E-mini Dow Futures - Initiate Short Positions

rhboskres

Publish date: Fri, 10 May 2019, 04:21 PM

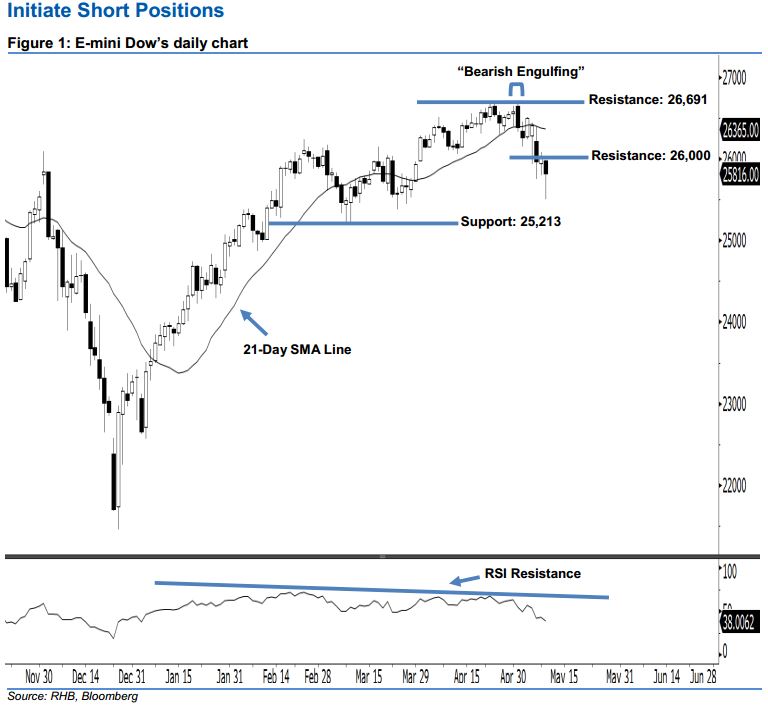

Initiate short positions below the 26,000-pt level. The E-mini Dow ended lower to form a black candle last night. It declined 198 pts to close at 25,816 pts, off the session’s high of 25,994 pts. Technically speaking, the index successfully closed below the 25,932-pt support mentioned previously and hit its lowest point in more than a month, implying that the sentiment has turned bearish. This can be viewed as a continuation of the sellers extending the downside swing from the “Bearish Engulfing” pattern that formed on 1 May. Yesterday’s closing also triggered our trailing-stop, which we previously recommended at the 25,932-pt threshold.

As seen in the chart, the immediate resistance is now seen at the 26,000-pt round figure, which is also set near the high of 9 May. The next resistance is likely to be at 26,691 pts – this was determined from the high of 1 May’s “Bearish Engulfing” pattern. Towards the downside, we anticipate the near-term support at 25,213 pts, ie the previous low of 8 Mar. This is followed by the 25,000-pt psychological mark.

Hence, we advise traders to initiate short positions below the 26,000-pt level. A stop-loss can be set above the 26,691-pt threshold to limit the risk per trade.

Source: RHB Securities Research - 10 May 2019

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024