Hang Seng Index Futures - Outlook Stays Positive

rhboskres

Publish date: Thu, 27 Jun 2019, 05:16 PM

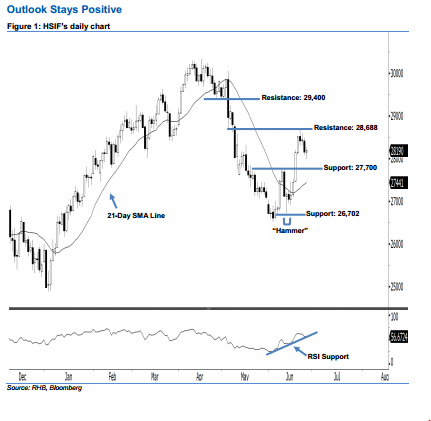

Stay long while setting a trailing-stop below the 27,700-pt support. The HSIF formed a “Doji” candle yesterday. It settled at 28,190 pts, off its high of 28,275 pts and low of 27,989 pts. However, we believe the upside move is not over yet, as the index continues to hover above the rising 21-day SMA line. Moreover, on a technical basis, the 14- day RSI indicator rose above the 50 neutral point to flash a bullish reading at 56.67 pts, this indicates that additional buying momentum may be present in the coming sessions. Overall, we keep our positive view on HSIF’s outlook.

Currently, we anticipate the immediate support at 27,700 pts, set near the midpoint of 19 Jun’s long white candle. The next support is seen at 26,702 pts, determined from the low of 13 Jun’s “Hammer” pattern. On the other hand, the immediate resistance is maintained at 28,688 pts, obtained from the high of 21 Jun. Meanwhile, the next resistance is anticipated at 29,400 pts, ie near the midpoint of 6 May’s long black candle.

Therefore, we advise traders to stay long, following our recommendation to initiate long above the 27,436-pt level on 12 Jun. A trailing-stop can be set below the 27,700-pt threshold in order to secure part of the gains.

Source: RHB Securities Research - 27 Jun 2019

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024