COMEX Gold - Bulls Remain in Control

rhboskres

Publish date: Wed, 26 Jun 2019, 10:16 AM

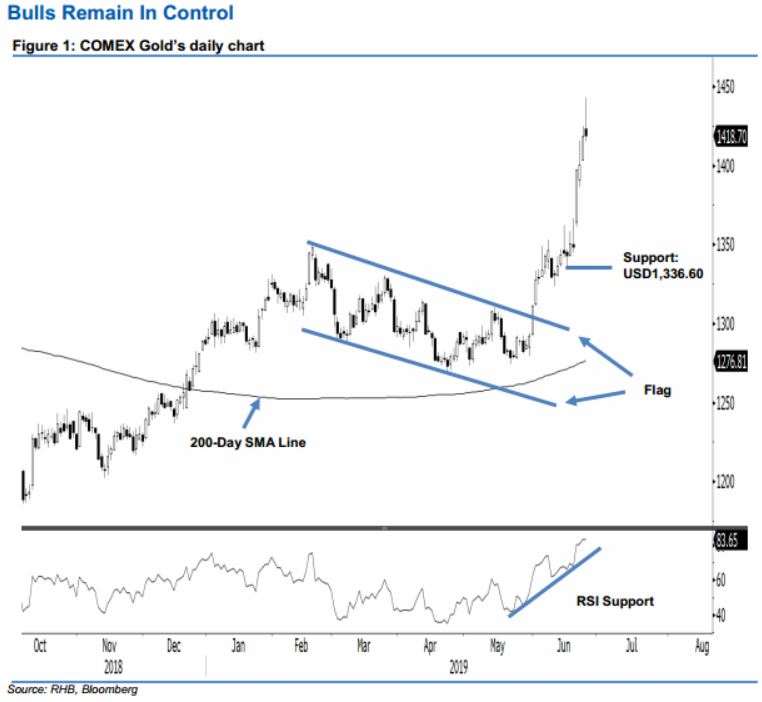

Maintain long positions as the precious metal attempted a breakout from the immediate resistance. Despite its failure to hold on to most of its earlier session’s gains, the precious metal managed to settle slightly higher – by USD0.50 at USD1,418.70. Session’s high and low were recorded at USD1,442.90 (it briefly tested the immediate resistance of USD1,432.90) and USD1,415.10. While the commodity failed to cross above the said immediate resistance, there were no clear price rejection signals either. Overall, the commodity’s upward price trajectory is still intact, despite being overbought. Maintain our positive trading bias.

In the absence of price exhaustion signals, we continue to recommend traders stay in long positions. We opened these positions at USD1,333.60, which was the closing level of 5 Jun. For risk management purposes, a stop-loss can be placed at the breakeven mark.

Immediate support is maintained at USD1,400 level, a round figure. This is followed by USD1,336.60, which was the low of 17 Jun. Meanwhile, the immediate resistance is set at USD1,432.90, the high of 28 Aug 2013, followed by USD1,500.

Source: RHB Securities Research - 26 Jun 2019

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024