E-mini Dow Futures : Maintain Long Positions

rhboskres

Publish date: Thu, 09 May 2019, 05:49 PM

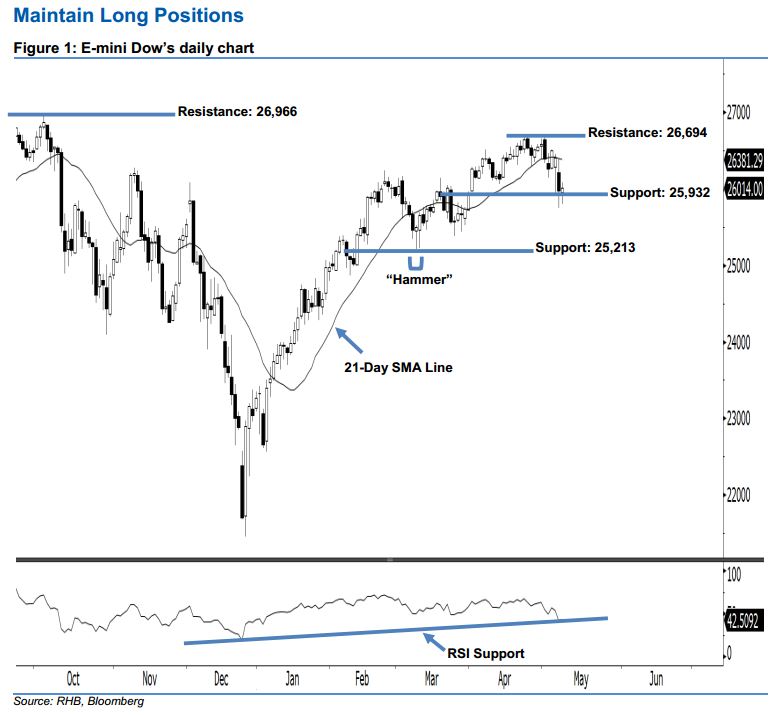

Stay long, provided the 25,932-pt support is not violated at the close. The E-mini Dow formed a white candle last night. It rose 41 pts to close at 26,014 pts after oscillating between a high of 26,079 pts and low of 25,799 pts. Yet, we maintain our positive sentiment, as the index has failed to close below the previously-indicated 25,932-pt support. As the E-mini Dow has marked a higher close vis-à-vis the previous session, coupled with the bullishness of 1 Apr’s upside gap not being cancelled, this shows the upside move has not diminished so far. Overall, we remain positive on the index’s outlook.

Based on the daily chart, we maintain the immediate support at 25,932 pts, which is situated at the low of 6 May. If this level is taken out decisively, the next support is seen at 25,213 pts, ie the low of 8 Mar’s “Hammer” pattern. To the upside, we are eyeing the immediate resistance at 26,694 pts, or the previous high of 24 Apr. Meanwhile, the next resistance is anticipated at the 26,966-pt historical high.

As a result, we advise traders to maintain long positions, since we originally recommended initiating long above the 26,000-pt level on 2 Apr. A trailing-stop set below the 25,932-pt threshold is preferable to limit the downside risk.

Source: RHB Securities Research - 9 May 2019

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024