COMEX Gold - Bulls Are Attempting Another Breakout

rhboskres

Publish date: Fri, 10 May 2019, 05:51 PM

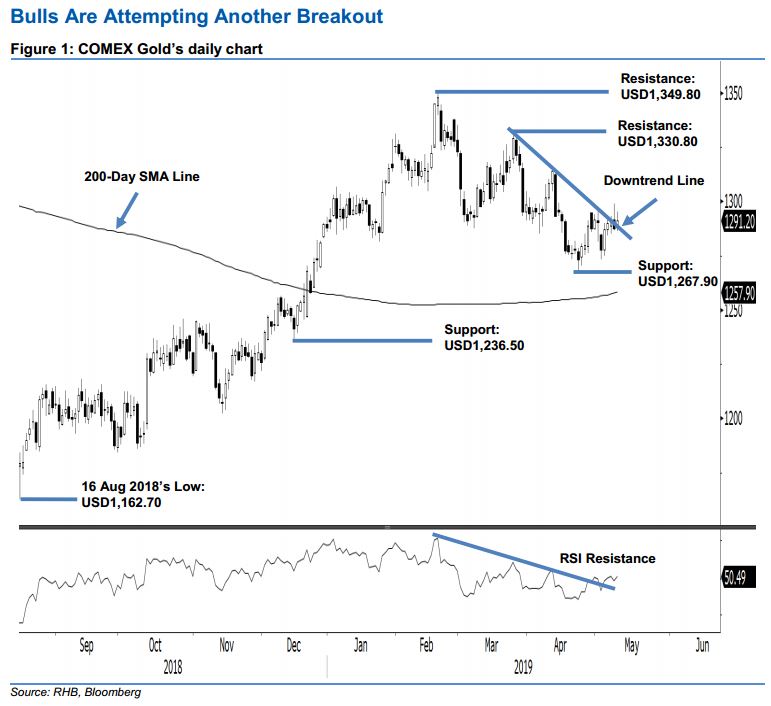

Bulls are still testing the downtrend line; maintain long positions. The COMEX Gold added USD3.80 to close at USD1,291.20 ie near the downtrend line (as drawn in the chart). Session’s low and high were at USD1,286.40 and USD1,295.10. The positive session improves the possibility for the commodity to signal the completion of its multi-week correction phase that started from the high of USD1,349.80 on 20 Feb. However, further positive price actions in the coming sessions are needed. Until this happens, the rebound that started from the low of USD1,267.90 is still considered as just a minor rebound – which would remain in place provided the said low is not breached. Maintain our positive trading bias.

As there is still a likelihood for the commodity to extend its rebound, we continue to recommend traders stay in long positions. These were initiated at USD1,290.20, which was the closing level of 1 May. A stop-loss can be placed below the USD1,267.90 level.

Immediate support is set at USD1,267.90, or the low of 23 Apr. This is followed by USD1,236.50, ie the low of 14 Dec 2018. On the other hand, the immediate resistance is expected at USD1,330.80, which was the high of 25 Mar. This is followed by USD1,349.80, or the high of 20 Feb.

Source: RHB Securities Research - 10 May 2019

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024