E-mini Dow Futures - Sentiment Remains Bearish

rhboskres

Publish date: Mon, 13 May 2019, 10:45 AM

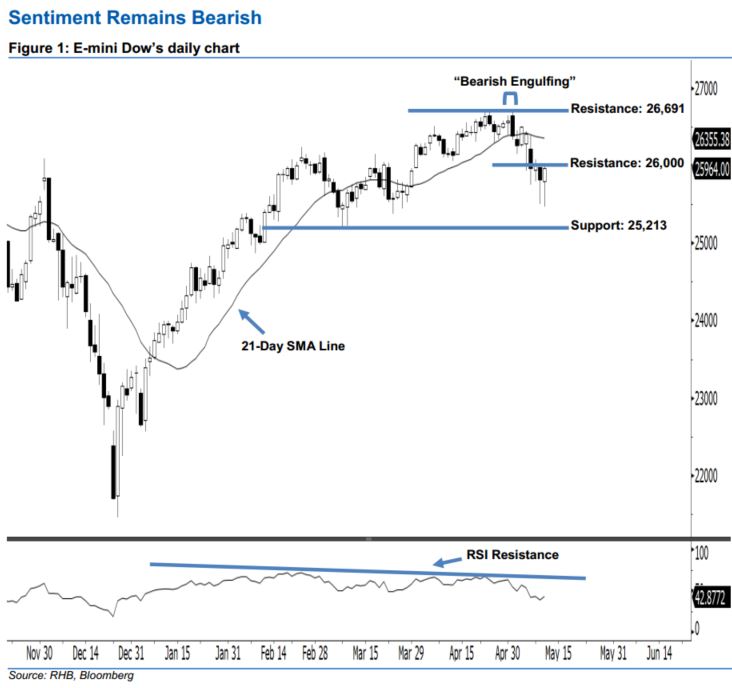

Stay short while setting a stop-loss above the 26,691-pt resistance. The E-mini Dow formed a white candle last Friday. It rose 148 pts to close at 25,964 pts after oscillating between a high of 26,016 pts and low of 25,464 pts. On a technical basis, last Friday’s white candle should merely be viewed as a result of bargain-hunting activities following recent losses. We think the bears may continue to control the market as long as the index does not negate the bearishness of 1 May’s “Bearish Engulfing” pattern. Overall, we keep our bearish view on the E-mini Dow’s outlook.

Based on the daily chart, we anticipate the immediate resistance at the 26,000-pt round figure, which is situated near the high of 9 May as well. If this level is taken out, the next resistance is maintained at 26,691 pts, ie the high of 1 May’s “Bearish Engulfing” pattern. To the downside, the near-term support is seen at 25,213 pts, which was the previous low of 8 Mar. This is followed by the 25,000-pt psychological spot.

Therefore, we advise traders to maintain short positions, in line with our initial recommendation to have short positions below the 26,000-pt level on 10 May. A stop-loss can be set above the 26,691-pt threshold to minimise the risk per trade.

Source: RHB Securities Research - 13 May 2019

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024