Hang Seng Index Futures - Downward Momentum Resumes

rhboskres

Publish date: Thu, 09 May 2019, 05:47 PM

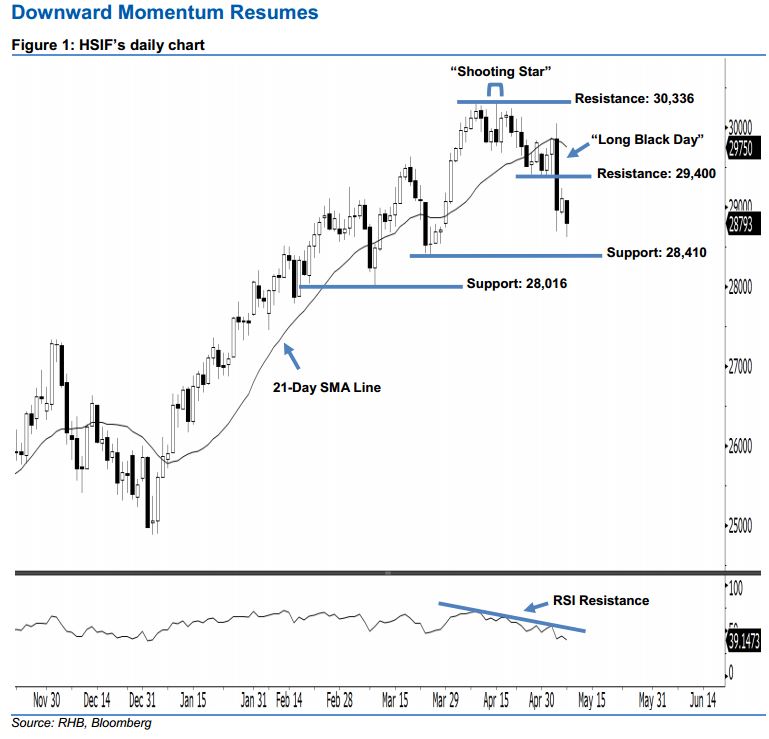

Market sentiment remains negative, stay short. The HSIF ended lower to form a black candle yesterday. It closed at 28,793 pts, off its high of 29,086 pts and low of 28,619 pts. As the index has erased the previous day’s gains and marked a lower close below the 21-day SMA line, this indicates the selling momentum is likely to continue in the coming sessions. With the 14-day RSI indicator sliding below the 50 neutral point to flash a bearish reading at 39.14 pts, this has led us to believe the downside swing – which started off 15 Apr’s “Shooting Star” pattern – may continue. Overall, we remain bearish on the HSIF’s outlook.

As shown in the chart, we anticipate the immediate resistance at 29,400 pts – this is set near the midpoint of 6 May’s “Long Black Day” candle. The next resistance will likely be at 30,336 pts, ie the high of 15 Apr’s “Shooting Star” pattern. Towards the downside, the near-term support is seen at 28,410 pts, which was defined from the low of 26 Mar. This is followed by 28,016 pts, or the previous low of 11 Mar.

Consequently, we advise traders to stay short, following our recommendation of initiating short below the 29,400- pt level on 7 May. A stop-loss can be set above the 30,336-pt threshold to minimise the risk per trade.

Source: RHB Securities Research - 9 May 2019

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024