Hang Seng Index Futures - a Weak Rebound

rhboskres

Publish date: Mon, 13 May 2019, 10:42 AM

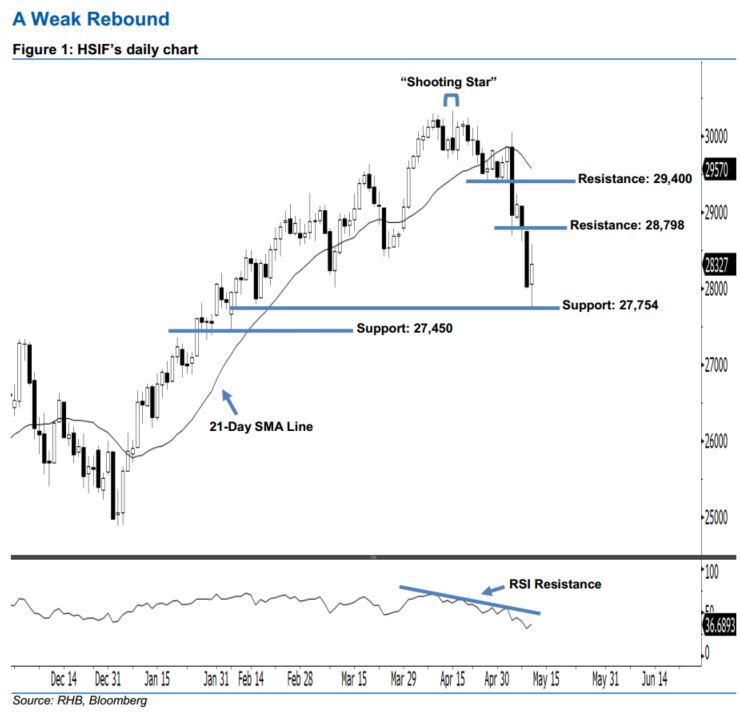

Maintain short positions. After positing two black candles in a row, the HSIF ended higher to form a white candle last Friday. It gained 148 pts to close at 28,327 pts after oscillating between a high of 28,588 pts and low of 27,754 pts for the day. Still, the appearance of last Friday’s white candle indicates that the market may be experiencing a technical rebound after the losses seen in the past week. As the index did not recoup the losses from 9 May’s long black candle, this implies that the negative sentiment stays unchanged. Overall, we think the downside swing – which started from 15 Apr’s “Shooting Star” pattern – may persist.

As seen in the chart, the immediate resistance is seen at 28,798 pts, or the high of 9 May’s long black candle. If a breakout occurs, look to 29,400 pts – set near the midpoint of 6 May’s long black candle – as the next resistance. To the downside, we now anticipate the immediate support at 27,754 pts, ie the low of 10 May. Meanwhile, the next support is maintained at 27,450 pts, which was defined from the previous low of 8 Feb.

As a result, we advise traders to stay short, given that we previously recommended initiating short below the 29,400- pt level on 7 May. A trailing-stop can be set above the 28,798-pt mark to secure part of the gains.

Source: RHB Securities Research - 13 May 2019

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024