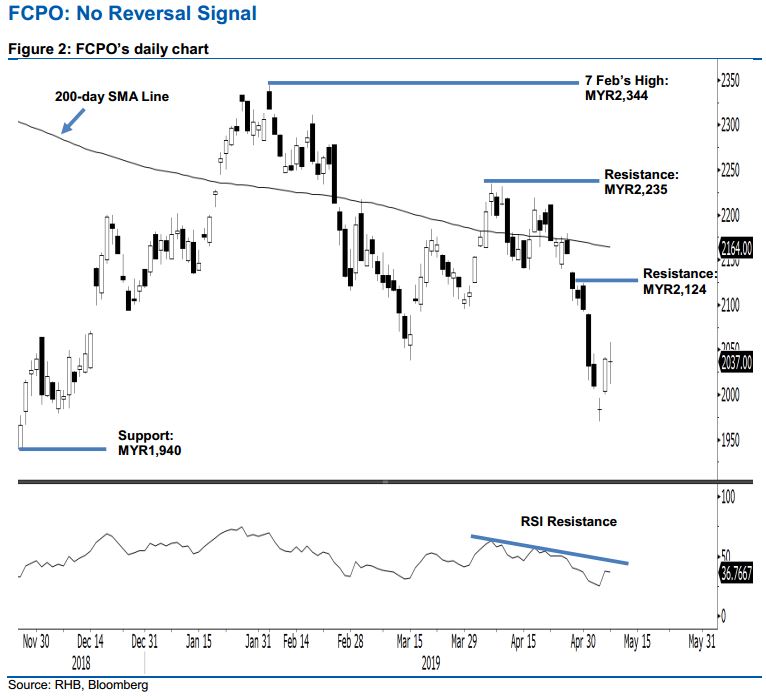

Maintain short positions. The FCPO failed to sustain its earlier session’s positive tone. It slid from a high of MYR2,058 to a low of MYR2,012, before ending slightly lower by MYR3 at MYR2,037. The intraday reversal indicates the commodity is still not able to generate the required price signals that could indicate a deeper rebound is developing. For now, we regard the recent sessions’ price actions as just a minor rebound within a weak price trend – after the recent weeks’ sharp retracement sent the Daily RSI into an oversold reading. We maintain our negative trading bias.

As there is still no clear evidence to indicate the commodity has reached an interim low, we continue to recommend that traders stay in short positions. We initiated these at MYR2,154, the closing level of 11 Apr. To manage risks, a stop-loss can be placed above MYR2,058, the latest session’s high.

Immediate support is pegged at MYR1,940, the low of 27 Nov 2018. This is followed by MYR1,900. On the other hand, the immediate resistance is now set at MYR2,124, the high of 30 Apr. This is followed by MYR2,235, the high of 5 Apr.

Source: RHB Securities Research - 9 May 2019

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024