FKLI - Nearing Immediate Support

rhboskres

Publish date: Mon, 13 May 2019, 10:38 AM

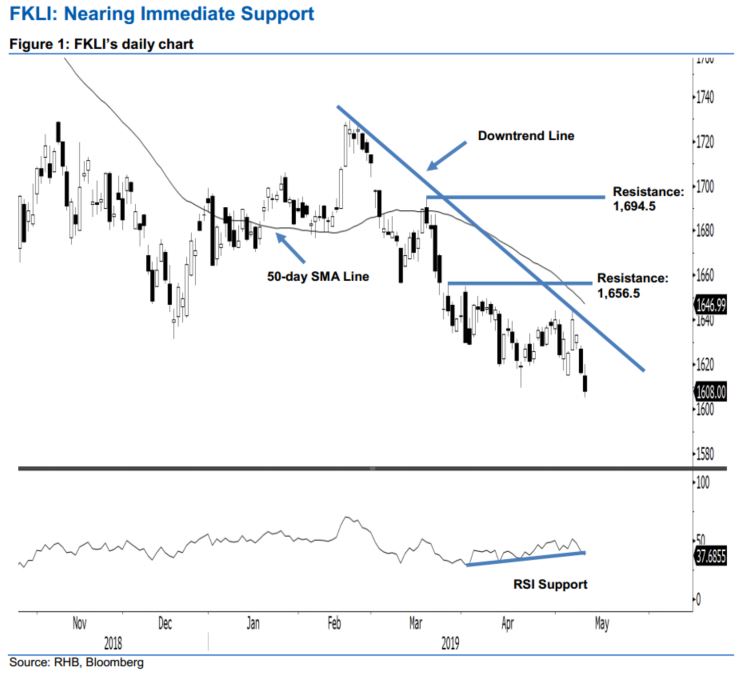

Maintain short positions. The FKLI ended lower by 8.5 pts at 1,608 pts. The trading range was between 1,605 pts and 1,620 pts. The latest weak session placed the index in the support area of around 1,600 pts. If there are strong and positive price movements in the sessions ahead, this could indicate the index has reached, at the minimum, an interim low. Until we see signs of this emerging, the overall weak price trend that started from the failed attempt to breach above the 1,729-pt level is still considered valid. Hence, we maintain our negative trading bias.

As the bears are still showing strong control over the price trend, we recommend that traders stay in short positions. These were initiated at 1,698 pts, the closing level of 1 Mar. To manage risks, a stop-loss can be placed above 1,646 pts.

Immediate support is pegged at 1,600 pts, followed by 1,550 pts. Moving up, we are eyeing the immediate resistance at 1,656.5 pts, the high of 26 Mar. This is followed by 1,694.5 pts, the high of 19 Mar.

Source: RHB Securities Research - 13 May 2019

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024