Trading Stocks - Tenaga Nasional

rhboskres

Publish date: Thu, 20 Jun 2019, 04:26 PM

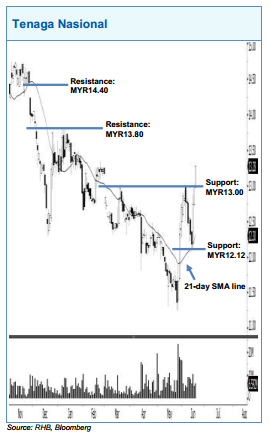

Tenaga Nasional may trend higher after it formed a third consecutive white candle. As the 21-day SMA line is likely to turn higher, it would appear that the bullish sentiment has been enhanced. A bullish bias may appear above the MYR13 level, with an exit set below the MYR12.12 threshold. Towards the upside, the near-term resistance is at MYR13.80. This is followed by the MYR14.40 level.

Source: RHB Securities Research - 20 Jun 2019

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

2024-11-25

TENAGA2024-11-25

TENAGA2024-11-25

TENAGA2024-11-25

TENAGA2024-11-25

TENAGA2024-11-24

TENAGA2024-11-22

TENAGA2024-11-22

TENAGA2024-11-22

TENAGA2024-11-22

TENAGA2024-11-22

TENAGA2024-11-21

TENAGA2024-11-21

TENAGA2024-11-21

TENAGA2024-11-21

TENAGA2024-11-21

TENAGA2024-11-20

TENAGA2024-11-20

TENAGA2024-11-20

TENAGA2024-11-19

TENAGA2024-11-19

TENAGA2024-11-19

TENAGA2024-11-19

TENAGA2024-11-19

TENAGA2024-11-19

TENAGA2024-11-18

TENAGA2024-11-18

TENAGA2024-11-18

TENAGA2024-11-18

TENAGA2024-11-18

TENAGA2024-11-15

TENAGA2024-11-15

TENAGA2024-11-15

TENAGAMore articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024